Bitcoin price analysis has become increasingly crucial as recent market movements showcase volatility influenced by broader investor behavior. The latest decline in BTC’s value can be closely linked to changes in the Coinbase Premium, which sheds light on U.S. crypto whales’ actions. Recent data indicates a significant drop in this premium, revealing heightened selling activity among institutional investors and high-net-worth individuals. As the Bitcoin trading trends evolve, it’s essential to analyze how these shifts impact potential BTC price corrections and investor sentiment. Understanding these dynamics may provide valuable insights for those monitoring the market closely.

When examining the dynamics surrounding Bitcoin, it is imperative to consider the intricate factors affecting its market value. The fluctuations in the cryptocurrency’s price, particularly the noticeable downturn, can often be attributed to the behaviors of major American investors and market giants. Observing the differences in Bitcoin’s pricing across various platforms, notably in relation to the Coinbase exchange, gives a clear perspective on trading tendencies among institutional buyers. Such price movements often signal crucial indicators of future corrections and can reveal the sentiment of prominent U.S. crypto players. By delving into these elements, both seasoned traders and new investors can gain clearer insights into the ongoing developments in the Bitcoin landscape.

Understanding Bitcoin Price Analysis

Bitcoin price analysis is critical for both traders and investors seeking to make informed decisions in the ever-changing cryptocurrency market. The recent downturn in Bitcoin’s price underscores the importance of careful analysis of market indicators, such as the Coinbase Premium. By examining these trends, traders can gauge investor sentiment and assess potential market movements effectively. A firm understanding of these price dynamics helps investors navigate the complexities of Bitcoin trading and anticipate future price corrections.

Historically, Bitcoin has shown substantial volatility, which makes continuous price analysis essential. The recent drop in the Coinbase Premium to -5.07 is a significant signal of potential bearish activity among U.S. investors. As deviations in price signals arise, particularly around critical levels like $100,000, they can affect broader trading trends and investor behavior. Understanding how institutional investors and U.S. crypto whales influence Bitcoin prices provides invaluable insights into trading patterns.

The Impact of Coinbase Premium on Market Sentiment

Coinbase Premium is an essential metric for gauging U.S. investor sentiment in the cryptocurrency market. A decrease in this premium often indicates that major players, including institutional investors and high-net-worth traders, are selling off their assets. The current negative reading suggests that American investors are experiencing heightened caution, potentially contributing to the overall bearish sentiment surrounding Bitcoin prices. Observing such metrics enables traders to adapt their strategies in response to evolving market conditions.

As indicated by recent analysis, a sustained negative Coinbase Premium can pose increased short-term risks for Bitcoin prices. Whenever domestic whales decide to offload large quantities of Bitcoin, it can create significant downward pressure on the asset’s value. This information is crucial for investors aiming to capitalize on price fluctuations while mitigating risks associated with potential corrections. By staying informed about changes in market sentiment reflected through the Coinbase Premium, traders can make more strategic moves.

US Crypto Whales and Their Effects on Bitcoin Trading Trends

U.S. crypto whales play a pivotal role in shaping Bitcoin trading trends, as their decisions can significantly impact market prices. Recent observations suggest that these large-scale investors have begun to ease their participation in the market, leading to increased selling pressure. This withdrawal aligns with a historical pattern where significant price corrections often follow such behaviors, indicating that whales are reacting to changing economic factors or profit-taking scenarios.

The influence of American whales extends beyond just price movements; it also affects overall market liquidity and sentiment. During periods of rapid price appreciation, like the recent rally toward $98,000, whales may aggressively buy, pushing prices higher. Conversely, when the market appears to be topping out, as seen now, they may choose to sell, leading to sharp corrections. Understanding these dynamics allows smaller investors to anticipate big shifts in Bitcoin trading trends, which is vital for their investment strategies.

Indicators of Bitcoin’s Price Correction

The indicators of Bitcoin’s price correction are multi-faceted and include various market metrics and trader behaviors. The recent Bitcoin price drop has been linked to specific catalysts, including the significant decline in the Coinbase Premium. With the premium now in negative territory, it reinforces the notion that there may be a looming bearish trend. Traders should pay careful attention to these corrective signals as they may help forecast future price movements.

Moreover, analysis of Bitcoin’s price correction must take into account broader market conditions, including external economic factors. Amid fluctuations in investor behavior and declining market enthusiasm, Bitcoin’s trajectory appears to be influenced by larger economic heats. A comprehensive understanding of these indicators will enable traders to better navigate potential buying and selling opportunities and to remain ahead of price trends in this volatile landscape.

