Data infrastructure in DeFi is a critical component that significantly impacts the future of decentralized finance. As blockchain technology continues to evolve, the need for robust and efficient data systems becomes increasingly evident. Unfortunately, many existing infrastructures suffer from severe data latency issues, hindering the seamless integration of financial applications. Without real-time data access, DeFi adoption faces substantial barriers, limiting innovation and user engagement. To realize the full potential of decentralized finance, we must address these challenges head-on and invest in modern solutions that can keep pace with the rapid advancements in blockchain technology.

The framework supporting decentralized finance (DeFi) is under immense pressure as traditional data systems struggle to adapt to the demands of modern blockchain ecosystems. As the landscape of financial technology shifts, the necessity for an enhanced data architecture becomes paramount. Outdated models are proving inadequate, leading to significant data latency challenges that undermine the effectiveness of financial applications. In an era where instantaneous access to information is crucial, the ability to harness real-time data flow will determine the success of DeFi initiatives. To foster widespread DeFi adoption, the industry must prioritize the development of innovative data solutions that align with the speed and complexity of today’s blockchain networks.

The Importance of Data Infrastructure in DeFi

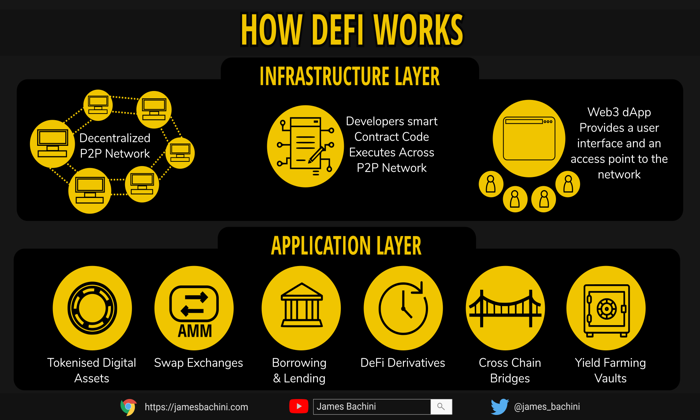

Data infrastructure serves as the backbone of decentralized finance (DeFi), enabling seamless transactions and interactions across various financial applications. In a landscape where blockchain technology is advancing at an unprecedented rate, the need for robust and efficient data systems is paramount. Currently, many DeFi platforms struggle with outdated infrastructure that cannot keep up with the speed and complexity of modern blockchain networks. This inefficiency not only hinders user experience but also stifles innovation within the ecosystem.

As DeFi adoption grows, the reliance on outdated systems poses a significant threat to the market’s future. Slow transaction times and data latency issues can deter users and investors, leading to decreased engagement and participation. To fully realize the potential of DeFi, stakeholders must prioritize the development of advanced data infrastructure that can support real-time data access and rapid transaction processing. Ultimately, a strong data foundation is essential for fostering trust and enabling the next wave of financial innovation.

Overcoming Data Latency Issues in Decentralized Finance

Data latency issues are a critical concern for the DeFi ecosystem, as they can significantly impact the efficiency and effectiveness of financial applications. High-performance blockchains like Aptos can handle thousands of transactions per second, yet outdated indexing solutions often struggle to deliver this data in real-time. The reliance on ‘Frankenstein Indexers’—ad-hoc systems cobbled together from traditional databases—is a recipe for disaster, ultimately leading to missed opportunities and frustrated users.

To overcome these data latency challenges, the DeFi community must invest in innovative solutions that provide instantaneous access to on-chain data. By rethinking data architecture and implementing systems that push data directly to users, we can achieve the low-latency performance necessary for high-frequency trading and other advanced financial applications. This transition is crucial for maintaining competitive advantages in an increasingly fast-paced market.

The Role of Blockchain Technology in DeFi Innovation

Blockchain technology is at the heart of DeFi’s promise, offering unprecedented levels of transparency, security, and decentralization. However, the effectiveness of these technologies is heavily dependent on the underlying data infrastructure that supports them. As DeFi applications evolve, they require an equally sophisticated data framework capable of handling complex transactions and real-time updates. Without this, the innovative potential of blockchain can be severely limited.

Moreover, as we witness the rise of derivatives and other complex financial products within DeFi, the need for a robust data infrastructure becomes even more apparent. These products often rely on rapid price discovery and real-time data access, which can only be achieved through advanced technological solutions. Therefore, investing in cutting-edge data systems is essential for the continued growth and success of blockchain-based financial applications.

