The US economy GDP forecast has taken a sharp turn, with predictions indicating a potential decline of 2.8% in the first quarter, according to the Federal Reserve Bank of Atlanta’s GDPNow model. This forecast marks a significant shift from earlier projections that anticipated nearly 4% growth, raising concerns about a possible GDP decline reminiscent of the tumultuous period during the COVID-19 pandemic. As economic indicators point to a downturn, analysts warn that this trend could trigger a “Trumpcession,” impacting consumer confidence and spending. Moreover, the record trade deficit reported in January, coupled with mounting pressures on the crypto market, highlights the interconnectedness of these economic challenges. Investors and policymakers alike will need to closely monitor these developments to navigate the complexities of the evolving financial landscape.

In light of the recent turbulence in economic projections, the anticipated contraction of the US economy has garnered significant attention. The latest GDP estimates suggest a worrying trend that could be indicative of a broader recession, sometimes referred to as a “Trumpcession.” Indicators such as the alarming trade deficit reported for January and the decline in consumer confidence are raising red flags. Additionally, the volatility in the cryptocurrency market adds another layer of uncertainty, as macroeconomic factors continue to influence investor sentiment. As these dynamics unfold, it becomes crucial for stakeholders to stay informed about the implications these shifts may have on both domestic and global economic conditions.

US Economy GDP Forecast: A Shift Towards Contraction

The recent forecast from the Federal Reserve Bank of Atlanta indicates a concerning 2.8% decrease in the GDP for the first quarter, marking a dramatic shift from the previous prediction of nearly 4% growth. This decline could signify a potential turning point for the US economy, especially as it aligns with a broader sentiment of uncertainty and volatility in economic indicators. As the nation grapples with these challenges, the term ‘Trumpcession’ has emerged, reflecting fears that the current economic landscape may echo the troubling downturns during previous administrations. Analysts are closely monitoring these developments, as they could herald a period of economic contraction reminiscent of the COVID-19 lockdowns.

The implications of a declining GDP extend beyond mere numbers; they resonate throughout various sectors, including consumer confidence and investment strategies. With the consumer confidence index experiencing its most significant dip since August 2021, many are questioning the sustainability of economic recovery. The relationship between GDP fluctuations and consumer behavior is critical, as a decrease in GDP often translates to reduced spending power, which can further exacerbate economic stagnation. Consequently, businesses and investors alike are bracing for potential repercussions in the market.

Understanding GDP Decline and Its Implications

The latest economic reports highlight a worrying trend of GDP decline, exacerbated by a record-high trade deficit of $153 billion in January. This substantial trade imbalance indicates a rising consumption of imports, prompting concerns that domestic production may not be keeping pace with demand. In the context of a potential recession, often referred to as ‘Trumpcession’, the implications on both consumers and businesses could be severe. Historically, significant GDP declines have led to increased unemployment rates and reduced consumer spending, creating a vicious cycle that is hard to break.

Additionally, the factors contributing to GDP decline are multifaceted, involving both international trade relations and domestic economic policies. The recent tariffs introduced during the Trump administration have sparked debate over their long-term effects on inflation and consumer prices. As businesses adjust their strategies in response to these tariffs, many may face increased costs that ultimately get passed down to consumers, further straining household budgets and contributing to a decline in overall economic activity.

Economic Indicators Pointing Towards Recession

Several economic indicators suggest that the US may be on the verge of a recession, with the consumer confidence index tumbling from 105.3 to 98.3 in February. This drop represents the largest monthly decline since the summer of 2021 and raises alarms about future consumer spending patterns. A decrease in consumer confidence often signals a reluctance to spend, which can lead to reduced business revenues and further contraction in GDP. As we witness these shifts, it is clear that economic indicators play a critical role in forecasting the health of the economy.

Moreover, the interplay between consumer confidence and economic growth cannot be overstated. When consumers feel uncertain about their financial future, they tend to curb spending, which directly impacts GDP growth. This is particularly relevant in the context of the current economic environment, where uncertainty is fueled by geopolitical tensions and potential liquidity crises. As analysts continue to monitor these economic indicators, the implications for both the crypto market and traditional investments remain significant.

The Impact of Trade Deficit on Economic Growth

The record trade deficit reported in January, amounting to $153 billion, has raised concerns about its impact on the US economy and GDP growth. A trade deficit occurs when a country imports more goods and services than it exports, indicating an imbalance in trade relationships. This situation can have far-reaching effects on domestic industries, potentially leading to job losses and economic contraction. As businesses face the challenges of increased tariffs and global competition, the implications for GDP may become increasingly pronounced.

Furthermore, the rise in the trade deficit by 25.6% from December suggests that businesses have been stockpiling imports in anticipation of future tariffs. This behavior can create short-term spikes in GDP figures but may not translate into sustainable economic growth. In the long run, persistent trade deficits can weaken the economy’s structural integrity, making it more vulnerable to external shocks and reducing overall economic resilience.