Institutional Investors’ Role in Bitcoin Market Dynamics

Institutional investors are becoming increasingly influential in the Bitcoin market, often acting as trendsetters that can sway retail investor sentiment. The recent actions of these large wallets demonstrate caution, particularly with the noticeable dip in the Coinbase Premium signaling revoking interest. As institutional money holds substantial sway over market pricing and movements, understanding their motives and investment strategies becomes crucial for other market participants.

In times of economic uncertainty or market corrections, institutional investors generally adopt more conservative strategies, which can directly impact Bitcoin’s liquidity and valuation. As evidenced by the current market, when institutional players offload their holdings, it can lead to cascading effects on price valuations across exchanges. Keeping a close eye on institutional investor movements can provide retail traders with insights into future market trends, helping them formulate better trading strategies.

Monitoring Bitcoin’s Current Market Movements

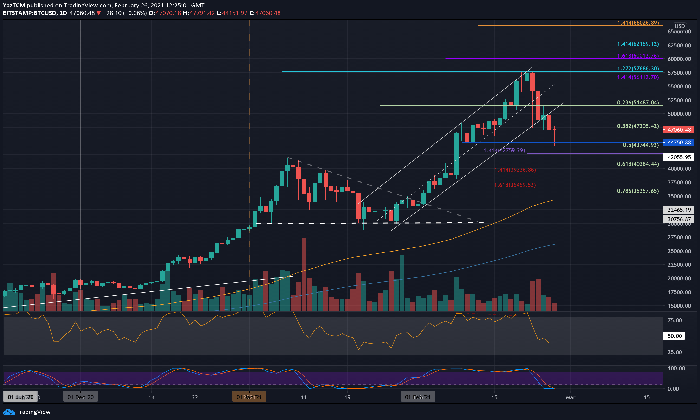

Real-time monitoring of Bitcoin’s market movements is essential for traders and investors looking to capitalize on price volatility. Bitcoin is currently experiencing slight fluctuations around a price of approximately $94,294, showing a modest decline over the past days. This mirrors the overall trend of the crypto market, portraying a similar contraction amid varying levels of enthusiasm and participation across investor groups.

The latest price actions reflect the volatile nature of Bitcoin, where dramatic surges and drops can occur rapidly based on market sentiment and external economic factors. Analyzing these movements with respect to support levels, such as the crucial $93,000 mark, can help traders identify strategic buying or selling opportunities. Continuous assessment of market trends enables informed decision-making while navigating the unsteady waters of cryptocurrency investments.

The Psychological Price Levels of Bitcoin

Psychological price levels play an important role in how traders view Bitcoin’s valuation and subsequent trading decisions. The recent attempt of Bitcoin to surpass the $100,000 threshold signifies a key psychological barrier for many investors. Such levels can ignite either bullish enthusiasm or bearish caution, influencing trading behavior significantly. Recognizing the importance of these threshold values enables traders to anticipate potential reactions from the market.

Moreover, disruptions around psychological levels can lead to significant price adjustments. For example, as Bitcoin approached $100,000, it attracted media attention and investor speculation, often leading to sudden buyouts or sell-offs. Understanding how the community responds to these price points can refine traders’ strategies, allowing them to align their actions with prevailing market psychology to optimize their outcomes.

Volatility and Its Implications for Bitcoin Investments

Volatility is a defining characteristic of the Bitcoin market, influencing both risk and opportunity for investors. The current fluctuation in Bitcoin’s price vividly exemplifies this characteristic, as traders navigate sharp upturns followed by sudden corrections. For investors, this volatility presents both challenges and prospects for substantial returns, underscoring the necessity for well-calibrated investment strategies.

In understanding Bitcoin’s volatility, investors should acknowledge factors contributing to these price swings, such as macroeconomic developments and changes in market sentiment driven by U.S. whales. By staying attuned to such volatile movements, traders can make more informed decisions, particularly in timing their entries and exits in the market to maximize their profits while minimizing risks.

Future Predictions for Bitcoin’s Price Trajectory

Future predictions concerning Bitcoin’s price trajectory are always fraught with uncertainty, yet they form an essential part of strategic investment planning. Analysts currently observe a mix of bearish sentiment and potential rebound signals indicated by previous performance. If Bitcoin manages to consolidate above the crucial support levels around $93,000, it could stabilize and align investor confidence for a rebound towards the $100,000 mark.

Furthermore, the role of external factors, such as regulatory developments and market liquidity, will be vital in shaping Bitcoin’s future price path. Traders must remain vigilant, honing their strategies while incorporating these predictive elements into their trading plans. By understanding trends and potential headwinds, market participants can position themselves optimally for the inevitable swings that characterize the cryptocurrency landscape.

