In the rapidly evolving landscape of finance, **crypto ownership** is emerging as a significant trend among Americans, with reports indicating that roughly 55 million adults in the US now possess digital assets. According to the 2025 cryptocurrency survey, around 21% of the population has embraced this innovative form of currency, showcasing a diverse range of holders across various demographics. Findings from the US crypto statistics reveal that a remarkable 76% of these individuals perceive their cryptocurrency investments as enhancing their overall well-being. The growing presence of women in this space, now comprising 31% of crypto holders, highlights shifting societal norms and increased accessibility. As digital assets continue to impact personal finance, understanding cryptocurrency demographics becomes essential for grasping its future trajectory in the market.

The phenomenon of digital asset ownership is reshaping how we view finance in today’s world. With a surge in the number of individuals engaging with virtual currencies, discussions around ownership, user experiences, and financial practices are more relevant than ever. The 2025 crypto holders report sheds light on how these assets are not only investments but integral tools for transactions and payments in everyday life. As more users from varying backgrounds enter the space, it becomes crucial to analyze the broader implications of this market trend, including how emerging financial pathways are influencing personal and societal growth.

Current Trends in Crypto Ownership

The landscape of cryptocurrency ownership is shifting rapidly in the United States, with approximately 55 million adults now owning some form of digital asset. According to the latest 2025 Cryptocurrency Survey, around 21% of the US population has ventured into the world of crypto. This uptick in adoption highlights a growing trust in cryptocurrencies as valid and valuable assets. Notably, the demographic profile of crypto holders is evolving, showcasing a more diverse representation in terms of age, income, and gender that was not as prominent a few years back.

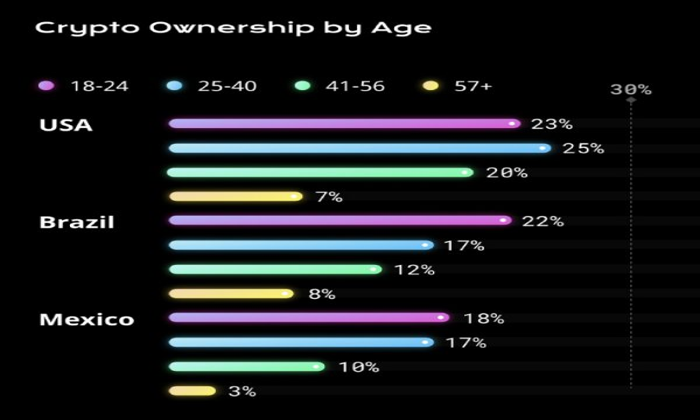

The 2025 State of Crypto Holders Report reveals that a significant portion of these owners is younger, with about 67% of holders under 45 years old. The survey also points to a broader spectrum of income levels participating in crypto ownership, where even those in lower-income brackets are making significant strides in adopting and utilizing digital assets. The report identifies that financial independence and improved transaction experiences are key motivators driving interest in cryptocurrencies across various demographics.

The Societal Impact of Digital Assets

An intriguing facet of the cryptocurrency ecosystem is its potential to create societal benefits. The 2025 survey reveals that 45% of respondents believe cryptocurrency promotes financial inclusion and can serve as a tool for poverty reduction. This perspective aligns with the growing narrative that cryptocurrencies are not merely speculative investments but rather vehicles for economic empowerment. Furthermore, enhancements in digital transaction infrastructure, reported by 45% of respondents, showcase how cryptocurrencies can streamline and transform traditional financial systems.

From a technological standpoint, 38% of individuals acknowledged the role of cryptocurrencies in advancing technology and fostering sustainable financial practices. As digital currencies gain popularity, they stimulate innovation and even push traditional financial institutions to adopt more progressive technologies, leading to a holistic improvement in the financial landscape. This transformation suggests that engaging with digital assets can have far-reaching consequences for financial inclusivity and economic growth.

Demographics of Cryptocurrency Users

The demographic landscape of cryptocurrency users is shifting dramatically, as evidenced by the findings from the 2025 cryptocurrency survey. Traditionally dominated by male investors, the crypto space is now seeing a more balanced gender representation, with women constituting about 31% of crypto holders. Moreover, the report highlights that younger adults are increasingly engaging with cryptocurrencies. This shift not only reflects changing attitudes towards digital currencies but also suggests a broader acceptance across different societal segments.

Additionally, the financial backgrounds of cryptocurrency owners are becoming increasingly varied. The report shows that 26% of crypto-owning households earn less than $75,000 annually, indicating that the barriers to crypto ownership are lowering. This trend of diverse cryptocurrency demographics implies that digital assets are gaining traction beyond high-income earners, further democratizing access to these emerging financial tools.

