In the world of cryptocurrency, Dogecoin analysis is crucial for understanding the current market landscape and future price movements of this meme coin. Following a recent dip to the $0.1293 level, many traders and investors are eager to predict the next move for DOGE, as sentiment around the digital asset fluctuates. As investors weigh Dogecoin price predictions and heed DOGE technical analysis, key market trends emerge, indicating potential bullish divergences that could shape upcoming price action. Although enthusiasm may have dwindled compared to its meteoric rise, analyzing Dogecoin market trends reveals nuances that suggest a possible resurgence. By delving into the depths of meme coin analysis, enthusiasts can uncover insights into the evolving narrative surrounding Dogecoin in a dynamic crypto market.

When exploring the intricacies of Dogecoin, often referred to as the playful digital currency originating from a popular meme, it is essential to dive into its analytical dimensions. Many crypto aficionados are engaging in a thorough examination of DOGE’s price trajectories, driven by recent fluctuations and the broader implications of market trends. As various analysts offer their insights into Dogecoin’s momentum, the technical movements including any bullish divergences are closely scrutinized. This meme-inspired cryptocurrency faces a unique set of challenges and opportunities that merit a comprehensive investigation. Through thoughtful assessment of the fluctuating landscape, one may come to appreciate the complex dynamics at play in Dogecoin’s market journey.

Current Market Trends for Dogecoin

As Dogecoin finds itself at a crossroads, understanding the current market trends is essential for investors looking to navigate the fluctuation in its price. The recent price action has highlighted a growing shift toward utility-driven tokens, leaving many to speculate if DOGE can maintain its relevance amidst rising competition. With the price recently dipping to $0.1293 yet rebounding, the analysis indicates that the notorious meme coin might still have a fighting chance but requires vigilant market engagement.

Furthermore, Dogecoin’s status as a meme coin presents unique challenges and opportunities as market interest shifts. While new tokens gaining traction may momentarily overshadow DOGE, the meme factor that initially fueled its ascent cannot be discounted entirely. Investors will keenly watch how these trends evolve as Dogecoin attempts to carve out its space amid emerging market dynamics.

Dogecoin Technical Analysis and Price Predictions

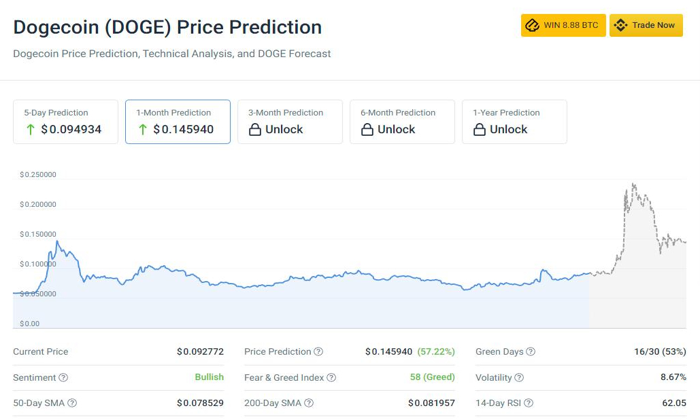

The recent technical analysis of Dogecoin shows a promising bounce at the significant support level of $0.1293, propelled by a bullish divergence in the Relative Strength Index (RSI). This divergence signifies a weakening of selling pressure, suggesting that Dogecoin could be approaching a potential price recovery. Traders often rely on such signals to inform their market strategies, making this analysis vital for predicting future movements.

Looking forward, if Dogecoin can leverage this technical momentum, predictions indicate that it could aim for higher resistance levels, potentially reaching up to $0.2403. Positive market conditions coupled with sustained buying pressure are crucial as the cryptocurrency seeks to break free from its current resistance. The technical landscape will continue to shift as observers analyze how well DOGE can hold above its support and navigate through these technical barriers.

Assessing Dogecoin’s Bullish Divergence

The concept of bullish divergence is pivotal in understanding Dogecoin’s price dynamics. When the price descends yet the RSI shows increased lows, it indicates a possible reversal. Recent analysis identifies that right before Dogecoin reached the $0.1293 bounce point, this situation unfolded—signaling that despite downward price action, buyer interest was being rekindled.

