The landscape of cryptocurrency is buzzing with anticipation as bullish Bitcoin signals continue to gain momentum, suggesting a robust upward trend for the digital asset. Analysts are drawing parallels with previous cycles, asserting that the current conditions might reflect the most favorable Bitcoin price prediction since 2020. Factors such as a recent increase in liquidity and the declining trust in fiat money are emerging as clear bull market indicators. As Bitcoin approaches key resistance levels, a major BTC breakout seems imminent, igniting interest among traders and investors alike. Amidst evolving cryptocurrency trends, it is crucial to stay informed on these signals to navigate potential opportunities in the financial market.

Recent developments in the cryptocurrency sector hint at a resurgence, prompting discussions around optimistic Bitcoin trends. The indicators of a potential upward shift in Bitcoin’s value are becoming more pronounced, as various market factors converge to support a bullish stance. With many experts emphasizing the importance of liquidity and shifts in interest rates, understanding these elements can provide valuable insights into future price movements. As investor sentiment leans towards a rebound, it’s essential to delve deeper into the implications of these market signals. The convergence of rising liquidity, market confidence, and broader economic factors is setting the stage for what might be a historic lift-off in Bitcoin’s trajectory.

Understanding Bullish Bitcoin Signals

Bitcoin has been a leading cryptocurrency since its inception, and recent trends suggest a favorable trajectory for BTC. Analysts are increasingly identifying bullish signals which could indicate a significant price surge. In particular, with Bitcoin showing phenomenal resilience amid evolving economic conditions, its potential for growth appears very promising. These bullish Bitcoin signals not only suggest a possible price ascent but also resonate with those who follow Bitcoin price prediction and cryptocurrency trends closely.

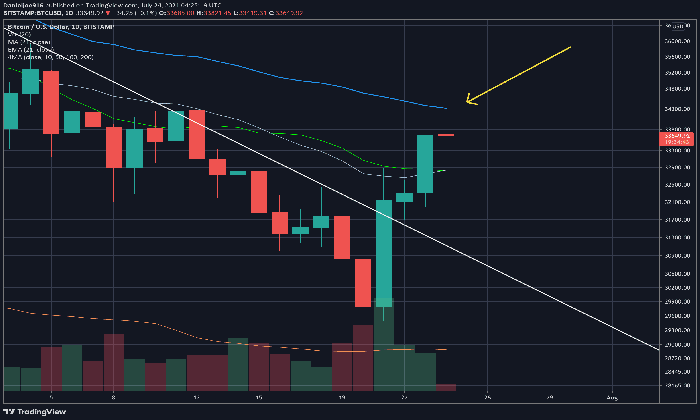

The current landscape is marked by fluctuating financial conditions, making it a pivotal time for Bitcoin investors. As the cryptocurrency market reacts to traditional financial indices, the signs of increased liquidity and economic shifts are crucial for assessing Bitcoin’s forthcoming performance. Investors keen on financial market analysis should note how these trends align with prior bull market indicators, further reinforcing the optimism in BTC’s impending breakout.

Rising Liquidity and Its Influence on Bitcoin

One of the foremost signals indicating a bullish Bitcoin setup is the rise in global liquidity, specifically the M2 money supply. Since 2021, there is a noticeable increase in M2 supply by approximately 4%, which correlates with historical data suggesting that every major bull market in Bitcoin has been preceded by such liquidity expansion. This metric, analyzed alongside BTC breakout potential, reveals that Bitcoin often thrives in conditions where fiat trust is diminishing, leading to a preference for digital assets.

With liquidity influences at play, once again, Bitcoin showcases its ability to absorb monetary expansions, encouraging investors to consider the longevity and sustainability of its growth trajectory. As the MVRV ratio indicates a rare bounce, there is optimism regarding the BTC price movement above the $90,000 mark. This emerging trend, fueled by increased liquidity, highlights the interconnectedness of global financial conditions and Bitcoin market performance, making it a critical area for investors.

Impact of Interest Rates on Bitcoin’s Future

Interest rates significantly influence asset valuations across the board, and Bitcoin is no exception. Current analyses show that reductions in interest rates lead to substantial price increases for Bitcoin; specifically, every 25 basis points lower could equate to a 10% rise in BTC. With fiscal policies shifting towards lower rates, a marginal drop of 75 basis points could see Bitcoin potentially approaching $130,000. Such predictions emphasize the importance of monitoring interest rate trends, especially for cryptocurrency traders.

