Berachain proof of liquidity has officially launched, marking a groundbreaking development for this innovative bear-themed layer-1 blockchain. With the introduction of reward vaults, the BERA token has soared, achieving a remarkable 14% surge in just a single day, allowing it to break into the top 100 cryptocurrencies by market capitalization. This milestone demonstrates how Berachain’s proof of liquidity consensus is transforming the crypto space, providing a fresh perspective on decentralized finance. Utilizing both the BERA token for network security and BGT as the governance token, Berachain creates a unique ecosystem where liquidity is incentivized and rewarded. As users engage with crypto liquidity vaults, the potential for sustainable growth within Berachain’s vibrant network is becoming increasingly evident.

The recent activation of the liquidity confirmation system within Berachain resonates with the broader trend of innovative consensus models in the blockchain industry. This mechanism combines features of traditional proof of stake while introducing a new paradigm focused on liquidity provision and reward dynamics. By leveraging the BERA token alongside the BGT governance asset, Berachain is steering towards greater community involvement in decision-making processes. This tailored approach not only fuels the ecosystem but also enhances the functionality of decentralized applications (dapps) in a rapidly evolving crypto landscape. As a result, the interconnection between liquidity and governance within Berachain is poised to reshape opportunities for investors and users alike.

Understanding Berachain’s Proof of Liquidity

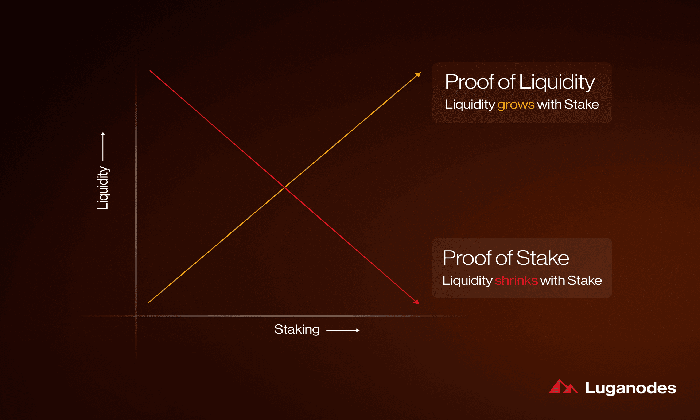

Berachain has introduced an innovative proof of liquidity consensus mechanism, which marks a significant evolution in blockchain technology and governance. This system allows validators to stake the BERA token, ensuring network security and facilitating block proposals. By creating a decentralized infrastructure, Berachain enables participants in its ecosystem to actively contribute to liquidity pools, which plays a crucial role in the overall health of the network. This shift towards a proof of liquidity model not only enhances user engagement with the BERA token but also promotes stability and growth within the Berachain ecosystem.

The core concept of proof of liquidity revolves around combining two tokens: BERA and BGT. BERA is utilized for transaction fees and network operations, whereas BGT serves as a governance token, granting holders voting rights on important network proposals. This dual-token system incentivizes validators to participate actively, as they can earn rewards from both their staking activities and their contributions to liquidity vaults. As a result, Berachain is paving the way for a more integrated approach to blockchain governance and liquidity management.

Frequently Asked Questions

What is Berachain proof of liquidity and how does it work?

Berachain proof of liquidity is a consensus mechanism similar to proof of stake that incentivizes liquidity provision within the Berachain network. It utilizes two tokens: BERA for transaction fees and network security, and BGT as a governance and reward token. Validators stake BERA, earn BGT, and provide liquidity to reward vaults, enabling users to earn rewards by staking their assets.

How did the launch of Berachain proof of liquidity affect the BERA token?

The launch of Berachain proof of liquidity had a significant positive impact on the BERA token, causing its price to increase by 14% within a day and leading to its entry into the top 100 cryptocurrencies by market cap, with a current valuation of approximately $858 million.

What are the benefits of using Berachain’s crypto liquidity vaults?

Berachain’s crypto liquidity vaults allow validators to stake BERA, earn BGT rewards, and provide liquidity, thus aligning incentives for network security and decentralization. Users can stake their assets in these vaults to earn rewards, making it an attractive option for liquidity providers.

How does the BGT governance token function within Berachain’s ecosystem?

The BGT governance token empowers holders to vote on proposals affecting the Berachain ecosystem, guiding its development and direction. As part of the proof of liquidity mechanism, users earn BGT by staking and providing liquidity, allowing for active participation in governance decisions.

What milestones has Berachain achieved with proof of liquidity?

