XRP’s price decline has triggered a ripple effect in the broader cryptocurrency market, raising eyebrows among investors and analysts alike. As Ripple whales shift their investment strategies, a massive sell-off of over 60 million tokens over three days has contributed significantly to this downturn. Despite XRP’s earlier surge past $2.4, it faced a sharp rejection, falling by around 5% shortly after hitting that milestone. This dramatic price movement highlights the influence of major investors on XRP’s value, especially in a cryptocurrency market cap that hovers around $140 billion. With current price analysis indicating that XRP is stabilizing just above $2.35, close to a critical support line, the future trajectory remains uncertain as market participants reassess their positions and strategies.

The recent downturn in XRP’s valuation is emblematic of a larger trend within the digital asset landscape. Ripple’s whales are adjusting their tactics, having liquidated substantial amounts of their holdings amidst shifting market dynamics. This unexpected market movement contrasts sharply with the cryptocurrency’s prior gains, where a brief peak at $2.44 suggested potential bullish momentum. However, the subsequent drop has raised questions about long-term investment strategies in a sector characterized by volatility and rapid changes. As enthusiasts and stakeholders analyze the implications of these developments, XRP’s position in the cryptocurrency ecosystem becomes increasingly complex.

Ripple Whales Strategy: A Shift in Investment Approaches

In recent weeks, Ripple whales have consistently redefined their investment strategies, which has drawn significant attention from market analysts. Just recently, they executed the sale of 60 million XRP tokens within a mere three days, a move that raised eyebrows across the cryptocurrency landscape. This divestment is particularly striking given the larger context of Tesla’s impact on the market, with Ripple whales previously indulging in aggressive accumulation strategies leading up to this shift, where they had acquired over 900 million tokens in April. Such a rapid change in their investment approach indicates a potential bearish sentiment among these key players.

The implications of this newfound strategy might suggest a more cautious outlook on XRP’s future performance within the volatile cryptocurrency market. Such actions by these influential investors could trigger other investors to reassess their positions, creating shifts in market dynamics and consequently, impacting the price movements of XRP dramatically. As they play a crucial role within the XRP market movement, their changes also signal an underlying uncertainty that could lead to further price declines or corrections, particularly as the market cap of cryptocurrencies hovers around $140 billion.

Market Response: Analyzing XRP Price Movement Trends

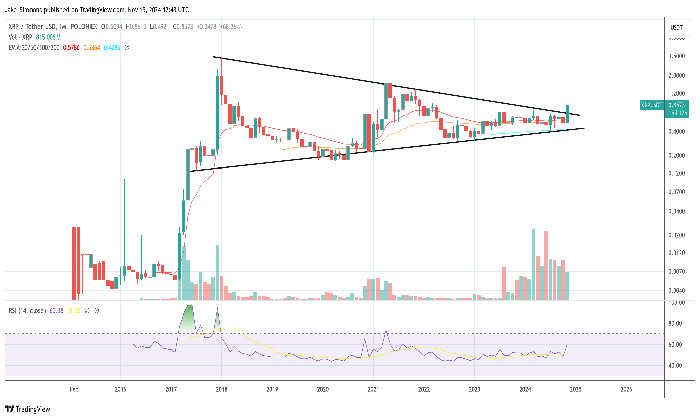

The recent XRP price decline is a significant indicator of how external and internal factors can shape market trends. After reaching a peak of around $2.44 impelled by broader market enthusiasm—especially following Bitcoin’s latest all-time high—XRP experienced a sudden drop of about 5%. This kind of volatility is not new to the cryptocurrency field, yet the rapid ascent followed by a downturn raises questions regarding investor sentiment and market stability. The resistance and support lines, particularly around the critical mark of $2.3, will warrant close scrutiny as they potentially dictate the next leg in XRP’s price trajectory.

Furthermore, XRP’s ability to remain just above the $2.3 support level is crucial for maintaining investor confidence. If the price dips below this line, it may trigger further sell-offs, exacerbating the decline and leaving many to rethink their existing Ripple investment strategy. Continuous price analysis will be vital in guiding investors as they navigate through the ongoing fluctuations in the cryptocurrency ecosystem. As XRP sits precariously in the market, the interplay of whale actions and retail investor responses will undoubtedly shape its path forward.

Understanding XRP’s Role in the Cryptocurrency Market Cap

XRP’s position in the cryptocurrency market cap reflects not only its value but also its potential for growth and adoption as a major player in digital finance. With the market cap currently approaching a staggering $140 billion, XRP’s movements can influence the overall landscape of cryptocurrency investments. The price adjustments seen in XRP often serve as indicators for retail investors, tracking how seasoned professionals react to market fluctuations and leveraging insights for their own trades. As the fourth-largest cryptocurrency, XRP’s success will have ripple effects across the entire market.

