Solana price pressure has intensified recently as the cryptocurrency struggles to maintain its footing amid a market-wide downturn. Trading at its lowest levels since September 2024, SOL is feeling the weight of extreme fear among investors, which has only escalated since reaching its all-time high in January. With a staggering retracement of over 55%, the Solana price prediction looks bleak unless it can find robust support levels soon. Analysts are closely monitoring SOL market analysis, as further declines seem imminent if the cryptocurrency cannot regain bullish momentum. Additionally, the alarming Solana volume drop raises concerns about the overall health of the Solana ecosystem, making it crucial for investors to stay informed about these developments and potential recovery signs.

The recent challenges facing Solana can be attributed to increasing downward pressure on its price, as the cryptocurrency grapples with significant selling activity. This downturn has left many investors wary, particularly as SOL struggles to bounce back from its recent lows, which have not been seen since September of the previous year. The current cryptocurrency market downturn has exacerbated the situation, pushing altcoins like Solana into a precarious position where support levels are perilously close to breaking. With analysts pointing to critical support thresholds and declining trading volume, the outlook for Solana remains uncertain. As the market continues to evolve, understanding these dynamics will be vital for anyone looking to navigate the complexities of SOL’s current performance.

Understanding Solana Price Pressure

Solana is currently under significant price pressure, trading at its lowest point since September 2024. Following a market-wide correction, the cryptocurrency has struggled to maintain its footing as bearish sentiment prevails. With SOL experiencing a staggering retracement of over 55% from its all-time high, investors are left questioning the asset’s short-term viability. The current state of Solana reflects broader trends in the cryptocurrency market, characterized by uncertainty and heightened fear among traders.

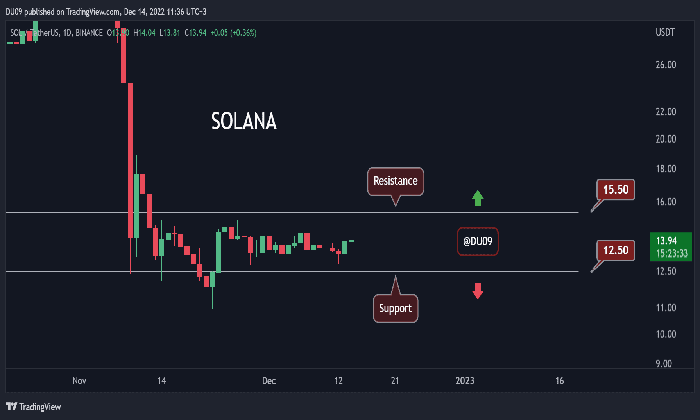

As Solana’s price continues to falter, key support levels are being tested. Analysts have noted that if these support levels break, the potential for further declines could dramatically increase. The pressure on Solana is compounded by a significant drop in transfer volume, further indicating a lack of network activity and interest. This situation mirrors a broader downturn in the cryptocurrency market, where many altcoins are also struggling to regain their bullish momentum.

Solana Price Prediction Amid Market Downturn

In light of the current market downturn, Solana’s price prediction remains cautious. Analysts suggest that without robust support, SOL could face additional pressure as it attempts to navigate through this challenging environment. The cryptocurrency market’s volatility has created an atmosphere of uncertainty, making it difficult for investors to predict near-term price movements. As SOL hovers around critical support levels, the next few days will be crucial for determining the future trajectory of its price.

Market analysts are closely monitoring Solana’s performance, particularly in light of recent drops in transfer volume. The reduced activity on the network raises concerns about Solana’s overall viability and investor confidence. If SOL can manage to hold above crucial support levels, there may be a window for a potential rebound; however, any further deterioration in market conditions could exacerbate the situation, leading to a downward spiral in prices.

Impact of Solana Volume Drop on Price Stability

The recent drop in Solana’s transfer volume has significant implications for its price stability. With transfer volume plummeting from $1.99 billion in November 2024 to just $14.57 million today, it signals a drastic reduction in user engagement and market activity. This volume drop not only reflects waning interest in Solana but also poses risks to its price stability, as low trading activity often correlates with increased volatility.

