Bitcoin’s emergence as a store of value has transformed the landscape for safe-haven assets, offering investors a new refuge amid market volatility. In recent turbulent times, traditional investments like gold and the Swiss Franc are no longer the sole options for those seeking safety; Bitcoin is stepping into that role. This cryptocurrency investment is gaining reputation as a non-sovereign store of value, making it an appealing alternative for those disillusioned by conventional financial securities. As economic uncertainties loom large and investor confidence fluctuates, Bitcoin stands out as a potential investors refuge, solidifying its place among established store of value assets. The ongoing dialogue about Bitcoin’s capacity to act effectively during periods of upheaval underscores its relevance in a rapidly changing market.

In recent discussions about financial security, Bitcoin has emerged as a compelling alternative to traditional safe-haven investments. As a non-sovereign asset, it’s captured attention as a viable option for those looking to protect their wealth from market disruptions. Investors are increasingly recognizing Bitcoin’s potential to perform well in the face of economic unpredictability, likening it to established forms of wealth preservation. This cryptocurrency’s ability to withstand fluctuations and provide stability marks it as a noteworthy contender in the realm of investment assets. With increased scrutiny on conventional financial instruments, Bitcoin’s role in safeguarding value is becoming more prominent than ever.

Bitcoin’s Emergence as a Store of Value

In recent years, bitcoin has increasingly been viewed by investors as a viable store of value, much like gold or silver. This perspective has gained traction especially during periods of market volatility, where traditional safe havens have shown signs of instability. Bitcoin’s decentralized nature and finite supply make it appealing to those looking for an asset that can withstand economic turmoil. With global events often causing chaos in the financial markets, many are turning to bitcoin, highlighting its potential as a non-sovereign store of value.

The recognition of bitcoin as a store of value is further supported by its performance during economic downturns. As tariffs and geopolitical tensions rise, traditional safe havens are sometimes undermined by central bank policies or economic manipulation. Bitcoin’s reliability amidst such issues is drawing attention from both individual investors and institutional players. This shift indicates a growing trust in cryptocurrency investment as a strategy for safeguarding wealth against inflation and currency devaluation.

The Role of Bitcoin in Today’s Financial Landscape

Bitcoin’s role in today’s financial landscape has transformed significantly from its inception. Initially viewed as an alternative currency for online transactions, it has now gained stature as an investment vehicle and a refuge during market volatility. Investors are increasingly incorporating bitcoin into their portfolios, not only for its potential price appreciation but also as a hedge against economic instability. Unlike fiat currencies, bitcoin offers an asset that is immune to government interference, making it a focal point for those seeking financial security.

Moreover, the notion of bitcoin as a safe haven has gained further credibility in the face of traditional markets’ unpredictability. The recent tariff announcements and subsequent market reactions have led many to reconsider their risk management strategies. As a result, bitcoin’s appeal as a store of value asset has surged, providing an alternative avenue for preservation of wealth. This ongoing trend underscores a changing sentiment in investor behavior, moving towards cryptocurrencies as a preferred option amid global economic uncertainties.

Understanding Bitcoin as a Safe Haven Asset

As market volatility continues to plague traditional investments, many investors are exploring the benefits of bitcoin as a safe haven. With its unique characteristics, including being scarce and decentralized, bitcoin offers an asset class that could potentially outpace typical store of value assets like gold. In a recent analysis, the correlation between bitcoin prices and traditional safe havens demonstrated that during times of financial distress, investors flock to bitcoin, viewing it as a resilient safety net. This reinforces the idea that it can serve as an investors’ refuge when other asset prices fall.

The market response to Bitcoin’s fluctuating value amid economic crises has confirmed its rising status in the financial sector. As more individuals and institutions allocate funds toward cryptocurrency investment, it becomes evident that the narrative surrounding asset safety is shifting. Economic challenges, such as high inflation rates or economic sanctions imposed by governments, can severely impact traditional assets, whereas bitcoin has demonstrated an ability to maintain value, attracting those looking for security in uncertain times.

Tariffs and Their Effect on Bitcoin’s Value

The imposition of tariffs has historically influenced financial markets, causing fluctuations that can destabilize conventional safe-haven assets. However, bitcoin has seemed to rise to the occasion, demonstrating resilience and garnering alternative support. As tariffs disrupt traditional supply chains, many investors are reevaluating their strategies, with some opting to diversify into cryptocurrencies. This behavior highlights a growing perception of bitcoin as a safe place to hedge against adverse financial conditions resulting from trade wars.

During the peak of tariff news in April, bitcoin’s price movements reflected a newfound recognition among investors. Rather than reacting negatively like some traditional assets, bitcoin maintained a steady positioning, suggesting its potential as a reliable store of value during tumultuous times. This adaptive behavior in the face of market volatility emphasizes its emerging identification as a sanctuary for wealth preservation, earning its place alongside established safe havens.

Investors Turning to Bitcoin During Economic Uncertainty

In the face of economic uncertainty, investors are increasingly turning to bitcoin as an alternative asset class for wealth preservation. The unpredictability of the stock market and the lasting effects of geopolitical conflicts have led many to seek refuge in cryptocurrency investments. This sentiment reflects a wider acceptance of bitcoin as more than just a speculative asset; it is being seen as a strategic component of a diversified investment portfolio that can withstand economic shocks more effectively than traditional assets.

