Ethereum price analysis indicates that the cryptocurrency market is at a pivotal turning point, particularly as Ethereum has recently experienced a dramatic price crash, losing more than half its value. The ongoing Ethereum downtrend has raised concerns among investors, prompting an urgent need to evaluate ETH support levels. With the price now hovering around critical zones such as $1,900, market sentiment is largely bearish, highlighting the fragility of this once-strong asset. Traders are closely watching the charts for clues in ETH technical analysis, as any sign of recovery from this steep decline could influence the broader cryptocurrency landscape. In this volatile climate, understanding Ethereum’s price movement is essential for anyone looking to navigate the complex world of digital assets.

In the realm of cryptocurrency, assessing the fluctuations in Ethereum’s value has become increasingly crucial for traders and investors alike. This evaluation, often referred to as Ethereum valuation insight, sheds light on the current bearish trajectory and highlights significant technical indicators that could foreshadow future price actions. With the Ethereum market sentiment tilting towards pessimism, it is vital to pinpoint the essential support levels that may either stabilize or further weaken ETH prices. The recent cryptocurrency price crash has led to intense scrutiny of Ethereum’s market dynamics and price recovery prospects, making a comprehensive analysis of its resilience imperative in today’s market. As the ETH landscape evolves, understanding these metrics will empower individuals to make informed decisions regarding their investments.

Ethereum Price Analysis: Current Market Landscape

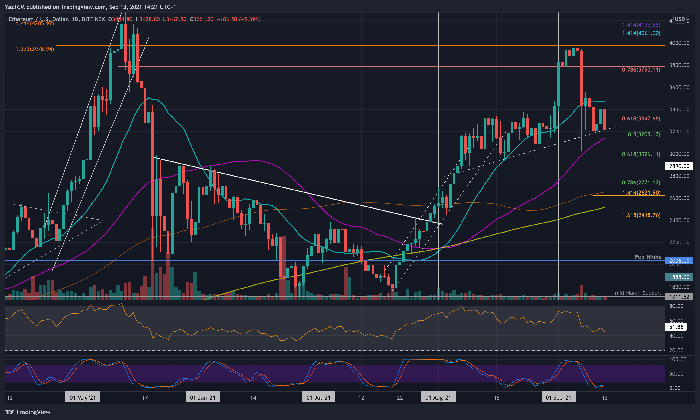

The recent price movements in Ethereum (ETH) depict a stark narrative of a cryptocurrency in distress. Over the past months, Ethereum has experienced a dramatic price crash, losing more than half of its value. This downturn has raised concerns among investors, especially as it breaks below several critical support levels, leading to a predominant bearish market sentiment. Observing the daily chart reveals a consistent downtrend characterized by lower highs and lower lows, illustrating the significant pressure ETH has been under. The breach of the psychological barrier of $2,000 further emphasizes the fragile state of this altcoin’s performance in the current economic conditions.

Looking at the technical analysis, the implications of the recent price decline show a clear struggle for Ethereum to maintain upward momentum. Currently testing the $1,900 support zone, ETH’s failure to recover above this line could signal deeper declines, potentially targeting the $1,600 range. Traders are closely watching these key support levels, as they determine ETH’s fate in the weeks to come. The Relative Strength Index (RSI) reading also suggests that while there is some potential for a short-term recovery, the overriding bearish sentiment continues to dominate, significantly affecting predictions for a stable market turnaround.

Understanding Ethereum’s Downtrend Dynamics

The downtrend observed in Ethereum’s price reflects broader challenges within the cryptocurrency market, particularly the impact of macroeconomic factors on investor behavior. As uncertainty looms over investor sentiment, Ethereum’s ability to lift itself from the persistent decline seems increasingly tenuous. The continuous selling pressure observed may further weaken ETH, with market participants queuing up to liquidate positions amidst fears of a prolonged downturn. This natural response in a volatile market leads to heightened concern around support levels, which have historically provided some cushion against price falls.

Furthermore, the importance of the 200-day moving average cannot be overstated in this context. As ETH struggles to reclaim this benchmark, the prevailing market sentiment portrays a bearish outlook that could perpetuate selling waves. Therefore, while investors remain hopeful for a reversal, the prevailing downtrend coupled with a lack of bullish signals complicates the path forward for Ethereum. In such a landscape, awareness of Ethereum’s technical indicators, such as support levels and overhead resistance, is essential for making informed trading decisions.

Ethereum Support Levels: Critical Points of Interest

Identifying the critical support levels for Ethereum is imperative for traders and investors alike. The recent test of the $1,900 support zone is pivotal, as it represents a significant barrier against additional losses. If this level fails to hold, the next target for Ethereum could potentially drop to the $1,800 range, and further below that to $1,600. Understanding these support levels is crucial as they inform the potential catch points for any recovery attempt, accentuating the underlying importance of psychological price thresholds in trading strategy.

