The XRP price forecast is garnering significant attention as analysts predict a remarkable potential surge to $6.5. With recent trends and momentum indicators turning bullish, there’s a growing sense of optimism surrounding XRP’s impending breakout. Industry experts have noted key resistance levels and entry points that suggest a strategic plan could lead to an impressive 200% increase from current levels. As we dive deeper into cryptocurrency analysis, XRP’s journey is not only of interest to investors but also highlights critical altcoin market trends. A bullish XRP outlook appears imminent, making it an exciting time for traders and enthusiasts alike.

As we explore the future of XRP, many are turning their sights toward an upcoming price prediction that hints at an impressive rise. With various analysts weighing in on the potential trajectory of this popular digital asset, discussions around XRP price targets have become increasingly prevalent. Current market dynamics are fostering an environment ripe for possibilities, especially in light of recent bullish signals observed in technical analysis. More than just a cryptocurrency, XRP is poised to shape the altcoin market with its anticipated movements, catering to investors eager for lucrative opportunities. The overall sentiment in cryptocurrency circles is one of cautious optimism, considering the crypto landscape’s highly volatile nature.

XRP Price Forecast: Aiming for New Heights

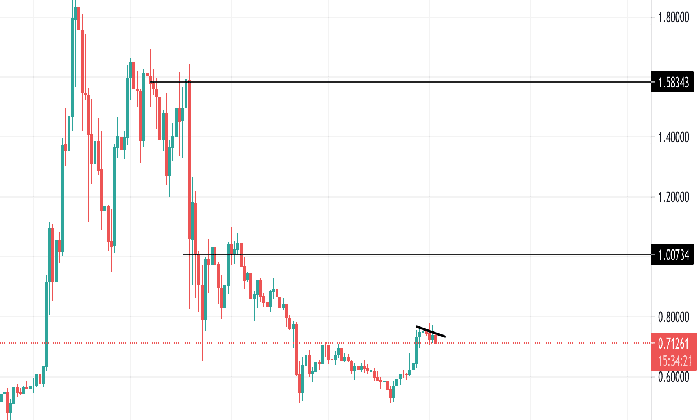

In examining the current XRP price forecast, analysts are increasingly optimistic about its trajectory toward a potential all-time high of $6.5. Recent technical analyses highlight significant bullish momentum, supported by the formation of a Descending Triangle pattern, which suggests that an upward breakout is imminent. The identification of key support levels, particularly at $2.10, provides traders with a strategic entry point, while the incorporation of a prudent stop-loss at $2.00 suggests a thoughtful approach to risk management. This dual strategy not only bolsters confidence in the XRP price prediction but also aligns with broader cryptocurrency analysis indicating strengthening altcoin market trends.

Moreover, XRP’s performance seems well-aligned with market trends as it steadily consolidates around the crucial resistance levels of $2.49, $3.00, and $3.39. Each of these points is crucial for establishing a solid bullish foundation. According to market analysts, breaking and stabilizing above these levels could pave the way for the anticipated surge towards $6.5. To maximize potential gains, traders are encouraged to remain vigilant regarding price actions and set clear targets that correlate with expert insights, reinforcing a bullish XRP outlook amid this exciting volatility.

The Impact of Market Trends on XRP Prices

As the cryptocurrency market evolves, the impact of altcoin market trends on XRP prices cannot be overstated. Market sentiment heavily influences investor psychology, often driving prices beyond technical forecasts. Recent insights from several cryptocurrency analysis reports suggest that XRP is poised to capitalize on these market conditions. With Bitcoin recently surpassing a major resistance level at $89,000, the ripple effect is likely to be felt across various altcoins, including XRP. Should Bitcoin sustain its momentum, XRP could very well experience a similar bullish rally, pushing it significantly closer to the $6.5 price target.

Furthermore, analysts are keeping a close watch on specific price points that serve as important indicators of market health. The $3 resistance level has been identified as a critical hurdle; a successful breakout from this zone could initiate a bullish sentiment, encouraging more substantial buying pressure. Traders should be mindful of how the broader altcoin market reacts to shifts in Bitcoin’s performance, as this correlation may dictate the speed and sustainability of XRP’s price movements. Analyzing these trends alongside XRP’s technical indicators could provide traders with a comprehensive view of potential outcomes.

Key Dates for XRP Price Movement

Monitoring key dates is crucial for traders interested in the XRP market. May 10, 2025, is highlighted as a potentially significant inflection point in the XRP price trajectory. As indicated by market analyst Cryptarch_, this date could see XRP either break through the formidable $3 resistance or face a corrective pullback. This anticipation allows investors to prepare for varying outcomes, ensuring they can respond effectively to these pivotal market events. Thorough analysis leading up to this date may reveal critical signals about market momentum and sentiment shifts.

