Ethereum price analysis reveals a concerning trend as the cryptocurrency has recently fallen below the $2,000 threshold, marking its lowest point since December 2023. This significant decrease has intensified the bearish sentiment among investors, prompting discussions around Ethereum’s potential for further declines or if it is poised for a reversal soon. The Ethereum RSI (Relative Strength Index) has reached historically low levels, raising questions about the future trajectory of the leading altcoin amidst prevailing crypto market trends. Analysts are closely monitoring technical indicators, including the Ethereum technical analysis, to predict possible outcomes in the coming weeks. As speculation grows about Ethereum price predictions, stakeholders are eager to understand whether this drop signifies a buying opportunity or a deeper bearish phase ahead.

In the realm of cryptocurrency, the evaluation of Ethereum’s recent price trajectories serves as a window into broader market behaviors and investor sentiments. Following a downward shift that saw this prominent altcoin dip below the $2,000 mark, discussions have arisen concerning its near-term outlook and potential recovery patterns. Insights from the Ethereum monthly Relative Strength Index (RSI) suggest a pivotal moment, as it hits unprecedented lows, echoing historical trends seen during previous bear phases. Analysts are actively dissecting Ethereum’s technical indicators to decipher whether current market conditions point toward a forthcoming resurgence or if selling pressures will continue to dominate. As observers assess Ethereum price forecasts, the interplay of stochastic indicators and market dynamics adds another layer of complexity to their predictions.

Ethereum Price Analysis: Current Trends and Predictions

Ethereum’s recent price trajectory has raised significant concerns among investors. The drop below the $2,000 threshold marks a critical juncture for the leading altcoin, not seen since late 2023. This trend has been exacerbated by the prevailing bear market sentiment, where market participants are grappling with the implications of this downward shift. Analysts have been keenly observing the behavior of the bears, particularly in light of Ethereum’s technical foundation, which is essential for understanding future price predictions.

As market trends continue to unfold, Ethereum’s price remains subject to the broader dynamics of the crypto market. The intersection of various technical indicators, like the falling RSI and the Stochastic oscillator, further complicates the predictions for Ethereum prices in the near term. As investors assess these indicators alongside cryptocurrency market trends, it becomes evident that Ethereum’s performance will heavily rely on overcoming current downward pressure, possibly leading to either a rally or further declines.

Understanding Ethereum’s Monthly RSI and Its Implications

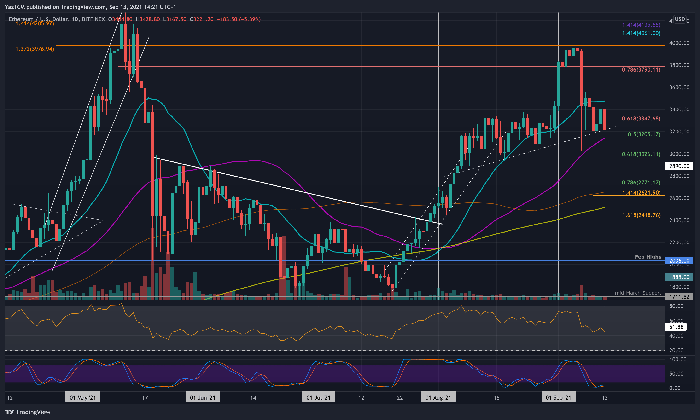

The Relative Strength Index (RSI) serves as a pivotal tool for traders seeking to gauge market sentiment regarding Ethereum. Recently, the monthly RSI for Ethereum has plummeted to unprecedented lows, indicating a critical moment in its price behavior. The significance of this drop cannot be understated; an RSI reading that surpasses previous bear market levels signals strong selling momentum, which, on one hand, raises fears of prolonged downtrends, while on the other, hints at potential buying opportunities as indication of oversold conditions surface.

Historical contexts illustrate that extreme lows in RSI have previously ushered in promising recoveries. The situation mirrors what was observed during the 2022 bear market, where Ethereum formed a base around $900 before ascending. This presents a dual narrative for investors: while the current market sentiment skews bearish, anomalies such as hidden bullish divergences could provide a silver lining for those watching closely. Recognizing these signals is vital for navigating the complexities of Ethereum, especially in an environment increasingly influenced by altcoins and broader crypto-market dynamics.

The Impact of Ethereum’s Stochastic Indicator on Market Sentiment

Ethereum’s Stochastic oscillator, like the RSI, is integral in understanding market momentum and potential price corrections. The recent dip below the 50 mark indicates that Ethereum has entered bear market territory—an ominous sign for those anticipating immediate recovery. Analysing prior trends, the oscillator must fall below the 20 threshold for the altcoin to enter extremely oversold conditions, which would ideally set the stage for a price resurgence. As it stands, the Stochastic’s current reading adds to the narrative of cautious optimism among traders.