Berachain marked a major milestone by launching its proof of liquidity on a Monday, unveiling 37 reward vaults and distributing BGT across its ecosystem. This launch has facilitated an increased market interest in the BERA token, propelling it into the top 100 cryptocurrencies by market capitalization.

Can anyone participate in Berachain’s proof of liquidity and reward vaults?

Yes, anyone can participate in Berachain’s proof of liquidity by staking BERA in the reward vaults. The network ensures an open environment, allowing more users and decentralized applications (dapps) to contribute to liquidity and governance through these vaults.

What future developments are expected for Berachain’s proof of liquidity mechanism?

Berachain plans to expand its proof of liquidity mechanism by introducing additional reward vaults shortly. This expansion aims to enhance liquidity provider participation and improve governance through increased BGT distribution, fostering sustainable growth within the ecosystem.

How does Berachain ensure security and economic value in its proof of liquidity model?

Berachain emphasizes security and economic value by carefully selecting participants based on their alignment with the network’s goals. Validators play a crucial role in securing the network through staking BERA and providing liquidity, thereby incentivizing responsible participation and governance.

What makes Berachain stand out in the crypto market?

Berachain stands out due to its innovative proof of liquidity mechanism, which combines the benefits of proof of stake with unique liquidity vaults. This approach not only attracts liquidity but also empowers users through governance with the BGT token, positioning it as a forward-thinking layer-1 blockchain.

Is the BERA token expected to grow further following the proof of liquidity launch?

Following the successful launch of the proof of liquidity, many analysts anticipate further growth for the BERA token, as its fundamental utility in the Berachain ecosystem, coupled with increased liquidity and governance engagement, could drive demand and price appreciation.

| Key Point | Description |

|---|---|

| Launch of Proof of Liquidity | Berachain launched its proof of liquidity consensus mechanism, introducing 37 reward vaults. |

| Token Performance | Following the launch, BERA token increased by 14%, reaching $8.03 and entering the top 100 cryptocurrencies by market cap. |

| Consensus Mechanism | Proof of liquidity is a variation of proof of stake, utilizing BERA for gas/network security and BGT for governance/rewards. |

| Validator System | Validators stake BERA to propose blocks and earn rewards in BGT, aligning incentives for securing the network. |

| Governance Token | BGT token holders can vote on ecosystem proposals, facilitating decentralized governance. |

| Growth Opportunities | The launch of reward vaults allows projects to attract liquidity and sustain growth through proof of liquidity. |

| Future Developments | A second batch of reward vault requests is expected to be voted on soon, further expanding the ecosystem. |

Summary

Berachain proof of liquidity is a groundbreaking advancement in the blockchain space, allowing for innovative reward mechanisms that leverage a unique consensus protocol. With the successful launch of 37 reward vaults and a significant spike in the BERA token’s market performance, the event marks a pivotal moment for Berachain. This new liquidity mechanism incentivizes validators and empowers users to engage more deeply with the network, supporting decentralized governance while encouraging sustainable growth. The enthusiasm surrounding Berachain is evident, and as the community anticipates further expansions and the next steps in governance, the promise of a robust and dynamic ecosystem becomes increasingly clear.

Berachain proof of liquidity has recently made waves in the cryptocurrency world as it introduces a groundbreaking consensus mechanism that leverages rewards and fosters sustainable growth within its ecosystem. Following this launch, the BERA token skyrocketed by 14%, propelling it into the top 100 cryptocurrencies by market capitalization. This innovative system utilizes a unique approach that combines the functionalities of both the BERA and BGT governance tokens, enhancing the ability of validators to provide robust liquidity through crypto liquidity vaults. With 37 reward vaults now live, participants can earn BGT rewards while staking their assets, promoting a dynamic interplay between users and the network. As Berachain establishes itself as a leader in the crypto landscape, the proof of liquidity framework is set to redefine how tokens are managed and governed, showcasing the potential for significant returns in this evolving market.

The launch of Berachain’s liquidity verification mechanism marks a pivotal advancement in blockchain technology, attracting attention for its innovative nuances. By integrating a system of reward vaults and multi-token dynamics, the platform empowers users to engage more actively in its governance structure with the BGT token. This new proof of liquidity framework not only bolsters confidence among users but also ensures a steady flow of assets vital for network functionality. Emphasizing decentralized finance, Berachain’s model stands to challenge traditional liquidity management strategies, making it an intriguing option among emerging layer-1 solutions. As the crypto ecosystem continues to evolve, Berachain’s approach could serve as a reference point for future developments in decentralized governance and liquidity verification.