The recent ADA price pullback has caught the eyes of many investors and analysts alike, raising concerns about the future trajectory of Cardano. As ADA whales have returned to the scene, their significant sell-offs, totaling over $70 million worth of ADA, suggest an increasing selling pressure that could lead to further declines. Currently trading at around $0.71, ADA’s struggle to climb back past the crucial $0.80 resistance level may signal a turbulent period ahead for this cryptocurrency. With the cryptocurrency market trends shifting, the activities of large investors could create panic among smaller holders, prompting them to sell their assets and further exacerbate the pullback. However, analysts remain hopeful, especially with discussions surrounding an ADA ETF approval that could revitalize interest and investments in ADA in the near future.

The recent decline in ADA values has stirred substantial conversation across the crypto community, particularly among those watching Cardano’s market dynamics. The phenomenon of large-scale sell-offs by prominent investors, often referred to as ADA whales, is indicative of a potentially concerning trend. These moves have led to a notable decrease in price, aligning with the ongoing shifts seen in cryptocurrency market trends. Investment sentiment appears cautious, reflecting the uncertainty surrounding future price predictions for Cardano. Meanwhile, the possibility of regulatory advancements, such as ADA ETF approval, remains a beacon of hope for future investment potential in this blockchain project.

Impact of Whales on ADA Price Trends

Recent activities by large ADA investors, commonly referred to as ‘whales’, have significant implications on the overall price stability of Cardano. These high-volume trades can lead to drastic fluctuations as seen in the market trends over recent weeks. Currently, the series of sell-offs that accumulated to over $70 million in ADA suggests a mounting selling pressure that could lead to a further price pullback. When whales liquidate significant portions of their holdings, it not only increases the token’s circulating supply but can also instill fear among smaller investors who may panic and follow suit, accelerating the decline.

Amidst such volatility, analysts keep a close watch on how whale activity correlates with ADA’s price movements. Historical data indicates that significant sell-offs often result in corrections, echoing patterns seen earlier in the year when over 330 million ADA were sold off leading to a notable 10% drop in its valuation. As selling pressure continues, market sentiment may soften leading to a potential downtrend unless counteracted by strong buyer activity or favorable market news.

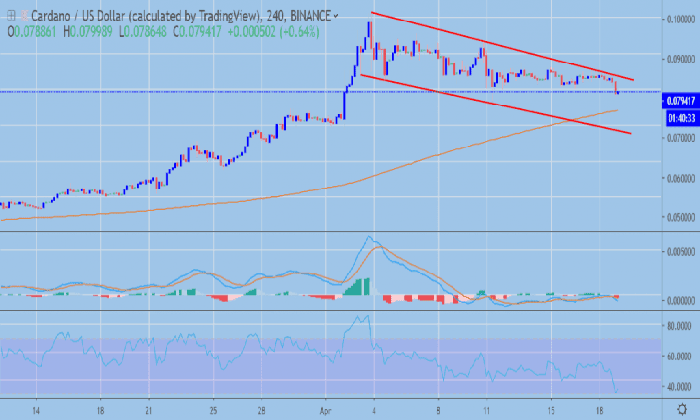

Analyzing ADA Price Pullback Patterns

With a recent pullback witnessed in ADA prices dropping down to around $0.71, traders and investors are speculating on whether this trend will continue. This scenario prompts a significant question: can ADA reclaim the critical resistance level of $0.80 which analysts see as pivotal for a potential bullish momentum? Analysts argue that while the short-term outlook looks grim, breaking through the $0.80 barrier could signal a turnaround and pave the way for further gains, particularly in the wake of larger events like ETF approvals.

Understanding the structural dynamics of the market is vital. If ADA bears maintain their grip, further pullbacks may not only trigger additional sell-offs but could also entice more investors to reevaluate their positions. Hence, investors looking into ADA should pay close attention to both technical signals and underlying market factors like whale activity, which may offer insight into probable price trajectories in the near term.

Future Cardano Valuations Post ETF Approval

The cryptocurrency landscape is buzzing with anticipation surrounding the potential approval of a spot ADA ETF, which could drastically alter the investment framework for ADA. This institutional-level investment option is expected to open the floodgates for new investments into Cardano, creating a substantial upside for holders and potentially leading to revived market interest. With futures trading in ADA becoming accessible, the overall perception of Cardano as an investment vehicle could transform, attracting a broader spectrum of investors.

