Ethereum price analysis reveals a troubling market dynamic as the cryptocurrency struggles to maintain momentum following a failed attempt to breach the critical $2,160 resistance level. This setback has highlighted Ethereum’s vulnerability to bearish trends, as significant selling pressure outweighed optimistic market sentiment among traders. As ETH price predictions and trends show a retreating momentum, attention is shifting to Ethereum support levels that could determine the next direction for this cryptocurrency. Analysts are increasingly concerned about the implications of this stall, particularly in the context of broader crypto market analysis, which indicates a cautious outlook for Ethereum’s recovery chances. With buyers hesitant and selling pressure mounting, Ethereum’s position remains precarious, leaving investors on alert for upcoming developments.

In the realm of digital currencies, Ethereum’s current situation serves as a case study in volatility and market psychology. Recent attempts to gain traction have hit a snag, particularly as the price struggled to navigate significant resistance points. Observers of market behavior are keenly analyzing Ethereum’s support levels to gauge potential next moves, particularly in light of the prevailing bearish sentiment. Given the intricate dynamics of cryptocurrency trading, assessing the likelihood of a recovery becomes crucial for traders and investors alike. An understanding of the market’s fluctuations and technical indicators will be essential in deciphering whether Ethereum will withstand the challenges ahead or succumb to further declines.

Ethereum Price Analysis: Understanding the Current Market Dynamics

The current state of Ethereum’s price is emblematic of the broader challenges faced by cryptocurrencies today. Despite attempting to regain momentum above the crucial $2,160 resistance level, Ethereum has experienced a significant setback due to heightened selling pressure. Traders and analysts alike are closely monitoring this behavior, as it not only represents Ethereum’s struggle but also reflects the overall sentiment in the crypto market. The repeated inability to break through resistance speaks volumes about the existing bearish trends and investor caution surrounding Ethereum’s immediate future.

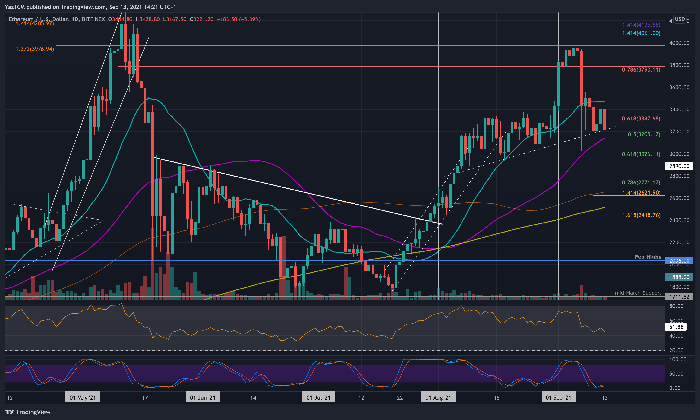

Market participants are particularly interested in the implications of the recent price action for Ethereum. Without a decisive move above resistance, the focus will inevitably shift to support levels. Traders are analyzing key indicators, like the RSI and MACD, which have recently exhibited bearish signals. This analysis informs their expectations for ETH’s forthcoming price trajectory, especially in the context of Ethereum price predictions. Understanding these dynamics is essential not just for Ethereum, but also for crafting a broader strategy within the volatile crypto market.

Bearish Sentiment: Navigating the Downward Pressure on Ethereum

The prevailing bearish sentiment surrounding Ethereum is driven by a confluence of technical indicators and market psychology. As ETH’s price failed to overcome the $2,160 level, overall sentiment has shifted toward pessimism, with many traders adopting a cautious approach. The market’s lack of strong buying pressure during the recent recovery attempts has underscored this trend, as the absence of buyers allowed sellers to exert more control. This environment has prompted discussions about the potential for Ethereum to test lower support levels, leading many to question its recovery chances amid ongoing challenges.

Moreover, the deteriorating technical landscape has resulted in a growing number of analysts reevaluating their Ethereum price predictions. As the MACD has turned negative and the RSI reflects diminishing bullish momentum, the risk of further declines looms large. For those trading or investing in Ethereum, understanding these bearish dynamics is crucial for timing entries and exits in a market that has proven to be unpredictable. Keeping an eye on the upcoming support levels will be key to gauging Ethereum’s potential for a rebound against further downward pressure.

Support Levels To Watch: Are Bulls Ready for a Comeback?