Moreover, this bearish phase illustrates the potential for a drawn-out recovery process, as historical instances indicate that stability and subsequent uptrends often take several months to materialize following such indicators. With Ethereum currently hovering just below $2,000, those involved in trading should stay vigilant and informed on price movements. Combining both the Stochastic and RSI insights, along with an analysis of crypto market trends, will be crucial for investors looking to capitalize on potential rebounds or navigate through further declines.

Analyzing Ethereum Technical Analysis for Future Market Movements

Technical analysis of Ethereum reveals a multifaceted picture that is crucial for investors. With insights drawn from various indicators, traders can glean valuable information about potential market behavior. Despite the negative sentiment surrounding Ethereum’s pricing, the comprehensive technical analysis suggests that there may be opportunities hidden beneath the surface. This requires a fine balance of caution and strategic positioning, as Ethereum stands at a crossroads, teetering between recovery and further decline.

Incorporating other metrics into this analysis shows that Ethereum’s technical environment remains volatile, with potential support around crucial levels, such as $1,900. Investors must remain alert to adapt their strategies quickly as price dynamics shift. Focusing on both the altcoins and trends in the broader cryptocurrency landscape will enable traders to make informed decisions, whether they opt to buy into potential rebounds or engage in more defensive strategies amidst uncertainty.

Ethereum Altcoins: A Market Comparison

When assessing Ethereum’s position, it’s essential to examine its altcoins. While Ethereum remains a dominant force within the crypto ecosystem, the performance of altcoins can often influence Ethereum’s price dynamics. In periods of decline, investors frequently look to altcoins for potential gains or as a diversified hedge against losses, thereby shifting market sentiment. This interplay between Ethereum and its alternative counterparts can impact everything from trading decisions to overall market psychology.

Understanding the broader altcoin landscape provides a contextual backdrop for evaluating Ethereum’s future. If altcoins rally while Ethereum struggles, we might see a decline in Ethereum’s market share. Conversely, if Ethereum rebounds, it could propel altcoins upward, reflecting a synergistic relationship. As the market evolves, keeping a close watch on altcoin developments will be crucial for Ethereum investors as it can serve as an indicator of broader market trends and sentiment shifts.

Navigating the Crypto Market Trends and Sentiment

The crypto market’s overarching trends are often dictated by a blend of investor sentiment and external factors influencing digital assets like Ethereum. For traders, understanding the ebb and flow of market emotions is critical, especially during turbulent times. The current bearish sentiment surrounding Ethereum may influence other digital currencies, leading to overarching trends across the crypto market that investors must account for when strategizing with their portfolios.

Furthermore, identifying and anticipating crypto market trends can provide insights into potential price movements for Ethereum. For instance, trends indicating heightened regulatory scrutiny or macroeconomic shifts could lead to amplified selling pressure across the board. In contrast, positive developments may ignite bullish sentiment, making it imperative for Ethereum investors to continuously monitor market conditions intimately. Keeping abreast of broader crypto trends and sentiment shifts will yield competitive advantages in trading decisions.

Ethereum Price Predictions: What Lies Ahead?

Predicting Ethereum’s price trajectory requires a calculated approach that factors in both technical indicators and prevailing market sentiment. Current predictions are heavily contingent on whether Ethereum can reclaim critical support levels above $1,900. Analysts have suggested that if positive momentum can stabilize, there may be upward movement toward resistance levels. A successful rebound could reignite bullish sentiment, rallying investor confidence amidst a period of heavy scrutiny.

However, the ambiguity of market factors calls for a nuanced interpretation of predictions. Continuous monitoring of both internal metrics like RSI and Stochastic oscillators, along with external conditions affecting the crypto environment, will be paramount. The intricacies of Ethereum price predictions necessitate an adaptable strategy, as market landscapes can shift rapidly, emphasizing the importance of staying informed and prepared in an environment laden with uncertainty.

Ethereum Support Levels: Key Insights for Traders

Support levels play a vital role in understanding Ethereum’s price action. As Ethereum hovers around the critical $1,900 mark, traders are keenly analyzing these levels to make informed trading decisions. Analysis indicates that once support is validated, a potential shift in price momentum could prompt a technical correction leading to recovery. However, if Ethereum fails to maintain this support, further declines may be on the horizon, reinforcing the need for vigilance among traders.

By keeping tabs on historical support levels, investors can better navigate emotional market responses. The learnings from previous market behaviors present a framework to help anticipate future movements. As Ethereum tests these pivotal levels, traders should prepare risk management strategies to capitalize on potential rebounds while protecting against heightened volatility in the broader crypto market.

Ethereum and the Role of Market Sentiment in Trading Strategies

Market sentiment greatly influences trading strategies, particularly for a volatile asset like Ethereum. Sentiment analysis often reveals how external factors—such as news events or macroeconomic trends—can drive emotions among traders, impacting decision-making processes. For Ethereum, the bearish climate has prompted many traders to reevaluate their strategies, choosing to hedge their bets or reposition assets based on current market dynamics.

