Ethereum price prediction remains a focal point for investors as the cryptocurrency navigates challenging market conditions. Recent analyses indicate that the current ETH price struggles to surpass the $2,000 mark, primarily due to diminished network activity and a sharp decline in Total Value Locked (TVL). As Ethereum market trends indicate a persistent slump, traders are keeping a close eye on the factors shaping the ETH price forecast. Technical analysis of Ether suggests a potential downtrend, embodying a bear flag pattern that could drive prices even lower in the coming weeks. With ongoing outflows from Ethereum investment products adding to the uncertainty, the ETH price analysis signifies significant concerns that could impact future investment strategies.

The outlook for Ethereum, or ETH, has become increasingly critical as investors evaluate potential fluctuations and shifts in its market position. Current trends reveal that Ethereum’s trajectory may be faltering, largely influenced by reduced investor enthusiasm and inadequate onchain engagement. Many are examining the ETH price trajectory closely, noting how recent downward patterns have raised alarms for the cryptocurrency’s future performance. Observing technical patterns, such as the bear flag formation, illuminates possible dips that could affect upcoming market decisions. As stakeholders analyze the shifting dynamics within the Ethereum ecosystem, their strategies may need to adapt to the unfolding ETH price landscape.

Current State of Ethereum Prices

The current state of Ethereum prices remains under intense scrutiny as investors assess the implications of on-chain data. At present, the ETH price hovers below substantial resistance at the $2,000 mark, an area that has proven difficult to breach. Ongoing price consolidation between $1,810 and $1,960 is reflective of market uncertainty, where the prediction remains grim for a movement towards the $2K threshold. This stagnation is correlated closely with waning network activity and decreasing Total Value Locked (TVL), prompting many analysts to engage in Ethereum price analysis to gauge potential future movements.

In addition to technical barriers, Ethereum’s fundamentals are showcasing signs of stress, with an evident decline in investor confidence leading to adverse price reactions. Recent metrics reveal a substantial drop in Ethereum’s TVL and a worrying trend in trading volume on key decentralized exchanges. As market vulnerability increases, analysts are advising potential investors to remain cautious while considering the ETH price forecast and the broader implications of current Ethereum market trends. Understanding these dynamics is critical as the crypto landscape faces a potentially long recovery phase.

Impact of Ethereum ETF Outflows

The decrease in Ethereum’s price can largely be attributed to significant outflows from the Ethereum exchange-traded funds (ETFs). Over the past weeks, these investment mechanisms have witnessed a staggering total of $265 million in outflows, contributing heavily to the current bearish sentiment surrounding ETH. This behavior reflects a broader risk-off approach taken by investors in today’s volatile environment, resulting in reduced speculative investments in Ethereum. Such negative trends concerning Ethereum ETF flows not only signal a waning interest but also suggest caution among institutional investors.

Market analysts emphasize the importance of these ETF trends against the backdrop of Ethereum investment strategies. The data shows that as these products draw away capital, Ethereum’s price grapples with downward pressure. The concerning pattern of sustained outflows, now reported for 17 consecutive days, is unprecedented and marks a critical juncture for Ethereum’s market health. Investors are urged to keep a watchful eye on these trends as they play a pivotal role in shaping the ETH price analysis and the potential outlook for Ethereum’s future price movements.

Analysis of On-Chain Metrics for Ethereum

A thorough analysis of Ethereum’s on-chain metrics reveals critical insights into the ongoing struggles of Ether. Despite maintaining a leading position in decentralized exchange (DEX) volume, there has been a stark 30% decline in trading activity recently, a telltale sign of decreasing investor engagement. Metrics show that trading volume fell to $16.8 billion, indicating a potential shift in market dynamics. Additionally, the fall in Ethereum’s Total Value Locked (TVL) highlights underlying weaknesses in the ecosystem, as various protocols witness significant downturns.

Ethereum’s declining activity metrics, such as a staggering 85% drop in the Maverick Protocol’s usage, suggest systemic issues may be at play. This decline is compounded by the downward trajectory of key initiatives like Lido, EigenLayer, and Maker, which have recorded notable TVL contractions. As ETH technical analysis continues to suggest a bearish outlook, understanding these on-chain dynamics becomes vital for investors. These indicators serve as crucial elements in forecasting Ethereum’s price trajectory, further exemplifying the interconnected nature of market activity and investor sentiment.

