Litecoin performance has been notably impressive amid the recent turbulence in the cryptocurrency market. While Bitcoin faced a steep decline, dropping to a multi-month low of just over $82,000, Litecoin has managed to defy market trends and showcase minor gains. This resilience makes Litecoin a standout in the current landscape, especially as analysts conduct a thorough Litecoin price analysis to forecast its trajectory. As Ethereum continues to struggle with a decline, many investors are turning their attention to Litecoin and other best performing altcoins that are showing potential stability. Understanding these cryptocurrency market trends is essential for investors looking to navigate the choppy waters of digital assets.

The performance of Litecoin stands out as it navigates the challenges posed by the broader cryptocurrency ecosystem. With Bitcoin’s recovery efforts from its recent slump and Ethereum’s ongoing decline, Litecoin presents an intriguing opportunity for investors. This altcoin has garnered attention not only for its current price movements but also for its potential to become one of the best performers within its category. By examining Litecoin’s recent activity, we can gain insights into the shifting dynamics of the market and the factors driving interest in alternative cryptocurrencies. As traders analyze these trends, the focus on Litecoin’s resilience may signal a shift in investor sentiment within the digital currency space.

Litecoin Performance Amidst Market Fluctuations

Litecoin (LTC) has emerged as a surprising performer in a cryptocurrency market that has been largely bearish. While Bitcoin recently faced a significant drop to around $82,000, Litecoin managed to maintain a positive trajectory, showing resilience amidst the turmoil. This performance is especially noteworthy considering the broader market trends, where many altcoins, including Ethereum, are struggling to regain their footing. As investors seek alternatives in a volatile market, Litecoin’s ability to defy the odds highlights its potential as one of the best-performing altcoins.

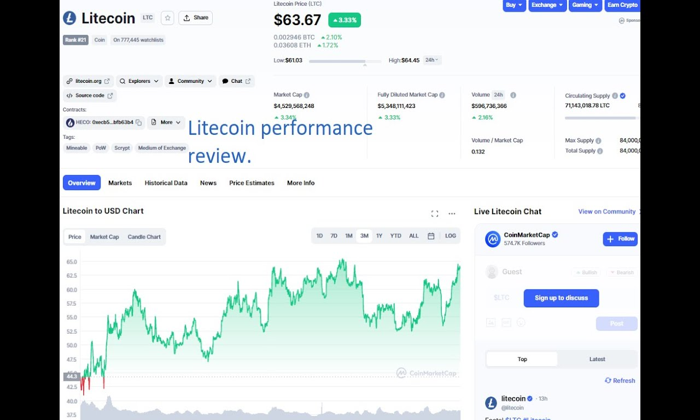

Recent price analysis indicates that Litecoin has recorded gains of over 3%, positioning it favorably among larger-cap altcoins. In contrast to Ethereum’s decline towards $2,200, Litecoin’s upward movement provides a glimmer of hope for cryptocurrency enthusiasts. The reasons behind Litecoin’s performance can be attributed to its strong fundamentals and the growing interest in altcoins as viable investment options. As the cryptocurrency landscape evolves, Litecoin’s resilience could symbolize a shift in investor sentiment towards altcoins that demonstrate stability.

Bitcoin Recovery and Its Impact on Altcoins

Bitcoin’s recovery from a sharp decline to $82,000 has significant implications for the entire cryptocurrency market. After hitting a three-month low, Bitcoin’s rebound to $86,000 signals potential stability, although it remains down 3% on the day. This recovery is crucial not only for Bitcoin itself but also for the altcoin market, where prices are often correlated with Bitcoin’s performance. A healthy Bitcoin recovery can instill confidence among investors, potentially leading to positive price movements in altcoins like Litecoin and others.

As Bitcoin navigates its recovery, altcoins often experience fluctuations based on BTC’s market movements. For instance, as Bitcoin seeks to regain its previous highs, altcoins that have demonstrated strong performance, like Litecoin, may attract more investment. This interplay between Bitcoin’s recovery and altcoin performance is essential for understanding current cryptocurrency market trends. Investors should keep an eye on Bitcoin’s price actions, as they can greatly influence the trajectory of other cryptocurrencies.

Ethereum Decline and Litecoin’s Ascent

Ethereum’s recent decline to approximately $2,200 has put a spotlight on the contrasting performance of Litecoin. While Ethereum struggles to maintain its market position, Litecoin’s minor gains present a stark contrast, showcasing its potential as a reliable alternative in turbulent times. The divergence in performance between these two prominent cryptocurrencies highlights the shifting dynamics in the market, where investors are increasingly looking for stability and growth opportunities among altcoins.