Furthermore, the increasing adoption of bitcoin by mainstream financial institutions has bolstered its credibility during crises. Many organizations have begun to recognize the advantages of incorporating bitcoin into their strategies for safeguarding capital. This aligns with a broader trend where more investors view bitcoin as an integral part of their long-term financial plans, especially as a hedge against inflation and currency fluctuations caused by economic and political instability.

Market Volatility and Bitcoin’s Resilience

Market volatility has been a defining characteristic of financial ecosystems, often leading investors to seek safe havens for their assets. Bitcoin’s resilience in such turbulent times demonstrates its ability to function as a store of value when traditional assets falter. With a limited supply and increasing demand, bitcoin has emerged as a potential refuge for many. Investors are becoming more aware that during times of heightened volatility, bitcoin can provide an escape from the unpredictability characteristic of fiat currencies and some established commodities.

The fluctuation in market confidence corresponding to tariff announcements and trade negotiations illustrates the fragility of traditional financial instruments, thereby highlighting bitcoin’s unique selling points. By choosing bitcoin as a safety net, investors are signaling a belief in its long-term value proposition, independent of governmental influences. This trend has shifted the dialogue around financial safety, solidifying bitcoin’s place among modern safe-haven assets amidst ongoing economic instability.

Bitcoin as an Alternative Safe Haven During Crises

As crises unfold globally, the traditional dynamics of safe-haven investing are shifting. Investors are increasingly looking towards bitcoin as a stable alternative during periods of economic hardship. Unlike traditional safe havens which can be influenced by political policies and central bank decisions, bitcoin stands apart as a decentralized asset, unaffected by global economic pressures. This characteristic has garnered attention and led to a growing consensus on its potential role as a safe haven during inevitable financial downturns.

The appeal of bitcoin during crises rests not only on its ability to retain value but also its global accessibility. As economic sanctions and trade barriers complicate access to conventional assets, bitcoin remains an unregulated frontier for diverse investors. Its immunity to government interference enhances its desirability, particularly among those seeking security for their capital during uncertain times. This adaptation of investor behavior indicates a broader cultural acceptance of cryptocurrencies as a hedge against crisis-driven market behaviors.

Future of Bitcoin as a Store of Value

Looking forward, the future of bitcoin as a store of value appears increasingly promising, especially in light of ongoing economic challenges. The paradigm shift in how investors perceive and use bitcoin suggests that its acceptance as a legitimate store of value will only deepen. With innovations in blockchain technology and continued growth in adoption, bitcoin may solidify its importance in global financial markets, especially as an alternative to traditional store of value assets that rely heavily on governmental frameworks.

Moreover, as global economic dynamics continue to evolve, bitcoin’s unique selling points position it favorably among prospective investors. The awareness of its potential as a safe haven amid rising inflation and market uncertainty will likely drive continued interest. Investors see bitcoin not merely as a speculative asset but as a fundamental component of future financial security strategies, thereby reinforcing its role as a dependable store of value.

Adoption of Bitcoin as a Wealth Preservation Strategy

The growing adoption of bitcoin as a wealth preservation strategy marks a significant change in asset management practices. Many investors are now recognizing the limitations of traditional assets in safeguarding wealth against economic downturns, leading them to explore bitcoin as a viable alternative. By allocating a portion of their investments to cryptocurrency, they aim to hedge against inflation and market volatility, which have become pronounced in recent times. This shift reflects a more diversified approach to wealth management in the face of changing economic landscapes.

As awareness of the advantages of bitcoin continues to rise, more institutions are considering its inclusion in their investment portfolios. The adaptability of bitcoin as a hedge against systemic risks is attractive to both individual and institutional investors alike. With an increasing acceptance of its role in preserving capital, bitcoin may well cement its status as a key player in future economic frameworks, appealing to those looking to protect their investments against traditional market pressures.

Frequently Asked Questions

What makes Bitcoin a reliable store of value during market volatility?

Bitcoin is increasingly recognized as a reliable store of value, especially during periods of market volatility. Its decentralized nature and limited supply, akin to traditional safe-haven assets like gold, make it an attractive option for investors. Amid economic uncertainty and events like tariff hikes, Bitcoin acts as a safeguard against inflation and currency devaluation, thereby fulfilling its promise as a non-sovereign store of value.

How does Bitcoin compare to traditional safe havens as a store of value asset?

While traditional safe havens like gold and the Swiss Franc have long served as store of value assets, Bitcoin is emerging as a contemporary alternative. With its unique properties—such as portability, ease of transfer, and a predetermined supply limit—Bitcoin offers advantages that can appeal to investors looking for refuge amid market volatility. Its role as a cryptocurrency investment has grown significantly, particularly when other assets falter.

Is Bitcoin considered a safe haven for investors in times of economic uncertainty?

