In the rapidly evolving world of cryptocurrency, **DeFi Whales Profit on Binance** has become a buzzworthy topic. These influential traders wield significant purchasing power, driving considerable whale trading activity that shapes the market dynamics on platforms like Binance. Recently, striking trends emerged as whales accumulated remarkable profits, collectively amassing a staggering $32.9 million in just 21 days. With the PancakeSwap volume surging to an impressive $1.64 billion, Decentralized Finance (DeFi) is witnessing an unprecedented growth phase, attracting substantial interest and investment. As cryptocurrency accumulation continues to thrive, stakeholders are eager to understand how these DeFi market trends will influence the broader landscape.

The intriguing phenomenon of large-scale investors capitalizing on **Binance’s DeFi ecosystem** has garnered significant attention. Known as ‘whales,’ these heavyweight traders are orchestrating notable trading maneuvers that leave lasting impacts on the cryptocurrency scene. Recent insights reveal a dramatic surge in profitable trades, highlighting the strategic accumulation of tokens like Uniswap and Maker over a short timeframe. As decentralized exchanges flourish, with PancakeSwap leading the charge in trading volumes, the dynamics of whale trading activity are integral to analyzing future cryptocurrency trends. Understanding the motivations and moves of these powerful entities can provide a clearer picture of the evolving DeFi landscape.

Understanding Binance’s DeFi Whale Trading Activity

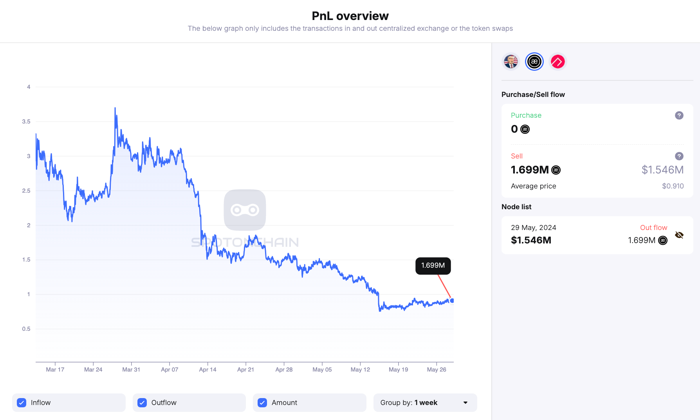

Recently, a significant rise in whale trading activity on Binance has secured attention within the DeFi space. Whales are known for accumulating vast quantities of cryptocurrencies, leveraging their financial strength to capitalize on price fluctuations. A prime example of this trend is the wallet label “0xace”, which aggressively acquired over 374,000 tokens of Uniswap within a very short period. Such activities are not just random trades but strategically planned moves to maximize profits in the evolving DeFi market.

This surge in whale activity has not only contributed to personal profit but has also influenced market trends across various cryptocurrencies. The 87% gains attributed to their investments signify a broader confidence in Binance’s DeFi offerings. With accumulating tokens like Maker and Bounce, these whales are positioning themselves as lead players in the DeFi revolution, a sentiment echoed by the impressive profit margins seen as a direct result of their strategic maneuvers.

Frequently Asked Questions

What are the recent profits of DeFi whales on Binance?

DeFi whales on Binance have amassed significant profits, totaling approximately $32.9 million within just 21 days. This extraordinary accumulation has led to an impressive 87% gain on their investments, primarily through strategic trading in tokens like Uniswap (UNI), Maker (MKR), and Bounce (AUCTION).

How does whale trading activity on Binance impact the DeFi market?

Whale trading activity on Binance has a profound effect on the DeFi market, as these large traders control substantial volumes of tokens. Their recent aggressive accumulation has not only increased their profits but also driven up prices and created broader interest in decentralized exchanges (DEXs). Notably, BNB Chain’s PancakeSwap has benefited greatly from this activity, reaching record trading volume.

Which decentralized exchanges are benefiting from DeFi whale profits on Binance?