As Ethereum faces downward pressure, Litecoin’s ascent may appeal to investors seeking to diversify their portfolios. With Ethereum’s market cap shrinking and the overall sentiment turning more cautious, Litecoin’s ability to defy the trend could attract new investments. This shift may indicate a broader trend where investors are prioritizing altcoins that exhibit resilience even in challenging market conditions, positioning Litecoin as a key player in the evolving cryptocurrency landscape.

Analyzing Cryptocurrency Market Trends

The cryptocurrency market is known for its volatility, and recent trends are no exception. As Bitcoin experiences fluctuations, the overall market sentiment remains cautious, with many investors monitoring altcoins for potential opportunities. A careful analysis of market trends reveals that while Bitcoin remains the dominant force, altcoins like Litecoin and APT are gaining traction, often moving independently of Bitcoin’s price actions. This separation could point towards a maturation of the cryptocurrency market, where diverse investment strategies begin to take shape.

Market analysis also shows a significant amount of outflows from Bitcoin ETFs, indicating a potential shift in investor preferences. As traditional investors reevaluate their positions, altcoins that demonstrate strong fundamentals may see increased interest. Understanding these market dynamics is crucial for investors looking to navigate the complexities of cryptocurrency trading, especially as they consider the performance of both Bitcoin and leading altcoins like Litecoin.

The Role of Altcoins in the Cryptocurrency Ecosystem

Altcoins play a vital role in the cryptocurrency ecosystem, offering diversity and alternative investment opportunities beyond Bitcoin. As the market matures, many investors are recognizing the potential of altcoins to deliver substantial returns, especially during periods when Bitcoin experiences volatility. Litecoin stands out as one of the best-performing altcoins, drawing interest from investors looking for stability amidst uncertainty in the market.

The emergence of altcoins like Litecoin emphasizes the need for a diversified investment strategy in the cryptocurrency space. With the performance of Bitcoin often dictating market trends, altcoins that demonstrate resilience and growth can provide a safety net for investors. As the landscape continues to evolve, the importance of tracking altcoin performance alongside Bitcoin cannot be understated, particularly for those looking to maximize their investment potential.

Investing Strategies for Altcoins

As the cryptocurrency market remains unpredictable, developing effective investing strategies for altcoins is crucial. Investors should consider diversifying their portfolios by including altcoins like Litecoin, which have shown promising performance during Bitcoin’s downturns. Analyzing market trends, such as Litecoin’s recent gains amidst Ethereum’s decline, can inform strategic decisions that align with broader market conditions.

Furthermore, staying updated on news and developments related to altcoins is essential for making informed investment choices. Understanding factors that contribute to the success of altcoins, such as technological advancements and community support, can enhance an investor’s ability to capitalize on emerging opportunities. In a rapidly changing market, a proactive approach to altcoin investing can yield significant rewards.

The Future of Litecoin and Other Altcoins

The future of Litecoin and other altcoins appears promising, especially as the cryptocurrency market evolves. With Bitcoin’s recovery signaling potential stability, altcoins like Litecoin are poised to capture investor interest. As more investors seek alternatives to Bitcoin, Litecoin’s strong fundamentals and historical performance may position it well for future growth.

Moreover, the increasing adoption of altcoins in various sectors, coupled with technological advancements, could lead to a surge in demand for cryptocurrencies beyond Bitcoin. Litecoin’s adaptability and community support are key factors that will influence its trajectory in the coming years. As the market continues to mature, understanding the potential of altcoins will be essential for investors looking to navigate the dynamic landscape of cryptocurrency.

Market Sentiment and Its Influence on Altcoin Prices

Market sentiment plays a crucial role in determining the prices of cryptocurrencies, including altcoins like Litecoin. As Bitcoin’s price fluctuates, it often influences the overall mood of investors in the cryptocurrency market. Positive sentiment following a Bitcoin recovery can lead to increased investment flows into altcoins, while negative sentiment during downturns can result in significant sell-offs across the board.

Understanding market sentiment can help investors make informed decisions regarding altcoin investments. By analyzing social media trends, news coverage, and trading volumes, investors can gauge the prevailing mood in the market and adjust their strategies accordingly. As altcoins gain traction, staying attuned to these sentiment shifts will be vital for maximizing investment opportunities.

The Impact of Bitcoin on Altcoin Performance

Bitcoin’s performance remains the benchmark for the cryptocurrency market, significantly impacting the performance of altcoins. As the largest cryptocurrency, Bitcoin’s market movements often dictate the direction of altcoin prices. For example, during Bitcoin’s recent recovery from a drop to $82,000, altcoins like Litecoin have experienced positive momentum, showcasing the interconnectedness of these digital assets.

