In the ever-evolving landscape of cryptocurrency, Ethereum price prediction has garnered significant attention as analysts speculate on its potential to reach new heights. With expert forecasts suggesting a surge up to $2,700, the Ethereum price analysis indicates this climb could be fueled by the nearing completion of the Wyckoff accumulation phase. Despite current market conditions leading to a decline in ETH’s market share, many are optimistic about the altcoin’s future as it holds critical support levels. The ETH market forecast remains cautiously optimistic, especially if Ethereum can break through notable resistance points. As the crypto market trends shift, investors are eagerly watching for the Ethereum price target that could usher in a new bullish rally.

The Ethereum price outlook is a hot topic among traders and investors alike, especially with promising signs for potential gains. Analysts highlight key patterns such as Wyckoff accumulation, suggesting a pivotal moment for ETH as it could bounce back to significant price levels. As the cryptocurrency ecosystem reacts to broader market dynamics, the focus on Ethereum’s recovery is increasingly relevant. Examining support and resistance levels will be crucial, as many believe Ethereum might be poised for an upward breakout. With the potential for a bull market revival, understanding the Ethereum price dynamics becomes essential for those engaged in the digital asset space.

Understanding Ethereum Price Predictions

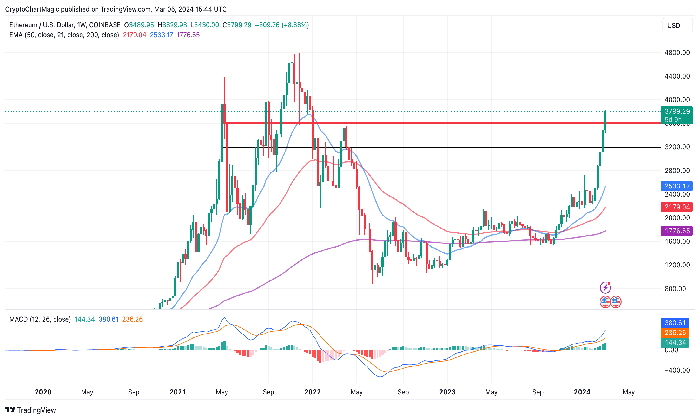

The demand for Ethereum has been fluctuating in tandem with the broader cryptocurrency market, making Ethereum price predictions a hot topic. As analysts assess market conditions, predictive models like the Wyckoff accumulation theory illustrate potential price movements based on historical patterns. In particular, a recent forecast from crypto analyst Incognito suggests that ETH could surge to $2,700, contingent upon the completion of its current accumulation phase. This aligns with the emerging trends in crypto markets where bullish momentum often follows lengthy periods of price consolidation.

Ethereum price analysis shows a relationship between technical patterns and broader market dynamics, including the influence of Bitcoin. If Bitcoin maintains upwards momentum, Ethereum’s price could follow suit, achieving the predicted levels. Analysts emphasize that, while short-term fluctuations are common, understanding the long-term market forecast for Ethereum is critical for investors. As ETH approaches key resistance levels, traders must remain vigilant and prepared to act based on emerging data.

Wyckoff Accumulation and Its Impact on Ethereum

The Wyckoff accumulation phase plays a significant role in understanding the potential trajectory of Ethereum’s price. This concept hinges on the idea that large investors accumulate assets before a price surge, often leading to a bullish breakout. In the current context, Incognito’s analysis highlights that once support at critical levels holds, Ethereum could see a rebound towards the $2,700 target. This reinforces the importance of market dynamics as they relate to Ethereum, particularly for investors looking to determine entry and exit points.

Moreover, the successful completion of the Wyckoff phase can significantly influence Ethereum price targets, thereby shaping the overall ETH market forecast. Analysts suggest that as the accumulation phase progresses, patterns will emerge that indicate potential buy signals for savvy traders. Recognizing these patterns, particularly amidst shifting crypto market trends, is vital for informed decision-making in the volatile world of cryptocurrency.

Ethereum’s Market Trends and Future Outlook

Ethereum’s journey through the cryptocurrency space is closely tied to broader market trends. Recent fluctuations in crypto prices have made many speculate on the future outlook of ETH, especially as potential price milestones draw closer. As outlined by Ali Martinez, this week could be crucial for Ethereum, especially if it manages to breach the $2,330 level to initiate a new bullish rally. Such market behavior underscores the importance of staying attuned to crypto market trends, considering factors such as investor sentiment and external economic influences.

Crypto analysts also note that Ethereum’s price has a history of bouncing back after periods of decline, driven by its robust ecosystem and growing adoption rates. The relationship between Ethereum and Bitcoin often dictates trading sentiment; a rise in Bitcoin prices typically leads to increased investor confidence in Ethereum as well. With predictions hinting at Ethereum possibly reaching between $6,000 to $8,000 by year-end, the sentiment in the market remains cautiously optimistic, urging investors to carefully evaluate their strategies moving forward.

