In today’s digital landscape, financial fraud risks are escalating, particularly as discussions around crypto regulation heat up. The Australian Competition and Consumer Commission (ACCC) has issued stark warnings that any relaxation of oversight in the US could open the floodgates to investment scams targeting unsuspecting investors, especially in Australia. With the rise in cryptocurrency fraud, consumers are increasingly vulnerable to sophisticated schemes designed to exploit gaps in regulation. The potential implications of Trump crypto policies, which aim to position the US as a global leader in cryptocurrency, could further complicate this landscape, leading to an alarming increase in scams. As the stakes rise, it is imperative for both regulators and consumers to stay vigilant against the tide of fraud threatening their financial security.

As the world navigates the complexities of digital currencies, the risks associated with financial deception are becoming more pronounced. Regulatory changes, especially in influential markets like the US, could significantly impact the landscape of investment fraud, particularly within the realm of cryptocurrencies. The ACCC’s concerns reflect a broader apprehension regarding how lenient regulatory frameworks might embolden scammers to target investors more aggressively. Furthermore, the rise of cryptocurrency-related scams emphasizes the urgent need for effective consumer protection measures. With the potential for increased vulnerabilities, it is crucial for stakeholders to understand the implications of relaxed regulations and the necessity for robust defenses against fraudulent activities.

Understanding Financial Fraud Risks in Cryptocurrency

Financial fraud risks, especially in the realm of cryptocurrency, have become a pressing concern for regulators worldwide. As the Australian Competition and Consumer Commission (ACCC) chair Gina Cass-Gottlieb stated, the potential relaxation of crypto regulations in the U.S. could create a breeding ground for investment scams, exacerbating vulnerabilities for Australian consumers. The sophistication of global cybercrime means that lax regulations can lead to increased fraudulent activities, making it imperative for investors to remain vigilant. Terms such as ‘cryptocurrency fraud’ and ‘investment scams’ have become alarmingly common as the landscape of digital currency evolves.

Moreover, as the U.S. shifts towards a more relaxed regulatory stance under figures like Donald Trump, who has advocated for the country to become the ‘crypto capital of the planet,’ the potential for cross-border fraud increases. With Australia already facing significant losses—over $1.3 billion in 2023 alone due to investment scams—there is a heightened urgency for stronger regulatory frameworks and consumer protections. This scenario underscores the importance of not only national regulations but also international cooperation to combat the risks of financial fraud in the cryptocurrency space.

Impact of Trump’s Crypto Policies on Global Regulation

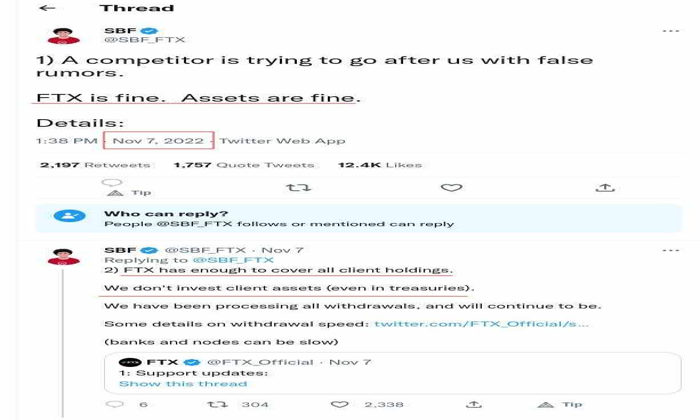

The policies proposed by former President Donald Trump regarding cryptocurrency regulation have stirred considerable debate within the global financial community. Advocating for a more favorable environment for crypto investments, Trump’s approach starkly contrasts with that of President Biden, who has pursued stringent regulatory measures against crypto firms. This shift could encourage investment but also heightens the risk of financial fraud, particularly as scammers are known to exploit regulatory ambiguities. As Cass-Gottlieb pointed out, such deregulation could lead to ‘horror scenarios’ for consumers, highlighting the necessity of a balanced regulatory approach.

