Bitcoin, often viewed as a risk-oriented asset, has been at the forefront of discussions surrounding the cryptocurrency market’s volatility. Recently, the Bitcoin price decline has raised eyebrows, especially as macroeconomic factors continue to influence investor sentiment. According to Emily Nicolle, a crypto reporter for Bloomberg, Bitcoin’s sharp 13% plunge into bear territory reflects a strong correlation with Wall Street movements, emphasizing the interconnectedness of traditional and digital markets. This Bitcoin trading analysis suggests that external pressures, such as political uncertainty and economic instability, play a pivotal role in shaping the crypto landscape. As analysts delve deeper into crypto market analysis, it’s clear that understanding these risk-oriented assets is essential for navigating the challenges of the current cryptocurrency bear market.

Often characterized as a volatile digital currency, Bitcoin represents a high-risk investment that captures the attention of both seasoned traders and new investors alike. The recent downturn in Bitcoin’s value can be linked to various macroeconomic influences, prompting experts to examine the broader implications for the cryptocurrency sector. As we explore the dynamics of this innovative financial instrument, it becomes evident that external factors—ranging from stock market fluctuations to regulatory discussions—significantly impact Bitcoin’s performance. In this context, the analysis of Bitcoin trading patterns reveals critical insights into market behavior and investor psychology. Understanding these nuances is crucial for anyone looking to engage with this unpredictable asset class.

Understanding Bitcoin as a Risk-Oriented Asset

Bitcoin has established itself as a highly risk-oriented asset, often influenced by macroeconomic fluctuations. As the crypto market undergoes various shifts, Bitcoin’s value tends to react sharply to changes in the economic landscape. For instance, during periods of economic uncertainty, like those seen with the recent decline in the stock market, Bitcoin can experience significant price drops, as noted in Emily Nicolle’s analysis. Investors are increasingly aware of this correlation, recognizing that their strategies must adapt to the prevailing macroeconomic conditions.

In particular, the recent 13% plunge in Bitcoin’s price highlights how external factors can precipitate drastic movements in the cryptocurrency market. This risk orientation stems from Bitcoin’s status as a digital asset that reflects broader financial trends. As Nicolle pointed out, the interdependence between Bitcoin and the S&P 500 illustrates how investors’ sentiments on traditional markets often spill over into the crypto space, making Bitcoin a speculative investment that can yield high rewards but also carries substantial risks.

Macroeconomic Factors Influencing Bitcoin Prices

The macroeconomic landscape plays a pivotal role in shaping Bitcoin’s price movements. Events such as inflation rates, employment statistics, and geopolitical tensions can create ripples across the crypto market. As seen in recent trends, Bitcoin’s decline can often be traced back to broader economic instability, which sends investors seeking safer assets, thereby impacting Bitcoin’s demand. Nicolle emphasizes that political factors and regulatory uncertainties further complicate this relationship, as they can undermine investor confidence and exacerbate market volatility.

For example, the political climate surrounding cryptocurrency regulation in the United States has left traders in a state of uncertainty. While promises of clearer guidelines were made, their absence has led to hesitation among potential investors. This uncertainty directly contributes to Bitcoin’s fluctuations, reinforcing the idea that macroeconomic factors are not just background noise but rather critical determinants of market behavior in the cryptocurrency sector.

The Impact of Political Uncertainty on Bitcoin Trading

Political uncertainty can significantly impact Bitcoin trading, as seen in the current climate where potential regulatory changes remain in limbo. Emily Nicolle highlights how delays in promised regulations can lead to a bearish sentiment in the market, leaving investors wary and hesitant. This cautious approach can stall investment inflows, leading to further price declines in Bitcoin. As traders watch for any signs of regulatory clarity, the lack of action can contribute to a perception of instability in Bitcoin as a trading asset.

