Solana price analysis reveals a turbulent landscape for SOL as it battles significant selling pressure in the wake of broader economic uncertainties. The altcoin has faced aggressive declines, plummeting over 60% from its recent all-time highs, largely influenced by rising fears surrounding the ongoing trade tensions underpinning the global economy. Despite these challenges, a glimmer of hope emerges as market analysts like Bluntz highlight bullish divergence patterns, suggesting a potential recovery for Solana trading enthusiasts. As the crypto market grapples with volatility, many are closely monitoring key support levels to gauge future price movements, particularly in context to Solana price prediction trends. Could the recent price recovery signs signal a shift in the altcoin market trends, or is there further decline ahead for SOL?

Analyzing the Solana cryptocurrency reveals critical insights into its current trading performance amidst a backdrop of volatility in the financial landscape. With the SOL token experiencing dramatic fluctuations, the recent price drops have prompted many investors to seek clarity through market trend evaluations. Market analysts and crypto traders are watching closely for potential price rebounds, particularly under the lens of supportive trading indicators and investor sentiment. As Solana navigates this precarious phase, understanding the broader crypto market analysis will be vital for anticipating future movements. Is there a light at the end of the tunnel for this altcoin, or will it continue to reflect broader economic concerns?

Understanding Solana Price Analysis Amid Market Turmoil

The recent price analysis of Solana reveals a tumultuous period for the altcoin, accentuated by external economic factors that have led to substantial selling pressure. The cryptocurrency market has been rocked by the implications of aggressive trade policies from US President Donald Trump, which have instigated fears of prolonged trade wars and macroeconomic instability. Consequently, traders have witnessed a dramatic plunge in Solana’s price, which has fallen over 60% from its prior all-time highs. This volatility reflects broader trends in the altcoin market, where fear and uncertainty have pushed both retail and institutional investors into a panic, resulting in steep drops across various digital assets.

In this context, Solana’s price movements highlight significant challenges within the crypto market. As SOL struggles to maintain key support levels, the importance of price recovery cannot be overstated. Analysts are focusing on key metrics, including volume and volatility, to gauge whether the altcoin can reclaim its footing. Notably, the influence of macroeconomic factors cannot be ignored in this price analysis; as global markets react to external pressures, traders must remain vigilant of potential shifts in sentiment that could impact Solana’s trajectory in the coming weeks.

Potential for Solana Price Recovery and Future Trends

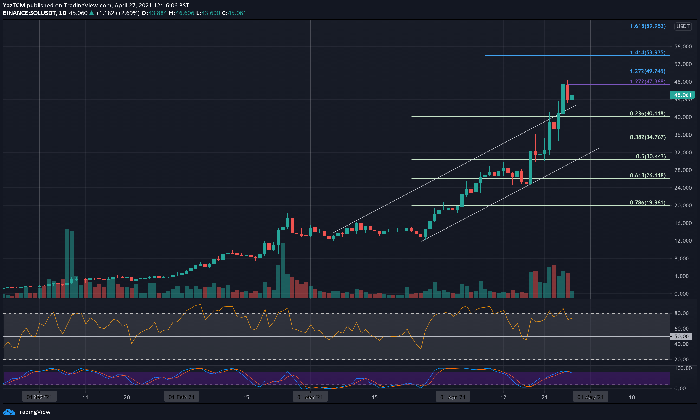

Despite recent downturns, there are early indicators suggesting a possible recovery for Solana. Analysts like Bluntz have pointed out emerging bullish divergences in SOL’s charts, which often signal imminent price reversals. This technical setup, combined with Solana’s current trading levels hovering around the critical $100 mark, creates a scenario where a rebound could occur if buyers step in to establish support. Such price recovery attempts are pivotal as they can influence overall market sentiment and potentially lead to a resurgence in trading activity, setting a positive precedent for Solana and other altcoins.

Altcoin market trends indicate that after significant drops, many cryptocurrencies often see relief rallies, benefiting from oversold conditions. For Solana, the challenge remains whether it can hold or break through the psychological $100 resistance level. A successful retention above this threshold, followed by a reclaim of the $120 mark, could catalyze further bullish momentum. Conversely, failure to maintain these critical levels may trigger deeper corrections, pushing the SOL price towards the $80 demand zone. The upcoming days will be instrumental for traders to observe Solana’s response to market dynamics and identify opportunities within its trading landscape.

Navigating Solana Trading Strategies During Volatility

As traders set their sights on Solana amidst current volatility, examining effective trading strategies becomes vital. Given the high levels of uncertainty in the crypto market, adopting a well-thought-out trading strategy is essential. Risk management tactics, such as setting stop-loss orders and diversifying one’s portfolio, can help mitigate potential losses during periods of downturn. Furthermore, keeping abreast of major market news, such as developments in trade policies or macroeconomic metrics, can provide insights into potential price movements, enhancing trading decisions.

