The Bitcoin MVRV Ratio has recently fallen to yearly lows, raising intriguing questions for investors and enthusiasts alike about potential buy signals in the cryptocurrency market. This metric, which measures Bitcoin’s market value against its realized value, suggests that the asset may be on the verge of a recovery, especially in light of reduced investor positions following recent market corrections. As analysts delve into MVRV ratio analysis, they highlight its value in shaping effective Bitcoin investment strategies amidst fluctuating cryptocurrency market trends. Furthermore, the current low ratio could serve as a pivotal indicator for Bitcoin price prediction, hinting at upcoming Bitcoin recovery signals. By understanding this critical metric, investors can better position themselves to capitalize on the unique opportunities presented in today’s volatile crypto landscape.

The MVRV metric for Bitcoin, representing the relationship between its market capitalization and the value realized from previous transactions, offers vital insights into market dynamics. As this ratio trends downwards, it highlights potential investment openings that savvy traders might leverage. Analysts often evaluate the MVRV alongside broader cryptocurrency trends to anticipate market movements and shifts in investor sentiment. Moreover, this ratio serves as a fundamental tool for predicting Bitcoin’s price recovery, linking investor behavior directly with market health and future price trajectories. Understanding these alternate terminologies is crucial for grasping the investment landscape and making informed decisions in the ever-evolving world of digital currencies.

Understanding Bitcoin’s MVRV Ratio

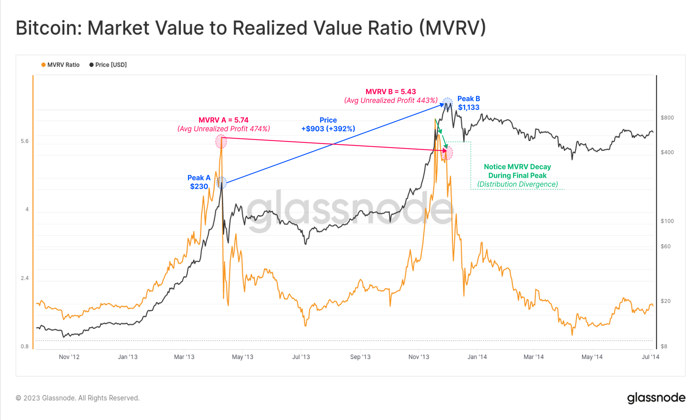

The Bitcoin MVRV ratio, which stands for Market Value to Realized Value, serves as a crucial metric for evaluating market sentiment and potential price movements. By comparing the current market value of Bitcoin to its realized value (the price at which the last Bitcoin was transferred on-chain), investors can gauge whether Bitcoin is overbought or oversold. Currently, the MVRV ratio has plummeted close to yearly lows, revealing significant correlations to previous market corrections. Understanding this ratio is essential for formulating an effective Bitcoin investment strategy that can enhance long-term profitability while mitigating risks.

Analyzing the MVRV ratio further indicates that when the value nears or dips below 1, it often signals undervaluation—a potential buy signal for strategic investors. This dynamic creates opportunities especially in a bearish market, where sentiments are weighed down and panic selling prevails. Historical data suggests that past low points in the MVRV ratio were followed by substantial price rebounds, making it a valuable tool for discerning Bitcoin recovery signals. Keeping abreast of these fluctuations is necessary for anyone looking to navigate the volatility inherent in cryptocurrency market trends.

Current Cryptocurrency Market Trends

The cryptocurrency market is currently exhibiting signs of a potential rebound, as identified by analysts observing key trends alongside Bitcoin’s MVRV ratio. There is a robust correlation between growing Bitcoin holdings and an oversold market, which together stimulate innovative strategies for Bitcoin investors. Following a significant correction, trends are pivoting as new user base statistics reflect resilience despite the volatile climate. It’s critical for traders and investors to recognize how global economic conditions impact Bitcoin price prediction, as macroeconomic factors, alongside on-chain data like whale movements, play significant roles in shaping market directions.

Moreover, embracing current market trends requires a nuanced understanding of underlying factors affecting price movements. Increased activity among larger Bitcoin holders, combining with network growth, suggests a strong foundation for potential appreciation. This compatibility of cyclical trends can provide foresight into predicting future market conditions. Investors who attune themselves to these indicators are better positioned to leverage shifts in investor sentiment and price dynamics that ultimately drive Bitcoin’s trajectory.

Rebound Opportunities in Bitcoin Investments

After a prolonged period of price volatility and market correction, many investors are left questioning their strategies. However, key parameters suggest that Bitcoin investments may soon present significant rebound opportunities. Analysts take note of the MVRV ratio nearing its lowest points, coupled with a lightening of investor positions. These conditions can create a fertile ground for recovery, enticing strategic entries in anticipation of upward price movements. The balance between fear and opportunity is delicate but offers a pivotal moment for savvy investors.

