Ethereum price analysis reveals a market grappling with the aftermath of a staggering $1.4 billion hack attributed to the notorious Lazarus Group. As of Sunday, Ethereum traded at $2,795, slightly above last week’s low of $2,665, yet still 32% lower than its peak in December. This situation has sparked interest in Bybit ETH balances, which have surged from a mere 61,000 to over 200,000, amounting to $558 million, indicating a potential recovery of user confidence. In light of these events, the ongoing discussions surrounding Ethereum price prediction have become increasingly relevant, especially regarding the safety of crypto cold wallet storage following the hack. As traders and investors analyze these developments, the focus on Ethereum’s trajectory could shape future investment strategies and market dynamics.

In the realm of cryptocurrency, assessing the current state of Ethereum’s market performance is crucial. The recent high-profile security breach involving the Lazarus Group has left many in the crypto community questioning the integrity of their holdings, particularly regarding crypto cold wallet safety. The fluctuations in Ethereum’s value, now standing at $2,795, have led to a notable increase in Bybit ETH balances, suggesting a shift in investor sentiment. As analysts delve into Ethereum price forecasts, they must consider the implications of this breach and its potential impact on investor trust. With the looming threat of further price declines, understanding these dynamics is essential for anyone looking to navigate the evolving landscape of digital currencies.

Ethereum Price Analysis After the Lazarus Group Hack

The recent hack by the Lazarus Group, which saw $1.4 billion worth of Ethereum stolen, has undoubtedly shaken investor confidence in the cryptocurrency market. Despite the turmoil, Ethereum’s price has shown resilience, trading at $2,795, a slight increase from last week’s low of $2,665. This stability is particularly noteworthy given that Ethereum is still hovering around 32% below its all-time high reached in December last year. Market analysts are closely monitoring the situation as the aftermath of the hack unfolds.

Coinglass data indicates an increase in Ethereum balances on Bybit, which suggests a growing interest from traders despite the recent hack. The balances surged to over 200,000 ETH, valued at approximately $558 million, after a significant drop following the incident. This rebound could point to a positive sentiment returning to the market, as traders potentially view this as a buying opportunity amidst ongoing concerns surrounding the security of their assets.

Frequently Asked Questions

What impacts have the Lazarus Group hack had on Ethereum price analysis?

The Lazarus Group hack, which involved a $1.4 billion theft, has significantly impacted Ethereum price analysis. Following the incident, Ethereum’s price fluctuated, trading at $2,795, just above last week’s low of $2,665. This hack raised concerns about the security of crypto assets, particularly in exchange cold wallets, affecting overall market confidence.

How do Bybit ETH balances influence Ethereum price prediction?

The rise in Bybit ETH balances, which increased from 61,000 to over 200,000 after the hack, suggests a potential rebound in market confidence. This could positively influence Ethereum price prediction, indicating that users are transferring ETH back to the exchange, possibly anticipating a price recovery.

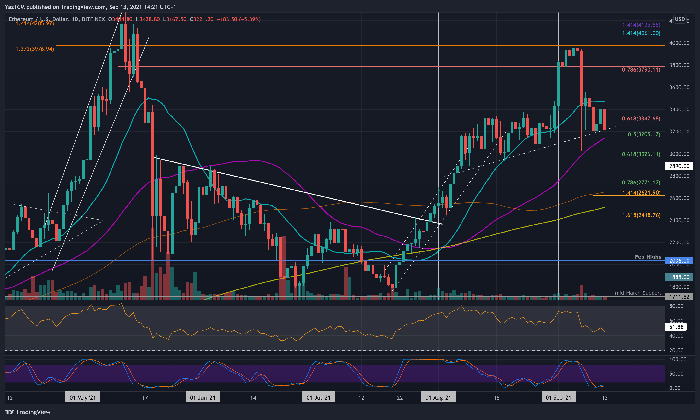

What is the significance of the death cross pattern in Ethereum price analysis?

The formation of a death cross pattern in Ethereum price analysis is a bearish signal. It occurs when the 200-day and 50-day weighted moving averages cross, indicating potential downward momentum. This pattern suggests that Ethereum may face a bearish breakdown, with a next support level around $2,155, which is about 23% below the current trading level.

How does the recent hack affect crypto cold wallet safety for Ethereum?

The Lazarus Group hack has raised significant concerns regarding crypto cold wallet safety for Ethereum and other cryptocurrencies. With $1.4 billion worth of ETH stolen, users are more cautious about storing assets in exchange wallets, prompting discussions about improving security measures in the crypto space.

What are the implications of Ethereum’s bearish flag chart pattern on its price analysis?

Ethereum’s bearish flag chart pattern indicates a continuation of downward momentum in its price analysis. This pattern, characterized by a consolidation phase following a sharp decline, suggests that Ethereum could experience further price drops, with critical support levels to watch closely.

| Key Points |

|---|

| Ethereum price held steady at $2,795 despite the $1.4 billion hack by the Lazarus Group. |

| Ethereum is currently about 32% below its December peak. |

| Balances on Bybit started rising, indicating potential recovery after the hack. |

| Bybit may be buying ETH to boost confidence, and is committed to covering losses from the hack. |

| Concerns have risen regarding the safety of crypto assets in cold wallets. |

| Daily charts indicate potential further decline, forming a ‘death cross’ pattern. |

| Bearish patterns suggest a possible drop to $2,155, a significant risk for Ethereum. |

| A bullish outlook depends on breaking above the 200-day moving average at $3,085. |

Summary

Ethereum price analysis reveals that while the cryptocurrency has remained stable at $2,795 following a significant hack, it faces potential challenges ahead. The recent rise in Ethereum balances on Bybit suggests a shift in market sentiment, yet technical indicators warn of a bearish trend. Investors should remain vigilant, as a drop to $2,155 could be on the horizon unless Ethereum can regain momentum and surpass critical resistance levels.

Ethereum price analysis is crucial for investors as it navigates through recent turbulence, particularly following the shocking $1.4 billion hack attributed to North Korea’s Lazarus Group. As of Sunday, Ethereum was trading at $2,795, slightly recovering from last Friday’s low of $2,665, but still languishing 32% below its peak in December. The aftermath of the hack has led to a surge in Ethereum balances on Bybit, climbing to over 200,000 ETH, valued at approximately $558 million, as users regain confidence in the platform. This rebound suggests that customers are either moving their ETH back to Bybit or that the exchange is actively purchasing tokens to reassure its user base. With discussions surrounding Ethereum price prediction and the implications of such security breaches, understanding the current market dynamics has never been more vital.

When examining the current state of Ethereum, it’s essential to consider the broader implications of recent events, particularly the massive security breach involving cold wallets. The hack, executed by the notorious Lazarus Group, has raised serious questions about crypto cold wallet safety and the overall security measures employed by exchanges. Following this unsettling incident, the balance of Ethereum on platforms like Bybit indicates a potential recovery, as users seem to trust the exchange’s commitment to compensating for losses. Investors are now closely watching Ethereum’s price movements, as technical indicators suggest it may be on the brink of a significant downturn. As discussions around Ethereum price forecasts intensify, the market remains vigilant, reflecting on the lessons learned from this security failure.