Utilizing technical analysis in Solana trading offers another avenue for traders to navigate this challenging environment. Chart patterns, volume indicators, and metrics like the Relative Strength Index (RSI) can help traders determine entry and exit positions effectively. By monitoring Solana’s price action closely, traders can identify signs of market recovery or continued decline, guiding their positions accordingly. Ultimately, it’s essential for participants in the Solana trading ecosystem to remain adaptive and informed about both technical setups and the overarching macroeconomic landscape.

Long-term Solana Price Predictions Amidst Market Forces

Long-term price predictions for Solana must take into account both current market forces and the potential recovery cues highlighted by analysts. The cryptocurrency has shown resilience in past downturns, and ongoing developments in the broader crypto space suggest that SOL may recover as investor confidence returns. Analysts often utilize historical data and price sentiment to forecast long-term trends, indicating that once the initial fear subsides, Solana could experience a strong recovery phase attracting fresh capital.

However, potential investors should also be aware of the inherent risks. If trade tensions persist or if regulatory pressures increase, these external factors could hinder Solana’s path to recovery and impact its long-term price predictions negatively. Awareness of these dynamics can inform better decision-making for those looking to invest in Solana as part of a diversified portfolio approach that considers both upside potential and the risks associated with volatility in the altcoin market.

Analyzing Key Support and Resistance Levels for Solana

Analyzing key support and resistance levels is critical for traders looking to position themselves in Solana. The $100 level has become a focal point for market participants, representing a psychological barrier that needs to hold firm for a recovery to gain momentum. If Solana can consolidate above this mark, it may signal strength against the ongoing selling pressure. Conversely, a breakdown below this level could trigger a cascade of selling, leading the price to test further support found at the $80 range.

Resistance is equally important for Solana as it attempts to regain footing in the altcoin market. The previous support around $120 now serves as a significant hurdle for the cryptocurrency. A push above this level would not only signal a change in market sentiment but also potentially usher in a fresh wave of buying activity. Therefore, traders must monitor these levels intently to gauge Solana’s movement in alignment with overall market trends.

Impact of Macroeconomic Factors on Solana’s Price Movement

The impact of macroeconomic factors on Solana’s price movement cannot be overstated, especially in the current climate marked by trade wars and evolving financial policies. The uncertainty generated by macroeconomic events often results in heightened volatility within the crypto markets, with Solana being particularly susceptible due to its perceived risk profile. Understanding how these factors influence trading sentiment offers valuable insights for both short-term and long-term investors.

For instance, the recent actions taken by the US government have a direct link to Solana’s declining price, as investor fear about market stability mounts. This intricate relationship between global economic events and cryptocurrency values paints a complex picture for traders. Adapting to these changing dynamics is crucial for anyone investing in Solana, as macroeconomic instability could lead to continued fluctuations in the altcoin’s price.

Recent Trends in Altcoin Market and Solana’s Position

Recent trends in the altcoin market indicate a significant level of interconnectedness among various cryptocurrencies. Solana’s performance is particularly noteworthy as it mirrors broader market sentiments. As altcoins react to external pressures, Solana has experienced dramatic shifts, indicating how trends in the crypto market can impact its valuation. The cooperation and rivalry among altcoins often drive trading strategies, thereby affecting Solana’s market position.

Currently, Solana finds itself amidst a turbulent altcoin landscape, where many tokens are experiencing sharp declines. Nonetheless, with certain altcoins appearing oversold, the potential for a market rebound remains alive. Traders are keenly observing Solana’s movements in relation to other altcoins, as collective recoveries may provide a necessary lift for SOL’s pricing. The ability for Solana to navigate this competitive market could reinforce its position and drive new trading opportunities.

Exploring Investor Sentiment Surrounding Solana

Investor sentiment plays a crucial role in shaping Solana’s price movements and overall market behavior. Recent downturns have understandably led to increased skepticism within the investor community, with many fearing further declines. This sentiment can heavily influence market trends as fear often leads to panic selling, exacerbating downward pressure on prices. Understanding the psychological dynamics at play can provide actionable insights for traders looking to capitalize on potential reversals.

Conversely, there are signs of cautious optimism emerging among some segments of the investor base, particularly as analysts forecast potential recovery points for Solana. The discussions around bullish divergences have sparked interest, leading certain investors to view this as an opportune moment to acquire the cryptocurrency at lower prices. Monitoring shifts in investor sentiment thus becomes vital, as moments of clarity and confidence can lead to recovery rallies supported by increased buying activity—a stark contrast to the current fear-driven atmosphere.

Solana’s Future in the Cryptocurrency Ecosystem

As the cryptocurrency ecosystem evolves, Solana’s future remains a topic of great interest among market analysts and investors alike. The platform has attracted attention for its unique characteristics, including high throughput and low transaction costs, which positions it favorably among blockchain solutions. Despite recent price declines, the underlying technology and ecosystem developments may serve as foundational pillars for growth as market conditions stabilize.