As ETH approaches critical support zones, investors are keenly watching the $1,523 level, which has served as a vital demand zone in previous trading sessions. Sustaining above this mark is crucial for bulls looking to instigate a recovery effort. If Ethereum remains buoyant around this area, traders may begin to see renewed interest and potential for a rebound. However, failing to hold above this support could deepen bearish trends and raise questions about Ethereum’s strength in the current market.

In addition to the $1,523 support level, there’s another significant psychological level at $902 that traders must monitor closely. This level has provided substantial reactions in the past and is indicative of ETH’s overall health. A breakdown below $1,523 could trigger a cascade of selling pressure, driving ETH toward even deeper support levels at $902. Thus, understanding these levels and their implications for Ethereum’s price movements is essential for those participating in the crypto markets. Keeping informed about Ethereum’s support zones can help traders make strategic decisions to navigate through potential tough times.

Ethereum’s Recovery Chances: Analyzing the Market

The potential for Ethereum’s recovery is currently fraught with uncertainty, given the recent price behavior observed around the key $2,160 resistance level. While bulls are eager to capture a rebound, the market conditions reflect an entrenched bearish sentiment. The prevailing indicators, like the MACD’s negative crossover and the RSI’s decline, suggest that recovery chances are dwindling unless significant buying interest returns. This situation has led many in the crypto community to ponder not just Ethereum’s immediate future, but also whether a sustained recovery is on the horizon for the broader market.

For traders evaluating ETH’s recovery potential, understanding market sentiment is critical. Observing movements at significant support levels and anticipating reactions can prove advantageous. If Ethereum can consolidate above $1,523 and attract buying momentum, there could be room for a bullish turnaround. However, this will require robust market participation and a shift in investor sentiment away from the current bearish outlook. Thus, keeping abreast of emerging trends and market analysis is essential for capitalizing on Ethereum’s recovery chances.

Crypto Market Analysis: Factors Influencing Ethereum’s Performance

The performance of Ethereum cannot be viewed in isolation; it is intricately tied to the prevailing conditions of the crypto market. Various factors, ranging from macroeconomic trends to regulatory developments, significantly impact price movements in Ethereum. As market participants assess these influences, it’s crucial to note how elements such as market liquidity, trading volumes, and investor sentiment play roles in shaping price trajectories. An effective crypto market analysis is integral to understanding how these factors might interact with Ethereum, especially in periods of heightened volatility.

Additionally, Ethereum’s correlations with other cryptocurrencies can offer insights into its potential price movements. For instance, movements in Bitcoin often catalyze shifts in Ethereum’s price, serving as a barometer for overall market resilience. Analyzing how Ethereum reacts to such macro shifts, alongside broader economic considerations, can provide valuable insights for traders looking to make informed decisions in a congested market. Therefore, continual monitoring of these aspects is essential for navigating Ethereum’s ongoing challenges and opportunities.

Future Outlook: Predictions for Ethereum and Market Trends

Looking ahead, predictions for Ethereum’s future performance will hinge on multiple variables, including external economic factors and internal market dynamics. Analysts are particularly focused on how Ethereum can address its recent failures at key resistance levels and what that means for price expectations. As traders digest these prospects, the conversation surrounding Ethereum price prediction has become increasingly nuanced, taking into account the potential for recovery, along with persistent bearish trends.

Furthermore, staying ahead of market trends and adapting to changing conditions is vital for anyone involved in Ethereum trading. Potential market shifts—whether due to regulatory news or changes in broader economic indicators—can significantly affect Ethereum’s price trajectory. Therefore, it is paramount for investors to remain vigilant and investigative, embracing comprehensive research and technical analysis as they navigate this complex landscape while managing their risk effectively.

Ethereum Investment Strategies: Navigating the Volatility

Given the current volatility in the Ethereum market, strategic investing has never been more important. Investors should consider incorporating various strategies to manage their exposure effectively. Dollar-cost averaging, for instance, can help mitigate risks associated with price fluctuations by allowing investors to purchase ETH steadily over time. This strategy can minimize the impact of volatility and create a well-averaged entry point for those considering long-term investment in Ethereum.

Moreover, using stop-loss orders is another effective way to manage risk in the bearish environment surrounding Ethereum. By setting predetermined exit points, investors can protect their capital from severe downturns while maintaining the potential to benefit from any market recovery. As Ethereum continues to navigate the challenges of resistance levels and bearish sentiment, adopting such strategies will be pivotal for fostering a resilient portfolio within the crypto landscape.

