The Pi Network token has gained significant attention following the launch of its Open Mainnet, a pivotal moment in the cryptocurrency landscape that has led to notable price fluctuations. As the excitement around this launch surged, many investors engaged in cryptocurrency speculation, driving the token’s value to new heights before a sudden sell-off took hold. The transition to an open blockchain not only allows for broader blockchain integration but also enhances the potential for real-world applications of the Pi token. Amidst this volatility, the Pi Network price fluctuations have raised questions about its long-term stability and market viability. With a community of millions behind it, the future of the Pi Network token remains a hot topic in discussions surrounding the evolution of digital currencies.

Following the recent unveiling of its Open Mainnet, the Pi cryptocurrency has captured widespread interest, marking a transformative phase for this mobile-based mining initiative. This significant development has triggered a wave of trading activity, leading to dramatic shifts in the token’s market value. As users engage with this emerging digital asset, the implications of its blockchain technology are becoming increasingly apparent, paving the way for new transactional opportunities. While the community anticipates a surge in adoption, analysts remain cautious, highlighting potential challenges that could impact the token’s future. Overall, the Pi Network’s journey from a closed beta to an open blockchain signifies a crucial step in its quest for legitimacy and broader acceptance in the blockchain realm.

Understanding Pi Network’s Token Dynamics

Pi Network’s token dynamics have become a focal point of interest since its transition to an Open Mainnet. The initial surge in the token’s value, which saw Pi (PI) spike by 45% shortly after the launch announcement, highlighted the speculative nature of cryptocurrency investments. As users rushed to capitalize on the newfound accessibility of the token, the market witnessed an unprecedented trading volume increase of over 1,700%. However, this excitement soon led to a sharp sell-off, with the token’s value plummeting by more than 52%, raising questions about the sustainability of such rapid price fluctuations.

The volatility experienced by Pi Network’s token reflects broader trends in cryptocurrency speculation, where initial enthusiasm can quickly turn into panic selling. Analysts have pointed out that the tokenomics of Pi, including its total supply of 9.7 billion tokens and a current fully diluted valuation of approximately $83.07 billion, could lead to further price instability. This situation is compounded by the uncertainties surrounding future token releases and market demand, making it crucial for investors to remain vigilant.

The Impact of the Open Mainnet Launch

The launch of Pi Network’s Open Mainnet marks a significant milestone in its development, offering users new avenues for engaging with the cryptocurrency. This transition from a closed beta to an open blockchain environment not only allows for external transactions but also paves the way for potential exchange listings and integration with decentralized applications. By enabling real-world use cases for its token, Pi Network aims to enhance its credibility and usability within the broader digital economy.

However, the impact of the Open Mainnet launch is not without its challenges. Critics argue that the lack of clarity surrounding tokenomics and regulatory compliance could hinder the project’s growth. Moreover, the mixed reactions from major exchanges, notably Binance’s community voting process, indicate ongoing skepticism about Pi’s long-term viability. As the network seeks to establish itself within the competitive landscape of blockchain integration, it must navigate these uncertainties while maintaining user trust and fostering adoption.

Challenges Facing Pi Network’s Future

Despite the optimistic outlook following the Open Mainnet launch, Pi Network faces several challenges that could impact its future trajectory. Regulatory scrutiny remains a significant concern, especially given past allegations labeling the project as a scam. Such perceptions can deter potential investors and hinder partnerships with reputable exchanges. As cryptocurrency regulations evolve worldwide, Pi Network must ensure compliance to sustain its growing user base.

Furthermore, the volatility of Pi’s token price raises questions about its long-term stability. The drastic fluctuations observed after the Open Mainnet launch serve as a warning to investors about the risks associated with cryptocurrency speculation. As the project continues to develop, it must address these concerns head-on, ensuring transparency and building a robust framework that instills confidence in its community and potential investors.

The Role of Community Support in Pi Network

Community support plays a vital role in Pi Network’s journey, especially as it navigates the complexities of launching on an open blockchain. The overwhelming approval from Binance’s community vote demonstrates a significant backing from users, which can be a powerful catalyst for growth. A strong and engaged community can help drive awareness, foster trust, and enhance the overall legitimacy of the token, providing a buffer against market volatility.

However, reliance on community sentiment also poses risks. If the project’s trajectory does not meet user expectations, or if regulatory issues arise, community confidence could wane, leading to further price instability. As Pi Network aims to position itself as a viable player in the cryptocurrency space, it must actively engage with its community, addressing concerns transparently while promoting the benefits of its token and network.

Navigating Price Fluctuations in Cryptocurrency

Price fluctuations are a common phenomenon in the cryptocurrency market, and Pi Network’s token is no exception. The dramatic rise and fall in Pi’s value shortly after the Open Mainnet launch underscores the speculative nature of digital currencies. Investors often react impulsively to news and trends, leading to rapid price changes that can complicate investment strategies. Understanding these dynamics is crucial for anyone looking to navigate the volatile world of cryptocurrency.

To mitigate risks associated with price fluctuations, investors should consider implementing strategies such as dollar-cost averaging or diversifying their portfolios. A thorough analysis of market trends, combined with awareness of the underlying factors driving price changes—such as regulatory developments or technological advancements—can help investors make informed decisions. As Pi Network continues to evolve, staying updated on its progress and market conditions will be essential for anyone interested in the token.

