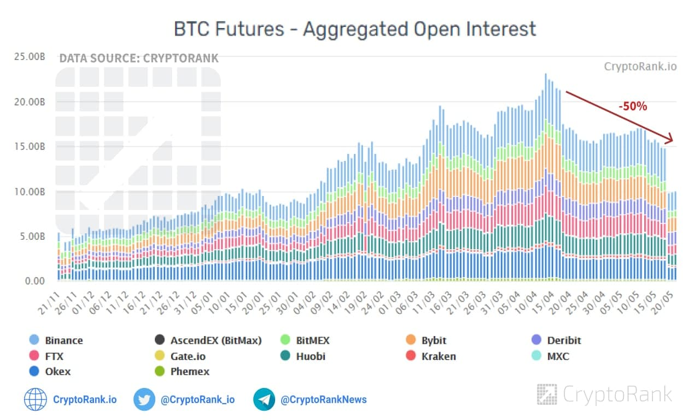

The recent decline in Bitcoin open interest has sent ripples through the cryptocurrency market, raising eyebrows among traders and analysts alike. As Bitcoin’s price plummeted to $88,500, the futures market experienced a staggering loss of $2.24 billion in open interest, highlighting a significant shift in investor sentiment. This decline in open interest not only signals a decrease in market confidence but also correlates with the $1.48 billion in liquidations that swept across platforms as panic set in. Observing the contrasting movements on exchanges like Coinbase, which saw a 41.1% drop in open interest, provides valuable insights into the current state of the futures market. Understanding these trends is crucial for predicting potential future movements in Bitcoin’s price and overall cryptocurrency market trends.

The recent downturn in Bitcoin’s trading activity, particularly in terms of open positions in futures contracts, has raised important questions about the health of the cryptocurrency ecosystem. Following the sharp decline to $88,500, many traders are questioning their strategies, as evidenced by the notable decrease in liquidity and open interest on major platforms. This situation reflects broader market dynamics, with significant liquidations occurring as traders reacted to the volatility. By examining the shifts in open interest, particularly on exchanges like Coinbase, we can better understand the psychological factors influencing investor behavior. It’s essential to analyze how these market fluctuations impact trading strategies and future price movements in the cryptocurrency landscape.

Impact of Bitcoin Price Drop on Open Interest

The recent decline in Bitcoin’s price, dipping to $88,500, has had a profound effect on the futures market, leading to a staggering loss of $2.24 billion in open interest. This phenomenon is indicative of a broader trend in the cryptocurrency space, where price volatility can trigger significant shifts in investor sentiment. Open interest, which represents the total number of outstanding contracts in the futures market, is a crucial indicator of market health and liquidity. As Bitcoin’s price plummeted, many traders were forced to liquidate their positions, contributing to the overall decline in open interest.

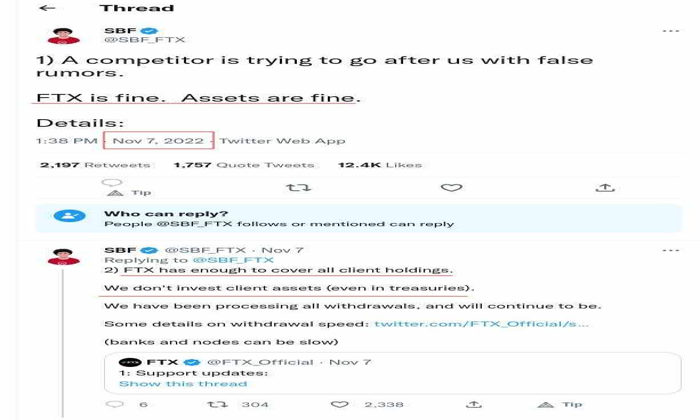

Moreover, this Bitcoin price drop not only affected open interest on major exchanges but also highlighted the contrasting dynamics between institutional and retail investors. Retail investors, often more reactive to market movements, may have rushed to close their positions out of fear, while institutional players might have viewed this as an opportunity to accumulate more assets at lower prices. This divergence in behavior emphasizes the complexities of market psychology and the varying strategies employed by different classes of investors.

Coinbase Open Interest Decline Analysis

Coinbase, one of the leading cryptocurrency exchanges, experienced a dramatic 41.1% decline in open interest following the recent Bitcoin downturn. This significant drop raises questions about the trading behaviors of Coinbase users compared to those on other platforms like Binance, which managed to withstand the liquidations better. Such discrepancies suggest that Coinbase’s user base may consist of a larger proportion of retail investors who are more susceptible to panic selling during market downturns.

The decline in Coinbase’s open interest also reflects broader cryptocurrency market trends, where exchanges are increasingly becoming battlegrounds for different trading strategies. While some investors may take a long-term view, others react to short-term price fluctuations, leading to increased volatility. Understanding these dynamics can provide insights into future market movements and the potential recovery of open interest as Bitcoin stabilizes.

