Bitcoin price analysis reveals a tense moment in the cryptocurrency market as Bitcoin (BTC) struggles just below critical resistance levels. In the past week, BTC faced rejections around the $86,000 range, signaling significant investor uncertainty and a lack of momentum. Despite the absence of major price pullbacks, the prolonged sideways movement could indicate potential opportunities for savvy traders to capitalize on upcoming shifts. Market analysts, including the renowned Daan Crypto, have employed technical analysis to dissect current Bitcoin market trends and identify pivotal resistance barriers that must be overcome for a breakout. As investors keep a close watch on key metrics such as BTC resistance levels and indicators for Bitcoin price prediction, the fate of cryptocurrency trading hangs in the balance.

Exploring the current market status of Bitcoin, often referred to as digital gold, allows us to better understand recent dynamics affecting this leading cryptocurrency. As recent data showcases, Bitcoin’s price has been trapped within a narrow range, creating a consolidation phase that traders are keenly observing. This period of stagnation reflects broader cryptocurrency market trends and highlights the importance of technical analysis Bitcoin enthusiasts rely on for insights. Analysts are focusing on crucial resistance points, specifically those around the $86,000 mark, to gauge future price movements. With concerns surrounding market volatility and potential bullish reversals, the discussions surrounding BTC’s performance are more pertinent than ever.

Understanding Bitcoin Price Analysis

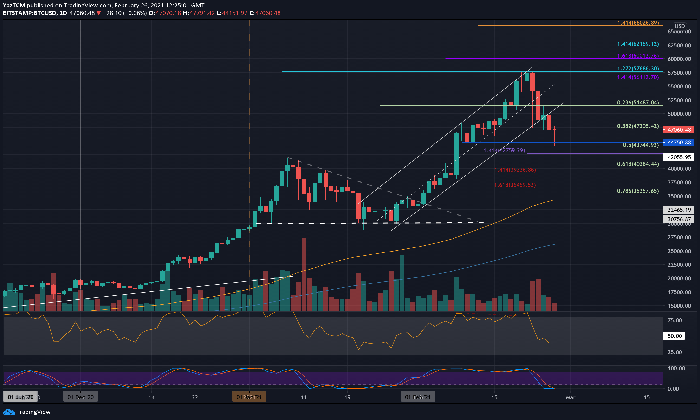

Bitcoin price analysis is essential for investors wanting to navigate the dynamic cryptocurrency market. Over the past week, Bitcoin has consistently faced resistance near the $86,000 mark. This crucial price range has served as a strong barrier against upward movement, raising concerns about market stability. A technical analysis highlights the significance of certain price patterns and indicators that influence Bitcoin’s trajectory, including resistance levels and moving averages.

As analysts like Daan Crypto have noted, the failure to break through the $86,000 ceiling suggests investor uncertainty and market volatility. Traders should be attentive to key indicators such as the 200-day EMA and simple moving averages, as these can provide insights into future price movements. By leveraging technical analysis, investors can develop a more strategic approach to cryptocurrency trading and potentially improve their chances of capitalizing on price fluctuations.

Current Bitcoin Market Trends Revealed

Analyzing current Bitcoin market trends is critical for those involved in cryptocurrency trading. Recent developments show that Bitcoin’s price has not only been stagnant but has also struggled to reclaim previous highs. This situation has led to increased speculation regarding future market behavior and Bitcoin price predictions. According to analysts, the prolonged sideways movement indicates a consolidation phase, where traders are waiting for clearer signals before making significant investments.

Daan Crypto emphasizes the importance of monitoring key resistance levels, particularly the 200-day EMA and the 200-day MA. As Bitcoin approaches these critical indicators, market sentiment could shift, leading to either a continuation of the current trend or a potential breakout towards higher price levels. Understanding these market dynamics is crucial for investors looking to make informed decisions based on Bitcoin price analysis.

Resistance Levels Holding Bitcoin Back

Bitcoin’s recent challenges are closely tied to resistance levels that have proven difficult to overcome. The diagonal trendline formed by a series of lower lows marks a significant barrier to upward momentum. For Bitcoin to show signs of a bullish reversal, it must break above this trendline convincingly. Failure to do so could result in further corrections or continued consolidation, leaving traders cautious about future investments.

