Bitcoin is becoming increasingly deflationary as institutional investors, particularly through entities like Strategy, significantly alter Bitcoin market dynamics. With Strategy accumulating Bitcoin at a pace that surpasses the total miner output, analysts note an impressive annual deflation rate of -2.33%. This surge in institutional Bitcoin purchases not only restricts available supply but also solidifies Bitcoin’s role as a treasury asset for many organizations combating fiat currency inflation. Market analysts have observed that Strategy’s holdings alone can lead to further deflation, with this growing trend likely enticing more investors to adopt a Bitcoin treasury plan. As the institutional landscape evolves, the implications for crypto deflation are profound, raising questions about Bitcoin’s future pricing and volatility enhancements in the digital asset market.

The phenomenon of Bitcoin’s diminishing supply has sparked considerable interest as large-scale entities begin to reshape the crypto landscape. Terms like ‘digital scarcity’ and ‘inflation hedging’ provide alternative perspectives on Bitcoin’s potential as fiscal strategy amidst fluctuating financial markets. As large investors adopt comprehensive strategies to accrue Bitcoin, the traditional currency systems find themselves challenged in how they retain value. The confluence of corporate interest and digital currencies signals an era where institutional purchases could redefine Bitcoin’s role in both portfolios and broader economic environments. As financial giants integrate Bitcoin into their investment frameworks, questions about market stability and future valuations loom larger than ever.

Understanding Bitcoin’s Deflationary Nature

Bitcoin’s deflationary nature has recently gained attention as institutional purchases significantly alter the market dynamics. As new entities and traditional financial companies like Strategy engage in aggressive accumulation, the supply of Bitcoin becomes increasingly limited. Notably, Strategy’s treasury plan involves purchasing Bitcoin at a remarkable pace, successfully surpassing the daily output by miners. This approach not only contributes to the deflationary pressure on Bitcoin’s economy but also raises the prospect of artificially inflating Bitcoin’s value due to restricted supply.

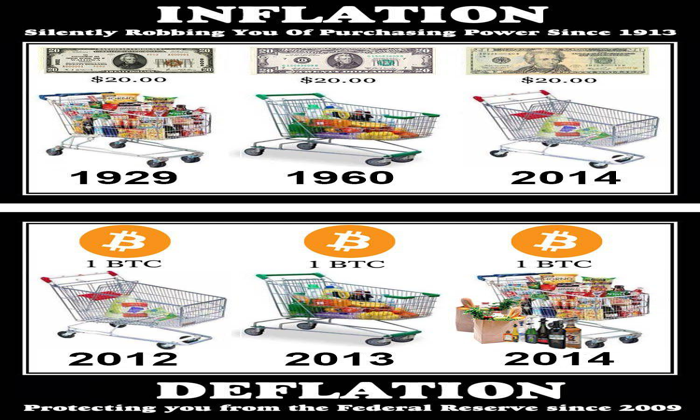

The implications of Bitcoin being deflationary are profound. With a recorded annual deflation rate of -2.33%, the asset contrasts sharply with traditional currencies that often face inflation. As Bitcoin’s supply diminishes, its scarcity intensifies, leading to heightened interest among investors who perceive it as a hedge against inflation and economic uncertainty. This perception aligns with institutional market trends where entities are increasingly diverting their investments into Bitcoin as part of a more expansive ‘Bitcoin treasury plan’ strategy.

Institutional Bitcoin Purchases and Market Dynamics

The impact of institutional Bitcoin purchases on market dynamics cannot be overstated. Entities like Strategy are leading the charge, acquiring vast amounts of BTC, which reformulates the landscape of digital asset investment. By absorbing newly minted Bitcoin faster than the miners can produce, institutional holders contribute to a tightening supply, ultimately driving prices upwards. Bitcoin market dynamics are not solely influenced by retail investors—large-scale buyers play an essential role in the evolution of this market as they establish precedents for institutional adoption.