Moreover, the rising interest in digital assets means that XRP cannot be viewed in isolation; its price performance impacts and is affected by the overall sentiment towards cryptocurrency as a whole. A healthy XRP encourages liquidity and trust in the market, which in turn can attract further investment. However, if XRP continues to face declines, it could instill fear and uncertainty among investors, leading to broader market instability. Analyzing these dynamics is crucial for understanding the existential role XRP plays within the cryptocurrency market.

The Impact of External Factors on XRP Price Analysis

Various external factors continuously influence XRP price analysis and the overall narrative surrounding this prominent digital asset. With fluctuating regulations, evolving market trends, and global economic conditions, the performance of XRP is not immune to the overarching themes that affect the entire cryptocurrency industry. Additionally, events like macroeconomic shifts or technological advancements within the blockchain universe can shift investor focus and sentiment, impacting XRP’s market value. Staying informed about such developments is critical for traders engaged in both short-term and long-term strategies.

Recent events like the sharp price retraction following XRP’s brief surge further highlight the significance of external conditions in driving market behavior. Investors should consider the overall cryptocurrency landscape, including potential Bitcoin-related influences, as they engage in XRP price analysis. Moreover, incorporating these insights into strategic investment decisions will empower stakeholders to navigate risks effectively while optimizing their potential returns in these uncertain times.

Long-Term Cryptocurrency Strategies: Lessons from Ripple

Investors looking to establish long-term cryptocurrency strategies can gain valuable insights from Ripple’s recent price movements and the actions of its whales. The dynamic nature of their trading, particularly the aggressive sell-offs seen in the wake of market optimism, emphasizes the necessity for adaptive strategies that can withstand sudden market corrections. As XRP continues to experience declines, investors must remain vigilant, leveraging technical analysis and market trends to fortify their portfolios against potential downturns.

Additionally, focusing on the principles behind successful investment strategies can provide a solid foundation for those interested in engaging with the cryptocurrency market. Ripple’s case exemplifies how significant player actions can spur market shifts, prompting serious consideration of timing and position-taking strategies. Crafting a well-researched approach considering market dynamics, potential regulatory changes, and the role of influential investors will be paramount as the cryptocurrency ecosystem continues to evolve.

XRP Price Support Levels: A Crucial Element for Future Movements

Understanding XRP’s key support levels is essential for predicting its future movements within the cryptocurrency market. Currently hovering around the $2.35 mark, XRP finds itself just above a critical support line at $2.3. This price point will be pivotal for determining whether the asset can maintain stability or risk further declines. Should the price break below this critical support, it may prompt panic selling among investors, leading to significant downward pressure across the broader market.

Conversely, if XRP can secure a strong foothold above $2.3 and rally towards higher resistance levels, it would signal renewed strength and confidence among traders. The interplay between these support and resistance levels can guide market participants in their decisions, as they assess risks and potential rewards. Employing technical analysis to monitor these crucial points will be imperative for investors aiming to navigate the unpredictable nature of cryptocurrency trading.

Ripple Investment Strategy: Lessons from Whale Behavior

Observing the behavior of Ripple whales can provide insights into effective investment strategies for those looking to capitalize on the cryptocurrency’s volatility. The strategic decision to divest 60 million tokens demonstrates a shift that may indicate a loss of confidence or a calculated move to lock in profits before potential market corrections. Understanding these influences can equip retail investors with perspectives on how to navigate their own strategies and adapt to changing market conditions.

Additionally, the importance of timing is exemplified in this scenario, as Ripple whales had previously engaged in an accumulation phase prior to this sell-off. The lessons drawn from these movements underscore the necessity for investors to continually evaluate market trends, seek to understand the motivations behind large sell-offs or buy-ins, and formulate strategies that maximize potential returns while managing risks effectively. A well-informed investment strategy, reflective of these observations, can position investors favorably in the competitive cryptocurrency landscape.

XRP and Broader Market Trends: Correlations in Volatility

XRP often mirrors broader cryptocurrency market trends due to its status as one of the top digital assets. Current movements are closely linked not only to Ripple’s internal developments but also to the larger market narrative, including Bitcoin’s performance and investor sentiment. The 5% decline after a brief surge illustrates how XRP’s fate is intertwined with major market forces, making it crucial for traders to stay attuned to overall sentiment and capitalization fluctuations.