Liquidations in the Crypto Market: A Closer Look

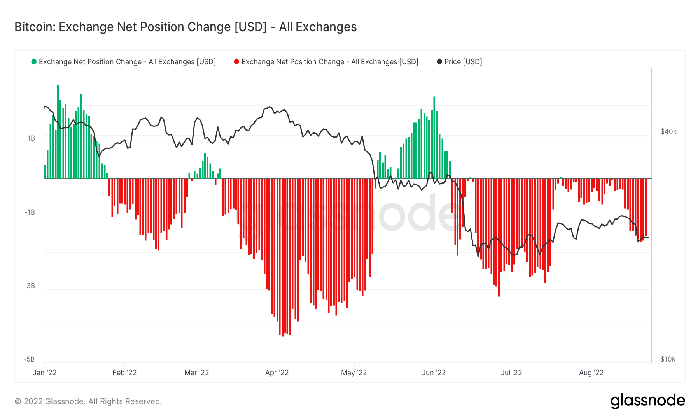

The recent wave of liquidations in the cryptocurrency market, totaling $1.48 billion, paints a stark picture of the risks associated with leveraged trading. When Bitcoin’s price fell, many traders found themselves unable to meet margin requirements, leading to forced liquidations. This cascading effect not only impacted individual traders but also contributed to the overall market instability, magnifying the price drop and further exacerbating the situation.

Liquidations in the crypto market are not a new phenomenon, but their scale can often be linked to broader market trends and investor sentiment. As traders become more cautious in the face of price volatility, we may see a shift towards less leveraged positions, which could lead to a more stable market environment. However, the potential for future liquidations remains as long as traders engage in high-risk strategies without adequate risk management.

Future Trends in the Cryptocurrency Market

As the cryptocurrency market continues to evolve, several key trends are emerging that could shape its future. Increased regulatory scrutiny, changing investor behaviors, and technological advancements are all playing a role in how market dynamics will unfold. The recent decline in Bitcoin’s price and the consequent changes in open interest serve as a reminder of the market’s inherent volatility and the need for investors to remain vigilant.

Additionally, the way exchanges adapt to these trends will be critical in determining their long-term viability. Platforms that can provide better risk management tools, educational resources, and robust trading strategies will likely attract more users, particularly institutional investors who are looking for stability in a turbulent market. As we look ahead, understanding these emerging trends will be essential for navigating the complexities of the cryptocurrency landscape.

Institutional vs. Retail Investors in Cryptocurrency

The recent fluctuations in Bitcoin’s price have highlighted the stark differences between institutional and retail investors in the cryptocurrency market. Institutional investors tend to have more sophisticated strategies and risk management practices, allowing them to weather market storms more effectively. In contrast, retail investors often react emotionally to price changes, which can lead to rapid sell-offs and increased volatility.

This divergence in behavior is evident in the varying impacts on open interest across different exchanges. For instance, while Binance’s open interest remained relatively stable despite the price drop, Coinbase saw a significant decline. This suggests that retail investors on Coinbase may have been more influenced by fear and uncertainty, while institutional investors on Binance were possibly better positioned to take advantage of the market’s fluctuations.

Macroeconomic Factors Influencing Crypto Prices

The cryptocurrency market does not operate in a vacuum; macroeconomic factors play a significant role in influencing price movements and investor behavior. Recent geopolitical events, such as proposed tariffs, can create uncertainty that ripples through markets, including cryptocurrencies. When external pressures mount, investors often reassess their risk tolerances, leading to shifts in buying and selling behavior.

As Bitcoin’s price faced downward pressure due to these macroeconomic uncertainties, the resulting sell-off was not just a reaction to technical factors, but a reflection of broader economic sentiments. Understanding these external influences is crucial for investors looking to navigate the complexities of the crypto market and anticipate future trends based on economic indicators.

The Role of Futures Markets in Crypto Trading

Futures markets play a pivotal role in the cryptocurrency ecosystem, allowing traders to speculate on the future price of assets like Bitcoin. By enabling leverage, futures trading can amplify both gains and losses, making it a double-edged sword. The recent losses in open interest illustrate how quickly market dynamics can shift, emphasizing the importance of understanding futures trading for anyone looking to participate in the crypto space.

Moreover, futures markets can serve as a barometer for overall market sentiment. A decline in open interest may signal a lack of confidence among traders, while increasing open interest can indicate growing interest and potential price movements. As such, keeping an eye on futures market trends can provide valuable insights into the broader cryptocurrency market landscape.

Market Recovery Strategies for Investors

In the aftermath of significant market corrections, like the recent Bitcoin price drop, investors often seek recovery strategies to mitigate losses and capitalize on future opportunities. Diversification is a key principle that can help investors spread their risk across different assets, reducing the impact of a downturn in any single investment. Additionally, maintaining a long-term perspective can help investors ride out short-term volatility.

Investors should also consider employing risk management techniques, such as setting stop-loss orders and adjusting leverage levels. By doing so, they can protect their capital during periods of heightened uncertainty. As the cryptocurrency market continues to evolve, developing a robust strategy that accounts for both potential gains and risks will be essential for navigating future challenges.