How Trump’s Policies Are Reshaping Economic Landscapes

The economic landscape is being reshaped significantly by the policies implemented during the Trump administration, particularly regarding tariffs and trade relations. The term ‘Trumpcession’ has emerged as a descriptor for the potential recession attributed to these policies, which some economists argue have contributed to rising inflation and decreased consumer spending. As the economy grapples with these challenges, it becomes increasingly important to analyze the long-term effects of such policies on GDP and overall economic health.

Moreover, Trump’s administration had pledged to position America as the ‘crypto capital’ of the world, yet the recent economic downturn has raised questions about the viability of this vision. With significant fluctuations in cryptocurrency values and a decrease in investor confidence, many are left wondering if the ambitious goals set forth can be achieved in light of the current economic realities. The intersection of economic policy and market performance will be crucial in determining the future trajectory of the US economy.

Cryptocurrency Market Effects Amid Economic Turmoil

As economic indicators point towards a potential recession, the cryptocurrency market is feeling the effects of this uncertainty, with Bitcoin and Ether experiencing significant price drops. Over the past two weeks, Bitcoin has fallen by 10.2%, while Ether has dropped by 21.6%. These declines can be attributed to macroeconomic concerns that influence investor sentiment and market stability. As traditional markets react to GDP forecasts and trade deficits, cryptocurrencies are often viewed as riskier assets that can experience heightened volatility during economic downturns.

Furthermore, the relationship between the cryptocurrency market and the broader economy is complex. While some investors view cryptocurrencies as a hedge against inflation and economic instability, others are wary of their potential for significant loss during turbulent times. With more than $670 billion wiped off the total cryptocurrency market capitalization, it is evident that the market is reacting to the broader economic trends and uncertainties. As we move forward, the interplay between economic performance and cryptocurrency valuations will be closely watched by analysts and investors alike.

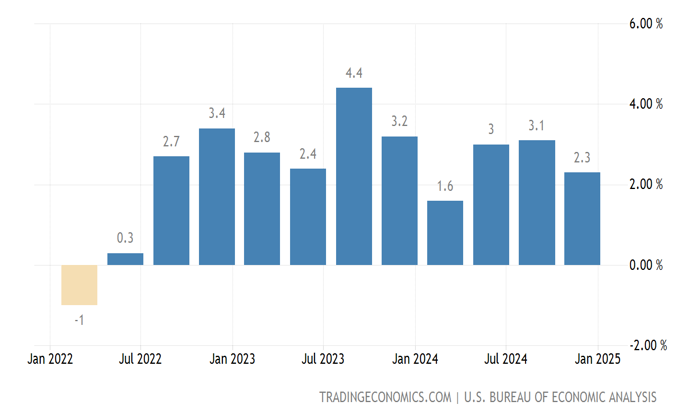

Diverging GDP Models: A Tale of Two Forecasts

While the Federal Reserve Bank of Atlanta’s GDPNow model presents a pessimistic outlook with a predicted decline of 2.8%, other models, such as those from the Federal Reserve Bank of New York and Dallas, offer a more optimistic perspective. The New York Fed predicts a 2.9% increase, whereas the Dallas Fed anticipates a 2.4% growth for the same period. These divergent forecasts highlight the complexities of economic modeling and the inherent uncertainty in predicting GDP changes amid fluctuating economic indicators.

The differences in methodology used by these various GDP models contribute significantly to their contrasting predictions. The Atlanta Fed employs traditional estimation techniques similar to those of the Bureau of Economic Analysis, while the New York Fed utilizes Bayesian estimation to analyze a broader array of data. This variation in approach underscores the importance of understanding the underlying assumptions and data sets that inform economic forecasts. As stakeholders look to navigate the uncertain economic landscape, the diversity of GDP models could provide valuable insights into potential future trends.

Navigating Economic Challenges in the Current Climate

In the face of mounting economic challenges, individuals and businesses alike must navigate this turbulent environment with care. With the potential for a recession looming, driven by factors such as rising trade deficits and fluctuating GDP forecasts, strategic planning becomes essential. Companies may need to reassess their supply chains, adapt their pricing strategies, and explore new markets to mitigate risks associated with economic downturns.

Furthermore, consumers are encouraged to stay informed about economic trends and adjust their spending habits accordingly. Understanding the implications of GDP decline and trade deficits on personal finances can empower individuals to make informed decisions regarding investments and savings. As the economy continues to evolve, remaining vigilant and proactive in response to economic indicators will be crucial for weathering potential storms.

Frequently Asked Questions

What is the current US economy GDP forecast for Q1 2023?