Such divergence is not merely academic; it can be a crucial factor for traders. Recognizing that Dogecoin is potentially oversold opens avenues for strategic entry points, allowing investors to take advantage of anticipated rebounds. Thus, it is imperative to keep an eye on the RSI movements as DOGE wrestles with its recent price levels.

Dogecoin Price Recovery: What Lies Ahead?

In the wake of a recent price recovery, the pressing question for Dogecoin investors is whether this rebound can stave off further declines and lead to a solid upward momentum. The shift from the significant low of $0.1293 could represent a turning point, yet the lack of vigorous trading and market buzz raises concerns. The sustainability of this price recovery will heavily depend on broader market sentiments and how Dogecoin responds to ongoing pressures.

If Dogecoin manages to break through resistance levels, notably the $0.18 threshold, this could signal renewed confidence in the market. A successful break could set the stage for a revisit of higher price points around $0.2403, thus invigorating the bullish sentiment. In conclusion, the price recovery trajectory for DOGE will be contingent on external market forces, as well as its intrinsic ability to adapt to changing investor preferences.

The Role of Community Sentiment in Dogecoin’s Journey

Community sentiment plays an influential role in the performance of Dogecoin. The enthusiasm that once propelled it to incredible heights is starting to dwindle, which reflects in the noticeably muted trading volumes. As newer tokens captivate investor attention, the necessity for a robust and engaged Dogecoin community has never been more critical.

Revitalizing the community’s interest could provide the momentum needed to push boundaries and drive up demand for DOGE. Efforts to increase engagement through social media, updated communications from developers, and collaboration with other projects could spark a resurgence in community-driven enthusiasm. The path forward for Dogecoin depends significantly on the ability of its supporters to reinvigorate the environment that once created such explosive growth.

Analyzing Dogecoin’s Resistance Levels

The analysis of Dogecoin’s various resistance levels is crucial for understanding its potential price movements. Currently, the significant resistance threshold sits around the $0.18 mark. Overcoming this barrier is essential as it not only validates bullish momentum but also instills confidence in potential future gains. Failure to breach this level could lead to further uncertainty in price action.

In conjunction with the broader market landscape, Dogecoin’s ability to navigate these resistance levels will define its trading pattern moving forward. Market players will be particularly keen on identifying if triggers such as higher trading volumes or favorable market news can aid in overcoming these technical obstacles. Therefore, closely monitoring key resistance points could provide vital insights into timing investment decisions.

Comparing Dogecoin with Other Meme Coins

In the evolving cryptocurrency market, Dogecoin often draws comparisons with other meme coins like Shiba Inu. While both started as humorous ventures, their trajectories have diverged significantly. Investors are now evaluating the strength of each respective community, technological developments, and market responses to maintain interest. Dogecoin’s previous success can be attributed to its strong community support and social media presence, which continue to be relevant today despite competitive pressures.

Furthermore, analyzing market trends relative to these other meme coins can inform investment strategies. Observers note that shifts in investor interest often trend in cycles, making it crucial for DOGE to adapt its messaging and community engagement strategies. The ability to maintain a fanbase and attract new investment will be essential as meme coins seek to establish themselves in an increasingly utility-driven market.

Long-Term Perspectives on Dogecoin’s Market Viability

Looking beyond the immediate waves of price action, assessing the long-term viability of Dogecoin is a pressing consideration. The initial appeal was primarily its meme status, which captivated a vast audience. However, as the cryptocurrency landscape continues to mature, it has become necessary for digital currencies like DOGE to find unique value propositions that resonate with investors.

Future market viability may hinge on adopting a more serious approach concerning utility and real-world applications. While the community-driven push might remain, the drive toward establishing legitimate use cases for Dogecoin will determine whether it can transform from a speculative investment into an enduring financial instrument in the crypto space.

The Future of Dogecoin: Speculation and Hopes

As investors look forward to Dogecoin’s future, speculation remains a significant part of the narrative. Many hope for a resurgence akin to its previous bull runs; however, this requires the convergence of favorable market conditions and sustained community interest. The interplay of various factors such as technological advancements and sentiment within the broader meme coin landscape is expected to shape the future trajectory of DOGE.

Ultimately, the outlook for Dogecoin will largely rely on its adaptability and resonance within the evolving market context. If DOGE can pivot to align with investor expectations and market trends, it could embark on a new chapter of growth. Nevertheless, the journey ahead may be complex, with challenges requiring diligent monitoring of market sentiment, technical developments, and community support.

