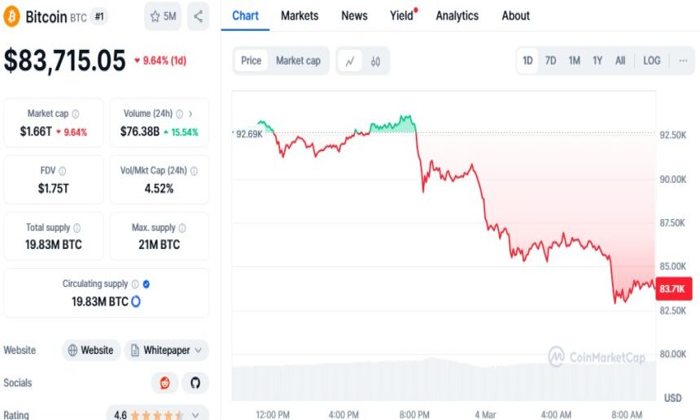

The recent Bitcoin price drop has sent shockwaves through the cryptocurrency market, as investors grapple with the implications of President Donald Trump’s Strategic Bitcoin Reserve initiative. Following a rapid decline of 5.7% within just an hour, Bitcoin’s value slipped below $89,000, evaporating the gains it had accrued earlier in the week when it approached $92,000. This volatility highlights the sensitivity of the crypto market reactions to regulatory news, prompting traders to reassess the effects of the new Bitcoin regulation impact. In light of the executive order on cryptocurrency, analysts are keenly observing market trends that could determine Bitcoin’s future trajectory. Despite this sell-off, Bitcoin remains up nearly 30% year-to-date, showcasing its resilience amidst fluctuating market conditions.

Bitcoin’s recent downturn reflects wider trends impacting the digital currency landscape, particularly following government policy announcements. As the market absorbs the effects of the executive directives such as the Strategic Reserve initiative, investors are adjusting their strategies in response to the rapidly evolving cryptocurrency environment. The varied shifts in Bitcoin and other altcoin prices reveal a turbulent sentiment amongst traders, especially regarding expectations around regulatory frameworks and governmental oversight. With attention shifting towards how these new measures will shape the future of digital currencies, stakeholders are keenly analyzing the cryptocurrency market dynamics that influence asset valuations. Understanding these emerging factors is crucial as the landscape of digital assets continues to evolve.

Understanding the Bitcoin Price Drop

The recent drop in Bitcoin’s price highlights the volatile nature of the cryptocurrency market, especially in response to geopolitical developments. As President Trump’s executive order establishing a Strategic Bitcoin Reserve made waves, Bitcoin’s value diminished sharply, reflecting investors’ unease about the implications of such regulatory measures. Such price fluctuations can often be exacerbated by profit-taking behavior among traders, leading to rapid sell-offs after a surge in value. This kind of reaction is common within the crypto market, significantly influenced by external political decisions and economic indicators.

Bitcoin’s decline from the earlier peak of $92,000 to around $87,200 demonstrates the immediate impact that governmental actions can have on cryptocurrency valuations. The increase in Bitcoin’s price earlier in the week showed optimism among traders, likely fueled by speculation about the benefits of a federal reserve. However, once the executive order was put into effect, many investors recalibrated their expectations. Understanding these market reactions is crucial for both new and experienced investors looking to navigate the unpredictable cryptocurrency landscape.

Impact of Trump’s Bitcoin Executive Order

President Trump’s executive order to create a Strategic Bitcoin Reserve could represent a significant shift in how Bitcoin is perceived and regulated within the financial landscape. By funding this reserve with seized assets from criminal activities, the government aims to establish a foothold in the cryptocurrency market, potentially influencing Bitcoin’s price and availability. This move underscores the complicated relationship between cryptocurrencies and regulation, as governments seek to harness digital assets while simultaneously managing risks associated with illicit activities.