Yes, Bitcoin is increasingly considered a safe haven for investors amid economic uncertainty. As political and economic factors lead to heightened market volatility, Bitcoin has shown resilience, gaining recognition as a refuge for investors. This has positioned it alongside traditional assets like gold, establishing it as a viable store of value in turbulent times.

What factors contribute to Bitcoin’s status as an investors’ refuge?

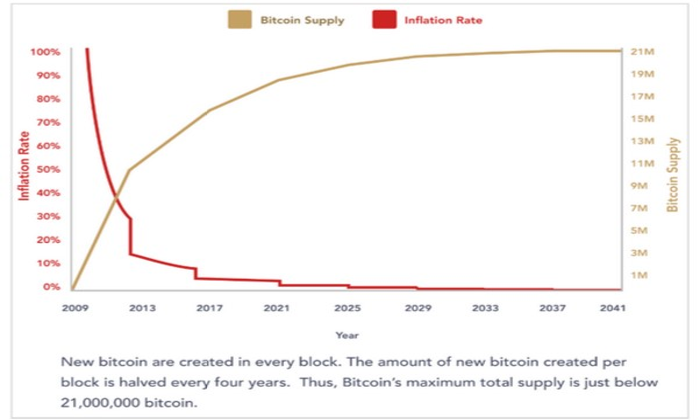

Several factors contribute to Bitcoin’s growing status as an investors’ refuge. First, its decentralized nature means it is less susceptible to government interference compared to fiat currencies. Additionally, Bitcoin’s fixed supply of 21 million coins ensures scarcity, which can drive up value during inflationary periods. These characteristics have led many to view Bitcoin as a secure store of value asset amidst economic turmoil.

How does market volatility affect the perception of Bitcoin’s value as a store of value asset?

Market volatility often heightens the perception of Bitcoin’s value as a store of value asset. During times of economic distress or uncertainty, investors tend to seek alternatives to traditional assets, turning to Bitcoin for its potential to preserve value. As historical trends show, Bitcoin can serve as a buffer during extreme market conditions, further solidifying its role as a safe haven.

Can Bitcoin replace traditional store of value assets like gold and silver?

While Bitcoin may not fully replace traditional store of value assets like gold and silver, it is carving out its niche as a contemporary alternative. As investors increasingly recognize Bitcoin’s unique properties and benefits—especially in terms of portability and decentralized nature—it could complement rather than directly replace these traditional assets during periods of market volatility.

What should investors consider when viewing Bitcoin as a store of value?

Investors should consider several factors when viewing Bitcoin as a store of value. Understanding its volatility, regulatory landscape, and market trends is crucial. Additionally, one should recognize Bitcoin’s status as a relatively new asset compared to historical alternatives like gold. Finally, diversification—balancing Bitcoin with traditional store of value assets—can help mitigate risks associated with its price fluctuations.

| Key Points | Details |

|---|---|

| Market Volatility | April saw extreme volatility influenced by President Trump’s tariff announcements. |

| Bitcoin’s Role | Bitcoin is gaining recognition as a non-sovereign store of value amid this market uncertainty. |

| Traditional Safe Havens | Gold and the Swiss Franc have been traditional safe havens but Bitcoin is emerging as a competitor. |

| Investor Sentiment | Investors are noticing Bitcoin as a safer alternative as other traditional assets fail to perform. |

| NYDIG Research Findings | Bitcoin is acting as a non-sovereign store of value, fulfilling its intended role during unstable times. |

Summary

Bitcoin’s store of value has come to the forefront in recent market upheavals, particularly during April’s tumultuous volatility driven by tariff announcements. While gold and the Swiss Franc have traditionally served as safe havens, Bitcoin is increasingly being recognized for its potential to act as a refuge for investors during uncertain times. This shift highlights Bitcoin’s evolving role in the financial landscape, suggesting that it may indeed fulfill its promise as a reliable non-sovereign store of value.

In a rapidly changing economic landscape, Bitcoin has emerged as a significant store of value, capturing the attention of investors seeking refuge from market volatility. As traditional assets like gold and the Swiss Franc contend with uncertainty, Bitcoin stands out as an alternative safe haven, presenting a compelling case for those in the cryptocurrency investment space. With its unique characteristics as a non-sovereign asset, Bitcoin has increasingly been recognized as a reliable store of value asset amidst the chaos of financial markets. This trend indicates that investors are moving towards cryptocurrencies as a new form of wealth preservation, especially in light of recent tariff disruptions. As awareness grows, Bitcoin’s role as a digital store of value is expected to solidify further, appealing to those looking for more than just conventional hedging strategies.

In recent times, the concept of Bitcoin as a viable alternative has gained traction, leveraging its potential as a digital currency and appreciating asset. Often referred to as a “safe haven” akin to traditional securities, Bitcoin has captured the imagination of many as an investor’s refuge during tumultuous periods. As individuals look for robust store of value options, this cryptocurrency stands tall among market alternatives, promising a hedge against instability. Market players increasingly view digital currencies, particularly Bitcoin, as vital components of their investment portfolios, specifically in response to rising uncertainties. This shift illustrates a growing recognition of cryptocurrency, not just as an innovative financial tool, but as a key player in a diversified wealth strategy.