The Role of Digital Assets in Financial Independence

A striking outcome reflected in the 2025 State of Crypto Holders Report is the role of cryptocurrency in contributing to financial independence for many users. About 49% of surveyed individuals stated that their engagement with digital assets has enhanced their financial self-sufficiency. This aspect of financial empowerment speaks volumes about how cryptocurrency serves not just as an investment vehicle but as an essential component of personal finance strategy for a growing number of individuals.

Beyond the superficial benefits of investment, crypto offers practical applications that foster economic resilience. For instance, a significant portion of crypto holders utilize their assets for making purchases and sending money to family members. This trend indicates a transition from viewing cryptocurrency solely as a speculative asset to recognizing its utility in everyday financial transactions. Such a shift redefines how individuals perceive and interact with their finances, emphasizing independence through diversified strategies.

The Motivations Behind Crypto Adoption

Understanding the reasons behind the surge in cryptocurrency ownership is critical for stakeholders in this space. The 2025 cryptocurrency survey highlights that curiosity about the technology drives initial interest, with 50% of respondents identifying this as their entry point into the market. Alongside technological fascination, 60% cited investing in their financial future as a primary motivator, showcasing a mix of both speculative and utility-driven motivations among users.

The ongoing education and information-seeking behavior of crypto holders also reflect their desire to deepen their understanding of this complex asset class. With 81% of individuals indicating a keen interest in learning more about digital assets, topics such as investment strategies and tax implications emerge as critical avenues for ongoing engagement. This push for knowledge not only reinforces the underlying motivations for crypto adoption but also perpetuates a culture of informed investing.

Crypto Use Beyond Investment

As highlighted in the 2025 State of Crypto Holders Report, the role of cryptocurrency extends far beyond mere investment. Approximately 39% of holders use their digital assets for everyday purchases, reflecting a growing acceptance of cryptocurrency as a legitimate currency. This practical application of crypto demonstrates its potential to revolutionize the way individuals transact, enabling faster, more secure, and often lower-cost payments compared to traditional banking methods.

Moreover, the use of crypto for sending money to family and friends adds another layer to its utility. With 31% of respondents utilizing digital assets for peer-to-peer transactions, it reveals how cryptocurrencies cater to the need for efficient money transfers in an increasingly globalized world. This move away from conventional financial frameworks dovetails with the broader trend toward decentralized finance, further embedding cryptocurrencies into the fabric of everyday financial interactions.

Concerns About Cryptocurrency Use

While the optimism surrounding cryptocurrency is palpable, there are inherent concerns that potential holders must navigate. The survey revealed that only 3% of respondents reported negative experiences with crypto, indicating a generally favorable view of the asset class. However, issues related to scams, volatility, and the complexities of taxation still loom large, warranting attention from both regulators and users alike to ensure safer crypto experiences.

The overwhelming support for regulation among crypto holders, with 64% favoring government oversight, juxtaposes the caution expressed by many. Approximately 67% of respondents cautioned that poorly crafted regulations could stifle innovation in the sector. These insights illustrate the delicate balance between fostering industry growth and protecting consumers from potential pitfalls, underscoring the importance of smart regulatory frameworks in guiding the evolution of cryptocurrency.

The Future of Cryptocurrency in Financial Systems

The findings of the 2025 State of Crypto Holders Report paint an optimistic picture for the future of digital assets within the financial ecosystem. Many users believe that cryptocurrencies will play a transformative role in the broader financial systems, enhancing efficiency and inclusivity. Respondents exhibit a strong commitment to remaining engaged with the evolving landscape, indicating that the future of cryptocurrency will be marked by continued growth and increased acceptance across society.

Additionally, the notion of the United States taking a leadership role in global cryptocurrency development is a sentiment echoed by 73% of surveyed individuals. This ambition toward global leadership implies a recognition of the economic potential embedded in digital assets and an advocacy for structures that encourage innovation while safeguarding public interest. Ultimately, the ongoing commitment to cryptocurrency suggests a dynamic future where digital assets become integral to global financial systems.

Educational Trends in Cryptocurrency

The thirst for knowledge in the realm of cryptocurrency is evident among current holders, with 81% expressing a desire to learn more about digital assets. The 2025 survey identifies educational trends that cater to this demand, with individuals seeking out topics like investment strategies and blockchain technology. This appetite for information amongst crypto holders is indicative of a community ready to adapt and evolve with the market, recognizing that informed investors are better equipped to navigate the complexities surrounding cryptocurrencies.

Particularly striking is the reliance on popular media as a primary source for learning about crypto. YouTube, along with traditional media, stands out as a leading avenue for education, suggesting that content creators and educators play a pivotal role in shaping public understanding of digital assets. As the landscape continues to change, effective educational initiatives will be crucial in fostering a well-informed community, empowering individuals to engage confidently with cryptocurrencies.