Frequently Asked Questions

What is the current Dogecoin price prediction based on market trends?

The current Dogecoin price prediction suggests a cautious outlook amid slowing momentum. After a rebound from a low of $0.1293, analysts are watching if DOGE can overcome key resistance levels to signal a sustained rally. An uptick in demand and breaking the $0.18 resistance could lead to further gains.

How is DOGE technical analysis impacting investor sentiment?

DOGE technical analysis indicates a potential shift in momentum due to a recent bullish divergence noted in the RSI. This suggests weakening selling pressure, which may restore investor confidence. However, ongoing resistance and low trading volume contribute to a cautious market atmosphere around Dogecoin.

What are the key Dogecoin market trends affecting its performance?

Key Dogecoin market trends include a noticeable decrease in community engagement and transitioning interest toward utility-focused tokens. Despite a recent bounce off $0.1293, the overall sentiment appears subdued, indicating that while Dogecoin shows some recovery potential, it must overcome significant resistance to ensure a strong market presence.

Can Dogecoin’s bullish divergence lead to a significant price rally?

Yes, Dogecoin’s bullish divergence noted in the RSI may indicate a potential price rally. This divergence occurs when the price makes lower lows while the RSI shows higher lows, often signaling an impending reversal. If DOGE can sustain momentum and surpass resistance levels, it could lead to a substantive upward move.

What role does meme coin analysis play in Dogecoin’s future?

Meme coin analysis is crucial for Dogecoin’s future as it highlights market sentiment and community involvement. Currently, waning interest in meme coins could hinder Dogecoin’s growth. Analysts are closely evaluating the balance of traditional market dynamics against the unique appeal of meme coins to forecast potential price movements.

| Key Point | Details |

|---|---|

| Current Price Dynamics | Dogecoin is facing a slowdown in momentum with a price drop to $0.1293. Although it has rebounded, trading activity remains subdued. |

| Market Sentiment | There is waning excitement around Dogecoin as market interest shifts towards utility-driven tokens. |

| RSI Analysis | A bullish divergence in the RSI indicates a weakening of selling momentum and a potential price reversal. |

| Current Resistance Levels | To regain a bullish trend, Dogecoin needs to overcome current resistance levels, especially around $0.18. |

| Potential Price Targets | If a breakout occurs, Dogecoin could target higher resistance zones at $0.2403 and $0.2923. |

Summary

Dogecoin analysis indicates that the meme coin is currently experiencing a challenging market phase, struggling to maintain momentum after a significant bounce from the $0.1293 support level. While technical indicators like the RSI show potential for a reversal, the overall resistance from broader market sentiments and trading activity may hinder a sustained rally. If DOGE can overcome crucial resistance levels, it may head toward stronger price points, reflecting the resilience needed in the meme coin market.

Dogecoin analysis reveals an intriguing landscape for this once-beloved meme coin, as it faces a notable slowdown in momentum that has left investors pondering its future trajectory. Following a dip to the $0.1293 mark, DOGE demonstrated resilience with a significant rebound, hinting at the bullish potential that remains within the market. However, as shifting market interest leans towards utility-driven tokens, the fading excitement surrounding Dogecoin becomes harder to ignore. Despite the recent recovery signs, trading volumes remain low, questioning the sustainability of this bullish divergence witnessed in DOGE technical analysis. Moving forward, understanding the Dogecoin price prediction and overall market trends will be crucial for investors looking to navigate the fluctuating waters of this dynamic cryptocurrency.

In the world of cryptocurrencies, a careful exploration of Dogecoin presents a unique narrative, especially against the backdrop of its current performance trends. This popular meme coin has experienced inconsistent trading momentum, characterized by significant price movements alongside fervent community engagement. With many market participants scrutinizing DOGE’s price actions, there’s a palpable tension between the desire for a bullish recovery and the reality of waning trading volumes. Insights from recent Dogecoin market trends signal that the cryptocurrency may be at a pivotal crossroads, necessitating keen attention to technical indicators such as bullish divergences. Ultimately, a comprehensive understanding of these factors will illuminate the potential pathways ahead for Dogecoin enthusiasts and traders alike.