The implications of this executive order extend beyond the immediate effect on Bitcoin’s pricing; it could widely affect market sentiment and future cryptocurrency regulations. Investors are likely to closely monitor how this reserve is managed and what policies may follow. For cryptocurrency advocates, this initiative is a double-edged sword. While it lends legitimacy to Bitcoin as a government-backed asset, it also raises concerns over increased regulation and oversight, which may alter the foundational principles of decentralized finance.

Bitcoin Regulation and Market Trends

The interplay between Bitcoin regulation and market trends can significantly influence the cryptocurrency landscape. As regulatory frameworks evolve, investors must adapt to the changing rules that govern digital assets. The establishment of the Bitcoin Strategic Reserve adds a new dimension to this issue, as it signals a deeper engagement by the government in the cryptocurrency space. This proactive stance could lead to more stringent regulations, affecting trading strategies and market dynamics profoundly.

As market participants await further clarity on regulatory guidelines stemming from the latest executive order, the crypto community is likely to experience mixed feelings. On the one hand, increased government involvement can provide a safety net for Bitcoin, possibly attracting institutional investors. Conversely, the looming potential for stringent regulations may create an atmosphere of caution, leading to market hesitance and volatility in price movements. With Bitcoin having initially surged nearly 30% year-to-date, understanding these regulatory impacts will be critical in forecasting future market trends.

Understanding Crypto Market Reactions

The cryptocurrency market is known for its quick reactions to external stimuli, including political actions and regulatory announcements. When President Trump signed the Strategic Bitcoin Reserve order, it prompted a swift response from investors, resulting in a notable price drop for Bitcoin and other cryptocurrencies like Ethereum and Solana. This phenomenon highlights the sensitivity of the crypto market to news cycles, as traders often react impulsively to new information, which can lead to significant fluctuations in asset prices.

Moreover, market fluctuations in cryptocurrencies like Bitcoin can create a ripple effect throughout the entire digital asset ecosystem. As investors react to news about Bitcoin, they often reassess their positions across other tokens, resulting in widespread movements in the crypto space. This interconnectedness makes it essential for investors to stay informed not only about Bitcoin’s price but also about overarching market trends and regulatory developments that can sway market sentiments across the board.

Predictions for Cryptocurrency Market Trends

As investors grapple with the implications of the recent Bitcoin price drop and Trump’s executive order, attention will turn to future cryptocurrency market trends. Analysts speculate that the increased regulation could either bolster Bitcoin’s credibility among institutional investors or stifle the market due to excessive oversight. The potential for government-backed assets may attract new investments, while simultaneously causing existing investors to reassess their strategies in light of heightened regulatory scrutiny.

The trajectory of the cryptocurrency market will likely depend on how the government implements its new policy and manages the Bitcoin reserves. If transparency and supportive measures are prioritized, market confidence may increase, leading to upward price momentum. Conversely, if the regulations are perceived as too restrictive or punitive, market participants may react negatively, possibly leading to further price declines. As such, predicting the future of the cryptocurrency markets will require close attention to both regulatory developments and the broader economic landscape.

Effects of Cryptocurrency Regulations on Market Behavior

Cryptocurrency regulations play a pivotal role in shaping market behavior and investor sentiment. As governments around the world, including the U.S., explore different frameworks for digital assets, traders must navigate this evolving landscape. The announcement of the Bitcoin Reserve could serve as a catalyst for more robust regulatory measures, enhancing accountability while also instilling caution among investors. Such shifts can redefine how market participants engage with cryptocurrencies, impacting trading volumes and price stability.

Additionally, regulatory announcements often lead to increased volatility in cryptocurrency prices as markets react to anticipated changes. The recent downturn in Bitcoin and other altcoins following the executive order is a prime example of how news can trigger decisive actions from traders. As the crypto space continues to develop, understanding the implications of regulatory decisions will be essential for effectively predicting market trends and adjusting investment strategies.