Frequently Asked Questions

What does the Coinbase Premium indicate in Bitcoin price analysis?

The Coinbase Premium is a key indicator in Bitcoin price analysis that measures the price difference between Bitcoin on Coinbase compared to other global exchanges. A rising Coinbase Premium often reflects bullish sentiment from U.S. investors, while a declining premium, like the recent drop to -5.07, can signal increasing selling pressure and bearish sentiment among American whales.

How do US crypto whales affect Bitcoin trading trends?

US crypto whales significantly impact Bitcoin trading trends as their buying and selling actions can sway market sentiment and pricing. Recently, observations of whales offloading their holdings have coincided with a decline in Bitcoin’s price, indicating that these actions may be contributing to overall market corrections and leading to heightened volatility.

What role do institutional investors play in Bitcoin price corrections?

Institutional investors’ behavior is crucial in understanding Bitcoin price corrections, as they often have large holdings that can influence market movements. Their selling activities, particularly when signaled by drops in the Coinbase Premium, can enhance bearish market trends and contribute to notable price corrections in Bitcoin, like the recent downturn experienced after BTC attempted to soar past $100,000.

How can Bitcoin price analysis help predict market movements?

Bitcoin price analysis, incorporating metrics like the Coinbase Premium and trends among US crypto whales, helps predict market movements by assessing overall investor sentiment. By understanding the selling behavior of whales, analysts can gauge the likelihood of price corrections and potential bullish or bearish trends, aiding traders in making informed decisions.

What is the significance of Bitcoin’s behavior near the $100,000 level?

The $100,000 level is psychologically significant for Bitcoin traders, as it represents a major milestone. Recent Bitcoin price analysis showed a struggle for BTC to maintain momentum past this threshold, coinciding with changes in the Coinbase Premium. Ideally, a sustained hold above this level could indicate bullish market conditions, while failure to do so might suggest impending price corrections driven by bearish sentiment.

| Key Points |

|---|

| Bitcoin’s price weakness may result from U.S. whales selling their holdings. |

| Coinbase Premium has dropped to -5.07, indicating Bitcoin is trading at a discount on U.S. exchanges. |

| The negative premium signals bearish sentiment among U.S. investors and increased short-term downside risk. |

| Current Bitcoin price is approximately $94,294, with a 0.4% drop in the last 24 hours and 0.9% dip over the past week. |

| Despite minor short-term corrections, Bitcoin still shows positive performance over the last month and year, increasing by 13.6% and 44.7%, respectively. |

Summary

Bitcoin price analysis indicates that the recent decline in Bitcoin’s value may not solely stem from macroeconomic factors. Instead, it appears to be significantly influenced by selling pressures from American whales, as highlighted by the crashing Coinbase Premium, now sitting at -5.07. This suggests a distinct shift in U.S. investor sentiment, particularly among institutional traders. The combination of a challenging resistance at $95,000 and negative sentiment on domestic exchanges suggests caution for potential investors. Despite these short-term fluctuations, the overall trend remains positive when considering the monthly and yearly performance of Bitcoin.

Bitcoin price analysis reveals a nuanced landscape, where recent market fluctuations may stem more from U.S. crypto whales’ strategic sales rather than broader economic fears. The notable decline in the Coinbase Premium—decreasing to a striking -5.07—suggests a shift in sentiment among American investors, indicating an increase in Bitcoin selling pressure. Institutional investors and high-net-worth traders appear to be offloading their BTC holdings, coinciding with Bitcoin’s struggle near the critical $100,000 mark. Furthermore, the bearish outlook, reflected in current Bitcoin trading trends, raises concerns about a potential BTC price correction. As market participants navigate this volatile atmosphere, understanding these dynamics is crucial for predicting future price movements and investment strategies.

When exploring recent Bitcoin market dynamics, one could consider the analysis of Bitcoin pricing through a lens focused on its trading behaviors and investor sentiments. The disparity in Bitcoin values between exchanges—often highlighted by metrics such as the Coinbase Premium—sheds light on the activities of large-scale U.S. crypto investors. In particular, observations about American crypto whales discretely adjusting their holdings can illuminate current Bitcoin trading trends. As institutional players react to market pressures, the implication of these adjustments may suggest forthcoming volatility or stabilization in BTC price trends. A deeper understanding of these patterns, especially in relation to price corrections and overall market equilibrium, is vital for anyone engaged in cryptocurrency investment.