Ethereum’s Bear Flag Pattern Explained

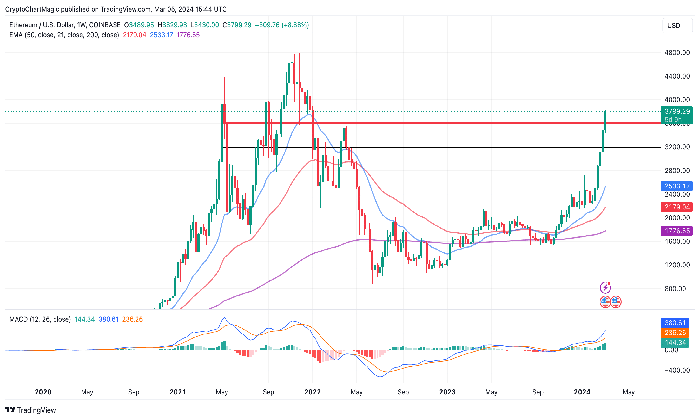

Currently, technical indicators are suggesting that Ethereum may be forming a bear flag on its price chart. This pattern typically signifies a continuation of a downward trend and indicates possible further pricing declines in the near future. With the lower boundary of support positioned at $1,880, a decisive close below this threshold could trigger significant bearish activity, forecasting a potential drop towards the $1,530 target. This potential movement represents a 20% decrease from current levels, further heightening the caution for traders and investors alike.

The significance of the bear flag lies in its ability to structure market behavior and set expectations for future price movements. Analysts monitor the relative strength index (RSI) closely, which currently aligns with a negative trend, suggesting that bearish sentiment prevails in the market. To prevent further declines, ETH bulls must aim for a climbing close above the flag’s upper limit, ideally pushing past $1,970, which would challenge the existing bearish narrative. Hence, for those engaged in Ethereum investment, understanding the implications of this bear flag is crucial for navigating potential price fluctuations.

Understanding the Declining Total Value Locked (TVL)

The concept of Total Value Locked (TVL) has become increasingly vital in understanding the health of the Ethereum ecosystem. Recent reports indicate a monumental drop in TVL, with figures plummeting by nearly 47% from January’s peak of $77 billion to $46.37 billion in March. Such declines not only impact the immediate liquidity of the market but also reflect waning interest from investors in various Ethereum-based decentralized finance (DeFi) protocols. This downturn poses significant implications for Ethereum’s price forecasts, as decreased liquidity typically correlates with heightened market volatility.

Moreover, when examining Ethereum TVL and its corresponding performance, one must consider the various factors influencing these metrics, such as investor sentiment and network utility. The downstream effects of reduced TVL are clear, with implications for Ethereum’s market trends as it struggles to maintain investor confidence. As DeFi platforms face significant drops in TVL, this leads to overall instability within the Ethereum ecosystem, making it essential for investors to weigh these considerations seriously in their ETH investment strategy.

Potential Risks for Ethereum Investors

As Ethereum continues to display signs of bearish sentiment, it is critical for investors to recognize the associated risks in the current market landscape. The combination of declining on-chain activity, significant ETF outflows, and technical indicators signaling further downturns create a precarious environment for ETH holders. The persistent slide below the key resistance level of $2,000 marks a significant psychological barrier that could pose risks for those attempting to re-enter the market without a thorough understanding of these dynamics.

Investors are advised to conduct diligent research and stay abreast of rate changes in sentiments surrounding Ethereum investment products. While long-term holders may reaffirm their commitment based on Ethereum’s technology and potential, short-term traders should exercise caution in navigating these turbulent waters. Maintaining awareness of ongoing ETH technical analysis, including price trends and market signals, will be critical in shaping how best to approach investing in Ethereum moving forward.

Market Sentiment and Its Effects on Ethereum Prices

Understanding market sentiment is paramount for interpreting Ethereum’s price movements. Currently, a prevailing risk-off sentiment has surfaced among investors who are reassessing their positions in light of a tumultuous market. This shift in sentiment is underscored by Ethereum’s continued struggles to push above the critical $2,000 resistance, reflecting a broader apprehension about entering the market at these levels. The prevailing market trends suggest that many investors are holding back, awaiting clearer signals before committing further investments in ETH.

As market conditions remain uncertain, the interplay between investment flows, price analysis, and technical indicators encapsulates the current sentiment toward Ethereum. Investors are encouraged to remain vigilant and utilize comprehensive analysis to navigate this challenging environment. By understanding these psychological market factors, Ethereum investors can better strategize their approaches while keeping an eye on potential opportunities for future rebounds in the ETH price trajectory.

