Ripple cross-border payments are revolutionizing the way money moves between countries, particularly in the vibrant landscape of Africa. By partnering with Chipper Cash, Ripple is set to streamline financial transactions across nine African nations, enabling customers to make swift and cost-effective payments using blockchain technology. This innovative alliance leverages Ripple’s advanced payment solutions to enhance the speed and efficiency of cross-border transfers, dramatically reducing costs and transit times. As businesses and consumers in Africa increasingly embrace digital payments, the potential for financial inclusion and access to global markets expands significantly. With this strategic move, Ripple not only reinforces its commitment to innovation in financial services but also contributes to the economic growth of underserved regions across the continent.

The evolution of international payment systems is gaining momentum, particularly through initiatives such as Ripple’s collaboration with Chipper Cash. This partnership aims to provide enhanced cross-border transaction capabilities, allowing users in Africa to engage in seamless financial exchanges. Utilizing blockchain technology, this solution addresses the pressing need for quick and affordable payment options, thereby promoting economic integration within African markets. As such, the focus on enhancing digital payment infrastructure through innovative partnerships showcases a crucial step towards improving financial access and fostering growth across the continent. By capitalizing on the benefits of digital currencies, regional stakeholders are poised to transform the landscape of financial services, ensuring that more individuals and businesses can participate in the burgeoning global economy.

The Ripple Cross-Border Payments Revolution

Ripple has fundamentally transformed the landscape of international financial transactions with its innovative cross-border payment solutions. By integrating cutting-edge blockchain technology, Ripple allows users to transfer funds quickly and efficiently across borders, significantly reducing the time taken for such transactions. This new revolution in payment systems not only lowers costs for consumers but also enhances the overall experience of sending money internationally, making it an attractive option for countless individuals and businesses.

The partnership with Chipper Cash amplifies this revolution by extending Ripple’s unique capabilities to a vast audience within Africa. With millions of users across nine nations now able to access Ripple Payments, the potential for streamlined financial transactions becomes a reality. As countries in the region often face hurdles with traditional banking systems, the approach taken by Ripple promises to alleviate some of these challenges while fostering economic growth and connectivity.

Enhancing Financial Inclusion in Africa

The collaboration between Ripple and Chipper Cash is poised to significantly enhance financial inclusion across Africa. Historically, many regions in Africa have been underserved by conventional banking facilities, leaving a considerable segment of the population without access to essential financial services. By utilizing blockchain technology, the partnership aims to bridge this gap, enabling more users to engage with global markets and secure financial services that were previously unattainable.

Experts like Ham Serunjogi, CEO of Chipper Cash, argue that crypto-enabled payments can open doors for businesses and individuals alike. By simplifying cross-border transactions, users gain access to a wider array of resources and opportunities, ultimately paving the way for economic empowerment. This shift towards digital payments not only fosters individual growth but also contributes to the broader economic development of the continent.

The Impact of the Chipper Cash Partnership

The partnership with Chipper Cash marks a significant milestone for Ripple’s strategy to penetrate the African market. By combining Ripple’s robust blockchain payment solutions with Chipper Cash’s extensive user base, this collaboration can facilitate rapid transactions that outperform conventional methods. Users are not only looking for speed and security but also for low-cost options to send and receive money, especially across borders.

The integration of Ripple Payments into the Chipper Cash platform is set to enhance user experience dramatically. With reduced fees and faster processing times, users will be able to execute international transactions with ease, enabling better cash flow for businesses and improved access to funds for consumers. These improvements are essential for fostering a thriving digital economy across various African nations.

Transforming Africa’s Digital Payments Landscape

The advent of digital payments in Africa is reshaping the traditional finance landscape, providing increased opportunities for users and ushering in a new era of economic activity. Ripple’s partnership with Chipper Cash stands at the forefront of this transformation, enabling users to harness the power of blockchain technology for their financial transactions. With a focus on accessibility, this initiative targets the vast population that has been marginalized from the conventional banking system.

As these digital payment systems gain traction, they stimulate economic growth and encourage innovation throughout the region. The ability to transact seamlessly with international partners can lead to enhanced trade opportunities and bolster local economies by providing businesses with better access to necessary financial services.

Ripple’s Global Expansion Efforts Beyond Africa

While Ripple is making significant strides in Africa with its partnership with Chipper Cash, its global expansion efforts continue to gain momentum. The recent collaboration with Unicâmbio in Portugal demonstrates Ripple’s commitment to enhancing financial connections between countries. Leveraging blockchain technology, this partnership is expected to facilitate smoother transactions and better integration of digital assets within cross-border commerce.