Bot the current macroeconomic climate and upcoming interest rate changes create a favorable backdrop for Bitcoin’s price growth as it adjusts to shifting financial conditions. As economic uncertainty continues to prevail, Bitcoin is soon expected to be on the rise, driven by both external economic pressures and intrinsic market strength. Investors banking on Bitcoin’s capabilities should keep an eye on interest rate movements as they directly affect BTC price prediction and trading strategies.

Volatility and Bitcoin Resilience

Recent metrics indicate heightened volatility in the markets, particularly reflective of what was witnessed during the chaotic days of March 2020. Bitcoin’s unique positioning allows it to thrive amid such volatility, providing a sense of stability to investors looking for assurance in uncertain times. Historical patterns suggest that periods of increased volatility often lead to favorable outcomes for Bitcoin, reaffirming its role as a proactive hedge against market turmoil.

As the VIX (CBOE Volatility Index) showcases fluctuations, analysts note a strong relationship between reduced volatility and Bitcoin’s bullish potential. A predictive model suggests that with a VIX score dropping into the ‘risk-on’ territory, Bitcoin prices could see significant upward momentum. The historical evidence aligning Bitcoin’s performance to volatility trends emphasizes its resilience as an asset class amid broader financial uncertainties.

MVRV Ratio as a Bullish Indicator

The Market Value to Realized Value (MVRV) ratio is proving to be a critical bullish signal for Bitcoin. Recent changes to this ratio indicate that Bitcoin could be gearing up for another bull run, as historical data suggests that values bouncing above 1.74 have marked the beginnings of major price rallies. This becomes increasingly relevant as investors watch for signs of market stability and growth potential.

With the MVRV ratio’s recent movements alongside climbing Bitcoin prices above historical cost baselines signifies shifting market dynamics. Such patterns often occur as less confident traders exit the market, paving the way for new investors. Hence, this indicator serves as a critical component in financial market analysis surrounding Bitcoin’s price trends, painting a broader picture of future bullish movements.

Gold and Bitcoin: A Comparative Analysis

The recent performance of gold sets an intriguing precedent for Bitcoin’s future prospects. As a time-tested safe haven, gold saw substantial gains early in the year, which leads many to draw parallels with Bitcoin’s potential breakout scenarios. The observed relationship between gold and Bitcoin remains a focal point for market analysts, significantly influencing Bitcoin price predictions during times of economic disruption.

As gold passes various historical price thresholds and pauses to adapt to new pressures, Bitcoin’s ability to capture investor interest becomes more pronounced. Such dynamics illustrate how both assets serve as alternative financial instruments, especially in volatile market conditions, reinforcing Bitcoin’s standing as a sound investment in contemporary finance.

The Role of Financial Conditions on Bitcoin Growth

The current financial condition is markedly conducive to Bitcoin’s growth potential, reflecting a broader trend in cryptocurrency markets. As liquidity expands and interest rates show signs of decline, Bitcoin stands to benefit from favorable market dynamics that could catalyze price surges. When analyzing the conditions under which Bitcoin thrives, the alignment of financial indicators proves critical for predicting its path forward.

Analysts note that declining trust in traditional fiat systems enhances Bitcoin’s appeal, especially as it solidifies its position as a financial alternative during inflationary periods. This evolution emphasizes the need for thorough financial market analysis, as developments within traditional economies often impact cryptocurrency valuations significantly, defining Bitcoin’s growth narrative as it propels towards new heights.

Predictions for Bitcoin’s Near-Term Future

As analysts reflect on current trends in Bitcoin, their predictions for the cryptocurrency’s near-term future are increasingly optimistic. The convergence of multiple bullish signals suggests that Bitcoin might reach noteworthy price points within the next few months, contingent on favorable economic conditions. Emerging consensus around the Bitcoin price prediction indicates a strong possibility of BTC breaking through established resistance levels, particularly if liquidity and monetary policy shifts continue to align positively.

Investor sentiment currently surrounding Bitcoin also plays a pivotal role in shaping expectations for future performance. As more investors acknowledge Bitcoin’s resilience and growth potential, naturally, positive sentiment could stimulate upward momentum in adoption rates and drive prices higher. The interplay of these factors sets the stage for what could be a defining moment for Bitcoin as it navigates through a landscape marked by uncertainty and opportunity.