Moreover, the market currently is experiencing heightened levels of risk, raising the importance of due diligence in pursuing investments. With the sentiment being on a recovery trajectory, understanding the nuances of market cycles, from oversold conditions to potential breakout signals, can vastly improve investment outcomes. Investors should keep an eye on leading indicators, such as Bitcoin’s liquidity and engagement metrics, to refine their investment strategy amidst prevailing uncertainty while validating recovery signals.

The Impact of Whale Movements on Bitcoin’s Future

Whale movements, or large holders of Bitcoin, significantly influence cryptocurrency market dynamics, manifesting profound effects on price action and sentiment. During periods of extreme volatility, monitoring these movements helps anticipate market trends, especially in relation to the MVRV ratio. Analysts have noted that whale accumulation often precedes market rebounds, serving as a bellwether for potential upward momentum. Observing these patterns closely is critical for developing a well-rounded Bitcoin investment strategy.

In addition to whale movements, the concentration of Bitcoin ownership can also impact market conditions. When larger wallets operate, they have the potential to sway market direction, impacting both supply and demand. As Bitcoin’s network grows, smaller wallets are created from the splitting of larger wallets, increasing liquidity and access for a broader user base. This redistribution can stabilize market volatility, allowing smaller investors to capitalize on trends shaped by whale movements, thus making an informed strategy essential to navigate the imminent shifts in the market.

Factors Influencing Bitcoin Price Predictions

Pricing predictions in the cryptocurrency market heavily rely on analysis of multi-faceted indicators, including the MVRV ratio, trading volumes, and macroeconomic conditions. The dissection of market trends indicates that, despite existing headwinds, fluctuations in the MVRV ratio can provide insights into future price action. As investors react to price movements, understanding how these indicators align empowers them to make informed decisions regarding their portfolios. Price predictions hinge on a variety of signals, reinforcing the need for meticulous analysis when gauging future outcomes.

Additionally, behavioral factors among traders greatly impact short-term price volatility. Sentiment analysis across various investor cohorts reveals patterns where psychology often drives market reactions more than concrete data. As Bitcoin approaches its historical price resistance and its user base continues to expand, the upcoming price shifts could reshape predictive models. Continuous monitoring of these influences enables investors to adapt their strategies flexibly, setting them up for success amid unpredictable market conditions.

Navigating Market Sentiment and Recovery Signals

The cryptocurrency market is notoriously driven by sentiment, and understanding the underlying psychology of investors is key to navigating risk effectively. Recent trends indicate that despite weakened sentiment in 2025, accumulation phases occur when Bitcoin’s MVRV ratio indicates potential undervaluation. Market participants are challenged to decode these signals to identify recovery windows that can lead to better entry points for investments. Emphasis on tracking investor sentiment, alongside technical indicators, is vital to recognize when market recovery is realistically on the horizon.

In periods of prolonged dips, psychological factors often render investors hesitant, driving them to adopt a wait-and-see approach. However, momentum indicators suggest that remarkable opportunities can arise when the market outlook turns positive. The interplay between heavier sell-offs and market recovery signals provides a glimpse into where sentiment may shift, driving renewed interest in Bitcoin. By capitalizing on these insights, astute investors can position themselves advantageously in the upcoming recovery phase.

Building a Stronger Bitcoin Holding Base

The expanding user base of Bitcoin reflects a robust interest in the cryptocurrency, despite recent price volatility. The total number of non-empty Bitcoin wallets has seen significant growth, showcasing a decisive trend that solidifies confidence in the network. As the market stabilizes and more individuals get involved in Bitcoin, the dilution of ownership among smaller wallets fosters an environment conducive to holding strategies. This not only supports price stability but also encourages longer-term investment perspectives.

Furthermore, this increase in Bitcoin holders suggests a shift in market dynamics, where a more varied pool of investors contributes to more consistent demand. As individual and institutional adoption scales, the ripple effects will likely bolster price predictions, enhancing overall market resilience. For investors, remaining attuned to this evolving landscape is crucial, as understanding the collective mindset of the Bitcoin holding base becomes paramount in anticipating future price movements.

Strategizing for Bitcoin in a Volatile Market

In a volatile cryptocurrency market, developing a sound strategy for Bitcoin investment becomes paramount for success. An informed approach necessitates utilizing key metrics, such as the MVRV ratio, alongside understanding market cycles to position oneself effectively. Diverging from impulse-driven investing and embracing calculated strategies can protect assets against sudden price changes, while also allowing for better growth opportunities. As corrections occur, so do the chances to acquire Bitcoin at lower prices—this is where foresight and market understanding can transform risks into rewards.

Additionally, considering the overall economic landscape can enhance strategic positioning in the Bitcoin market. Investors must align their strategies not only with market sentiment but also with external economic indicators influencing Bitcoin’s trajectory. As events unfold globally, the ability to adapt strategies based on these influences can provide a competitive edge in navigating the complexities of the cryptocurrency market, ensuring that informed decision-making remains at the forefront of Bitcoin investment.