In addition to the specific date, the influence of Bitcoin’s price action adds another layer of complexity to the forecast. Given Bitcoin’s current bullish trend, as evidenced by its movement above $89,000, a subsequent surge in altcoins, including XRP, seems probable. Keeping an eye on BTC’s performance leading up to crucial dates will offer valuable insights into the overall market direction. Thus, aligning one’s trading strategy with these key dates and external influences could enhance the potential for investment success.

Analyzing XRP’s Breakout Potential

XRP’s breakout potential hinges on various technical indicators and market sentiments. Analysts have noted the importance of the Descending Triangle formation on XRP’s price chart, which often precedes a strong bullish movement when properly validated. The emergence of positive momentum signals, particularly noted with the daily Relative Strength Index (RSI), further supports the case for an imminent breakout. A decisive movement above the established resistance levels could not only validate these technical patterns but also instill renewed confidence among investors, driving further interest in XRP.

A successful breakout would not only push XRP towards the anticipated price target of $6.5 but could also lead to a multifold surge, with speculative upper targets reaching even $6.82. However, the key will be testing and confirming these resistances, as maintaining momentum above $3 will be critical for sustaining bullish sentiment. Therefore, ongoing analysis of market trends and vigilant monitoring of price actions is essential for those looking to capitalize on XRP’s bullish forecast.

Strategic Trading Insights for XRP Investors

For investors eyeing XRP’s potential for significant gains, having a strategic trading plan is imperative. The current market analysis suggests that entry points around $2.10 provide an advantageous position for traders aiming to benefit from future price surges. Coupled with the implementation of security measures such as a stop-loss at $2.00, this approach mitigates risks while optimizing profit potential. Understanding market dynamics and aligning trades with technical forecasts will be vital to effectively navigate the volatile nature of XRP.

Investors should remain agile, adjusting their strategies as market conditions evolve. The charted resistance levels – at $2.49, $3.00, and $3.39 – serve as critical markers for price action and should inform traders’ decisions on when to enter or exit positions. By continuously analyzing these levels in conjunction with overall cryptocurrency market trends, investors can make informed choices that leverage XRP’s bullish outlook to their advantage. Additionally, insights derived from analysts can serve as a guiding framework for traders seeking to maximize their time in the altcoin market.

Understanding XRP’s Role in the Cryptosphere

XRP has carved out a notable position within the larger landscape of cryptocurrencies, especially as new technological developments and regulatory frameworks emerge. With its unique value proposition as a digital asset aimed at enhancing global payment systems, XRP’s growing adoption continues to attract both attention and analysis. This dynamic makes understanding its role in the cryptosphere essential for investors seeking to capitalize on the altcoin’s potential.

As XRP continues to innovate and adapt within the fast-paced cryptocurrency market, its performance in correlation with major players like Bitcoin and Ethereum will be critical. Observing how XRP reacts to broader market movements can reveal insights into its future price trajectory. Investing in XRP not only requires attention to its specific price actions but also a broad understanding of the evolving cryptosphere to make strategic and informed investment decisions.

The Future of XRP in Cryptocurrency Markets

Looking ahead, the future of XRP within cryptocurrency markets appears increasingly promising, bolstered by recent technical forecasts illuminating a bullish trend. As analysts project a price target nearing $6.5, many investors are optimistic about the altcoin’s capacity to recover and gain momentum. This positivity is underscored by the recent resurgence of interest in altcoins, suggesting that XRP may be well-positioned to return to prominence.

However, potential investors must remain cautious, keeping an eye on pivotal price movements and market sentiments. Factors such as regulatory development and Bitcoin’s price action will indubitably play vital roles in shaping XRP’s near-term and long-term feasibility. A proactive approach to understanding these variables allows investors to better prepare for what could be exciting times in the XRP market. Keeping abreast of expert analyses and market trends should serve as a guiding compass in navigating the space ahead.

Navigating XRP Volatility: Expert Guidance

Volatility is inherently part of the cryptocurrency markets, and XRP is no exception. As traders engage with this altcoin, understanding the nuances of its price fluctuations can provide a clearer pathway to profitability. With analysts noting key resistance levels and potential price targets, having a structured approach to trading XRP becomes crucial for mitigating risks associated with market volatility. Cryptarch_’s analysis exemplifies these considerations by providing clear entry and exit strategies.

Moreover, continuous learning and adaptation to market conditions can empower traders. By staying informed about developments in the cryptocurrency landscape, traders can make more educated decisions that align with XRP’s predicted movements. Establishing connections within the digital asset community and leveraging expert guidance can serve as invaluable resources in times of volatility. This proactive mindset will enable investors to navigate the complexities of trading XRP successfully.

Trends Influencing XRP’s Price Trajectory

Several trends are influencing XRP’s price trajectory, ranging from technological developments to regulatory insights. Analysts emphasize the significance of market psychology and investor sentiment, which are often swayed by broader economic factors and news cycles. As shifts in these areas occur, they can impact liquidity and the perceived value of XRP in the altcoin market. Understanding these influences provides a richer context for interpreting price actions.