If the SEC grants approval for a spot ADA ETF, it is projected that we could see a significant rally in the price of ADA. Current sentiment within the market suggests that such a move could escalate ADA’s value upwards of not just $1, but potentially much higher, considering the price predictions indicating up to $12 in the long run. As this narrative unfolds, both existing and new investors should monitor developments closely to capitalize on this potential upturn.

Cardano Market Trends and Predictions

Understanding the current ADA market trends is crucial for making informed investment decisions. Despite recent pullbacks and selling pressures, many market analysts are still bullish on Cardano, predicting potential price movements based on historical patterns and current economic blocks. Cardano’s resilience in the face of market volatility makes it an attractive option for savvy investors who are willing to ride out fluctuations for a brighter long-term outlook.

The markets are also influenced by broader cryptocurrency trends, particularly as competition heats up among different blockchain technologies and their respective coins. While ADA has faced challenges, such as whale sell-offs and the current price pullback, the overarching cryptocurrency market dynamics suggest that its unique value proposition could help it weather current turbulence, especially if the anticipated ETF approvals come through.

Investing in ADA: Opportunities and Risks

Investing in ADA presents both unique opportunities and inherent risks. The recent actions of whales provide a lens into market sentiment, and while large sales might signal caution, they can also represent a strategic move by knowledgeable investors. Those looking to invest in Cardano should weigh these signals against the potential rewards of future gains, especially if market conditions align favorably with upcoming events like ETF approvals.

As with any cryptocurrency, investing in ADA requires a nuanced understanding of market dynamics and individual risk tolerance. Investors are advised to adopt a vigilant approach, keeping abreast of ADA price predictions and market news, while also considering the historical context that influences current trends. By balancing these factors, investors can make more informed choices, positioning themselves strategically within the evolving landscape of the cryptocurrency market.

Understanding ADA Whale Activities

Whale activities within the cryptocurrency market reflect a concentrated influence that can drastically shift price trajectories. In the case of ADA, the most recent sell-offs by large holders have drawn significant attention. Monitoring whale behavior is critical for investors, as these entities have the power to not only drive down prices through massive sell orders but can also create opportunities for shrewd investors if timed correctly.

These large transactions can generate ripples throughout the market, affecting the sentiment of smaller investors and leading to broader selling pressure. As a result, understanding ADA whale activities offers key insights into potential immediate movements within the broader cryptocurrency market trends and should be a focal point for anyone involved with or considering investments in Cardano.

Critical Resistance Levels for ADA

As ADA grapples with resistance levels, market participants are deeply attuned to the significance of the $0.80 mark. Exceeding this level is seen as crucial not merely for psychological reasons but for technical validation in charts. Should ADA manage to consistently hold above this figure, it would likely attract greater trading volumes and might even turn prior sellers into buyers, thus enhancing market momentum.

In contrast, failing to breach this resistance could further entrench bearish sentiments, resulting in additional pullbacks. Investors should remain alert and analyze both historical price behaviors and real-time trading volumes around this pivotal level to navigate their positions effectively.

Long-Term ADA Investment Considerations

For investors interested in Cardano, it’s essential to look beyond the immediate price fluctuations and focus on the long-term fundamentals. Factors such as network developments, technological advancements, and potential partnerships play a crucial role in shaping ADA’s future valuation. In an evolving landscape, where cryptocurrency is increasingly going mainstream, Cardano’s positioning can afford it growth potential that far exceeds short-term market stress.

As the overall cryptocurrency market continues to evolve, those looking to invest in ADA should consider it in the lens of a diversified portfolio. A diverse investment strategy could help mitigate risks associated with short-term volatility, particularly as ADA moves through various market cycles influenced by broader economic factors and local industry progress.

Market Sentiment: Bullish vs Bearish Towards ADA

Market sentiment surrounding ADA remains a topic of heated debate among analysts and investors alike. The dichotomy between bullish and bearish perspectives is significant, particularly in light of recent whale activities that invoke caution. While some view current price pullbacks as a temporary setback, fostered by larger transactions to realize profits, others express concern over potential decline patterns that could challenge ADA’s recovery trajectory.