Frequently Asked Questions

What percentage of crypto holders use digital assets for purchases according to the 2025 cryptocurrency survey?

According to the 2025 cryptocurrency survey, approximately 39% of crypto holders use their digital assets to make purchases. This highlights the practical applications of crypto ownership beyond merely investing.

How many US adults currently own crypto based on the 2025 crypto holders report?

As of the 2025 crypto holders report, roughly 55 million US adults are identified as crypto owners, representing about 21% of the US population.

What is the impact of digital assets on the lives of US crypto holders?

The 2025 State of Crypto Holders Report indicates that 76% of crypto holders believe that their experiences with digital assets have significantly improved their lives, showcasing the positive personal impact of crypto ownership.

What demographic trends were revealed in the cryptocurrency demographics of the 2025 survey?

The survey highlighted that 67% of crypto holders are under 45 years old, with a notable increase in older demographics, indicating a shift in cryptocurrency demographics from previous years.

What motivations drive people to own crypto according to the 2025 survey findings?

The 2025 cryptocurrency survey showed that 60% of crypto holders are motivated by the desire to invest in their financial future, while half were initially curious about the technology, reflecting diverse motivations behind crypto ownership.

How does income level affect crypto ownership in the US?

The 2025 US crypto statistics reveal that households earning less than $75,000 annually now represent 26% of crypto-owning households, indicating that low barriers to entry have encouraged crypto ownership among lower-income groups.

What are the most commonly owned cryptocurrencies among holders?

According to the 2025 crypto holders report, Bitcoin is the most commonly owned cryptocurrency, noted by 99% of holders, followed by Ethereum and Dogecoin, both recognized by 91% of crypto owners.

What role does crypto play in financial inclusion according to US crypto statistics?

The statistics show that 45% of crypto holders believe digital assets contribute to financial inclusion and help reduce poverty, demonstrating the societal benefits associated with crypto ownership.

What educational interests do crypto holders have based on the 2025 survey?

The survey revealed that 81% of crypto holders are eager to learn more about digital assets, with topics of interest including investment strategies (47%) and tax implications (39%), reflecting a commitment to understanding crypto ownership.

What concerns do crypto holders have about regulations?

The 2025 survey indicated that while 64% of respondents support government oversight, 67% cautioned against poorly designed regulations that could hinder innovation, showing a nuanced view of regulation in relation to crypto ownership.

| Key Points | Statistics |

|---|---|

| Usage of Crypto | 39% use it for purchases; 31% send money to friends/family; 31% use it for business transactions. |

| Demographics | 55 million US adults own crypto; 67% of holders are under 45; 15% over 55; 31% are women. |

| Income Distribution | 26% of crypto holders have annual household incomes below $75,000. |

| Education and Interest | 81% want to learn more about crypto; 47% are interested in investment strategies. |

| Benefits of Crypto | 45% believe crypto promotes financial inclusion; 49% say it boosts financial independence. |

Summary

Crypto ownership is increasingly viewed as beneficial by its holders, with a significant portion of users employing digital assets for various purposes beyond mere investment. The 2025 State of Crypto Holders Report indicates that 39% of crypto holders utilize their assets for purchases, and many perceive improvements in their personal and financial lives due to this ownership. It also highlights a growing demographic diversity among holders, revealing that crypto is appealing across various income levels and age groups. As interest in continued education about cryptocurrencies grows, there is optimism about the future role of these digital assets in enhancing financial systems.

Crypto ownership has surged in popularity, with data from the 2025 cryptocurrency survey revealing that around 55 million adults in the United States now hold digital assets. This significant growth is reflected in the latest crypto holders report, which highlights that 21% of the U.S. population is now invested in cryptocurrencies. With nearly 76% of these crypto holders believing that owning digital assets has positively impacted their lives, it is clear that the influence of cryptocurrency on American culture is profound. The survey, which sampled over 53,000 adults, underscores a demographic shift, showcasing a younger crowd embracing this financial revolution. As the world continues to adapt to various US crypto statistics, understanding the overall impact of crypto ownership on personal finance and broader economic trends becomes essential.

The rising trend of digital asset ownership signifies a monumental shift in how individuals perceive and interact with currency. Terms like cryptocurrency, digital currency, and virtual assets are becoming commonplace, as more people explore the benefits of these technologies. Emerging demographics in this space indicate that ownership is diversifying, with younger individuals showing keen interest in blockchain innovation and its implications for personal wealth. As we examine the landscape of digital asset enthusiasts, it becomes evident that a knowledge revolution is underway, where education about cryptocurrencies and their potential is becoming increasingly critical. With an expanding interest in the various applications of these assets, the conversation surrounding financial independence and inclusion is more relevant than ever.