Looking ahead, the path for Solana will likely be shaped by both market trends and advancements in its blockchain technology. Projects built on the Solana platform could drive demand and positively influence prices, especially if the altcoin can re-establish itself as a leading player. As the entire crypto market navigates challenges, Solana’s ability to adapt to new developments and maintain robust engagement with its community will be crucial for its long-term success and relevance in the rapidly changing landscape.

Frequently Asked Questions

What are the key factors influencing Solana price analysis currently?

Solana’s price analysis is heavily influenced by macroeconomic factors, including trade tensions initiated by US policies. The recent aggressive trade measures have led to increased selling pressure in the crypto markets, significantly impacting Solana, which has seen prices drop over 60% from its all-time highs.

What does the current Solana price prediction indicate for traders?

Current Solana price predictions suggest a potential recovery if it can maintain the crucial $100 support level. Prominent analysts have noted bullish divergences across charts, indicating that while the market is under pressure, short-term opportunities for profit may emerge.

How is Solana trading amidst the recent bearish sentiment in the crypto market?

Solana is currently trading at approximately $108, facing intense pressure to hold above the $100 level. The significant volatility in the broader altcoin market has contributed to rapid price fluctuations, putting traders on high alert for potential recovery signals.

What does the SOL price recovery depend on?

The SOL price recovery heavily depends on its ability to defend the $100 support level. Analysts have identified this as a critical juncture; if Solana can maintain this level, it may trigger a rebound. Conversely, a breakdown below this price might lead to further losses.

What are the implications of Solana’s recent price action and market trends?

Solana’s recent price action highlights a struggle within the altcoin market, driven by external economic factors. The current downward trend raises concerns, but analysts are cautiously optimistic about potential recovery bounces, especially with bullish patterns forming on some charts.

Are there any bullish signals in the current Solana price analysis?

Yes, recent Solana price analysis has shown bullish divergences on technical charts, suggesting that despite a broader downtrend, there may be opportunities for recovery. Analysts like Bluntz have noted the oversold conditions, indicating potential price corrections or bounces ahead.

What should traders watch for in Solana’s price movements moving forward?

Traders should closely monitor Solana’s ability to hold above the $100 support level and its attempts to reclaim the $120 mark. A successful breakout above this resistance zone could indicate a trend reversal or a strong recovery phase for SOL.

What are the long-term implications of the current Solana price trends?

Long-term implications for Solana will depend on macroeconomic stability and overall market sentiment. While current conditions suggest a bearish outlook, if the $100 level can be defended and bullish trends continue to emerge, it could set the stage for recovery in the altcoin market.

| Key Points | Details |

|---|---|

| Significant Selling Pressure | Solana has seen over 60% drop from recent highs, primarily due to panic selling influenced by US trade policies. |

| Critical Support Level | Currently testing the $100 mark, with previous support now acting as resistance. |

| Analyst Insights | Bluntz suggests bullish divergence; a recovery may occur but not viewed as the definitive market bottom. |

| Market Sentiment | Overall market remains fragile with ongoing concerns about macroeconomic factors affecting risk assets. |

| Future Price Actions | A failure to hold $100 may lead to further declines; reclaiming $120 important for signaling a potential reversal. |

Summary

In summary, the Solana price analysis reveals that the cryptocurrency is currently under intense scrutiny as it grapples with a significant downturn and pressure at the $100 support level. With analysts pointing towards potential recovery signals amidst broader market instability, all eyes are on Solana to see if it can defend this crucial threshold. As the market evolves, traders should remain vigilant for signs that may indicate a shift in sentiment and momentum.

Solana price analysis reveals a turbulent period for the cryptocurrency as it grapples with significant selling pressure amidst challenging market conditions. The recent volatility in the crypto market has left many investors on edge, with Solana struggling to maintain its position above crucial support levels. This downturn follows a concerning trend across the altcoin market, highlighting fears of a broader correction that could impact SOL price recovery. Notably, experts like the analyst Bluntz are weighing in with Solana price predictions that suggest potential bullish divergences might signal upcoming recovery opportunities. Understanding these market dynamics is essential for traders looking to navigate the complexities of Solana trading in the current environment.

In the realm of cryptocurrency, a detailed examination of Solana’s recent performance is crucial for understanding its future potential. As analysts delve into the intricacies of SOL’s price movements, the discourse on price recovery and market trends lays the groundwork for informed decisions. The fluctuating dynamics of the crypto landscape create an atmosphere of uncertainty, making it imperative for traders to stay abreast of altcoin market trends. With Solana showing signs of resilience amid broader economic challenges, exploring various forecasting models can provide insights into possible outcomes for the token. Moreover, the current scenario underlines the importance of comprehensive crypto market analysis in determining the next moves for investors and traders alike.