In light of these developments, it is crucial for Australian regulators to remain proactive in their oversight of cryptocurrency markets. The ACCC has already emphasized the need to combat investment scams and protect consumers from potential losses. As Trump’s policies unfold, they may create ripple effects that could either enhance or undermine the integrity of cryptocurrency markets globally. The emphasis on consumer protection must be maintained to prevent the exploitation of investors, especially in jurisdictions like Australia, where the impact of U.S. regulatory changes can be profoundly felt.

The Surge of Cryptocurrency Fraud and Scams

Cryptocurrency fraud has surged in recent years, with reports indicating that Australians lost significant amounts to scams in 2023. The ACCC’s report highlights that scams involving cryptocurrencies have become increasingly prevalent, with fraudsters employing sophisticated tactics to lure victims. The rise of ‘pig butchering scams,’ which have accounted for billions in losses, illustrates the urgent need for consumers to be aware of the tactics used by scammers. Such scams often involve establishing false relationships over time, leading victims to invest in fraudulent schemes under the guise of legitimate opportunities.

As the landscape of cryptocurrency continues to evolve, so too do the methods employed by fraudsters. Scammers increasingly utilize dating apps and social media to establish trust with potential victims. The findings from the Web3 security firm Cyvers show the alarming extent of these scams, with over 150,000 blockchain addresses linked to fraudulent activities. This underscores the necessity for stringent regulations and consumer education to mitigate the risks associated with cryptocurrency investments.

Regulatory Responses to Combat Cryptocurrency Scams

In response to the growing threat of cryptocurrency scams, regulators have begun implementing stricter licensing requirements for crypto service providers. Australia, under the guidance of the ACCC, has recognized the importance of robust regulatory frameworks to protect consumers from financial fraud. The focus on enhancing oversight aligns with the need to address the sophisticated nature of scams that are prevalent in the crypto market. By tightening regulations, authorities aim to create a safer environment for investors and deter potential fraudsters from exploiting regulatory loopholes.

Furthermore, regulatory bodies are not only focusing on licensing but are also emphasizing the importance of consumer education. As scams continue to evolve, informing the public about the signs of fraudulent schemes is essential. Initiatives aimed at raising awareness can empower consumers to make informed investment decisions and recognize potential threats. The collaboration between regulators and cybersecurity firms is also crucial in tracking down stolen assets and recovering funds lost to scams, thus reinforcing trust in the cryptocurrency market.

The Role of Consumer Advocacy in Crypto Regulation

Consumer advocacy plays a vital role in shaping cryptocurrency regulations and ensuring that investor protections remain a priority. Advocacy groups have voiced concerns about the potential consequences of deregulation, especially in light of the significant losses Australians have incurred due to investment scams. By pushing for stronger consumer protections and regulatory measures, these organizations strive to create a safer environment for investing in cryptocurrencies. Their efforts are crucial in holding regulators accountable and ensuring that the interests of consumers are not overshadowed by the push for innovation in the crypto space.

Additionally, consumer advocates often work to educate the public about the risks associated with cryptocurrency investments. This includes providing resources on how to identify scams and understand the complexities of the crypto market. As the landscape continues to change, the partnership between regulators and consumer advocacy groups will be essential in developing effective strategies to combat financial fraud. Their collaboration can lead to more comprehensive regulations that protect consumers while still fostering innovation in the cryptocurrency sector.

Emerging Trends in Cryptocurrency Fraud

As the cryptocurrency market matures, new trends in fraud are emerging, with scammers continually adapting their strategies to exploit unsuspecting investors. The rise of decentralized finance (DeFi) platforms has created new opportunities for both legitimate investment and fraudulent schemes. Scammers often capitalize on the lack of regulation in these areas, luring investors with promises of high returns and innovative investment products. The ongoing evolution of technology in the crypto space means that fraudsters are increasingly sophisticated, making it essential for investors to be cautious and well-informed.

In response to these emerging trends, regulators must remain agile and responsive to the changing landscape of cryptocurrency fraud. This includes not only tightening existing regulations but also anticipating potential new methods of fraud. Collaborating with technology firms and cybersecurity experts can provide valuable insights into the tactics used by scammers, ultimately leading to more effective preventive measures. The focus on emerging trends in cryptocurrency fraud highlights the need for continuous vigilance and adaptive regulatory strategies to protect consumers.