As Solana continues to experience selling pressure, the lack of robust volume raises alarms for investors. A diminished volume can lead to wider price swings, making it challenging for bulls to mount a comeback. If the trend of low volume persists, it could further weaken Solana’s position in the market, potentially driving prices lower as sellers dominate the landscape. Therefore, monitoring volume trends will be crucial for assessing Solana’s price action in the coming weeks.

Analyzing Solana Support Levels and Market Sentiment

Support levels play a vital role in Solana’s price action, especially given the current bearish sentiment. As the cryptocurrency hovers around critical demand zones, the ability of bulls to defend these levels will largely dictate whether SOL can stabilize or if it will continue its downward trajectory. The market sentiment remains largely negative, with extreme fear permeating the cryptocurrency landscape, making it difficult for any asset, including Solana, to gain traction.

If Solana can maintain its support levels around $140, it may provide a foundation for a potential recovery. However, the sentiment remains fragile, and any adverse movement in Bitcoin or the broader market could lead to a breakdown of these support levels. Analysts are closely watching how Solana interacts with these key areas, as failure to hold could lead to further declines and heightened market anxiety.

The Role of Market Dynamics in Solana’s Performance

Market dynamics significantly influence Solana’s performance, particularly in the context of the current downturn. With many altcoins facing similar challenges, Solana is not alone in its struggles. The overall market sentiment has a ripple effect, impacting trading behavior and investor decisions across the board. As fear grips the market, traders are more likely to sell off assets in a bid to mitigate losses, further contributing to Solana’s price pressure.

Furthermore, the reaction of market participants to macroeconomic factors can exacerbate price movements. If broader economic conditions lead to increased volatility, Solana’s price could be affected disproportionately. Therefore, understanding the interplay between market trends and Solana’s performance is essential for investors looking to navigate the complexities of the cryptocurrency landscape.

Potential Recovery Scenarios for Solana

Despite the current challenges, there are potential recovery scenarios for Solana that investors are cautiously optimistic about. If SOL can successfully hold above critical support levels and volume begins to increase, it may signal a shift in market sentiment. A recovery in trading activity could reignite interest in Solana, providing the necessary momentum for bulls to drive prices higher.

However, such a recovery hinges on external market conditions and the general sentiment within the cryptocurrency space. If Bitcoin stabilizes and begins to gain traction, it could pave the way for altcoins like Solana to follow suit. Investors are advised to stay vigilant and monitor both Solana-specific metrics and broader market trends to gauge the likelihood of a rebound.

The Importance of Monitoring On-Chain Metrics

Monitoring on-chain metrics is crucial for understanding Solana’s performance in the current market environment. Data points such as transfer volume, active addresses, and network activity provide valuable insights into the health and viability of the ecosystem. The dramatic decline in Solana’s transfer volume serves as a red flag, indicating a potential weakening of user engagement that could impact price stability.

By keeping a close eye on these metrics, investors can better assess Solana’s position in the cryptocurrency market. An increase in on-chain activity could signal a resurgence in interest, while continued declines may suggest prolonged challenges ahead. Thus, understanding these metrics is key to making informed investment decisions regarding Solana.

Future Outlook for Solana in 2024

As we look ahead to 2024, the future outlook for Solana remains uncertain but not without hope. The cryptocurrency market is known for its volatility, and while Solana faces significant challenges, there are opportunities for recovery. If the broader market can stabilize and investor sentiment shifts positively, Solana could regain its footing and potentially rally back towards higher price levels.

The key for Solana will be its ability to adapt to changing market conditions and demonstrate resilience amidst adversity. Investors will be closely watching for any signs of recovery, particularly in terms of transfer volume and support level maintenance. As Solana navigates through this tumultuous period, its future largely depends on how effectively it can engage its user base and restore confidence in its ecosystem.

Frequently Asked Questions

What is the current state of Solana price pressure and its impact on SOL market analysis?