Moreover, the 200-day EMA plays a vital role in signaling medium to long-term trend changes. With Bitcoin currently hovering beneath this crucial line, the likelihood of a swift price recovery diminishes. Traders should focus on the intersection of on-chain analysis and technical indicators to gauge whether Bitcoin can muster enough bullish strength to overcome these resistance levels and initiate a new upward trajectory.

Technical Analysis of Bitcoin’s Consolidation Phase

Technical analysis is indispensable for understanding Bitcoin’s ongoing consolidation phase. The tight trading range between $84,000 and $86,000 reflects a market grappling with uncertainty. Analysts like Daan Crypto have called attention to this stagnation, noting that investors are likely waiting for a clear breakout signal. As they conduct technical studies, it becomes vital to pinpoint the factors influencing price movements, such as trading volume and market sentiment.

During this period of consolidation, Bitcoin’s movements can sometimes be dictated by broader market trends. Keeping an eye on various indicators, such as the RSI or MACD, can provide additional context to BTC’s behavior. Overall, a thorough technical analysis can help traders anticipate potential breakouts or pullbacks, making it a valuable tool for anyone involved in cryptocurrency trading.

Bitcoin Price Prediction: Key Indicators to Watch

The future of Bitcoin hinges on key indicators that market analysts are currently monitoring. With Bitcoin trading at approximately $84,868, predictions suggest that reaching the $90,000-$91,000 zone is pivotal for a bullish resurgence. This price range represents a crucial support point that, if reclaimed, could trigger a significant shift in market dynamics, reinstating Bitcoin within a bullish framework. For those looking into Bitcoin price predictions, understanding these pivotal levels is imperative.

Alongside price levels, monitoring trading volumes will also be critical in forming accurate Bitcoin price predictions. A drop in daily trading volume, as noted in recent reports, could suggest fading market interest or investor caution. Thus, traders should consider the interplay of various indicators to make informed predictions regarding Bitcoin’s price trajectory in the coming weeks.

Examining Bitcoin’s Performance Against Market Volatility

Bitcoin’s price performance over recent weeks highlights the cryptocurrency’s sensitivity to market volatility. With Bitcoin facing a significant correction of over 22% since its all-time high in January, external factors such as global trade tensions have contributed to this instability. Investors often seek refuge in less volatile assets during uncertain periods, which further complicates Bitcoin’s recovery potential. Assessing Bitcoin’s market performance amidst these conditions is essential for understanding its long-term prospects.

As the cryptocurrency landscape evolves, traders must remain vigilant about the impact of global economic events on Bitcoin’s performance. A careful analysis of both macroeconomic indicators and Bitcoin-specific events can provide necessary insights for predicting how BTC may respond to future volatility. Overall, understanding the relationship between Bitcoin and market volatility is key for any serious investor or trader.

Identifying Major Price Breakout Points for Bitcoin

Identifying major price breakout points is critical for successful cryptocurrency trading. As Bitcoin continues to consolidate in the $84,000-$86,000 range, traders need to recognize key resistance and support levels to predict potential breakouts. The diagonal trendline, 200-day EMA, and former support zones offer essential points of analysis for Bitcoin traders looking to capitalize on price movements.

Moreover, Bitcoin’s ultimate resistance level at $90,000-$91,000 is particularly noteworthy. Successfully breaking and holding above this range could signal a renewed bullish trend, inviting new investments and potentially sending prices skyrocketing once again. Investors who closely monitor these breakout points are better equipped to make strategic trading decisions in the highly volatile cryptocurrency market.

The Impact of Global Events on Bitcoin Prices

Global events play a significant role in shaping Bitcoin prices. For instance, recent trade tariff crises have prompted many investors to seek safer assets, contributing to Bitcoin’s recent downturn. However, news of potential negotiations to resolve these conflicts has sparked optimism, briefly boosting Bitcoin’s price. Understanding the relationship between geopolitical developments and market reactions is key for traders aiming to navigate the volatile landscape of cryptocurrency.

As external factors continue to impact Bitcoin’s price, traders must remain informed about both local and international developments that could influence market sentiment. Being proactive in monitoring news and understanding its potential market implications can help investors make more informed decisions. Overall, appreciating the connection between global events and Bitcoin prices is crucial for anyone hoping to sail through the turbulent waters of cryptocurrency trading.