The Role of Bitcoin in a Diversified Portfolio

In the realm of digital assets, Bitcoin holds a unique position, often seen as a digital gold or a cornerstone for an effective cryptocurrency investment portfolio. Its proven resilience and historical performance make it a prime candidate for portfolio diversification. Investors are increasingly recognizing Bitcoin’s role not only as a speculative asset but also as a hedge against inflation and market instability. Understanding how Bitcoin seamlessly integrates into a diversified portfolio is essential for long-term investment strategies.

Moreover, the relationship between Bitcoin and traditional assets is an evolving narrative that investors are beginning to appreciate. As crypto adoption grows, the analysis of Bitcoin’s correlation with stock market trends and economic factors gains significance. Integrating Bitcoin into investment portfolios can yield benefits like increased potential returns and enhanced risk management. This comprehension allows investors to navigate fluctuations in market sentiment, reinforcing Bitcoin’s critical role in a well-structured investment framework.

Frequently Asked Questions

What is the Bitcoin MVRV ratio and why is it important for investors?

The Bitcoin MVRV ratio, or Market Value to Realized Value ratio, measures the difference between Bitcoin’s market value and its realized value, helping investors understand whether Bitcoin is overvalued or undervalued. A low MVRV ratio may indicate a buying opportunity, suggesting potential Bitcoin recovery signals after market corrections.

How does the MVRV ratio play a role in Bitcoin investment strategy?

In Bitcoin investment strategy, the MVRV ratio is a critical metric that assists investors in identifying undervalued conditions in the cryptocurrency market. When the MVRV ratio approaches lower levels, it can suggest that Bitcoin may be poised for a rebound, aiding traders in making informed decisions based on historical market trends.

What does the current MVRV ratio indicate about Bitcoin price prediction?

The current Bitcoin MVRV ratio, which has fallen to yearly lows, implies cautious optimism among analysts regarding Bitcoin price prediction. This dip indicates that the market may be oversold, potentially signaling an upcoming recovery as the MVRV ratio has historically shown to lead to price rebounds after significant corrections.

How can MVRV ratio analysis assist in understanding cryptocurrency market trends?

MVRV ratio analysis provides insights into cryptocurrency market trends by highlighting periods of extreme market sentiment, whether bullish or bearish. When the MVRV ratio is low, it often reflects negative sentiment and can indicate potential buying opportunities, helping investors capitalize on market movements.

What recovery signals does the Bitcoin MVRV ratio provide to investors?

The Bitcoin MVRV ratio provides recovery signals by nearing its historical lows, suggesting that significant investor position reductions have occurred. This oversold condition may indicate that a price rebound is possible, especially as the market adapts to potential Bitcoin recovery amidst investor behaviors and market dynamics.

| Key Points | Details |

|---|---|

| MVRV Ratio Status | Bitcoin’s MVRV ratio has fallen to yearly lows, currently at 1.8, close to the crash low of 1.71. |

| Market Condition | The cryptocurrency market is in an oversold state following significant corrections. |

| Investor Behavior | Bitcoin holdings for less than one month surged to 23% and 24.5% in March and December 2024. |

| Potential for Recovery | Analysts suggest a rebound may occur if Bitcoin’s price declines further to the $70,000 range. |

| Increasing Number of Holders | The number of Bitcoin holders has surpassed 54.71 million, nearing the all-time high. |

| Investment Conditions | Current market conditions are risky yet they may favor a rebound due to the oversold situation. |

| Importance of Monitoring | Investors should monitor whale movements and on-chain data during potential rebounds. |

Summary

Bitcoin MVRV Ratio indicates that while the market sentiment is weakened, the potential for recovery is increasingly plausible. With the ratio currently at 1.8, close to previous lows, and a growing user base despite volatility, now may be an opportune time to consider Bitcoin investments. Observing movements in whale holdings and broader economic trends will be crucial in navigating the upcoming phases of market activity.

The Bitcoin MVRV Ratio, a vital indicator of market sentiment in the cryptocurrency landscape, has recently fallen to yearly lows, raising questions about its potential as a buy signal. This ratio, which compares Bitcoin’s market value to its realized value, suggests that despite the current downtrend, there may be impending recovery signals for savvy investors. As Bitcoin’s volatility continues to sway market trends, understanding the implications of MVRV ratio analysis becomes essential for anyone engaging in a Bitcoin investment strategy. Market analysts closely monitor these fluctuations to aid in Bitcoin price predictions and identify possible rebound opportunities. With the cryptocurrency market navigating uncertain waters, keeping an eye on such critical metrics can help investors make informed decisions amid burgeoning market trends.

Exploring the Bitcoin MVRV Ratio, often referred to as the Market Value to Realized Value ratio, unveils significant insights into investor behavior within the cryptocurrency realm. This analytical tool is instrumental when assessing market dynamics and helps in understanding the broader context of Bitcoin’s price movements. By leveraging MVRV ratio analysis, investors can gain a deeper perspective on the potential for future price recoveries. Moreover, as Bitcoin continues to fluctuate dramatically, this ratio serves as a foundational element in shaping effective Bitcoin investment strategies. Analyzing these metrics not only guides investors but also sheds light on prevailing cryptocurrency market trends.