Bitcoin volatility has become a defining feature of the cryptocurrency market, shaping investor strategies and behaviors. Recent movements of 170,000 BTC, valued at over $14 billion, from wallets held by mid-term holders signal impending shifts in the market landscape. This significant transfer aligns with historical patterns where similar actions often precede notable BTC price fluctuations. As traders and analysts delve into cryptocurrency market analysis, the implications of this volatility become paramount, especially for those tracking Bitcoin market trends. Understanding how these factors interact can provide keen insights for both seasoned investors and new participants navigating this dynamic realm.

The erratic price movements of Bitcoin, often termed as BTC fluctuations, are a critical aspect of the digital asset landscape. As medium-term holders adjust their positions, the market is ripe for potential shifts in sentiment and pricing. In this context, mid-term investors play a critical role, illustrating how their actions can foreshadow broader market trends. The combination of geopolitical factors and fluctuating demand creates a complex backdrop for Bitcoin’s journey, making cryptocurrency market navigation both challenging and thrilling. Embracing this volatility is crucial for those looking to understand the evolving dynamics of Bitcoin and its implications on investment strategies.

Understanding Bitcoin Volatility: Key Indicators

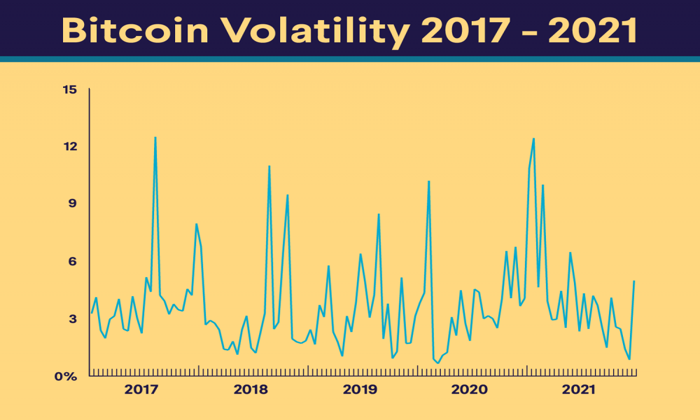

Bitcoin volatility refers to the degree of variation in the price of Bitcoin (BTC) over time. This volatility can often be traced back to several key indicators, including significant transfers of BTC among mid-term holders. Recent analysis suggests that the movement of 170,000 BTC from wallets held for three to six months is a strong indicator of impending market shifts. Historically, such transfers have foreshadowed major price fluctuations, making them a crucial focal point for cryptocurrency market analysis.

The transfer patterns of medium-term holders, who generally keep their assets for three to twelve months, offer insights into market sentiment. When these holders decide to move their assets, it can signify their reactions to changing market conditions. This behavior contrasts with long-term holders, who are less responsive to short-term movements, highlighting the importance of monitoring mid-term holders for anticipatory signals of volatility.

Frequently Asked Questions

What is Bitcoin volatility and how does it affect the BTC market trends?

Bitcoin volatility refers to the price fluctuations of Bitcoin (BTC) in the market. High volatility indicates significant price changes, which can influence BTC market trends dramatically. Traders often monitor these fluctuations to strategize their investments, as sharp movements can signal potential buying or selling opportunities.

How do BTC price fluctuations impact long-term and mid-term Bitcoin holders?

BTC price fluctuations significantly impact both long-term and mid-term Bitcoin holders. Mid-term holders, who typically hold BTC for three to twelve months, are particularly sensitive to price changes. They may adjust their strategies based on market volatility, while long-term holders might remain unaffected by short-term price swings.

What role do Bitcoin mid-term holders play in Bitcoin volatility?

Bitcoin mid-term holders often serve as critical indicators of Bitcoin volatility. When they move their assets, as seen with the recent transfer of 170,000 BTC, it can signal shifts in market sentiment. Such movements typically occur before major price changes, highlighting their influence on the overall volatility in the Bitcoin market.

How can cryptocurrency market analysis predict Bitcoin volatility?

Cryptocurrency market analysis utilizes historical data and current trading patterns to predict Bitcoin volatility. Analysts observe the behavior of mid-term holders, trading volumes, and significant transfers, like the recent ones, to anticipate possible price fluctuations. This analysis aids traders in making informed decisions amidst brewing volatility.

What historical events correlate with increased Bitcoin volatility?

Historical events such as the bull run of 2021 and subsequent market corrections in 2022 correlate closely with increased Bitcoin volatility. Significant movements, particularly from mid-term holders, often foreshadow these fluctuations, suggesting heightened market activity and uncertainty.

Why are Bitcoin market trends influenced by geopolitical events?

Bitcoin market trends are often influenced by geopolitical events, such as tariffs and political instability. For example, recent trading patterns have been affected by U.S. President Donald Trump’s tariff policies, contributing to the current fluctuations in Bitcoin prices. Such developments create uncertainty, leading to increased volatility.

What strategies can investors use to navigate Bitcoin volatility?

To navigate Bitcoin volatility, investors can employ strategies such as dollar-cost averaging, setting stop-loss orders, and being mindful of market analysis. By understanding BTC price fluctuations and monitoring the behavior of mid-term holders, investors can formulate better strategies to mitigate risks associated with volatility.

| Key Points |

|---|

| Bitcoin is moving towards increased volatility as 170,000 BTC worth over $14 billion change hands from holders of 3–6 months. |

| Historical data shows that transfers from this group often precede significant price shifts. |

| Mid-term holders (3–12 months) tend to be more reactive to market changes than long-term holders. |

| Recent trading patterns mimic those observed during previous market cycles including the 2021 bull run and the 2022 correction. |

| Bitcoin’s recent price has fluctuated between $75,000 and $87,000, impacted by geopolitical factors. |

Summary

Bitcoin volatility is set to increase due to significant movements from mid-term holders, which often signal shifts in market sentiment. Recent transactions involving 170,000 BTC suggest a pivotal moment that could lead to sharp price changes, as history indicates that such movements typically precede market turbulence. Investors should stay alert to these signals, as they provide crucial insights into market dynamics, particularly amid the ongoing geopolitical tensions influencing Bitcoin’s pricing.

Bitcoin volatility is becoming increasingly pronounced as recent movements in the Bitcoin market trends hint at significant changes ahead. A substantial amount of 170,000 BTC, valued at over $14 billion, has shifted from wallets typically held by mid-term holders, often signaling a critical turning point in BTC price fluctuations. Historical patterns reveal that these transfers are closely associated with major market shifts, increasing anticipation among cryptocurrency market analysts. With mid-term holders — those who hold assets for three to six months — actively adjusting their positions, the potential for sharp price movements grows. As the market digests these developments, staying informed about Bitcoin’s volatility will be crucial for investors navigating this dynamic landscape.

In the realm of cryptocurrency, the fluctuations of Bitcoin’s value remain a hot topic as the market grapples with changing investor sentiments. As a leading digital asset, its unpredictable nature often catches the attention of those involved in blockchain technology and financial trading. Observing the behavior of mid-term investors can provide insight into forthcoming trends, particularly when these players divest from their holdings, triggering noteworthy market repercussions. Many enthusiasts and experts alike analyze these price movements meticulously, linking them to broader economic indicators and political influences. Understanding the intricate patterns within Bitcoin’s trading history can serve as a valuable asset for anyone keen on mastering the cryptocurrency landscape.