The Role of Institutional Investors in Bitcoin’s Future

Institutional investors have increasingly entered the cryptocurrency market, significantly impacting Bitcoin’s price and overall market dynamics. With the announcement of the Strategic Bitcoin Reserve, there may be new opportunities for large investment firms to participate in the Bitcoin ecosystem. This could generate additional liquidity and potentially stabilize prices, provided that regulatory guidelines foster a healthier trading environment.

Conversely, the involvement of institutional players may lead to heightened scrutiny and regulatory oversight. As large institutional investments can sway market dynamics in profound ways, regulators may feel compelled to implement more comprehensive regulations that could affect the overall strategy for engaging with Bitcoin. Understanding the role and influence of institutional investors in shaping Bitcoin’s future will be crucial for market participants and analysts alike.

Market Stability Amidst Regulatory Changes

The volatility associated with cryptocurrencies often raises concerns about market stability, especially in the face of regulatory changes like those introduced by Trump’s executive order. While the establishment of a Bitcoin Reserve can be seen as a step towards legitimizing Bitcoin, it also brings questions regarding how the reserve will function and its influence on market prices. The balance between maintaining a flourishing market and implementing necessary regulations will be a significant challenge for both government bodies and the crypto community.

Investors are likely to differ in their perceptions of how regulatory changes affect market stability. Some may view the government’s involvement as a stabilizing force, potentially attracting more cautious investors to the market. Others might worry that increased regulation could limit trading opportunities and squeeze out smaller players. Ultimately, the direction the market takes will depend on how well these regulatory frameworks accommodate the innovative nature of cryptocurrencies while ensuring protection against risks associated with unregulated assets.

Speculations on Future Bitcoin Trends

Speculation regarding the future of Bitcoin remains a hotbed of activity within the cryptocurrency market. Each policy change or executive order prompts discussions about how these shifts could influence Bitcoin’s price trajectory and the broader market environment. After the recent price drop following the announcement about the Bitcoin Reserve, many analysts are evaluating potential scenarios that could either revive the bullish sentiment or deepen bearish trends.

Traders will keenly watch how the cryptocurrency market responds to future regulatory developments, especially as governments continue to clarify their stances on digital assets. Positive engagement from regulators could lead to price accelerations, while restrictive measures could compel traders to adopt more conservative positions. Speculating on these trends requires a careful assessment of both political movements and market behaviors to make informed decisions in the fast-paced world of cryptocurrency.

Frequently Asked Questions

What caused the recent Bitcoin price drop during the crypto market reactions?

The recent Bitcoin price drop was largely attributed to President Trump’s executive order establishing a Strategic Bitcoin Reserve. Following a surge that briefly pushed Bitcoin above $92,000, the announcement led investors to reevaluate the market implications, resulting in a 5.7% decline in less than an hour.

How did the Bitcoin price drop affect other cryptocurrencies in the market?

The Bitcoin price drop had a significant impact on other cryptocurrencies. Ethereum decreased by 6.1%, Solana by 6.8%, and Dogecoin by 5.8%. Binance’s BNB also fell by 3.6%, while Cardano experienced a steep decline of 13.8% during this period.

What is the significance of Trump’s Bitcoin executive order in relation to Bitcoin price fluctuations?

Trump’s Bitcoin executive order is significant as it allows the government to capitalize a Bitcoin reserve using seized assets. This policy has stirred market reactions, leading to short-term volatility in Bitcoin prices as investors assess its broader implications on cryptocurrency regulations and market stability.

What are the potential impacts of Bitcoin regulation on future price trends?

The introduction of Bitcoin regulation, as seen with Trump’s recent executive order, could lead to increased market stability in the long run. However, in the short term, regulations often result in price fluctuations and uncertainty as investors adjust to new policies, as evidenced by the Bitcoin price drop following the order.

How does the establishment of a Strategic Bitcoin Reserve affect investor sentiment towards Bitcoin?