The Significance of Key Price Levels for Ethereum

Key price levels for Ethereum are crucial indicators for traders and investors alike. Incognito’s analysis highlights two prominent resistance points: the falling wedge pattern and the projected surge to $2,700. Understanding these price levels can provide a roadmap for potential movements and where market participants should consider positioning themselves. Moreover, as Ethereum approaches the $2,330 supply wall, traders must carefully watch for signals indicating a possible breakout or reversal, which could inform their trading strategies.

Investors must also be wary of potential traps in the market, as outlined by Incognito’s cautionary advice. The anticipation of a smart exit strategy is paramount, particularly as Ethereum navigates through critical resistance points. Should ETH reclaim the $4,000 level, the momentum could translate into a bullish rally toward new all-time highs. Thus, recognizing and reacting to these key price levels is critical for making well-informed investment decisions in the ever-evolving crypto landscape.

Ethereum’s Correlation with Bitcoin’s Performance

The correlation between Ethereum and Bitcoin greatly influences trader sentiment and investment strategies across the cryptocurrency market. Historic patterns indicate that when Bitcoin experiences bullish momentum, Ethereum often follows closely behind. Analyst insights suggest that if Bitcoin can maintain above significant price points, Ethereum might see a consistent rise, potentially reaching the $2,700 forecast. This interdependency highlights the importance of monitoring Bitcoin’s performance for Ethereum investors, who could capitalize on correlated price movements.

Furthermore, understanding this correlation is essential when considering the broader crypto market trends. As Binance and other exchanges exhibit increased trading activity around Bitcoin, Ethereum typically benefits from the spillover effect. Hence, investors can look for trading opportunities in relation to Bitcoin’s movements as they develop investment strategies for Ethereum’s prospects. Additionally, being aware of external market influences, such as regulatory changes and institutional adoption, plays a crucial role in shaping the trading environment for both cryptocurrencies.

Analyzing Ethereum’s Current Support Levels

Support levels are integral to evaluating the potential resilience of Ethereum’s price in a fluctuating market. Currently, several analysts indicate that Ethereum has established a foundational support around $1,639, which appears to hold amidst market volatility. This level is significant as it could potentially act as a launchpad for upward movement towards bullish targets, such as the predicted $2,700 mark if momentum builds. The determination of these support levels leads to active trade decisions, as investors seek to capitalize on favorable conditions for entry.

Evaluating Ethereum’s current support levels highlights the significance of trading strategies based on technical analysis. Should these support levels fail to hold, concerns for sellers may arise, prompting a reevaluation of market positions. Such volatility reinforces the necessity for ongoing analysis, allowing traders to pivot quickly in response to changing conditions in the cryptocurrency market. Consequently, understanding support dynamics will assist traders in navigating Ethereum’s potential path towards recovery and growth.

Crypto Market Forecasts: What Lies Ahead for Ethereum

The future of Ethereum is particularly exciting, as many market analysts are predicting bullish outcomes for the upcoming months. The cryptocurrency market is charged with optimism, fueled by projections that ETH could reach new local highs and break historical price barriers. While current analyses point to significant milestones ahead, including the possibility of Ethereum reaching $4,300, navigating through conservative price targets will require understanding and responding to dynamic market relations and shifts.

Moreover, engaging with cryptocurrency market forecasts encourages investors to think critically about their positions. Analysts focusing on Ethereum often integrate fundamental factors such as technological advancements, scaling solutions, and network upgrades into their predictions. These elements not only bolster Ethereum’s utility but also play a role in establishing confidence in its value. As Ethereum continues to evolve, the convergence of analytics and investor sentiment will likely drive its price movements in a competitive digital landscape.

The Role of Technical Indicators in Ethereum Trading

Technical indicators provide essential insights for investors looking to optimize their Ethereum trading strategies. Tools like the TD Sequential indicator, which recently flashed a buy signal for ETH, suggest shifts in market momentum and can guide purchase decisions. Skilled traders often rely on these indicators alongside price analysis to determine strategic entry points, particularly in conjunction with established patterns like Wyckoff accumulation.

Furthermore, incorporating a variety of technical indicators allows for a nuanced understanding of market trends. As Ethereum navigates through support levels and faces potential resistance, traders can synthesize information from multiple sources to bolster their decision-making framework. By being adept in interpreting these indicators, investors can enhance their probability of success in capturing upward price movements, especially in a reactive landscape where micro-trends can have significant impacts on trading outcomes.

Ethereum’s Potential for a Bullish Turnaround

Analysts are increasingly optimistic about Ethereum’s potential for a bullish turnaround, particularly in light of recent price behavior. The accumulation phase suggested by prominent analysts indicates that a significant upwards movement could be on the horizon. If bullish trends continue and Ethereum breaks past key resistance levels, many expect that the market could witness a swift influx of capital, driving ETH towards targets as high as $2,700. This potential resurgence underscores the importance of careful monitoring of market indicators.