Cybersecurity Measures Against Cryptocurrency Scams

Cybersecurity measures are becoming increasingly critical in the fight against cryptocurrency scams. As fraudsters employ sophisticated techniques to breach security protocols and exploit vulnerabilities, both regulators and investors must prioritize cybersecurity. The implementation of advanced security measures, such as two-factor authentication and transaction monitoring, can help safeguard assets and reduce the risk of falling victim to scams. Moreover, educating users about best practices in cybersecurity is essential to empower them to protect their investments.

Additionally, collaboration between regulatory bodies and cybersecurity firms can facilitate the development of innovative solutions to combat fraud. By sharing information and resources, these entities can work together to create a more secure environment for cryptocurrency transactions. As the crypto landscape evolves, ongoing investment in cybersecurity measures will be vital to maintaining consumer confidence and preventing further financial fraud in the sector.

The Importance of International Cooperation in Crypto Regulation

International cooperation is critical in addressing the challenges posed by cryptocurrency fraud and scams. Given the borderless nature of digital currencies, regulatory efforts must extend beyond national jurisdictions to effectively combat fraud. Collaboration between countries can lead to the sharing of intelligence and resources, enabling regulators to track and dismantle international fraud networks. This unified approach is essential in safeguarding consumers from the vulnerabilities that arise from disparate regulatory frameworks.

Furthermore, international cooperation can enhance the effectiveness of regulatory measures by establishing common standards for cryptocurrency exchanges and service providers. By harmonizing regulations, countries can create a more consistent environment that reduces the opportunities for fraud and builds trust among consumers. As the cryptocurrency market continues to grow, the importance of international collaboration in regulation cannot be overstated, as it is vital to protecting investors and ensuring the integrity of financial systems globally.

Future Outlook for Cryptocurrency Regulation

The future of cryptocurrency regulation is a topic of significant interest and concern among investors and regulators alike. As the market continues to evolve, there is a growing recognition of the need for balanced regulations that foster innovation while protecting consumers from fraud. The potential for increased regulatory clarity could attract more legitimate investments, thereby enhancing the overall stability of the cryptocurrency market. However, this must be coupled with robust consumer protection measures to ensure that investors are safeguarded against the rising tide of scams.

Looking ahead, it is anticipated that regulatory frameworks will undergo significant changes to adapt to the dynamic nature of the cryptocurrency landscape. As seen with the ACCC’s commitment to tackling financial fraud, there is a clear emphasis on prioritizing consumer safety. The ongoing dialogue between regulators, industry stakeholders, and consumer advocates will play a crucial role in shaping the future of cryptocurrency regulation. Ultimately, a collaborative approach will be essential in creating an environment that supports innovation while simultaneously protecting investors from potential financial fraud.

Frequently Asked Questions

What are the financial fraud risks associated with cryptocurrency investment scams?

Investment scams in the cryptocurrency sector pose significant financial fraud risks, particularly as they exploit the lack of regulatory oversight. Consumers can fall victim to schemes that promise high returns but ultimately lead to substantial losses. The Australian Competition and Consumer Commission (ACCC) reported Australians lost over $1.3 billion to such scams in 2023, highlighting the urgent need for awareness and protection.

How does crypto regulation impact financial fraud risks for investors?

Crypto regulation plays a crucial role in mitigating financial fraud risks for investors. Stricter regulations can deter fraudulent activities by holding scams accountable and providing clear guidelines for crypto service providers. In contrast, any relaxation of regulatory measures, such as those proposed under Trump’s policies, could exacerbate vulnerabilities for investors, potentially leading to increased investment scams.

What warnings has the ACCC issued regarding cryptocurrency fraud?

The ACCC has issued warnings concerning the heightened financial fraud risks associated with cryptocurrency, especially if US regulations are relaxed. Chair Gina Cass-Gottlieb cautioned that this could create an environment where scammers target Australian consumers more aggressively, capitalizing on the regulatory ‘freeing up’ and the sophistication of global crime.

What are pig butchering scams and their financial fraud risks?

Pig butchering scams are a type of investment fraud that often involves grooming victims over time through social interactions, particularly on dating apps and social media. These scams have become a significant financial fraud risk, resulting in over $3.6 billion in crypto losses in 2024. Victims are manipulated into investing in fraudulent schemes after trust is established, making awareness and vigilance essential.