Moreover, political dynamics, both domestic and international, influence investor confidence. The recent hack involving North Korean entities serves as a stark reminder of the vulnerabilities within the crypto ecosystem. Such events can deter potential investors, particularly during times of significant political discourse regarding cryptocurrency. The interaction between political events and Bitcoin’s price shows just how intertwined the asset is with broader societal factors and emphasizes the need for a stable political environment to foster a more robust trading landscape.

Analyzing the Current Bear Market in Cryptocurrency

The cryptocurrency market is currently navigating a challenging bear phase, with Bitcoin at the forefront of this decline. Analysts like Emily Nicolle stress that the ongoing downturn is largely driven by macroeconomic factors and internal turmoil within the crypto sector. The recent significant hack and the broader political landscape have compounded the challenges faced by Bitcoin, pushing it deeper into bear territory. As a result, traders are closely monitoring key price points, such as the crucial $70,000 mark, which represents a psychological barrier that could dictate future market trends.

This bear market not only affects Bitcoin but also has a cascading effect on other cryptocurrencies, as they tend to follow Bitcoin’s lead. Nicolle aptly describes Bitcoin as the ‘tide that lifts all boats,’ indicating that its performance influences the entire cryptocurrency market. However, during such downturns, smaller cryptocurrencies often experience even sharper declines due to their heightened volatility, making market analysis crucial during these turbulent times.

Future Projections for Bitcoin Amidst Market Turmoil

Looking ahead, the future of Bitcoin remains uncertain amidst the ongoing market turmoil. Analysts emphasize the importance of monitoring macroeconomic indicators and political developments that could influence Bitcoin’s trajectory. Nicolle points out that if there are no significant improvements in these areas, Bitcoin may continue to face downward pressure. This uncertainty underscores the necessity for investors to remain vigilant and adaptable in their strategies, as the market can shift rapidly based on external factors.

Furthermore, the psychological effects of key price levels, such as the aforementioned $70,000 mark, cannot be overlooked. If Bitcoin continues to decline below this threshold, it may trigger further selling pressure, leading to a prolonged bear market. Therefore, understanding market sentiment and the external influences at play is paramount for anyone looking to navigate the complexities of Bitcoin trading in the current environment.

The Role of Market Sentiment in Bitcoin Trading

Market sentiment is a crucial element in Bitcoin trading, reflecting the collective attitudes and emotions of investors towards the cryptocurrency. As Bitcoin experiences price fluctuations, these sentiments can shift rapidly, driving market behavior. Analysts, including Nicolle, highlight the impact of negative news, such as regulatory uncertainties or significant hacks, which can swiftly alter investor perceptions and lead to panic selling. Conversely, positive developments can foster optimism, potentially driving prices higher.

Understanding market sentiment also involves analyzing trends and patterns in trading behavior. For instance, during periods of economic stability, investors might be more inclined to take risks with Bitcoin, viewing it as a potential hedge against inflation. However, in times of economic distress, the same investors may retreat to safer assets, leading to a decline in Bitcoin’s price. This reciprocal relationship between sentiment and market performance underscores the importance of incorporating sentiment analysis into Bitcoin trading strategies.

Technical Analysis of Bitcoin’s Price Movements

Technical analysis plays a vital role in understanding Bitcoin’s price movements, especially during periods of volatility. Traders utilize various indicators and chart patterns to predict potential price trends and reversals. As Nicolle pointed out, the $70,000 mark serves as a critical support level that traders are monitoring closely. If Bitcoin’s price can hold above this level, it may signal a potential recovery; however, a drop below could indicate further declines, prompting traders to adjust their positions accordingly.

Moreover, the integration of technical analysis with macroeconomic data can provide deeper insights into Bitcoin’s trading behavior. By examining correlations between Bitcoin’s price movements and key economic indicators, traders can better anticipate shifts in market sentiment. This comprehensive approach not only enhances trading strategies but also empowers investors to navigate the complexities of the cryptocurrency market more effectively.