Moreover, institutional interest has fostered a new wave of confidence in Bitcoin. With hedge funds and major corporate entities recognizing BTC as a viable treasury asset, the narrative surrounding Bitcoin continues to evolve. The volatility associated with BTC may also be stabilized through consistent institutional inflows, which help inject significant capital into the market. This new era of institutional investment signals a shift, inviting traditional finance into the cryptocurrency space and paving the way for broader acceptance and integration.

The Role of Strategy in Institutional Bitcoin Accumulation

Strategy’s approach to Bitcoin accumulation exemplifies the evolving nature of institutional investment in digital assets. By generating funds through corporate debt and equity offerings to purchase Bitcoin, Strategy effectively bridges the gap between traditional finance and the cryptocurrency ecosystem. This innovative strategy not only provides them with significant purchasing power but also reinforces the notion that Bitcoin can serve as a legitimate asset class within a diversified portfolio.

Furthermore, Strategy’s ongoing acquisitions have resulted in a substantial proportion of Bitcoin becoming illiquid, as the company has pledged not to sell its amassed holdings, which are currently nearing 555,000 BTC. This predilection for long-term holding further exacerbates deflationary pressure on Bitcoin’s supply, impacting market dynamics by creating an environment of scarcity. As traditional investors look to secure their stake in a deflationary asset, Strategy’s influence in the crypto market could lead to unprecedented levels of Bitcoin adoption.

Impact on Bitcoin Price and Volatility

The accumulation trend driven by institutional players like Strategy is significantly impacting Bitcoin’s price trajectory and volatility. With more than 2,087 BTC being purchased daily by Strategy versus the 450 BTC daily mined, the market is witnessing a synthetic halving effect. This increased demand from institutions raises prospects of price appreciation while further stabilizing the asset by smoothing out high volatility typically associated with cryptocurrency markets.

As more funds flow into Bitcoin via institutional purchases and financial instruments like ETFs, the market’s price action shows potential for greater stability. This influx of capital from traditional financial markets helps mitigate the adverse effects of downturns, providing a buffer for investors facing market corrections. Consequently, the synergy between institutional investment and the Bitcoin ecosystem creates a climate where price fluctuations can be anticipated and managed more effectively.

Challenges of Institutional Participation in Bitcoin

Despite the robust potential for institutional Bitcoin purchases, challenges remain that could impede further market expansion. Notably, the absence of comprehensive cryptocurrency regulations in the US poses a significant barrier to adopting Bitcoin as a treasury asset among sovereign wealth funds and other major institutional players. Anthony Scaramucci of SkyBridge has highlighted that the delay in regulatory clarity is a deterrent for these investors, who are poised to contribute significantly to the Bitcoin ecosystem once such frameworks are established.

This lack of regulatory oversight not only affects the willingness of large-scale investors to buy Bitcoin but also influences general market sentiment. The uncertainty surrounding compliance, taxation, and other legal aspects complicates investment decisions for institutions contemplating a significant stake. Until comprehensive regulations are in place, the massive influx of capital required to fuel Bitcoin’s growth might remain on hold, highlighting the necessity for coordination between regulators and market participants.

Future Outlook for Bitcoin and Institutional Adoption

Looking ahead, the future of Bitcoin appears closely intertwined with the trajectory of institutional adoption. As entities like Strategy continue to champion the cause of Bitcoin, we may see a ripple effect that encourages more companies to explore a ‘Bitcoin treasury plan.’ This evolution towards mainstream acceptance relies heavily on overcoming obstacles related to regulation, liquidity, and investment confidence.

Moreover, the future of Bitcoin as a deflationary asset will likely hinge upon the sustainability of institutional interest. As these players leverage the cryptocurrency for portfolio diversification, Bitcoin’s price could reach new heights, thereby solidifying its position as a prefered asset in a world of rising fiat inflation. Ultimately, the synergy between regulations and institutional strategies could yield a promising horizon for Bitcoin, reflecting its growing importance within the broader financial landscape.

The Benefits of a Bitcoin Treasury Plan

Implementing a Bitcoin treasury plan offers companies several advantages, particularly in terms of financial strategy and risk management. By holding BTC as part of their treasury, firms can position themselves to benefit from Bitcoin’s deflationary nature, which may enhance their overall asset valuation over time. This strategy enables businesses to hedge against inflationary pressures faced by fiat currencies, thereby promoting long-term financial stability.