Furthermore, by securing licensing from the Dubai Financial Services Authority, Ripple has set a precedent as the first blockchain payment provider to achieve this milestone. Such regulatory approvals reinforce Ripple’s position in the digital asset market, allowing it to enhance services and expand its reach to cover over 90 payout markets worldwide, including key regions like Brazil and Europe.

Driving Economic Growth Through Blockchain Technology

The integration of Ripple’s technology into financial platforms like Chipper Cash is a significant driver of economic growth in Africa. As businesses and individuals increasingly adopt blockchain solutions for payments, the efficiency gains and cost savings translate into larger economic contributions. Rapid cross-border payments enable businesses to transact internationally without the lengthy delays and high fees commonly associated with traditional banking methods.

This economic growth is not limited to businesses alone; it also positively impacts consumers. With lower transaction costs, users can access more competitive prices for goods and services, ultimately enhancing their overall purchasing power. Blockchain technology thus serves as a catalyst for broader economic activity and financial inclusion across the continent.

The Future of Cross-Border Solutions in Africa

As the digital landscape evolves, the future of cross-border payment solutions in Africa appears promising, particularly with the ongoing initiatives led by Ripple and Chipper Cash. The integration of more advanced technologies is expected to further streamline cross-border transactions, enhancing the speed, security, and affordability of remittances. Looking ahead, it is likely that additional players will emerge, competing to offer effective solutions for consumers seeking efficient payment methods.

Increased competition within this space will undoubtedly drive innovation, resulting in better services and wider acceptance of digital payments. With more individuals and businesses recognizing the advantages of utilizing blockchain for cross-border transactions, the continent stands to benefit from a technological transformation that promotes trade and economic prosperity.

Chipper Cash’s Role in Innovative Payments

Chipper Cash has emerged as a major player in the landscape of digital finance in Africa, allowing users to efficiently send and receive money across borders. With the partnership with Ripple, Chipper Cash users stand to benefit from a unique payment solution that harnesses the power of blockchain technology. This innovative approach epitomizes the evolution of cross-border payment solutions tailored to the needs of the African market.

Moreover, Chipper Cash’s user-friendly interface and engaging features empower users to navigate the world of digital payments seamlessly. As more people become aware of these technologies, they are more likely to adopt them, fostering a culture of digital financial literacy that is crucial for sustainable growth within the region.

Challenges and Opportunities in African Payments

While the partnership between Ripple and Chipper Cash creates immense opportunities for enhancing cross-border payments, there are also challenges to navigate. One significant hurdle is the regulatory environment in various African nations, which can be inconsistent and pose barriers to the adoption of new financial technologies. Ensuring compliance while promoting innovation is critical for the sustainable growth of the industry.

On the flip side, these challenges also present opportunities for stakeholders to engage with governments and financial authorities to shape favorable regulations. By working collaboratively, the potential for creating a digital payment ecosystem that supports financial inclusion and economic growth becomes a shared goal among all involved.

Frequently Asked Questions

What is Ripple cross-border payments and how does it work?

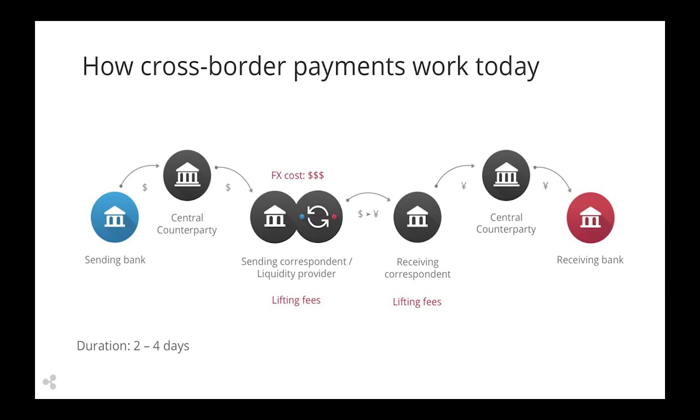

Ripple cross-border payments utilize blockchain technology to enable fast and low-cost international money transfers. By facilitating real-time transactions between financial institutions, Ripple’s solutions reduce transaction fees and waiting times, allowing users to send and receive funds efficiently across borders.

How does the Chipper Cash partnership enhance Ripple’s cross-border payment solutions in Africa?

The Chipper Cash partnership introduces Ripple’s blockchain-based payment technology to millions of users in Africa. This collaboration aims to streamline cross-border payments, making them quicker and more affordable, thereby enhancing financial inclusion across the continent.