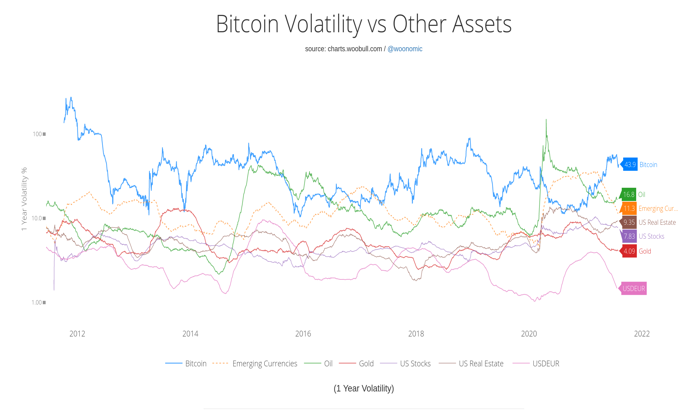

Bitcoin’s Volatility and Risk Management Strategies

Bitcoin’s inherent volatility presents both challenges and opportunities for traders. Its price can swing dramatically over short periods, making it crucial for investors to implement effective risk management strategies. Nicolle emphasizes the importance of being prepared for sudden market shifts and adjusting investment strategies accordingly. This might involve setting stop-loss orders or diversifying portfolios to mitigate potential losses during bearish phases.

Additionally, understanding the factors that contribute to Bitcoin’s volatility—such as macroeconomic developments, regulatory changes, and market sentiment—can help traders make more informed decisions. By staying updated on these dynamics, investors can better navigate the unpredictable nature of Bitcoin trading and position themselves for potential gains in the long run.

The Interconnectedness of Bitcoin and Traditional Markets

The interconnectedness of Bitcoin and traditional financial markets is becoming increasingly evident, particularly during times of economic upheaval. As Nicolle noted, movements in the S&P 500 can directly influence Bitcoin’s price, highlighting the asset’s role as a barometer for broader market sentiments. This relationship suggests that Bitcoin is not operating in a vacuum; rather, it is part of a larger financial ecosystem where events in traditional markets can have significant repercussions.

Traders must remain cognizant of this interconnectedness when developing their investment strategies. For instance, during periods of stock market volatility, Bitcoin may react in tandem, which could present both risks and opportunities for savvy investors. By understanding these correlations, traders can better position themselves to capitalize on market movements and navigate the complexities of trading Bitcoin in an environment heavily influenced by traditional financial trends.

Frequently Asked Questions

How does Bitcoin’s price decline relate to macroeconomic factors in the crypto market?

Bitcoin’s price decline is closely linked to macroeconomic factors, as changes in the financial landscape can significantly impact investor sentiment. For instance, turmoil in traditional markets like the S&P 500 often translates to volatility in the Bitcoin market, leading to a pronounced price decline.

What role do macroeconomic factors play in Bitcoin trading analysis?

Macroeconomic factors are crucial in Bitcoin trading analysis, as they can influence market trends and investor behavior. Analysts consider economic indicators, political stability, and financial market performance to predict potential price movements in Bitcoin, often highlighting its risk-oriented nature.

What should investors consider during a cryptocurrency bear market with Bitcoin?

During a cryptocurrency bear market, investors should be particularly cautious with Bitcoin, as its risk-oriented asset status means it can experience significant volatility. Factors such as macroeconomic uncertainty, regulatory changes, and overall market sentiment can exacerbate price declines, necessitating thorough market analysis.

How does Bitcoin’s correlation with macroeconomic factors affect crypto market analysis?

Bitcoin’s strong correlation with macroeconomic factors is a critical component of crypto market analysis. Analysts observe that shifts in economic conditions, such as inflation rates or stock market performance, can directly influence Bitcoin’s price movements, making it essential for traders to stay informed on macroeconomic trends.

What impact do political factors have on Bitcoin as a risk-oriented asset?