The Consequences of Technical Debt in DeFi

Technical debt within DeFi’s data infrastructure can have far-reaching consequences that extend beyond mere inefficiency. As development teams grapple with the limitations of existing tools, they often find themselves diverting significant resources to create custom solutions. This situation not only consumes valuable time and capital but also creates a performance paradox where the potential of high-speed blockchains is undermined by inadequate data handling capabilities.

Furthermore, the consequences of technical debt become increasingly evident in competitive trading environments. Market makers and traders are forced to navigate a landscape where every millisecond counts, and slow data access can mean the difference between profit and loss. Addressing technical debt is not just a matter of improving user experience; it is critical for maintaining the viability of DeFi as a whole.

Rethinking Data Architecture for Real-time Access

As the DeFi landscape continues to evolve, it is crucial to rethink data architecture to facilitate real-time access to blockchain information. Traditional centralized database models are ill-equipped to meet the demands of decentralized finance, particularly when it comes to low-latency performance. Next-generation systems must be designed to push data directly to users, enabling instantaneous processing and reducing the risks associated with data manipulation.

By adopting a decentralized approach to data management, DeFi platforms can enhance transaction speeds and improve overall user experience. This shift will enable the development of more complex financial products that require timely and accurate information, ultimately driving greater adoption and innovation within the ecosystem. Achieving this goal is essential for realizing the full potential of DeFi in a competitive financial landscape.

The Future of Financial Applications in DeFi

The future of financial applications in DeFi hinges on the ability to deliver real-time data access and streamline transaction processes. As blockchain technology continues to advance, DeFi platforms must adapt to meet the evolving needs of users and institutional traders alike. This adaptation requires not only addressing current data infrastructure challenges but also anticipating future demands for speed and efficiency.

Innovative financial applications that leverage the capabilities of high-performance blockchains will emerge as the market matures. However, these applications cannot thrive without the support of robust data systems that facilitate fast and reliable access to on-chain information. By prioritizing the development of next-generation data architectures, stakeholders can ensure that DeFi remains competitive and relevant in the rapidly changing financial landscape.

The Imminent Need for Infrastructure Change

The pressing need for infrastructure change within DeFi is becoming increasingly clear as market demands evolve. As faster blockchains and lower gas fees enable the development of sophisticated financial instruments, the limitations of current data infrastructure are more apparent than ever. Without significant improvements, the DeFi ecosystem risks stagnation, as existing models cannot support the complexities of modern financial applications.

To remain competitive, DeFi platforms must embrace innovative solutions that prioritize real-time data access and low-latency performance. The transition to more advanced data systems is not merely advantageous; it is essential for survival in a marketplace that values speed and efficiency. Stakeholders must take action now to ensure they can meet the demands of the future and capitalize on the opportunities presented by this rapidly evolving sector.

Market Forces Driving Change in DeFi

Market forces are increasingly driving the need for change in the DeFi ecosystem, particularly regarding data infrastructure. As trading firms and institutional players enter the scene, the demand for real-time data access has never been higher. These market participants require systems that can support complex trading strategies and respond to market changes with minimal latency. As such, the current model of excessive node polling and delayed data aggregation will not be sustainable.

The emergence of faster blockchains capable of processing transactions at unprecedented rates signals a shift in the market. To fully leverage these advancements, DeFi platforms must adapt their data infrastructure accordingly. This adaptation will not only enhance operational efficiency but also create a more competitive landscape where participants can thrive. The imperative for change is clear, and those who fail to keep pace will likely find themselves sidelined in the race for DeFi dominance.

The Essential Role of Real-time Data in DeFi

Real-time data access is essential for the success of decentralized finance, as it enables users to make informed decisions and execute trades without delay. As financial applications evolve, the ability to respond instantly to market fluctuations will distinguish successful platforms from those that falter. High-frequency trading, arbitrage opportunities, and other sophisticated strategies rely heavily on real-time data, making it a critical component of the DeFi infrastructure.

Moreover, the demand for real-time data is only expected to grow as more users and institutions enter the DeFi space. The current reliance on outdated data systems poses a significant risk to market efficiency and user satisfaction. To ensure the long-term viability of DeFi, stakeholders must prioritize the development of advanced data architectures that can deliver real-time insights and support the fast-paced nature of modern trading.

Frequently Asked Questions

What are the main challenges facing data infrastructure in DeFi today?

Data infrastructure in DeFi is currently challenged by outdated technology that struggles to keep up with the speed and performance of modern blockchains. High data latency issues and the reliance on inefficient indexing solutions create significant bottlenecks, hindering the adoption and innovation of decentralized finance applications.