The conversation surrounding Ethereum’s projected bullish narrative includes sentiments around macroeconomic factors and investor psychology. As Ethereum works its way through critical technical crossroads, the potential for a bullish turnaround could be further catalyzed by investor sentiment shifting towards building positions. Given the current landscape and sentiments expressed by analysts like Titan of Crypto, many in the market believe that Ethereum’s time for a solid upward trend may be drawing near, energizing traders and investors to seize opportunities in the market.

Frequently Asked Questions

What is the latest Ethereum price prediction from analysts?

Recent Ethereum price predictions suggest that ETH might rise to as high as $2,700. This forecast by analyst Incognito is based on the nearing completion of the Wyckoff accumulation phase, potentially leading to a breakout from its current falling wedge pattern.

How does the Wyckoff accumulation affect Ethereum price analysis?

The Wyckoff accumulation phase is critical in Ethereum price analysis, as it indicates that ETH may be preparing for a significant uptick. Analysts believe that once this accumulation phase completes and support holds, Ethereum could target $2,700.

What is the Ethereum market forecast for the upcoming weeks?

The Ethereum market forecast suggests a strong possibility of upward movement if Bitcoin maintains its bullish momentum. With key levels such as $2,330 needing to be surpassed, analysts are keeping a close watch on ETH’s potential to rally towards $2,700.

What are the main Ethereum price targets mentioned by analysts?

Analysts have identified several Ethereum price targets, with $2,499 being the first target following a potential breakout, and a more ambitious target of $2,700 set as the second target indicating a strong bullish trend.

Are there any risks mentioned regarding Ethereum’s price targets?

Yes, analyst Incognito warns that the upward movement towards $2,700 could be a trap to shake out sellers. Market participants are advised to remain cautious and ready to take profits as Ethereum’s price develops.

What indicators are suggesting a change in Ethereum’s momentum?

Recent signals like the TD Sequential indicator flashing a buy signal indicate a possible change in Ethereum’s momentum, suggesting that a new bull rally could be on the horizon if ETH breaks above the supply wall at $2,330.

Could Ethereum’s price have already hit its bottom?

Some analysts propose that Ethereum’s price may have already bottomed or be very close, as indicated by its movements within a large ascending channel, which could open opportunities for a rally up to $4,200.

What could influence Ethereum’s price to reach new all-time highs?

For Ethereum to reach new all-time highs, it must reclaim the $4,000 level and maintain bullish momentum. Analysts like Crypto Patel believe ETH could range between $6,000 and $8,000 by year-end if this upward trend continues.

| Key Points |

|---|

| Crypto analyst Incognito predicts Ethereum could rise to $2,700 soon, despite current lows. |

| Wyckoff accumulation phase nearing completion suggests possible price increase. |

| Initial target is $2,499; second target is $2,700 if breakout occurs. |

| Market caution advised; potential for a bear trap. |

| Bitcoin’s performance could influence Ethereum’s rally. |

| TD Sequential buy signal indicates possible momentum shift for ETH. |

| ETH needs to break $2,330 for a bullish trend. |

| Analysts suggest ETH may have bottomed, with potential upside to $4,200 or higher. |

| Current ETH price is around $1,639, showing a slight increase recently. |

Summary

Ethereum price prediction suggests that there could be a significant upward movement for ETH, with forecasts indicating a rise to $2,700 as the market braces for a potential rally. Analysts are cautiously optimistic, highlighting critical resistance levels and the importance of Bitcoin’s performance in influencing Ethereum’s future price action. If support levels hold and bullish indicators align, Ethereum could not only break through immediate resistance but potentially reach new all-time highs by the end of the year. Investors should remain vigilant as market conditions evolve.

Ethereum price prediction is the talk of the town among crypto enthusiasts, especially as analysts forecast a potential rally to $2,700 in the near future. An insightful analysis from crypto expert Incognito suggests that the leading altcoin’s price might surge, particularly as the Wyckoff accumulation phase appears to be nearing its completion. Despite facing significant obstacles and a decline in market share, Ethereum’s rising forecast gives optimism to investors. With key resistance levels to watch, including the crucial $2,499 target from the falling wedge pattern, the ETH market forecast is looking more promising by the day. As crypto market trends shift, understanding these dynamics becomes vital for making informed investment decisions.

The discussion surrounding Ethereum’s future value extends beyond mere forecasts, as many crypto market analysts explore why the altcoin could experience significant price shifts. Utilizing terms such as “ETH market outlook,” experts suggest that Ethereum is not only facing potential support levels but may also be heading into a phase ripe for a bullish trend. Concepts like Wyckoff accumulation and price targets are pivotal in comprehending the underlying movements in the crypto space. As traders keep a close eye on patterns that could influence Ethereum’s price action, insights into conditions that prompt upward momentum become essential for effective trading strategies. Ultimately, strategic analysis of Ethereum price trends offers crucial guidance for prospective investors.