Avalanche AVAX price analysis is at a pivotal moment as the cryptocurrency approaches the crucial $20 threshold, reflecting broader trends in the cryptocurrency market decline. This alarming situation has sent ripples through the digital asset space, prompting a wave of panic selling and investor withdrawal. Recent trends indicate that AVAX has struggled to maintain momentum after hitting the $34.40 resistance level, leading to concerns about its future performance. As the crypto fear and greed index hovers at 35, sentiment remains firmly entrenched in fear, further complicating the outlook. In this environment, Avalanche technical analysis reveals a bearish narrative, with indicators suggesting that the asset may be on the brink of a significant correction if resistance levels continue to hold strong.

The current evaluation of Avalanche’s AVAX token highlights a critical analysis of its pricing dynamics within the volatile cryptocurrency landscape. As the market grapples with significant declines, investor sentiment has shifted dramatically, causing many to reassess their positions in light of the prevailing fear-driven atmosphere. With technical indicators revealing potential resistance levels, the AVAX price prediction becomes increasingly complex, especially when factoring in the crypto fear and greed index. This comprehensive evaluation not only sheds light on the immediate challenges faced by AVAX but also emphasizes the importance of understanding on-chain metrics and market psychology in navigating these turbulent waters. As we delve deeper into Avalanche’s performance, it is essential to consider how these elements intertwine to shape future price movements.

Avalanche AVAX Price Analysis: Current Market Conditions

Avalanche (AVAX) is currently facing significant challenges as its price hovers dangerously close to the $20 mark. This precarious position arises amid a broader cryptocurrency market decline that has seen numerous digital assets reach multi-month lows. Investors are increasingly wary, leading to panic selling behavior that has swept through the ecosystem. The current state of AVAX reflects a larger trend in the crypto market, where fear and uncertainty dominate trading strategies.

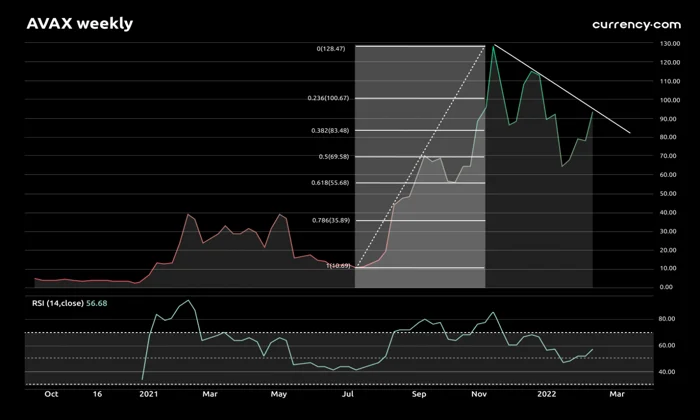

Analyzing the recent performance of AVAX, it is evident that the token has been in a consistent downtrend since February 1, following its failure to maintain momentum after encountering a resistance level at $34.40. Technical indicators, such as the Relative Strength Index (RSI), suggest that the token has entered oversold territory, which typically indicates a potential for price reversal. However, the prevailing negative readings in the Bull Bear Power (BBP) indicate that bearish forces remain firmly in control, implying that AVAX could face a more extended correction if this trend continues.

Frequently Asked Questions

What factors are influencing Avalanche AVAX price analysis amid the cryptocurrency market decline?

The current Avalanche AVAX price analysis indicates a significant impact from the overall cryptocurrency market decline. As digital assets experience multi-month lows, investor panic is leading to increased selling pressure. This environment has resulted in diminished support for AVAX, with key resistance levels, such as the $34.40 mark, going unbroken since February 1.

How does the AVAX resistance level affect future price predictions?

The AVAX resistance level, particularly around $23.60, plays a crucial role in future price predictions. This level is identified as a significant psychological barrier due to the concentration of over 128,000 addresses holding 3.31 million AVAX. If prices struggle to break through this resistance, further declines may be anticipated.

What does the crypto fear and greed index reveal about investor sentiment towards Avalanche AVAX?

The crypto fear and greed index currently stands at 35, indicating a shift towards extreme caution among investors regarding Avalanche AVAX. This level suggests heightened market anxiety, which could either serve as a potential entry point for contrarian investors or signal further declines if selling pressure continues.

How can Avalanche technical analysis help in understanding AVAX price movements?

Avalanche technical analysis reveals important indicators such as the Relative Strength Index (RSI) and Bull Bear Power (BBP). While the RSI indicates oversold conditions, suggesting a potential reversal, the negative BBP readings imply that bearish forces still dominate. This combination of indicators is crucial for predicting future AVAX price movements.

Is there any indication of a potential rebound in AVAX price despite current market conditions?

While Avalanche AVAX price analysis shows a bearish trend, the oversold RSI condition may hint at a potential rebound. However, the lack of significant buying activity and the ongoing resistance at critical levels suggest that any rebound may be short-lived unless market sentiment improves.

What role does on-chain data play in Avalanche AVAX price analysis?

On-chain data, particularly the In/Out of Money Around Price (IOMAP) analysis, is vital in Avalanche AVAX price analysis. It identifies key resistance levels where many holders are at a loss. This data indicates that selling pressure could increase, further complicating the price outlook for AVAX.

| Key Point | Details |

|---|---|

| Current Price Situation | Avalanche (AVAX) is close to the critical $20 mark amidst a market decline. |

| Market Sentiment | The Fear and Greed Index for AVAX is at 35, indicating a state of fear in the market. |

| Technical Analysis | RSI suggests oversold conditions, but Bear Power remains negative, indicating continued bearish control. |

| Resistance Levels | Significant resistance is at $23.60, with many holders at a loss possibly creating a ‘sale wall’. |

Summary

Avalanche AVAX price analysis indicates that the cryptocurrency is at a crucial turning point, facing significant resistance and negative market sentiment. With the price hovering near the $20 level and the Fear and Greed Index showing a score of 35, investors are experiencing heightened caution. Technical indicators suggest a bearish trend as the token struggles to regain momentum, potentially leading to extended corrections unless market conditions improve.

Avalanche AVAX price analysis reveals that the cryptocurrency is currently teetering on the edge, with its value hovering alarmingly close to the $20 threshold. This critical situation arises amidst a broader cryptocurrency market decline, where many digital assets are experiencing significant downturns and multi-month lows. Investor sentiment is shifting, leading to a wave of panic selling that is affecting Avalanche and other cryptocurrencies alike. As we delve into Avalanche’s technical analysis, we must also consider the implications of the AVAX price prediction, especially regarding its resistance levels. With the crypto fear and greed index signaling heightened anxiety, understanding the factors at play is essential for anyone looking to navigate this tumultuous market.

In assessing the current landscape of Avalanche’s digital asset, the AVAX token is facing a pivotal moment as it approaches a crucial support level. The ongoing decline across the cryptocurrency sector has exacerbated fears among investors, prompting a closer examination of the market dynamics influencing Avalanche. As analysts explore potential price trends, terms like AVAX resistance level and cryptocurrency market behavior become increasingly relevant. Furthermore, insights from the crypto fear and greed index serve as a barometer for market sentiment, indicating whether traders are feeling cautious or optimistic about future price movements. By leveraging Avalanche technical analysis, stakeholders can gain a clearer picture of potential outcomes and strategies moving forward.