The current US economy GDP forecast for the first quarter of 2023, according to the Federal Reserve Bank of Atlanta’s GDPNow model, predicts a 2.8% decrease in gross domestic product (GDP). This represents a significant shift from previous estimates that projected nearly 4% growth.

How does the GDP decline relate to the Trumpcession?

The projected GDP decline for Q1 2023 has led some analysts to refer to a potential recession as the ‘Trumpcession.’ This term suggests that economic policies and conditions during Donald Trump’s presidency may have lasting effects contributing to the current downturn.

What economic indicators are signaling a GDP decline in the US?

Several economic indicators, including a drop in the consumer confidence index from 105.3 to 98.3 and a 0.2% decrease in consumer spending in January, are indicating a GDP decline. Additionally, the record-high trade deficit of $153 billion in January has raised concerns about economic stability.

What effects might the GDP forecast have on the crypto market?

The negative GDP forecast could have detrimental effects on the crypto market, particularly if a global liquidity crisis arises. As macroeconomic concerns grow, recent downturns in cryptocurrency prices, including significant drops in Bitcoin and Ether, may continue to be influenced by the US economy’s performance.

How might the trade deficit impact the US economy GDP forecast?

The record-high trade deficit of $153 billion reported for January may negatively impact the US economy GDP forecast by reflecting increased imports and economic imbalances. This surge in the trade deficit could signal underlying issues within the economy that contribute to the anticipated GDP decline.

Can different GDP models provide varying forecasts for the US economy?

Yes, different GDP models can yield varying forecasts. While the Atlanta Fed’s GDPNow model predicts a 2.8% decline, the Federal Reserve Bank of New York’s model anticipates a 2.9% increase for Q1, illustrating the range of potential economic outcomes based on differing methodologies and data sets.

What role do macroeconomic concerns play in the US economy GDP forecast?

Macroeconomic concerns, such as inflation, trade deficits, and consumer confidence, significantly influence the US economy GDP forecast. These factors can lead to fluctuations in economic activity, affecting growth projections and contributing to the overall economic climate.

How does consumer confidence impact the US economy GDP forecast?

Consumer confidence impacts the US economy GDP forecast by influencing consumer spending habits. A drop in the consumer confidence index, like the recent decline from 105.3 to 98.3, can lead to reduced spending, which is a critical component of GDP and can signal potential economic contraction.

| Key Point | Details |

|---|---|

| Current GDP Forecast | The GDPNow model predicts a 2.8% decrease in GDP for Q1 2023. |

| Previous Prediction | Just a month ago, a growth of nearly 4% was expected for Q1. |

| Recent Economic Indicators | A high trade deficit of $153 billion and a drop in consumer confidence signal economic trouble. |

| Impact on Crypto Markets | Macroeconomic concerns have led to significant drops in cryptocurrency prices. |

| Contrasting Forecasts | Other models, like those from the New York and Dallas Fed, predict growth of 2.9% and 2.4%, respectively. |

| Historical Context | The last significant GDP contraction was a 32.9% drop in Q2 2020 due to COVID-19. |

Summary

The US economy GDP forecast indicates a concerning trend with predictions of a 2.8% decline for the first quarter of 2023, marking a stark contrast from earlier growth expectations. This downturn, influenced by high trade deficits and declining consumer confidence, raises alarms about potential recessionary pressures, often referred to as ‘Trumpcession.’ Despite some more optimistic models projecting growth, the overall economic landscape suggests significant challenges ahead, particularly for markets like cryptocurrencies that are sensitive to macroeconomic conditions.

The US economy GDP forecast is raising alarms as recent projections indicate a potential 2.8% decrease in gross domestic product for the first quarter, marking a stark contrast to earlier expectations of nearly 4% growth. This anticipated GDP decline has triggered discussions around the so-called “Trumpcession,” a term used to describe the economic downturn attributed to former President Trump’s policies. Various economic indicators, including a record-high trade deficit of $153 billion in January, suggest a troubling trend that could have significant implications for the broader economy and the volatile crypto market. As consumer confidence plummets and spending shows signs of contraction, analysts are closely monitoring the situation for potential ripple effects. With the current trajectory, the US economy may face serious challenges ahead, requiring strategic responses from policymakers and investors alike.

In light of the recent economic forecasts, the outlook for America’s financial landscape appears increasingly precarious. The projected contraction in the nation’s GDP signals potential headwinds that could lead to a recession, often referred to as the “Trumpcession.” As businesses grapple with soaring trade deficits and shifting consumer confidence, the implications for various sectors, including cryptocurrencies, are becoming more pronounced. Economic metrics, such as the alarming drop in consumer spending and the broader effects of geopolitical tensions, are adding to the uncertainty. As experts analyze these trends, the focus remains on how these factors will shape the US economy’s recovery in the coming months.

Leave a Reply