Moreover, a Bitcoin treasury plan aligns with contemporary investment trends that prioritize digital assets as essential components of a well-rounded portfolio. Companies can diversify their holdings and tap into the potential for significant appreciation that Bitcoin offers as a high-demand asset, especially amid upward pressures derived from institutional purchases. Consequently, firms adopting this strategy position themselves advantageously in a rapidly evolving financial landscape, ready to leverage emerging opportunities.

Cryptocurrency Regulations and Market Stability

The development of solid regulatory frameworks is crucial in stabilizing the cryptocurrency market, especially as institutional adoption of Bitcoin grows. Clear guidelines can foster confidence among institutional investors who may be hesitant due to the lack of regulatory clarity. Establishing a secure regulatory environment will not only promote investment but also ensure that the Bitcoin market operates transparently, minimizing risks of fraud and manipulation.

Furthermore, regulation can help protect investors while encouraging the participation of major financial players in the Bitcoin ecosystem. By establishing trust and accountability, the regulatory landscape can attract more capital into the market, potentially driving demand and prices higher. A well-regulated Bitcoin market could ultimately see a further reduction in volatility, enhancing its appeal as a viable investment alternative to traditional assets.

Navigating Bitcoin Market Dynamics with Institutional Insights

Understanding the market dynamics of Bitcoin in the context of institutional investment is vital for investors aiming to navigate this complex landscape. Institutional insights provide a broader perspective on market movements and trends, highlighting factors that influence Bitcoin’s price, including demand from treasury companies and traditional financial markets. Keeping abreast of institutional strategies helps investors identify potential opportunities and risks associated with their Bitcoin investments.

Additionally, as more institutions enter the Bitcoin space, it’s essential to recognize that their actions can significantly sway market direction. Investor sentiment, driven by institutional participation, sets the tone for the broader market. Thus, paying attention to these dynamics equips investors with the knowledge to time their entry and exit better, ultimately maximizing their returns in the ever-evolving Bitcoin ecosystem.

Frequently Asked Questions

How is Bitcoin deflationary due to institutional purchases?

Bitcoin has become deflationary primarily due to significant institutional buying, such as that by the company Strategy. This entity is acquiring Bitcoin at a rate that exceeds total miner output, shifting the dynamics of the Bitcoin market. With a deflation rate of approximately -2.33% annually, institutional purchases are restricting supply and potentially increasing value over time.

What role does the Strategy Bitcoin treasury plan play in Bitcoin deflation?

The Strategy Bitcoin treasury plan plays a crucial role in Bitcoin deflation by accumulating 555,000 BTC, which is considered illiquid with no intended sales. This accumulation results in less Bitcoin available in the market, directly contributing to a deflationary pressure on Bitcoin prices as demand continues to outpace supply.

How do Bitcoin market dynamics change with institutional investments?

Institutional investments have fundamentally changed Bitcoin market dynamics by introducing large-scale accumulation strategies. Companies like Strategy are buying Bitcoin in large quantities, leading to a supply shock that affects prices and volatility. This shift is causing a more stable investment environment for Bitcoin and potentially increasing its value.

What is crypto deflation, and how does it relate to Bitcoin?

Crypto deflation refers to the decreasing supply of cryptocurrency assets, which in Bitcoin’s case is worsened by increasing institutional purchases. As organizations like Strategy buy up Bitcoin, the effective market supply declines, resulting in deflationary characteristics, notably in price appreciation driven by scarcity.

Why are institutional Bitcoin purchases impacting Bitcoin’s price stability?

Institutional Bitcoin purchases are impacting price stability by injecting significant capital into the market through large, coordinated buys. Companies like Strategy have made Bitcoin a part of their treasury strategy, smoothing out volatility by stabilizing supply against solid institutional demand, ultimately leading to less severe market downturns.

What effects do large-scale Bitcoin acquisitions have on volatility?

Large-scale Bitcoin acquisitions, particularly by institutions like Strategy, reduce volatility by limiting the available supply and increasing demand. As these organizations acquire BTC at rates exceeding miner production, they create a more predictable market, leading to less price fluctuations and a more solid investment landscape for Bitcoin.