Moreover, these support levels serve as indicators of market sentiment, bridging investor psychology and market dynamics. A breach below these key levels could hint at a shift in sentiment, moving from cautious optimism to outright fear within the community. Traders need to remain vigilant of these changes, as the relationship between support levels and overall market activity can indicate impending volatility. Consequently, while discussions around bullish reversals continue, the conversation often gravitates toward how well Ethereum can defend these critical price points in the weeks to come.

Ethereum Market Sentiment: A Closer Examination

The prevailing market sentiment surrounding Ethereum is crucial in understanding current price movements and potential future outcomes. As fear and uncertainty grip the market, Ethereum has seen a decline in trading volume and Open Interest in futures markets, indicating a lack of confidence among traders. This sentiment is further exacerbated by the recent price crash, which has led many to liquidate long positions, amplifying selling pressure. Observing these trends allows one to gauge the overall market mood, which often dictates whether traders choose to enter or exit their positions.

The sentiment analysis showcases how important a collective shift in trader behavior can be, especially when considering the relationship between technical indicators and psychological factors. As ETH tests key levels, the response from traders will likely influence the immediate future of Ethereum’s price trajectory. If the sentiment shifts positively, we may see a recovery; however, the current bearish outlook suggests that until there is a significant rebound in confidence in the market, the struggle may continue for Ethereum and its investors. Hence, staying informed on both sentiment metrics and price action is essential for those involved in Ethereum trading.

Implications of the Cryptocurrency Price Crash on Ethereum

The broader cryptocurrency price crash serves as a significant backdrop against which Ethereum’s struggles are unfolding. This crash has not only led to substantial losses for Ethereum but has also contributed to a general atmosphere of fear within the crypto markets. The subsequent effect is a marked decrease in investment interest and a tendency among investors to shift toward less volatile assets. The volatility associated with such price swings often breeds apprehension, leading to increased selling and exacerbating ETH’s downtrend.

As Ethereum navigates through these tumultuous waters, understanding how external market factors, like regulatory news and macroeconomic changes, play into its price behavior becomes vital. The sensitivity to such influences can result in rapid price changes, reinforcing the need for comprehensive risk management strategies among traders. In the aftermath of a significant price crash, ensuring that one is equipped with the proper analysis tools and awareness of market trends is essential to avoid getting caught up in further volatility.

Analyzing Key Technical Indicators for Ethereum

Technical analysis reveals critical insights for Ethereum traders looking to navigate the ongoing market turbulence. Key indicators such as the moving averages, particularly the 200-day moving average, are pivotal in gauging both momentum and potential reversals. Currently, Ethereum’s inability to reclaim this moving average amidst the downtrend signals underlying weakness, indicating that traders should remain cautious about entering long positions until clearer bullish signals emerge.

In addition, the analysis of the Relative Strength Index (RSI) and volume trends provides further clarity into Ethereum’s market dynamics. With the RSI lingering in oversold territory, there is potential for a short-term bounce; however, without definitive volume support, such recoveries could be short-lived. As traders assess these technical indicators, they are primed to make informed decisions, anticipating potential breakouts or breakdowns, thus enabling strategic trading in a turbulent environment.

Open Interest and Its Role in Ethereum’s Market Dynamics

Open Interest (OI) serves as a critical component in understanding Ethereum’s market dynamics, particularly in times of extreme volatility. A notable decline in overall OI often indicates a deleveraging event, wherein highly leveraged positions face liquidation due to rising bearish pressure. This recent trend aligns closely with the drop in ETH’s price, demonstrating how interconnected the market’s speculative behavior is with price movements. Observers note that when OI decreases alongside falling prices, it often signifies a market retreat and reduced speculation, essential markers for those tracking market sentiment.

However, if OI begins to stabilize or increase, it could suggest a resurgence of interest in long positions, paving the way for a potential rally. In its current state, the declined OI hints that traders are cautious and potentially expecting further declines rather than a quick recovery. Monitoring OI, alongside price movements and market sentiment, thus becomes essential for a comprehensive view of Ethereum’s shifting landscape, providing insights into the probable future trends based on trading behavior.

Future Outlook for Ethereum: Challenges and Opportunities

Looking ahead, the future outlook for Ethereum is one filled with both challenges and potential opportunities. As the cryptocurrency grapples with a significant downtrend, the possibility for recovery heavily relies on how well it can navigate key resistance and support levels in the coming weeks. The critical question remains whether Ethereum can surpass the psychological $2,000 mark and establish a solid foothold above it. If bulls can gather enough momentum to break through this barrier, it might set up a new phase of bullish activity, potentially changing the current narrative.