Investors should recognize the correlation between Bitcoin and altcoins when devising their trading strategies. A strong Bitcoin performance can lead to increased confidence in altcoins, while a downturn can trigger caution and sell-offs. Understanding this dynamic is essential for navigating the cryptocurrency market effectively and identifying potential opportunities for investment in altcoins like Litecoin.

Frequently Asked Questions

How did Litecoin perform amidst the recent cryptocurrency market trends?

Litecoin has shown resilience in the recent cryptocurrency market trends, marking gains of over 3% even as Bitcoin and Ethereum faced declines. This performance positions Litecoin as one of the best-performing altcoins during a turbulent market period.

What is the latest Litecoin price analysis following Bitcoin’s recovery?

The latest Litecoin price analysis indicates that while Bitcoin has recovered to around $86,000, Litecoin has maintained a positive trajectory, defying the bearish trend seen in many larger-cap altcoins. This suggests strong market confidence in Litecoin’s long-term performance.

Is Litecoin a better investment compared to Ethereum during its decline?

Given Ethereum’s recent decline to approximately $2,350, Litecoin’s upward movement makes it a more attractive investment option at this time. Investors may find Litecoin’s performance more appealing, particularly in the context of current cryptocurrency market trends.

What factors are influencing Litecoin’s strong performance against other altcoins?

Litecoin’s strong performance can be attributed to its stability and investor confidence, especially in contrast to the declines experienced by Ethereum and other altcoins. Additionally, the overall market dynamics, including Bitcoin’s recovery, may also play a role in boosting Litecoin’s appeal.

Can Litecoin maintain its position as a leading altcoin despite market fluctuations?

Litecoin’s recent performance suggests it has the potential to maintain its status as a leading altcoin. Its ability to achieve gains while other cryptocurrencies decline indicates resilience, which may attract investors looking for stability in an unpredictable market.

What role does Litecoin play in the current cryptocurrency market trends?

Litecoin plays a significant role in the current cryptocurrency market trends as one of the best-performing altcoins. Its ability to post gains during a period of overall market decline highlights its importance as a reliable investment option for traders and investors.

How does Litecoin’s performance compare to Bitcoin’s recovery?

While Bitcoin has seen a recovery to around $86,000, Litecoin has outperformed many altcoins by achieving minor gains amidst the overall market downturn. This contrast emphasizes Litecoin’s strength in the face of volatility typically seen in the cryptocurrency market.

What are the implications of Litecoin’s performance for future cryptocurrency investments?

Litecoin’s positive performance amid market instability suggests that it could be a viable option for future cryptocurrency investments. Its resilience may indicate potential for growth, making it an attractive choice for investors looking for altcoins that can weather market fluctuations.

| Key Point | Details |

|---|---|

| Litecoin Performance | LTC showed a minor gain of over 3% amidst a general market downturn. |

| Bitcoin Recovery | BTC dropped to a new low of $82,100 but has since recovered to above $86,000. |

| Ethereum Decline | ETH fell to $2,200 and is currently down 5%. |

| Market Overview | The total crypto market cap decreased by $70 billion, now at $2.970 trillion. |

Summary

Litecoin performance has shown resilience as it marked a minor gain of over 3% while other major cryptocurrencies struggled. In a challenging market environment where Bitcoin recently dipped to a three-month low, Litecoin’s ability to defy general trends highlights its potential as a stable investment option. As the cryptocurrency landscape continues to evolve, Litecoin remains a key player amid fluctuating market conditions.

Litecoin performance has recently captured the attention of investors, as it rises above the prevailing market trends that have negatively impacted many cryptocurrencies. While Bitcoin struggled to recover from a significant dip to $82,000, Litecoin has managed to carve out its own path, showcasing resilience and strength. As the cryptocurrency market grapples with fluctuations, Litecoin stands out among the best performing altcoins, reflecting a positive price trajectory that contrasts sharply with Ethereum’s decline. With analysts providing ongoing Litecoin price analysis, the asset’s upward movement has been a beacon of hope amidst the chaos of Bitcoin recovery efforts and broader market concerns. This performance not only highlights Litecoin’s potential but also positions it as a noteworthy player in the evolving landscape of cryptocurrency market trends.

The recent surge in Litecoin’s value has become a focal point for crypto enthusiasts and investors alike, particularly in light of the current market dynamics. As Bitcoin attempts to regain its footing after facing a steep drop, Litecoin emerges as a strong contender among the alternative cryptocurrencies, often referred to as altcoins. This upward momentum has drawn attention to the broader implications for the cryptocurrency ecosystem, especially as Ethereum continues to experience setbacks. Analysts and traders are closely monitoring Litecoin’s performance, considering it a significant indicator of shifting trends within the crypto markets. The interplay between Litecoin’s gains and the overall market conditions exemplifies the volatility and opportunities present in the world of digital currencies.