A keen understanding of the factors driving market sentiment can empower traders to utilize psychological insights alongside technical analysis. By integrating sentiment analysis into trading strategies, traders can align themselves with prevailing market behaviors, potentially capturing opportunities that usual metrics may miss. Ethereum’s fluctuating market sentiment serves as a reminder that the successful navigation of trading requires holistic insights into both market indicators and emotional drivers.

Frequently Asked Questions

What are the recent trends in Ethereum price analysis?

Ethereum is currently experiencing substantial downward pressure, having dropped below the $2,000 mark for the first time since December 2023. This decline has negatively impacted bullish sentiment in the crypto market, leading to discussions about future price movements and potential recovery.

How does Ethereum’s RSI impact price predictions?

The monthly Relative Strength Index (RSI) for Ethereum has reached its lowest level on record, dropping below levels seen in the 2022 bear market. This historical RSI performance suggests potential support around $900 in past recoveries, raising questions about whether Ethereum is nearing a bottom despite current bearish sentiments.

What does Ethereum’s technical analysis indicate about its future performance?

Recent technical analysis indicates that while Ethereum shows strong selling momentum, it may also be forming a hidden bullish divergence. With current support around $1,900, there is potential for an upcoming uptrend, though caution remains due to the prevailing bearish outlook.

How do crypto market trends influence Ethereum price predictions?

Current crypto market trends reflect heightened bearish sentiment for Ethereum, especially as it faces significant selling pressure. Analysts suggest that this might drive Ethereum lower into oversold conditions, influencing future price predictions and market behavior.

What role does the stochastic indicator play in Ethereum price analysis?

The one-month Stochastic oscillator for Ethereum has fallen below the 50 mark, indicating bear market territory. Historically, declines below 20 suggest that Ethereum is in extreme oversold conditions and may take time to stabilize before initiating recovery.

Is there a potential bullish divergence in Ethereum’s price analysis?

Yes, Ethereum’s recent drop in RSI to record lows suggests a potential hidden bullish divergence. This signals that while selling pressure is strong, past trends have shown that significant recoveries can follow such extreme conditions.

What is the current price level for Ethereum and its implications?

At the time of writing, Ethereum is trading at approximately $1,920, having recently hit a low of $1,851. This price level suggests that Ethereum may be finding support, but analysts caution about the possibility of further declines before a potential reversal.

How can Ethereum altcoins be affected by the current price analysis?

The current bearish trend affecting Ethereum can have a ripple effect on Ethereum altcoins. As the leading altcoin shows weakness, it may affect investor confidence in other Ethereum-based projects, influencing their market performance.

| Key Indicator | Current Status | Previous Performance | Outlook | Notes |

|---|---|---|---|---|

| Ethereum Price | Below $2,000 | Dropped below $2,000 for the first time since December 2023 | Potential for further declines or nearing a bottom | Current price is $1,920, with a recent low of $1,851 |

| Monthly RSI | Lowest ever recorded | Lowest level noted below the 2022 bear market’s bottom | Possible hidden bullish divergence signal | Last support level was around $900 before an uptrend |

| Stochastic Oscillator | Dropped below 50 | Indicates bear market territory; bottoms until below 20 | More bearish sentiment expected | Recovery may take months after entering bear market territory |

Summary

Ethereum price analysis indicates a significant downturn as the cryptocurrency trades below the $2,000 mark for the first time since December 2023. This recent decline has brought bearish sentiment, with analysts debating the possibility of a further drop or whether Ethereum is approaching a bottom. Key indicators such as the monthly Relative Strength Index and Stochastic oscillator suggest a precarious situation—while a potential for a bottom and recovery exists, the current indicators also point toward a deeper bearish phase, requiring investors to stay cautious in the upcoming months.

Ethereum price analysis reveals a significant downturn as the cryptocurrency recently dipped below the crucial $2,000 threshold for the first time since December 2023. This notable decline has dampened bullish sentiment among traders and investors, raising questions about the potential future trajectory of this leading altcoin. Experts are examining various factors, including Ethereum price prediction models and the latest technical indicators such as the Relative Strength Index (RSI), to gauge market movements. With crypto market trends leaning toward caution, many are curious if Ethereum is nearing a support level or if it’s poised for further declines. By closely following Ethereum technical analysis, investors hope to discern patterns that might signal a recovery or an extended bearish phase for this pivotal cryptocurrency.

A deep dive into the current state of Ethereum’s market performance showcases a critical examination of this blockchain asset. As analysts unfold the potential implications of recent market dynamics, terms like Ethereum valuation forecasts and the overall landscape of Ethereum altcoins come into play. With key indicators such as the monthly RSI revealing unprecedented lows, the conversation surrounding Ethereum’s future intensifies. Observers are particularly interested in how these trends interact with broader crypto market behaviors and whether they hint at an upcoming reversal or prolonged stagnation. By leveraging in-depth technical evaluations, market participants aim to identify early signs of recovery or acknowledge potential risks that could influence Ethereum’s price movements.