Political factors can significantly affect Bitcoin, particularly as a risk-oriented asset. Uncertainty around regulations or political decisions can lead to market fluctuations, causing Bitcoin’s price to decline or rise sharply. Investors should monitor political developments to gauge potential impacts on Bitcoin’s performance.

What is the significance of the $70,000 mark for Bitcoin traders?

The $70,000 mark is a critical psychological and technical support level for Bitcoin traders. If Bitcoin continues to decline and breaches this support, it could signal further risk-oriented declines in the market. Traders closely watch this level to assess the potential for recovery or additional losses.

Why is Bitcoin described as the ‘tide that lifts all boats’ in the crypto market?

Bitcoin is often described as the ‘tide that lifts all boats’ because its performance typically influences the entire cryptocurrency market. When Bitcoin experiences gains, it often leads to price increases in other cryptocurrencies. However, during downturns, smaller altcoins can face even greater volatility and declines.

What are the risks associated with Bitcoin trading amid macroeconomic uncertainty?

Trading Bitcoin amid macroeconomic uncertainty carries significant risks due to its volatility as a risk-oriented asset. Fluctuations in the economy can lead to unpredictable price movements, making it essential for investors to conduct thorough analysis and remain vigilant regarding external economic factors.

| Key Point | Details |

|---|---|

| Bitcoin’s Volatility | Bitcoin is characterized as a highly risk-oriented asset, influenced by macroeconomic changes. |

| Market Correlation | Bitcoin’s price movements are closely tied to the S&P 500 and other stock markets. |

| Recent Decline | Bitcoin recently fell 13% and entered bear territory due to macroeconomic uncertainty. |

| Impact of Political Factors | Political uncertainty, including unfulfilled regulatory promises, is affecting Bitcoin’s value. |

| Security Concerns | A significant hack of $1.5 billion has added to the turmoil in the cryptocurrency sector. |

| Support Levels | Traders are monitoring the $70,000 mark as a critical support level for Bitcoin. |

| Broader Market Effects | Bitcoin’s movement influences other cryptocurrencies, which are generally more volatile. |

Summary

Bitcoin is considered a highly risk-oriented asset, primarily influenced by macroeconomic shifts and political factors. Recent events have shown that Bitcoin’s value can fluctuate dramatically due to external pressures, including stock market performance and significant security breaches within the cryptocurrency sector. As uncertainty looms over regulatory developments and macroeconomic stability, investors remain cautious, eyeing critical support levels to gauge Bitcoin’s potential recovery or further decline.

Bitcoin is increasingly recognized as a risk-oriented asset, particularly in light of recent market movements influenced by various macroeconomic factors. As highlighted by Emily Nicolle, a crypto analyst, the recent Bitcoin price decline, which saw the cryptocurrency plummet by 13%, underscores its vulnerability to shifts in the economic landscape. This decline not only reflects the inherent volatility of Bitcoin but also reveals how closely tied it is to macroeconomic conditions and stock market fluctuations. Investors are advised to conduct thorough Bitcoin trading analysis, especially during a cryptocurrency bear market, as external pressures can significantly impact its performance. Understanding these dynamics is crucial for anyone looking to navigate the complexities of the crypto market effectively.

The world of digital currencies is often characterized by assets that exhibit high levels of risk, and Bitcoin is no exception. This pioneering cryptocurrency has gained notoriety for its dramatic price fluctuations, particularly in response to broader economic trends and political uncertainties. Analysts emphasize the importance of evaluating the macroeconomic environment when assessing Bitcoin’s potential, especially amidst a challenging cryptocurrency market. As market analysts conduct comprehensive evaluations of Bitcoin’s performance, they highlight the need for careful scrutiny of market indicators that could signal bullish or bearish trends. Ultimately, the interplay between Bitcoin and the prevailing economic conditions remains a focal point for traders and investors alike.

Leave a Reply