How does Strategy’s Bitcoin accumulation create synthetic halving?

Strategy’s Bitcoin accumulation creates synthetic halving by purchasing Bitcoin at a rate that significantly exceeds miner output. For instance, accumulating an average of 2,087 BTC daily against a miner output of 450 BTC leads to an artificial supply reduction effect, mimicking the impact of a halving event in Bitcoin’s supply schedule.

What challenges do institutional investors face in increasing Bitcoin purchases?

Institutional investors face regulatory uncertainties as a major challenge in increasing Bitcoin purchases. Notably, Anthony Scaramucci of SkyBridge highlights that sovereign wealth funds are waiting for a clear regulatory framework in the US before committing more significantly to Bitcoin investments, which could trigger larger purchases and price increases.

How does Bitcoin deflation impact the long-term value predictions?

Bitcoin deflation, driven by institutional demand and limited supply, often leads to predictions of long-term value increase. As entities like Strategy hold significant amounts of Bitcoin without intentions to sell, the scarcity enhances Bitcoin’s investment allure, leading market analysts to forecast upward price trends.

How are traditional financial markets influencing Bitcoin’s deflationary nature?

Traditional financial markets influence Bitcoin’s deflationary nature by providing capital inflows into crypto assets. Strategies that involve selling corporate debt and equity to fund Bitcoin purchases create a bridge between these markets and Bitcoin, amplifying institutional buying pressure that drives deflation in Bitcoin’s market supply.

| Key Point | Details |

|---|---|

| Deflationary Status | Bitcoin shows a -2.33% annual deflation rate due to institutional buying. |

| Institutional Accumulation | Strategy is purchasing Bitcoin faster than miners, accumulating over 555,000 BTC. |

| Market Dynamics | Institutional investments are changing Bitcoin’s trading landscape, increasing demand and decreasing available supply. |

| Bitcoin Halving Effect | Strategy’s buying exceeds 2,087 BTC daily, impacting miner output of 450 BTC. |

| Institutional Diversification | Various institutions are now using BTC as a hedge against fiat inflation. |

| Regulatory Considerations | Sovereign wealth funds await clearer regulations before increasing Bitcoin purchases. |

Summary

Bitcoin deflationary status is significantly influenced by institutional buying strategies, particularly by firms like Strategy, which accumulates Bitcoin at a remarkable rate. This purchasing power outpaces miner output and creates a scarcity effect in the market. As a result, Bitcoin is not only experiencing a deflation rate but also setting the stage for increased prices due to reduced supply. With the ongoing trend of institutional investment and potential regulatory clarity, the future dynamics of Bitcoin markets are poised for transformative changes.

Bitcoin, now deflationary due to institutional Bitcoin purchases, is transforming the landscape of the cryptocurrency market. Major entities like the treasury company Strategy are rapidly accumulating Bitcoin, which is outpacing the total miner output, leading to a remarkable deflation rate of -2.33% annually. This significant shift alters Bitcoin market dynamics as it decreases the available supply, ultimately driving prices higher and dampening volatility. Prominent figures in the financial world, such as Michael Saylor, are championing the idea of a Bitcoin treasury plan, encouraging more institutional investments in this scarce digital asset. As more organizations participate in crypto deflation, the future of Bitcoin looks promising, with a collective move toward institutional adoption reshaping traditional investment strategies.

The evolution of Bitcoin as a deflationary asset marks a pivotal shift in financial landscapes. The recent surge in institutional interest — synonymous with organized Bitcoin investments from large entities — signals a change in how digital currencies are perceived. Analysts are increasingly recognizing that companies, particularly those like Strategy, are implementing robust strategies to accumulate Bitcoin, effectively diminishing the circulating supply. This phenomenon, often referred to as crypto deflation, impacts the Bitcoin market’s dynamics profoundly, paving the way for prices to stabilize and potentially escalate. With an increasing number of institutions adopting the cryptocurrency as a treasury asset, the implications for market volatility and price sustainability are significant.