Future Scenarios for Ethereum Pricing

Looking ahead, the future scenario for Ethereum pricing remains contingent on various market factors that influence investor behavior. The potential for recovery hinges not only on technical signals but also on the broader economic environment that governs market trends. If Ethereum can manage to break above resistance, particularly the significant $2,000 barrier, it could reinvigorate investor confidence and potentially drive liquidity back into the market. These dynamics will heavily impact ETH price predictions, with bullish sentiment requiring a convincing rally and sustained volume.

Moreover, alternative market scenarios suggest that if bearish patterns persist, Ethereum prices could slip further, dragging the broader crypto market with them. Traders and analysts are encouraged to stay alert to these developments, adapting their strategies as market conditions evolve. In doing so, they can formulate actionable insights from the ongoing ETH technical analysis, preparing to respond proactively to any shifts in investor sentiment or emerging market trends.

Frequently Asked Questions

What is the current Ethereum price prediction for the near term?

The current Ethereum price prediction indicates that the price may struggle to reach the $2,000 mark. Recent metrics suggest that ETH is likely to remain in a consolidation range, fluctuating between $1,810 and $1,960 due to weakening network activity and a significant resistance at $2,000.

How do ETH price analysis strategies suggest the future of Ethereum?

ETH price analysis reveals concerning trends, including a bear flag formation that could lead to a potential decline to around $1,530. Current onchain metrics and technical indicators paint a bearish outlook for Ethereum, making it essential to monitor these factors closely.

What are the main factors affecting the Ethereum market trends currently?

Current Ethereum market trends are influenced by decreasing Total Value Locked (TVL), negative ETF outflows, and reduced onchain activity. These factors combined have contributed to a negative sentiment surrounding ETH, keeping the price below the crucial $2,000 resistance level.

What does the ETH price forecast indicate about short-term investment opportunities?

The ETH price forecast suggests that short-term investment opportunities may be limited given the current bearish market indicators. With outflows from Ethereum investment products and declining trading volumes, prospective investors should remain cautious and conduct thorough research before entering the market.

Why is the ETH technical analysis showing bearish patterns?

The ETH technical analysis demonstrates bearish patterns due to the formation of a bear flag on the four-hour chart, indicating further downside potential. The weakening Relative Strength Index (RSI) and declining trading volumes reinforce the bearish sentiment, hinting at possible price drops below $1,880.

| Key Points | Details |

|---|---|

| Current Price Status | ETH price is consolidating between $1,810 and $1,960; significant resistance at $2,000. |

| Reasons for Price Slump | Weakened network activity, declining Total Value Locked (TVL), and negative ETF flows. |

| ETF Outflows | Spot ETH ETFs lost $265.4 million over seven days; total outflows this month reached $265 million. |

| Onchain Activity | DEX volumes have dropped by 30% in a week, with TVL down to $46.37 billion from a January peak of $77 billion. |

| Bear Flag Technical Pattern | Technical analysis suggests a potential target of $1,530 if price falls below $1,880. |

| Market Sentiment | Relative strength index at 48 suggests a downward trend; bulls need to push above $1,930. |

Summary

Ethereum price prediction indicates that the cryptocurrency is currently facing significant resistance at the $2,000 mark, as various indicators suggest continued downside potential. With ongoing negative sentiment and declining onchain activity, it appears that a rally beyond the $2K threshold is unlikely in the near term. Investors should remain cautious and monitor the evolving market conditions.

Ethereum price prediction shows a cautious outlook as the cryptocurrency struggles to break the $2,000 barrier. Recent ETH price analysis reveals significant factors contributing to this stagnation, particularly the decline in network activity and Total Value Locked (TVL) across the Ethereum ecosystem. Amid current Ethereum market trends, lingering bearish sentiment is prominent, further solidifying the $2,000 mark as a notable resistance level. This ongoing ETH price forecast suggests potential further declines, with current technical indicators pointing towards a challenging trading environment for investors. As Ethereum investment becomes increasingly cautious, understanding these dynamics is crucial for anyone looking to participate in the market.

When examining the future of Ethereum’s valuation, it’s essential to explore alternative ways to interpret the current situation of ETH. The digital currency faces significant headwinds, as various Ethereum investment metrics indicate a bearish phase, reflecting broader market apprehensions. Technical analysis of ETH suggests that trends point towards possible downturns, culminating in an urgent need for investors to stay informed about Ethereum’s movements and market engagement. This context allows for a more nuanced understanding of the cryptographic asset’s trajectory, particularly concerning Ethereum’s sustainable growth potential in fluctuating economic conditions.