Frequently Asked Questions

What are the most bullish Bitcoin signals for price prediction in 2023?

In 2023, analysts identify several bullish Bitcoin signals that suggest a strong price prediction. Key indicators include rising liquidity with a 4% increase in the M2 money supply, a decrease in the VIX indicating favorable market conditions for BTC, and bullish patterns from historical data such as the MVRV ratio signaling the beginning of new bull markets.

How do bull market indicators relate to Bitcoin’s price dynamics?

Bull market indicators for Bitcoin often correlate with increased liquidity, investor sentiment, and historical patterns. Key signals, such as a declining VIX and a rising M2 money supply, contribute to the bullish outlook by suggesting increased demand and less fear in financial markets, which historically leads to significant BTC price increases.

What does a BTC breakout indicate for traders in a bullish market?

A BTC breakout often serves as a strong bullish signal, suggesting that Bitcoin price is breaking above critical resistance levels. This can indicate increased buying pressure and trader confidence, leading to potential price surges as more investors enter the market, particularly when combined with bullish indicators like rising liquidity and favorable interest rates.

What cryptocurrency trends are currently suggesting a bullish outlook for Bitcoin?

Current cryptocurrency trends indicating a bullish outlook for Bitcoin include rising interest from institutional investors, increased adoption rates, and macroeconomic factors such as a softening monetary policy. Additionally, patterns like the MVRV ratio and improved liquidity levels serve as bullish signals that suggest BTC could see significant gains.

How does financial market analysis contribute to understanding BTC’s potential breakout?

Financial market analysis offers insights into macroeconomic conditions affecting Bitcoin’s price, such as liquidity trends, interest rate changes, and market volatility. By analyzing these factors, traders can better anticipate BTC’s potential breakout, especially when indicators like the VIX signal a favorable environment for risk assets.

| Signal | Description |

|---|---|

| Rising Liquidity | The M2 money supply is increasing for the first time since 2021, indicating expanding liquidity, which historically fuels Bitcoin bull markets. |

| Gold Rally | Gold has risen 30% this year, but a recent slight drop doesn’t deter Bitcoin’s gains, often signaling larger movements for BTC when market behaviors align. |

| VIX Volatility | The CBOE Volatility Index has fluctuated significantly, suggesting a favorable risk environment for Bitcoin, particularly when lower volatility is observed. |

| Interest Rate Impact | Each 25 basis points reduction in interest rates historically corresponds to about a 10% increase in Bitcoin’s price, predicting potential upward moves. |

| Market Value/Realized Value (MVRV) | The MVRV ratio’s upswing indicates the potential for a major bull market as sellers appear exhausted in the current price range. |

Summary

Bullish Bitcoin signals are increasingly evident as the cryptocurrency sector gears up for potential breakout movements reminiscent of previous bull runs. Key indicators like rising liquidity, significant gold market shifts, volatility patterns, interest rate impacts, and MVRV analytics show consistent bullish trends. As Bitcoin remains positioned to absorb liquidity and attract investments amidst changing financial landscapes, it could lead to unprecedented price evaluations in the near future.

Bullish Bitcoin signals are rapidly gaining traction as analysts project a potential breakout for the leading cryptocurrency. Following an impressive rally in gold prices, there is a growing consensus that Bitcoin may be on the cusp of a significant upward movement not seen since 2020. With indicators pointing towards a burgeoning bull market, such as increased liquidity and favorable financial conditions, many experts are hopeful for a positive Bitcoin price prediction. The landscape of cryptocurrency trends suggests that these bullish signals could pave the way for a substantial BTC breakout, enticing investors to evaluate their strategies closely. As financial market analysis continues to unfold, the anticipation surrounding Bitcoin’s next moves is palpable, promising to ignite discussions among traders and enthusiasts alike.

The emergence of optimistic signals regarding Bitcoin’s performance is becoming a focal point in the financial world, especially as it hints at a thriving bull market for cryptocurrencies. Analysts are closely monitoring key indicators that suggest Bitcoin could soon dominate the headlines with its price surging dramatically. Emerging patterns, particularly revolving around liquidity and economic conditions, bolster the narrative of a probable price acceleration. Furthermore, the anticipation of a BTC breakout is fueling conversations surrounding market dynamics, making it a vital topic in the ongoing assessment of cryptocurrency trends. This buzzing interest reinforces the need for in-depth financial market analysis as stakeholders brace for potential shifts in the market landscape.