How does outdated data infrastructure affect DeFi adoption?

Outdated data infrastructure directly impacts DeFi adoption by causing slow transaction speeds and high data latency. Users expect real-time data access, and when DeFi applications fail to deliver this, it leads to user abandonment and limits the potential for widespread use of decentralized financial applications.

What role does blockchain technology play in improving data infrastructure for DeFi?

Blockchain technology has the potential to enhance data infrastructure in DeFi by enabling faster transactions and decentralized data management. By rethinking data architecture to allow direct access to data points, blockchain can ensure low-latency performance and real-time data access, which are crucial for complex financial applications.

Why is real-time data access critical for financial applications in DeFi?

Real-time data access is critical for financial applications in DeFi because it enables timely decision-making and efficient trading. In a fast-paced market environment, every millisecond counts; thus, the ability to process and react to data instantly can significantly impact revenue and competitive positioning.

What are the implications of data latency issues in DeFi trading?

Data latency issues in DeFi trading can lead to missed opportunities and decreased profitability. When market makers depend on slow data retrieval or polling mechanisms, they face delays that can hinder their ability to execute trades effectively, especially in high-frequency trading scenarios.

How can the DeFi ecosystem evolve its data infrastructure to support advanced financial products?

The DeFi ecosystem can evolve its data infrastructure by adopting next-generation systems that prioritize real-time data streaming and local processing. This shift would enable the development of complex financial products, such as derivatives, that rely on instantaneous data access for price discovery and market efficiency.

What advancements are needed in data infrastructure to support the future of DeFi?

To support the future of DeFi, data infrastructure must advance to handle high data throughput and reduce latency to between 100 to 150 milliseconds. This requires a departure from traditional database architectures to more decentralized and efficient data handling methods, ensuring that the infrastructure can keep pace with the performance of emerging blockchains.

How does the performance of high-speed blockchains impact data infrastructure in DeFi?

The performance of high-speed blockchains puts pressure on existing data infrastructure in DeFi, highlighting the inefficiencies of current indexing solutions. As blockchains like Aptos can handle thousands of transactions per second, the inability of legacy systems to process data in real-time creates a significant gap that must be addressed to enable effective decentralized financial applications.

| Key Point | Explanation |

|---|---|

| Outdated Data Infrastructure | Current data infrastructure is based on 1970s technology, causing delays that hinder DeFi adoption. |

| User Experience Problems | 53% of users abandon sites after 3 seconds of loading. Slow transaction speeds threaten user retention. |

| Technical Debt | Development teams face high costs and limitations with existing indexing solutions, consuming up to 90% of resources. |

| Inadequate Indexing Solutions | Current tools fail to handle real-time changes across multiple high-performance chains, limiting scalability. |

| Need for Rethinking Architecture | Next-gen systems must push data directly to users for low-latency performance and reliable data provenance. |

| The Shift Towards Speed | To enable complex financial products like derivatives, data must be provided in 100-150 milliseconds for effectiveness. |

| Market Forces Driving Change | As trading firms build custom solutions, existing infrastructure’s inadequacy highlights the need for rapid adaptation. |

Summary

Data infrastructure in DeFi is at a critical juncture, as outdated systems jeopardize the sector’s growth and innovation. The pressing need is for a fundamental overhaul of how blockchain data is managed to ensure real-time access and efficient processing. As DeFi continues to evolve, adapting to these infrastructure challenges will be essential for the future of decentralized finance.

In the rapidly evolving world of decentralized finance (DeFi), the importance of robust data infrastructure cannot be overstated. As blockchain technology continues to drive DeFi adoption, the industry faces significant challenges, particularly concerning data latency issues and real-time data access. Current systems, rooted in outdated technology, struggle to meet the demands of high-performance financial applications, leading to inefficiencies that threaten innovation. Without a modernized approach, the potential of DeFi will remain untapped, hindering its growth and acceptance in the mainstream financial landscape. Addressing these foundational concerns is critical for ensuring that DeFi can fully realize its transformative potential.

When we discuss the backbone of decentralized financial systems, we often refer to the underlying data frameworks that facilitate operations. These data architectures are crucial for ensuring seamless transactions and efficient market interactions in the burgeoning landscape of blockchain-based finance. However, as the need for quick and accurate data processing grows, so do the challenges associated with traditional data handling methods. The current reliance on outdated indexing solutions can lead to significant delays, which are detrimental to real-time trading and the overall user experience. As we move forward, rethinking and upgrading these data systems will be essential for supporting the next generation of financial instruments and applications in DeFi.