For those in the bullish camp, ongoing developments like potential ETF approvals and robust community engagement ensure a strong belief in ADA’s long-term viability. Conversely, bearish sentiments highlight the risks associated with recent whale-induced price declines and demand fluctuations, reinforcing a cautious approach toward short-term trading strategies.

Frequently Asked Questions

What is driving the recent ADA price pullback in the cryptocurrency market?

The recent ADA price pullback is largely attributed to the actions of large investors, or whales, who have sold over $70 million worth of ADA. This increased selling pressure has intensified concerns about the token’s future performance, particularly as it approaches critical resistance levels.

How has ADA whales activity affected Cardano price prediction?

ADA whales activity has exacerbated downward pressure on Cardano prices, causing analysts to revise their price predictions. Observing a significant sell-off of over 100 million ADA by these whales has led to a bearish sentiment, pushing the price down to $0.71 and increasing the likelihood of further price corrections.

What role will ADA ETF approval play in the future of ADA price trends?

The potential approval of a spot ADA ETF could significantly influence future ADA price trends by attracting more investors. This could create demand that offsets current selling pressure from whales and foster a bullish environment for ADA prices.

What should investors consider when investing in ADA amidst current price fluctuations?

Investors should closely monitor ADA’s price movements in relation to whale activity and market trends. Given the recent pullbacks, prioritizing critical resistance levels like $0.80 is essential. Additionally, the potential for an ADA ETF approval could impact long-term price sustainability.

How do cryptocurrency market trends impact ADA’s price pullback?

Cryptocurrency market trends play a vital role in ADA’s price pullback. Factors such as overall market sentiment, trading volumes, and large-scale sell-offs by ADA whales contribute to short-term price volatility, affecting investor confidence and decision-making.

| Key Point | Details |

|---|---|

| Whale Activity | Large investors have sold over 100 million ADA, worth over $70 million, increasing selling pressure. |

| Current Price Dynamics | ADA’s price reached $0.75 but has dropped to $0.71 as bears regain control. |

| Resistance Level | Analysts point to $0.80 as a critical resistance level for bullish momentum. |

| Future Prospects | Possible approval of a spot ADA ETF could drive future gains. |

| Market Reaction | Panic selling may occur among smaller investors due to whale sell-offs. |

Summary

ADA price pullback seems inevitable as significant whale activity has resulted in selling pressure that may further depress prices. With the price currently hovering around $0.71, just below the critical resistance level of $0.80, market sentiment appears shaky. Historical sell-offs have typically led to corrections in the past, intensifying concerns for smaller investors as they react to the movements of larger holders. However, potential developments like the approval of a spot ADA ETF offer a glimmer of hope for future price recovery.

The recent ADA price pullback has raised alarms among investors and analysts alike, signaling a shift in the cryptocurrency market dynamics. Large investors, often referred to as ADA whales, have reportedly cashed out over $70 million worth of ADA, creating significant selling pressure that could lead to further declines. As these high-volume sell-offs increase the circulating supply, concerns mount over the ability of ADA to maintain its value, especially if smaller investors follow suit in panic selling. Despite these challenges, the Cardano price prediction remains cautiously optimistic, especially with the looming potential of ADA ETF approval, which could ignite future price rallies. Investors keeping an eye on ADA’s performance should consider both the current trends and potential triggers in the broader cryptocurrency market landscape when making their decisions.

In the world of digital currencies, the recent decline in ADA’s price has become a talking point among traders and investors. The trend of major stakeholders liquidating their ADA holdings is indicative of a broader market reaction, with many observing the activities of cryptocurrency whales. Such maneuvers not only affect the current valuation of Cardano but also stir discussions around Cardano’s projected price movements and the implications of potential regulatory approvals, like ADA exchange-traded funds (ETFs). As speculations rise surrounding ADA’s future, understanding these market forces becomes crucial for anyone considering investing in ADA. Overall, the prevailing sentiment emphasizes both caution and strategic planning in navigating the ever-evolving landscape of cryptocurrency investments.