As Bitcoin and other significant cryptocurrencies experience highs and lows, XRP’s performance becomes a reflection of that volatility. This correlation can provide a tactical advantage for investors, as patterns and trends in the broader market can predict movements in XRP. Staying informed about the intertwined nature of XRP with the larger crypto landscape will be vital for investors looking to leverage these insights for strategic decision-making.

Navigating the Ripple Effect: Future Prospects for XRP

Navigating the future prospects for XRP involves a comprehensive understanding of both direct and indirect influences on its price. As the scrutiny over whale trading behavior continues, investors must remain agile, reassessing their strategies in light of ongoing market changes. The unfolding narrative surrounding Ripple’s position and regulatory developments will be fundamental in directing the future of XRP, necessitating an environment of adaptability and informed decision-making.

Additionally, with the growing interest in cryptocurrencies, the ripple effect caused by XRP’s price fluctuations can further inform broader investment strategies. Market players can take these learnings to not just anticipate movements within XRP but also position themselves to navigate within a rapidly evolving landscape through proactive engagement and strategy optimization. As XRP faces both challenges and opportunities ahead, those who adopt a forward-thinking approach may find themselves at a significant advantage.

Frequently Asked Questions

What caused the recent XRP price decline?

The recent XRP price decline is primarily attributed to the selling activity by Ripple whales, who liquidated over 60 million tokens within a short span of three days. This selling pressure coincided with a broader market movement, as XRP surged earlier before facing a sharp correction.

How have Ripple whales influenced the XRP price analysis?

Ripple whales, who have a significant impact on market dynamics due to their large transactions, have shifted their investment strategy. Their recent sell-off equating to about $140 million represents a notable change compared to their previous accumulation strategy, thereby influencing the XRP price analysis.

What role does the cryptocurrency market cap play in the XRP price decline?

While XRP’s price decline may seem significant, it’s important to consider the context of the cryptocurrency market cap, which nears $140 billion. The recent sale of 60 million tokens by Ripple whales represents a relatively small percentage of the total market cap, yet the impact of such a large sell-off in a brief period raises concerns among investors.

How does the Ripple investment strategy affect XRP’s future price trajectory?

The Ripple investment strategy, particularly the recent decisions made by significant investors to sell off portions of their holdings, can greatly affect XRP’s future price trajectory. The price is currently hovering around a critical support level, and continued bearish sentiment from whales could lead to further declines.

What are the implications of XRP’s price movement for investors?

XRP’s recent price movement, especially after being halted just above $2.4, indicates potential volatility. Investors should closely monitor whale activities and the broader cryptocurrency market for insights into possible future price trends and investment opportunities.

| Key Point | Details |

|---|---|

| XRP Price Movement | XRP initially surged to over $2.4 before declining roughly 5%. |

| Whale Activity | Ripple whales sold over 60 million tokens amounting to about $140 million in just 72 hours. |

| Market Cap Context | The $140 million figure is relatively small in the context of a $140 billion crypto market. |

| Critical Support Levels | Currently, XRP is hovering around $2.35, just above a critical support line of $2.3. |

| Recent Market Trends | The price movement occurred alongside BTC reaching new all-time highs. |

Summary

The XRP price decline has been influenced significantly by recent whale trading strategies and overall market movements. Following a brief surge above $2.4, XRP experienced a decline, attributed to significant selling by major investors. With whales changing their approach, the decline raises concerns about the future price trajectory of XRP. Monitoring support levels will be crucial for investors as they navigate these turbulent times.

The recent XRP price decline has drawn considerable attention as the broader cryptocurrency market adjusts to shifting dynamics. Just last week, significant Ripple whales altered their investment strategy, abruptly selling over 60 million XRP tokens within a mere three days. This decisive action, amounting to an estimated $140 million, occurred despite the cryptocurrency market cap nearing $140 billion, highlighting the notable influence these large investors wield. With XRP initially surging past the $2.4 mark only to experience a 5% drop shortly afterwards, the fluctuations underline the intricate factors driving XRP price analysis today. This decline, however, is indicative of a larger trend in XRP market movement, reflecting a cautious sentiment among ripple investors.

Recently, the decline in XRP’s value has become a critical subject in discussions surrounding digital assets. This downturn parallels the fluctuations seen in the wider cryptocurrency landscape, emphasizing the intricate relationship between individual coin performance and market sentiment. As some of Ripple’s largest holders recalibrate their investment strategies, their actions could have profound implications for the asset’s future trajectory. Monitoring the nuances of this situation is crucial for understanding XRP’s potential recovery and the overall health of the cryptocurrency market. The current environment, marred by significant token sell-offs, calls for comprehensive XRP price scrutiny and informed investment planning.