Market Sentiment: Bulls vs. Bears in Bitcoin Trading

Market sentiment significantly impacts Bitcoin trading, often determining whether traders lean towards bullish or bearish positions. Current sentiment appears cautious, as Bitcoin struggles to break through its resistance levels, reflecting uncertainty among investors. This collective hesitation can slow momentum and lead to prolonged periods of sideways movement, as bulls and bears battle for control of the market.

In analyzing market sentiment, indicators such as the Fear and Greed Index can provide valuable perspectives on investor psychology. High levels of fear could suggest a bearish outlook, while increasing greed may signal optimism and potential price rallies. Assessing position shifts among traders can also highlight sentiment changes, making it a pivotal aspect of Bitcoin price analysis in the current trading environment.

Frequently Asked Questions

What are the current Bitcoin market trends affecting price analysis?

The current Bitcoin market trends indicate significant resistance around the $84,000-$86,000 range, with Bitcoin unable to break out of this consolidation zone. Market uncertainty has led to sideways movement, and analysts suggest that understanding these trends is crucial for traders.

How do BTC resistance levels influence Bitcoin price prediction?

BTC resistance levels are critical in Bitcoin price prediction as they indicate points where selling pressure could increase. Currently, major resistance barriers lie at the $90,000-$91,000 levels and below at the $84,000 total range, influencing traders’ expectations for future movements.

What role does technical analysis play in cryptocurrency trading, particularly for Bitcoin?

Technical analysis is vital in cryptocurrency trading as it helps identify patterns and trends in Bitcoin price movements. Using indicators like the 200-day EMA and resistance levels can aid traders in making informed decisions based on historical price data.

Why is the 200-day EMA important for Bitcoin price analysis?

The 200-day EMA is essential for Bitcoin price analysis as it provides insights into medium-to-long-term trend changes. It reacts faster to recent price movements compared to the 200-day MA, making it a valuable tool for traders seeking to identify potential breakouts.

What does the current Bitcoin price prediction indicate about future market trends?

The current Bitcoin price prediction suggests limited upward movement due to existing resistance levels. For a bullish signal, Bitcoin must successfully reclaim the $90,000-$91,000 range, which could indicate a resurgence in the broader market trends.

| Key Points | Details |

|---|---|

| Current Trading Range | Bitcoin is facing rejections in the $84,000-$86,000 range. |

| Investor Sentiment | There is considerable uncertainty among investors, leading to sideways movement. |

| Resistance Indicators | Key resistance is found at the diagonal trendline, 200-day EMA, and 200-day MA. |

| Price Reversal Indicators | A breakout above $90,000-$91,000 is crucial for a bullish trend. |

| Recent Price Performance | BTC is trading at $84,868, with a slight daily increase and a significant drop in trading volume. |

Summary

Bitcoin price analysis reveals that the cryptocurrency has recently struggled with significant resistance at the $84,000-$86,000 range, demonstrating investor caution amid prolonged sideways movement. The current market conditions, marked by key indicators, highlight the necessity for BTC to break through these barriers to initiate a potential price recovery. Without decisive upward movement, the uncertainty in the market persists, making future trends difficult to predict.

Bitcoin price analysis reveals that the leading cryptocurrency has struggled to break free from key resistance levels over the past trading week, remaining confined within the $84,000 to $86,000 range. Investors are keenly watching Bitcoin market trends as a prolonged period of sideways movement has introduced a sense of uncertainty among traders. Despite the absence of major pullbacks, the current price action highlights significant barriers, notably a diagonal downtrend line, the 200-day EMA and MA. Technical analysis of Bitcoin suggests that a breach above these resistance levels is crucial for any bullish momentum to materialize. As market participants look for a clear Bitcoin price prediction, understanding these dynamics becomes essential for effective cryptocurrency trading.

When delving into Bitcoin’s recent performance, a careful examination of its price movements is crucial for traders and investors alike. This cryptocurrency has encountered notable challenges lately, particularly around pivotal BTC resistance levels that have stymied upward momentum. Observing current trends within the Bitcoin ecosystem, analysts utilize technical analysis Bitcoin techniques to dissect price patterns and forecast future behaviors. The ongoing fluctuations have resulted in heightened interest in Bitcoin’s price outlook and its response to external market influences. Engaging with these developments not only enhances cryptocurrency trading strategies but also equips market enthusiasts with vital insights into potential price trajectories.