What advantages do Ripple blockchain payments offer for Africa’s digital payments landscape?

Ripple blockchain payments offer significant advantages for Africa’s digital payments landscape, including reduced transaction costs, increased transaction speed, and improved access to international markets. These features help promote financial inclusion and support economic growth in underserved areas.

How will the integration of Ripple Payments impact users of Chipper Cash in Africa?

The integration of Ripple Payments into Chipper Cash will empower users by enabling faster and cheaper cross-border transactions. Customers will be able to receive funds from abroad more efficiently, enhancing their financial opportunities and participation in the global economy.

What role does financial inclusion play in Ripple’s strategy for Africa?

Financial inclusion is a central aspect of Ripple’s strategy in Africa. By partnering with local financial technologies like Chipper Cash, Ripple aims to provide accessible cross-border payment solutions that improve financial access for underbanked populations, thereby facilitating broader economic empowerment.

What other regions is Ripple expanding its cross-border payment solutions to?

In addition to its focus on Africa, Ripple is expanding its cross-border payment solutions globally. Recent collaborations include partnerships in Portugal and Brazil, showcasing Ripple’s commitment to enhancing payment networks and financial services worldwide.

How does Ripple’s blockchain technology address the needs of underserved markets in Africa?

Ripple’s blockchain technology addresses the needs of underserved markets in Africa by providing a reliable, cost-effective payment infrastructure that enhances transaction speed and security. This technology is particularly beneficial for regions with limited access to traditional banking services.

What milestones has Ripple achieved in the global cross-border payment market?

Ripple has achieved significant milestones in the global cross-border payment market, including processing over $70 billion in payment volume and establishing partnerships that support over 90 payout markets, making it a leader in blockchain-based finance solutions.

| Key Point | Details |

|---|---|

| Partnership Announcement | Ripple partners with Chipper Cash to enhance cross-border payments in Africa. |

| Objective | To provide quicker and cheaper payments across nine African nations. |

| Technology Integration | Ripple’s blockchain payment technology will be integrated into Chipper Cash’s platform. |

| Consumer Impact | Enables rapid international transfers using digital assets for millions of users. |

| Economic Implications | Expected to foster economic growth and innovation in underserved markets. |

| CEO Statements | Both Reece Merrick and Ham Serunjogi highlight blockchain’s potential for financial inclusion. |

| Previous Collaborations | Ripple has previously partnered with Onafriq to expand its services in Africa. |

| Global Reach | Ripple has licensing deals and partnerships extending beyond Africa, including Portugal and Brazil. |

| Market Presence | Ripple has processed over $70 billion in volume, covering more than 90% of the global FX market. |

Summary

Ripple cross-border payments are making significant strides in enhancing financial transactions, particularly in Africa. The innovative partnership with Chipper Cash serves as a testament to Ripple’s commitment to facilitating faster and more affordable cross-border payments, benefiting millions of users across nine countries. By leveraging blockchain technology, Ripple is not just streamlining payment processes but also promoting financial inclusion and economic growth in underserved markets. This exciting development represents a key milestone in Ripple’s ongoing expansion and aligns with its mission to improve accessibility to global markets.

Ripple cross-border payments are making a significant impact on the financial landscape in Africa, thanks to the recent partnership with Chipper Cash. Announced on March 27, this collaboration seeks to leverage Ripple’s advanced blockchain technology, enhancing the speed and cost-effectiveness of international transactions for millions across nine African nations. By integrating Ripple Payments into the Chipper Cash platform, users will benefit from rapid, efficient digital asset transfers, essential for sending and receiving funds from abroad. This innovation not only addresses the challenges of traditional banking but also promotes greater financial inclusion across the continent. As Ripple continues to expand its reach, the partnership exemplifies how modern technology can transform Africa’s digital payments ecosystem.

The financial revolution in Africa is witnessing a new era of digital payment solutions, particularly through Ripple’s innovative cross-border transaction service. This initiative, developed in collaboration with the fintech platform Chipper Cash, is set to enhance the way funds are transferred internationally, enabling users to enjoy swift and affordable remittances. By harnessing blockchain technology, both businesses and individuals in underserved regions can now access global markets with unprecedented ease. As such partnerships grow, the focus on advancing financial inclusion Africa becomes increasingly critical, ensuring that more people can participate in the modern economy. This shift towards digital financial solutions marks a transformative step towards overcoming historical barriers associated with traditional finance.