Additionally, advancements within the blockchain space could provide catalysts for growth. Innovations aimed at improving transaction speeds and reducing costs may increase XRP’s attractiveness to investors and users alike. With various institutional players showing interest in integrating XRP into their operations, tracking these developments offers investors potential indicators of the altcoin’s market movements. Engaging with these trends can provide a more comprehensive view of what might lie ahead in XRP’s trading landscape.

Frequently Asked Questions

What is the XRP price forecast for 2025?

The XRP price forecast for 2025 is quite optimistic, with some analysts suggesting a potential surge to $6.5. According to analysis, if XRP successfully breaks through key resistance levels, it could see significant gains, especially with strong momentum indicators supporting a bullish outlook.

How does the XRP price prediction impact altcoin market trends?

The XRP price prediction plays a crucial role in altcoin market trends, as XRP is one of the leading cryptocurrencies. A bullish XRP forecast, particularly a projected rally to $6.5, can boost investor confidence and lead to increased interest in other altcoins, creating a ripple effect across the market.

What key levels are identified in the XRP price target analysis?

Key levels in the XRP price target analysis include resistance zones at $2.49, $3.00, and $3.39. These levels are critical for determining the potential path of XRP, with a forecast suggesting that once $3 is established as a support level, the price could aim for the upper target of $6.5.

What factors contribute to a bullish XRP outlook?

A bullish XRP outlook is supported by technical indicators such as a breakout from a Descending Triangle, an upward shift in the Relative Strength Index (RSI), and significant market conditions, including Bitcoin’s price action. These factors collectively suggest that XRP could experience substantial gains in the near future.

When is the key date to watch for XRP price movement?

The key date to watch for XRP price movement is Saturday, May 10, 2025. This date is highlighted as a potential inflection point where XRP could either break above significant resistance levels or face rejection, impacting its immediate price forecast.

What is the significance of the $3 resistance level in XRP price analysis?

The $3 resistance level in XRP price analysis is significant because it has historically been a critical turning point. A successful breakout above this level could lead to renewed bullish momentum, facilitating a further climb towards the anticipated price target of $6.5.

How does Bitcoin influence the XRP price forecast?

Bitcoin greatly influences the XRP price forecast, as its performance can impact the overall cryptocurrency market. A breakout above key levels in Bitcoin, such as $89,000, can trigger bullish sentiment across altcoins including XRP, potentially leading to higher price predictions.

What are the risks associated with the XRP price prediction strategy?

The risks associated with the XRP price prediction strategy include potential pullbacks if the price fails to hold critical support levels after breaking out. An anticipated drop to $1.61 could occur if strength is not maintained, which is why analysts often recommend setting tight stop-loss levels.

| Key Points | Details | |

|---|---|---|

| Current Price Level | $2.14 | |

| Forecasted Price Target | $6.5 | |

| Analyst | Cryptarch_ (TradingView) | |

| Optimal Entry Point | $2.10 | |

| Stop-Loss Level | $2.00 | |

| Key Resistance Levels | $2.49, $3.00, $3.39 | |

| Significant Date | May 10, 2025 | |

| Market Influence | Bitcoin price action | |

Summary

The XRP price forecast is generating considerable excitement as analysts predict a significant surge to $6.5. With bullish momentum indicators and key resistance levels identified, XRP’s potential for reaching this target appears strong. Investors should monitor May 10, 2025, as it could serve as a critical inflection point for XRP’s price movement, making strategic entry and exit points essential.

The XRP price forecast has become a focal point for traders and investors alike, as market analysts showcase predictions of a significant surge to $6.5. With the altcoin market trending towards bullish sentiments, many have turned their attention to XRP, driven by key momentum indicators that suggest a remarkable uptrend. An expert analysis from ‘Cryptarch_’ reveals a promising XRP price prediction based on technical setups, marking strategic resistance levels that could guide future movements. As anticipation builds around XRP’s potential to reclaim its previous highs, aligning with prevailing cryptocurrency analysis, the outlook remains optimistic. As we look toward the next few months, the XRP price target of $6.5 is within reach, making it a thrilling time for both seasoned and novice investors.

In recent discussions surrounding the value of XRP, various specialists have presented intriguing insights into its expected price trajectory. This emerging cryptocurrency, known for its utility within payment channels, has analysts buzzing over its future prospects, particularly as it competes within the dynamic landscape of digital assets. Observers are keenly analyzing patterns and indicators that highlight a trajectory promising significant increases, with many focusing on how XRP’s performance could influence broader altcoin market trends. The bullish XRP outlook generated by recent analyses suggests a vibrant and potentially lucrative trading period ahead. As the crypto community seeks clarity on price movements, understanding these patterns provides invaluable context for making informed investment decisions.