Technical Indicators: Gauging Ethereum’s Market Health

Technical indicators continue to play a critical role in assessing the health of Ethereum’s market. The Relative Strength Index (RSI) has shown declines, reflecting weakening bullish momentum, while the Moving Average Convergence Divergence (MACD) has provided bearish signals. By interpreting these indicators, traders can gain insights into the current market phase and make informed decisions based on the potential for continuation or reversal patterns.

Additionally, understanding crucial support and resistance levels through technical analysis aids traders in predicting potential price movements. As Ethereum interacts with these levels, it becomes essential to adjust trading strategies accordingly. Leveraging technical indicators to gauge the strength of price movements can empower investors to navigate the present landscape with increased confidence while positioning themselves for future opportunities.

Frequently Asked Questions

What are the current Ethereum price analysis insights regarding ETH price prediction?

As per the current Ethereum price analysis, ETH has struggled to surpass the crucial $2,160 resistance level, which has dampened bullish sentiments. Analysts suggest that without stronger buying volume, the ETH price prediction leans towards a potential continuation of bearish trends unless key support levels are defended.

What key support levels should I monitor in Ethereum’s price analysis?

In the ongoing Ethereum price analysis, the primary support level to watch is around $1,523. This level previously served as a demand zone. Failing to hold above it could signal deeper declines. Additionally, another significant support lies at $902, which could be critical if selling pressure increases.

How do bearish trends affect Ethereum price analysis?

The current bearish trends in Ethereum price analysis indicate that selling pressure is increasing, particularly after ETH’s failure to break the $2,160 resistance. If momentum continues to wane, traders should brace for potential declines, necessitating close monitoring of support levels.

What factors are influencing Ethereum recovery chances in the market?

Ethereum’s recovery chances, as observed in price analysis, are heavily influenced by trading volume and key technical indicators. The weak volume during the recent recovery effort suggests a lack of buyer interest, which could impede ETH’s ability to generate upward momentum.

How does the crypto market analysis impact Ethereum price analysis?

The crypto market analysis significantly impacts Ethereum price analysis by providing context on broader market sentiments and trends. Currently, a cautious market approach amid bearish performances is placing additional pressure on Ethereum, shaping expectations for future price movements.

| Key Points |

|---|

| Ethereum’s price is struggling to surpass the $2,160 resistance level, indicating bearish control. |

| Significant selling pressure has prevented a sustained breakout, disappointing upside expectations. |

| Weak trading volume during the recovery suggests a lack of buying interest, favoring sellers. |

| The Relative Strength Index (RSI) indicates diminishing bullish momentum and potential for further declines. |

| MACD trends negative, reinforcing bearish momentum and reducing immediate recovery possibilities. |

| Key support at $1,523 is critical; a break below raises the risk of deeper losses. |

| The next major support level is $902, which could trigger increased selling if crossed. |

Summary

Ethereum price analysis indicates a current struggle as the cryptocurrency faces substantial bearish pressure, particularly after its failure to break through the $2,160 resistance. This technical landscape suggests that traders should remain cautious, monitoring key support levels closely to gauge potential future movements in Ethereum’s price.

Ethereum price analysis indicates a critical juncture for the cryptocurrency, as its recent struggles have become evident following a failed attempt to breach the pivotal $2,160 resistance level. Despite moments of recovery, the recent price movements highlight a persistent struggle against mounting bearish trends that leave traders questioning Ethereum’s recovery chances. The prevailing market sentiment has shifted cautiously, prompting a closer focus on Ethereum support levels that could dictate potential future movements. As investors sift through the latest crypto market analysis, the importance of strategic positioning becomes paramount. Ultimately, with bears currently dominating the price action, the outlook for Ethereum remains uncertain as it seeks to regain a foothold.

Exploring the dynamics of Ethereum requires attention to its current pricing patterns and market behavior, particularly as recent observations reflect an ongoing battle for bullish recovery. The digital asset’s attempt to consolidate above key technical zones, particularly near the critical resistance level, paints a complex picture amid prevalent bearish pressure. In analyzing Ethereum’s market position, insights into its support zones become essential, especially for traders looking to anticipate future price shifts. The current landscape calls for a nuanced understanding of ETH’s performance within the broader crypto ecosystem. As sentiment fluctuates, the potential for Ethereum to navigate these challenges will be closely monitored by market participants.