How can consumers protect themselves from cryptocurrency fraud risks?

Consumers can protect themselves from cryptocurrency fraud risks by conducting thorough research on investment opportunities and being skeptical of offers that appear too good to be true. Staying informed about current scams and regulatory changes, such as those from the ACCC, can help individuals avoid falling victim to investment scams and other fraudulent activities in the crypto market.

What role does Trump’s crypto policy play in financial fraud risks?

Trump’s pro-crypto policies may pose increased financial fraud risks due to potential regulatory relaxation. This shift could create a favorable environment for scammers to operate, as highlighted by the ACCC’s concerns. Regulatory easing might lead to a rise in investment scams, making it crucial for investors to remain vigilant and informed about the risks associated with such changes.

Why are cryptocurrency fraud risks a concern for Australian consumers?

Cryptocurrency fraud risks are a significant concern for Australian consumers as they have been increasingly targeted by sophisticated scams that exploit the digital currency’s popularity. The ACCC has reported alarming losses due to investment scams, and with the potential for relaxed regulations, the risk of falling victim to these scams could escalate, necessitating robust consumer protection measures.

What is the significance of the ACCC’s enforcement priorities regarding financial fraud risks?

The ACCC’s enforcement priorities are significant as they focus on tackling financial fraud risks in conjunction with competition issues. By prioritizing the fight against investment scams and cryptocurrency fraud, the ACCC aims to enhance consumer protection and reduce the significant financial losses reported in recent years, thereby fostering a safer investment environment.

| Key Points | Details |

|---|---|

| Regulatory Concerns | ACCC warns of increased financial fraud risks if US crypto regulations are relaxed. |

| Impact on Australian Consumers | Heightened vulnerability to investment scams, with potential ‘horror scenarios’ outlined by ACCC chair Gina Cass-Gottlieb. |

| Current Crypto Landscape | Trump’s administration aims to create a pro-crypto environment, contrasting Biden’s enforcement-heavy approach. |

| Financial Losses | Australians lost over $1.3 billion to investment scams in 2023, with cryptocurrencies being a significant factor. |

| Scam Types | Pig butchering scams accounted for $3.6 billion in crypto losses in 2024, involving grooming victims over time. |

| Regulatory Response | Australia is implementing stricter licensing for crypto service providers to combat scams. |

| Recovery Efforts | Cyber investigators recovered $1.3 billion in stolen assets through tracking and bug bounty initiatives. |

Summary

Financial fraud risks are escalating, particularly in relation to cryptocurrencies, as highlighted by Australian regulators. The ACCC’s warnings about the potential consequences of relaxed US regulations underscore the urgent need for protective measures against investment scams. With significant financial losses already reported, the ongoing evolution of the crypto landscape necessitates a vigilant approach to safeguard consumers and mitigate risks.

As the landscape of finance continues to evolve, financial fraud risks are becoming a pressing concern for consumers globally. Recent warnings from the Australian Competition and Consumer Commission (ACCC) highlight that any relaxation of crypto regulation in the United States, particularly under Trump’s pro-crypto policies, could lead to increased vulnerability to investment scams in Australia. With a staggering loss of over $1.3 billion to scams in 2023, the threat of cryptocurrency fraud is ever-present, particularly as scammers exploit regulatory loopholes. The ACCC’s chair, Gina Cass-Gottlieb, emphasizes that sophisticated global crime is on the rise, and without stringent oversight, the potential for “horror scenarios” is significant. As we delve deeper into the implications of these warnings, it’s crucial to understand the dynamics of crypto regulation and how they intersect with consumer safety.

In today’s digital economy, the threat of fraud within the financial sector is escalating, particularly regarding digital currencies. The Australian regulator’s recent alerts regarding increased financial deception risks underscore the need for vigilance, especially if the United States loosens its grip on cryptocurrency oversight. Investment scams, including those that leverage cryptocurrency, are proliferating at an alarming rate, prompting concerns from consumer protection agencies. With the potential shift in U.S. crypto policies under former President Trump, who aims to make America a hub for digital assets, there is a palpable fear that such changes could embolden scammers. Understanding these financial vulnerabilities is essential for consumers navigating an increasingly complex investment landscape.