The establishment of a Strategic Bitcoin Reserve may create mixed investor sentiments. While some may view it as positive progress for regulation and institutional acceptance, others might be concerned about government control over Bitcoin, leading to volatility and abrupt price drops as investors respond to these governance changes.

Why did Bitcoin’s price surge above $92,000 before the drop?

Bitcoin’s price surge above $92,000 was initially driven by speculation surrounding the government’s potential embrace of digital assets versus traditional regulations. The excitement about the Strategic Bitcoin Reserve contributed to a bullish market sentiment before the subsequent price drop as reality set in regarding the implications of such governmental actions.

What does the recent Bitcoin price drop indicate about current cryptocurrency market trends?

The recent Bitcoin price drop indicates a cautious approach among investors amidst shifting cryptocurrency market trends. As regulations evolve and government policies are proposed, traders are likely to react swiftly, illustrating the volatile nature of the crypto market and the need for ongoing analysis of external factors influencing prices.

How can Bitcoin price fluctuations relate to federal government actions?

Bitcoin price fluctuations are closely related to federal government actions, such as regulatory developments or executive orders. These actions can fundamentally alter investor perception and market dynamics, leading to rapid increases or decreases in Bitcoin prices as seen with Trump’s executive order and subsequent market reactions.

| Metric | Bitcoin | Ethereum | Solana | Dogecoin | Binance’s BNB | Cardano |

|---|---|---|---|---|---|---|

| Price Change | -$5,700 (-5.7%) | -$136 (-6.1%) | -$56 (-6.8%) | -$0.012 (-5.8%) | -$21.37 (-3.6%) | -$0.13 (-13.8%) |

| Current Price | $87,200 | $2,100 | N/A | N/A | $576 | $0.81 |

| Market Reaction | Partially rebounds after executive order | Falling alongside Bitcoin | Falling alongside Bitcoin | Falling alongside Bitcoin | Falling alongside Bitcoin | Significant decline versus other tokens |

| Government Policy Impact | Strategic Bitcoin Reserve initiated | N/A | N/A | N/A | N/A | N/A |

Summary

The recent Bitcoin price drop has been significantly influenced by President Trump’s Strategic Reserve Order, leading to a 5.7% decline as the market reacted to this government policy. The creation of a Bitcoin reserve funded by seized assets has stirred mixed feelings among investors, resulting in a notable sell-off after a brief surge earlier in the week. With the cryptocurrency experiencing fluctuations due to these developments, market participants are now eagerly awaiting further announcements on the government’s approach to managing its new Bitcoin holdings.

The recent Bitcoin price drop has sent shockwaves throughout the cryptocurrency market, highlighting the volatility inherent in digital asset trading. Following President Trump’s executive order establishing a Strategic Bitcoin Reserve, Bitcoin experienced a steep decline of 5.7% in just an hour, closing in on $87,200. While it had briefly surged past $92,000 amid excitement over regulatory developments, this abrupt shift underscores the complex interplay between cryptocurrency market trends and governmental policies. As investors react to the implications of Bitcoin regulation and the potential for future market fluctuations, the sentiment remains cautious. This situation not only reflects investor nerves—but also highlights broader trends influencing the entire crypto market, including reactions to significant political announcements.

The plummeting value of Bitcoin, often dubbed the leading digital currency, marks a significant moment for the entire blockchain ecosystem. Following the announcement of a novel Strategic Bitcoin Reserve initiative by the government, stakeholders in the cryptocurrency domain are closely observing how such regulations will shape Bitcoin’s future. This executive order, part of a broader effort to manage digital assets, has sparked discussions about its potential consequences on the crypto market and general financial conditions. Investors are now evaluating the ramifications of this directive—and the role of such measures—on the ongoing fluctuations in the cryptocurrency landscape. With every new development, the quest for insight into how these changes will affect trading strategies remains pivotal for participants within the crypto sphere.