On the flip side, should Ethereum fail to hold above these essential support zones, it could witness further declines, posing challenges for long-term holders and traders alike. The path forward hinges on several factors, including market sentiment, regulatory decisions, and overall cryptocurrency market performance. As ongoing analysis of trends continues, keeping a close eye on these developments will guide traders in making informed decisions that could capitalize on potential market corrections or emerging opportunities.

Frequently Asked Questions

What recent trends can we observe in Ethereum price analysis?

Recent Ethereum price analysis indicates a significant downtrend, with ETH experiencing substantial losses as it has fallen below critical support levels, particularly the psychological $2,000 mark. The price seems to be forming lower highs and lower lows, suggesting continued bearish market sentiment.

What are the key support levels in Ethereum price analysis to watch?

In the current Ethereum price analysis, key support levels include the $1,900 zone, which is currently being tested, and the critical $1,800 level. A failure to maintain these levels could lead to a deeper correction towards $1,600.

How is market sentiment affecting Ethereum price analysis?

Ethereum market sentiment remains bearish following a cryptocurrency price crash that has seen ETH lose more than half of its value in recent months. The negative sentiment is reflected in the ongoing downtrend, and traders are closely monitoring key support levels for signs of potential recovery.

What role does technical analysis play in forecasting Ethereum’s future price movements?

Technical analysis plays a vital role in Ethereum price analysis by identifying trends and key levels. Currently, the formation of a descending wedge pattern on the 4-hour chart may indicate a potential bullish reversal, depending on whether ETH can break above resistance levels during upcoming trading sessions.

Can we expect a rebound in Ethereum’s price according to current analysis?

While Ethereum has shown signs of being oversold in current price analysis, any rebound is contingent on breaking the $2,400 resistance level. Until this threshold is exceeded, any short-term recoveries could be temporary, as further declines remain possible if support levels fail.

What impact does open interest have on Ethereum price analysis?

Open interest significantly affects Ethereum price analysis, as recent declines in both price and open interest indicate strong deleveraging among traders. This could suggest a period of reduced speculation and selling pressure, but for a sustained recovery, we need to see open interest rise alongside price, confirming renewed investor interest.

| Analysis Aspect | Description |

|---|---|

| Current Price Status | Ethereum has lost more than half its value recently, diving below the $2,000 mark and testing significant support at $1,900. |

| Daily Chart Analysis | The daily chart suggests a strong downtrend, with lower highs and lows, and it indicates potential further declines if key resistances aren’t overcome. |

| 4-Hour Chart Insights | A descending wedge pattern may indicate a bullish reversal, but failure to hold at $1,900 risks further decline. |

| Sentiment Analysis | A decrease in Open Interest reflects decreased market speculation and potential liquidation events, indicating traders closing positions. |

| Outlook | If ETH cannot hold key support or regain $2,400, further price declines toward $1,600 may be seen, with market sentiment remaining bearish for now. |

Summary

In summary, the Ethereum price analysis indicates a critical juncture for the cryptocurrency, as it struggles below significant support levels and faces bearish market sentiment. With the price hovering near the psychological $1,900 mark and a notable decline in Open Interest, the potential for further downside looms large. For traders and investors, keeping an eye on pivotal resistance levels and market sentiment will be crucial in navigating the future of ETH.

Ethereum price analysis suggests a turbulent period ahead for the second-largest cryptocurrency, as it has experienced a significant downturn, losing more than half of its value in the recent months. This ongoing Ethereum downtrend has raised concerns among investors, particularly as price action has seen ETH breach critical support levels, including the psychological $2,000 mark. Current Ethereum market sentiment leans towards bearishness, with traders closely monitoring ETH support levels around $1,900. The recent cryptocurrency price crash has left many questioning whether a recovery is on the horizon or if further declines are imminent. Coupled with ETH technical analysis, the indicators point to a cautious approach for traders aiming to navigate these volatile waters as they watch for signs of a potential reversal or additional downside risk.

In the realm of cryptocurrency trading, understanding price fluctuations is crucial for making informed decisions, and Ethereum price evaluation is no exception. This analysis delves into the broader trends and patterns affecting Ethereum’s value, particularly amidst recent losses and market instability. With ETH facing challenges in maintaining critical support thresholds, the question arises: can the asset regain bullish momentum, or will it continue to face hurdles? Investors and traders alike must remain vigilant, as the changing dynamics of Ethereum’s market can dictate future profitability. By exploring alternative metrics and market indicators, we can enhance our understanding of this prominent digital asset and its potential trajectory.