PancakeSwap, the flagship decentralized exchange (DEX) on the BNB Chain, is currently reaping the benefits of DeFi whale profits. It recently achieved a trading volume of $1.558 billion, outperforming other platforms like Ethereum and Solana. As more whales accumulate tokens on Binance, the demand on DEXs like PancakeSwap continues to rise.

What is the significance of PancakeSwap volume in the context of DeFi whale profits on Binance?

The PancakeSwap volume is significant as it reflects the heightened activity and interest in DeFi, particularly due to whale profits on Binance. With volumes hitting $1.64 billion in a single day, PancakeSwap has established itself as the leading DEX, showcasing the impact of whale trading as they accumulate tokens and drive market dynamics.

What tokens are DeFi whales accumulating on Binance and how does it affect the market?

DeFi whales are accumulating various tokens on Binance, including Uniswap (UNI), Maker (MKR), and Bounce (AUCTION). This accumulation has led to a substantial increase in the market prices of these tokens, contributing to the overall surge in DeFi market trends. The strategic investments by whales also indicate strong bullish sentiment in the market, positively influencing investor confidence.

How does the $32.9 million profit from DeFi whales in 21 days compare to past trends on Binance?

The recent $32.9 million profit from DeFi whales over 21 days marks a notable trend of aggressive accumulation, especially when juxtaposed with previous patterns of trading activity on Binance. This level of profit, derived from large-scale token acquisitions, signals a shift in trading strategies and growing confidence among larger investors in the DeFi space.

| Key Point | Details |

|---|---|

| Market Performance | BNB Chain’s PancakeSwap led DEX volumes at $1.64 billion. |

| Whales’ Profit | Whales amassed $32.9 million in unrealized profit in 21 days, marking an 87% gain on investments. |

| Notable Whale Activities | Wallet ‘0xace’ bought 374,333 UNI and 1,735 MKR for over $4 million within 18 hours. |

| Auction Control | Four whale wallets control over 26% of AUCTION’s total supply, with one wallet withdrawing half a million AUCTION tokens. |

| Token Performance | AUCTION’s token price increased to $35.49, a 14.7% rise in 24 hours and a 100% increase in the last seven days. |

| DeFi Growth | The overall interest in DEXs is rising, with significant volume changes seen across leading platforms like BNB, Solana, and Ethereum. |

Summary

DeFi Whales Profit on Binance highlights the significant financial maneuvers of major players within the decentralized finance landscape, with recent data showing that these investors accumulated a staggering $32.9 million in profit within just 21 days. The market shows increasing vitality as whales continue to buy up tokens, pushing the value of DeFi assets higher while driving the trading volumes of decentralized exchanges like PancakeSwap to record levels. As activities in the DeFi space escalate, it emphasizes the potential rewards for investors willing to navigate this rapidly evolving sector.

In the fast-paced world of cryptocurrency, **DeFi Whales Profit on Binance** has quickly emerged as a key story, showcasing how major players in the decentralized finance arena are capitalizing on market fluctuations. Recent analysis reveals that these affluent traders have accumulated over $32.9 million in profits in just 21 days, primarily through strategic investments in popular tokens such as Uniswap and Maker. As Binance continues to dominate decentralized exchange activity—with PancakeSwap leading the charge—whale trading activity has surged, further inflating the DeFi ecosystem. The cryptocurrency accumulation strategies employed by these whales reflect larger DeFi market trends, highlighting their growing influence within this innovative financial landscape. As more investors flock to Binance to mirror these successes, the potential for further gains looks promising.

In recent weeks, the phenomenon of **crypto magnates profiting on Binance** has captured the attention of many in the financial world. These influential investors, often referred to as ‘whales,’ have strategically increased their holdings, reaping significant rewards amidst the thriving decentralized finance (DeFi) scene. With platforms like PancakeSwap facilitating unprecedented trading volumes, whale trading patterns have revealed insights into cryptocurrency accumulation strategies that are shaping market dynamics. The recent uptick in DeFi assets illustrates how cryptographic innovations are reshaping investor behavior and enhancing overall market trends in the digital currency space. As this sector expands, tracking whale transactions on platforms like Binance becomes vital for understanding the broader DeFi landscape.