The Future of Bitcoin and Cryptocurrency Market Dynamics

Looking ahead, the future of Bitcoin and the broader cryptocurrency market remains uncertain but full of potential. As institutional participation increases and regulatory frameworks evolve, we may witness new dynamics that could stabilize the market. Furthermore, technological advancements in blockchain and cryptocurrency infrastructure could enhance user experiences and foster greater adoption among retail and institutional investors alike.

However, market participants must remain aware of the inherent risks involved in trading cryptocurrencies. Price volatility, regulatory changes, and macroeconomic factors will continue to influence market trends. By staying informed and adaptable, investors can better navigate the complexities of the cryptocurrency landscape and position themselves for success in the evolving market.

Frequently Asked Questions

What does Bitcoin open interest decline indicate about the futures market?

The decline in Bitcoin open interest signals a reduction in the number of outstanding futures contracts, which can reflect a decrease in market confidence or trading activity. Recently, the futures market saw a significant $2.24 billion drop in open interest following Bitcoin’s price drop to $88,500, suggesting traders may be liquidating positions in response to market volatility.

How does a Bitcoin price drop affect open interest in the futures market?

A Bitcoin price drop often leads to increased liquidations in the futures market, which can cause a decline in open interest. When Bitcoin plunged to $88,500, it resulted in a total liquidation of $1.48 billion, indicating that many traders exited their positions, contributing to the overall decline in open interest.

What is the significance of Coinbase’s open interest decline during Bitcoin’s price drop?

Coinbase experienced a staggering 41.1% decline in open interest amid Bitcoin’s price drop. This significant decrease highlights the differing strategies between exchanges and suggests that retail investors on Coinbase may be more reactive to price movements compared to institutional players on platforms like Binance.

What role do liquidations play in the decline of Bitcoin open interest?

Liquidations occur when positions are forcibly closed due to insufficient margin, often triggered by price declines like Bitcoin’s drop to $88,500. These liquidations can lead to a sharp decline in open interest, as seen with a $2.24 billion loss in the futures market, reflecting a broader trend of traders exiting the market.

How can cryptocurrency market trends influence Bitcoin open interest levels?

Cryptocurrency market trends, influenced by factors such as macroeconomic conditions and price volatility, can greatly affect Bitcoin open interest levels. A significant price drop, like the recent decline to $88,500, can lead to increased liquidations and a subsequent reduction in open interest across various exchanges.

What insights can be drawn from the decline in open interest on different exchanges during Bitcoin’s recent volatility?

The decline in open interest on exchanges like Coinbase, compared to more stable platforms like Binance, suggests a difference in investor sentiment and strategy. Retail investors may react more quickly to market fluctuations, while institutional investors might adopt a longer-term perspective despite short-term price drops.

| Key Point | Details |

|---|---|

| Bitcoin Price Drop | Bitcoin’s price fell to $88,500, contributing to a significant shift in the market. |

| Liquidations | The market experienced a wave of liquidations totaling $1.48 billion. |

| Impact on Futures Market | The futures market lost $2.24 billion in open interest following the price decline. |

| Exchange Differences | Coinbase saw a 41.1% drop in open interest, contrasting with Binance’s stability. |

| Macroeconomic Factors | The decline was influenced by macroeconomic uncertainties related to proposed tariffs. |

Summary

The recent decline in Bitcoin open interest signifies a major shift in the futures market, driven by Bitcoin’s plunge to $88,500. As the market reacts to broader economic factors, such as proposed tariffs, the divergent responses from exchanges like Coinbase and Binance shed light on the differing strategies of institutional versus retail investors. This trend is crucial for understanding market sentiment and future trading strategies.

The recent decline in Bitcoin open interest has sent ripples through the cryptocurrency market, raising concerns among traders and investors alike. Following Bitcoin’s sharp price drop to $88,500, the futures market experienced a staggering loss of $2.24 billion in open interest, highlighting a significant shift in market sentiment. This downturn was further exacerbated by a wave of liquidations, totaling $1.48 billion, as participants reacted to the sudden volatility. Notably, Coinbase reported a remarkable 41.1% decrease in open interest, contrasting with Binance’s resilience amid the turmoil. Such developments reflect broader cryptocurrency market trends, indicating a cautious approach as traders reassess their strategies in light of current conditions.

The recent downturn in Bitcoin’s open interest signifies a broader contraction in the futures market, impacting how investors engage with digital assets. As Bitcoin’s value plummeted to $88,500, the resulting liquidations and adjustments in positions revealed critical shifts in trading behavior. Notably, the significant reduction in Coinbase’s open interest, alongside other exchanges, underscores the evolving dynamics between retail and institutional investors. This scenario highlights the strategic re-evaluations occurring within the cryptocurrency landscape, prompting participants to adapt to new market realities. Understanding these fluctuations is essential for grasping the future trajectory of crypto investments.