Solana is currently facing significant price pressure, trading at approximately $141 after experiencing a substantial decline of over 55% since its all-time high in January 2024. This selling pressure is reflective of broader market trends, contributing to ongoing uncertainty in the SOL market analysis. Analysts suggest that if Solana fails to hold critical support levels, further declines could be anticipated, making it crucial for investors to monitor the situation closely.

How is the cryptocurrency market downturn affecting Solana price prediction?

The ongoing cryptocurrency market downturn has negatively impacted Solana’s price prediction, with SOL struggling to establish strong support above the $140 level. The decline in market sentiment and extreme fear among investors have raised doubts about Solana’s short-term recovery potential. To improve its price outlook, SOL needs to regain momentum and hold above key demand zones.

What are the current Solana support levels and their significance amidst price pressure?

The current Solana support levels are critical for determining the future price trajectory of SOL. Currently, support is observed around $140, with the next significant level at $130. These levels are crucial as they indicate where buyers may step in to prevent further declines. If Solana fails to maintain these support levels, it could lead to deeper corrections, increasing selling pressure in the market.

Why is Solana’s volume drop concerning for its price stability?

Solana’s recent volume drop, which has plummeted from $1.99 billion in November 2024 to just $14.57 million today, raises concerns about its price stability. This dramatic decline in transfer volume indicates reduced network activity and interest, which could exacerbate selling pressure and hinder potential recovery efforts. A lack of trading volume often correlates with weak price performance in the cryptocurrency market.

What factors contribute to the current Solana price pressure and its market outlook?

The current Solana price pressure is driven by a combination of extreme market fear, significant selling pressure from bears, and a sharp drop in network activity. The broader cryptocurrency market downturn has further complicated Solana’s market outlook, as altcoins struggle to regain bullish momentum. Analysts warn that unless Solana can defend key support levels and see an increase in volume, it may continue to face downward price pressure.

| Key Points | Details |

|---|---|

| Current Price Pressure | Solana is trading at $141, facing significant selling pressure and struggling to break above $150. |

| Market Sentiment | Extreme fear in the market has resulted in Solana retracing over 55% from its all-time high. |

| Transfer Volume Decline | Solana’s transfer volume has dropped dramatically from $1.99 billion in November 2024 to $14.57 million today. |

| Bull vs Bear Dynamics | Bears maintain control as bulls struggle to defend critical support levels, leading to uncertainty. |

| Potential Recovery | If Solana holds above $140, there may be a chance for a short-term recovery; otherwise, risks of further declines exist. |

Summary

Solana price pressure has intensified as the cryptocurrency faces significant challenges in the current market environment. With trading below critical support levels and a sharp decline in transfer volume, the outlook for SOL remains uncertain. Investors are closely monitoring whether bulls can reclaim momentum or if the prevailing bearish sentiment will lead to further price declines. In the coming days, Solana’s ability to hold above key demand levels will be crucial for potential recovery.

Solana price pressure is becoming increasingly evident as the cryptocurrency struggles to regain its footing amidst a significant market downturn. Trading at levels not seen since September 2024, SOL’s value has plummeted over 55% since its all-time high earlier this year, leaving many investors anxious about its future. The ongoing bearish sentiment has resulted in a concerning drop in Solana’s transfer volume, which fell from $1.99 billion in November to a mere $14.57 million today. Analysts are closely monitoring Solana’s support levels, as further declines could be on the horizon without a substantial recovery in market momentum. With the broader cryptocurrency market also facing hurdles, the outlook for Solana remains uncertain, and its price prediction will heavily depend on its ability to hold key support zones.

The current situation surrounding Solana reflects a broader trend of pressure on altcoins in the cryptocurrency landscape. With SOL experiencing a significant decline, many are questioning the resilience of this blockchain platform as it navigates through a turbulent market phase. As selling pressure intensifies, the analysis of Solana’s market dynamics reveals critical support levels that must be maintained to avoid further downturns. Additionally, the sharp drop in transaction volume signals a potential cooling of investor interest, prompting a reevaluation of Solana’s role within the digital asset ecosystem. Ultimately, the coming days will be pivotal for Solana, determining whether it can recover from this downturn or continue to struggle amidst ongoing volatility.