Cryptocurrency Speculation and Its Effects

Cryptocurrency speculation is a double-edged sword that can lead to both significant profits and devastating losses. For Pi Network, the speculative frenzy surrounding its Open Mainnet launch illustrated this reality vividly. The initial surge in token value, driven by excitement and anticipation, quickly devolved into a sell-off as investors sought to cash in on their gains. This behavior is typical in speculative markets, where sentiment can shift rapidly, leading to high volatility.

The effects of speculation extend beyond individual investors; they can influence broader market trends and perceptions of legitimacy within the cryptocurrency space. For Pi Network, maintaining a balance between fostering excitement and ensuring stability will be crucial for its long-term success. By focusing on real-world applications of its token and transparent communication with its community, Pi can work to establish a reputation that transcends speculation and builds sustainable value.

Blockchain Integration and Future Prospects

Blockchain integration is a pivotal factor in determining the future prospects of Pi Network. The transition to an Open Mainnet not only enhances the token’s usability but also positions it favorably for partnerships and collaborations with other blockchain projects. As Pi Network explores opportunities for integration with decentralized applications and exchanges, it can leverage these relationships to expand its reach and utility in the digital economy.

However, successful integration requires careful planning and execution. Pi Network must address potential technical challenges and ensure that its platform can support the demands of increased transaction volumes and user engagement. By prioritizing robust infrastructure and user experience, Pi Network can enhance its value proposition and establish itself as a key player in the evolving landscape of blockchain technology.

Legal Considerations for Pi Network

Legal considerations are paramount for the future of Pi Network, particularly in light of past allegations that have surfaced regarding the project’s legitimacy. As cryptocurrency regulations become more stringent globally, Pi Network must navigate these complexities to maintain its operations and user trust. Engaging with legal experts and regulators will be essential to ensure compliance and address any concerns that may arise.

Moreover, understanding the legal landscape will help Pi Network build a solid foundation for its future growth. By proactively addressing regulatory challenges and fostering transparency with its community, Pi Network can work to dispel any lingering doubts about its operations. This approach is critical for establishing credibility and attracting potential investors who may be hesitant due to the project’s history.

The Path Forward for Pi Network

The path forward for Pi Network is filled with both challenges and opportunities. As it continues to transition into an open blockchain environment, the focus must be on building a sustainable ecosystem that can withstand the pressures of market speculation and regulatory scrutiny. This involves not only enhancing the token’s real-world applications but also fostering a strong community that supports the project’s vision.

Looking ahead, Pi Network has the potential to carve out a unique space within the cryptocurrency landscape. By prioritizing transparency, user engagement, and strategic partnerships, it can work towards establishing itself as a reputable player in the digital economy. As the project evolves, it will be crucial to monitor its progress and adapt to the ever-changing market dynamics, ensuring that Pi Network remains relevant and resilient in the face of challenges.

Frequently Asked Questions

What is the significance of the Pi Network launch for the Pi Network token?

The Pi Network launch marked the transition to an Open Mainnet, allowing the Pi Network token (PI) to connect with external networks and facilitate transactions beyond its ecosystem. This significant upgrade is expected to enhance the token’s real-world applications and increase its availability on external platforms.

How did cryptocurrency speculation impact the Pi Network token after the Open Mainnet launch?

Following the Open Mainnet launch, the Pi Network token experienced a surge of 45% due to cryptocurrency speculation, resulting in significant trading volume increases. However, this initial excitement quickly turned into a sell-off, highlighting the volatile nature of cryptocurrency markets.

What are the implications of blockchain integration for the Pi Network token?

Blockchain integration allows the Pi Network token to operate on an open blockchain, enhancing its functionality and enabling real-world transactions. This development could lead to increased adoption and usage of the token within and outside the Pi ecosystem.

What caused the price fluctuations of the Pi Network token after its Open Mainnet launch?

The price fluctuations of the Pi Network token after the Open Mainnet launch were primarily driven by speculative trading. The token’s price surged to $2.10 before plummeting to $1.01 within hours, reflecting the volatility and rapid changes in investor sentiment typical in cryptocurrency markets.

What challenges does the Pi Network token face following the Open Mainnet launch?

Following the Open Mainnet launch, the Pi Network token faces several challenges, including regulatory uncertainties, ambiguous tokenomics, and potential difficulties in securing exchange listings. These factors may hinder the token’s long-term viability and price stability.

How does the total supply of Pi Network tokens affect its market valuation?

The total supply of Pi Network tokens is 9.7 billion, leading to a currently diluted market valuation of approximately $83.07 billion. Analysts warn that future token releases could exert downward pressure on the price if demand does not keep pace with supply.

What role does the community play in the future of the Pi Network token?

The community plays a crucial role in the future of the Pi Network token, especially regarding governance decisions like exchange listings. The community’s favorable vote on Binance’s potential listing indicates strong support, but ongoing uncertainties still pose risks to the project’s success.

What are the potential real-world applications for the Pi Network token following its Open Mainnet launch?

Following its Open Mainnet launch, the Pi Network token could be used for various real-world applications, including transactions in decentralized applications and potential integration with online marketplaces, which could drive its adoption and utility.

| Key Point | Details |

|---|---|

| Launch of Open Mainnet | On February 20, Pi Network transitioned to an open blockchain, enabling external transactions. |

| Price Fluctuations | After launching, Pi’s token surged 45% to $2.10 but quickly dropped 52% to $1.01. |

| Market Capitalization | The market cap fell to $7.02 billion, raising concerns about price stability. |

| Challenges Ahead | Regulatory uncertainties and ambiguous tokenomics may hinder future growth. |

| Community Support | Despite support, major exchanges have been cautious in granting listings due to legal concerns. |

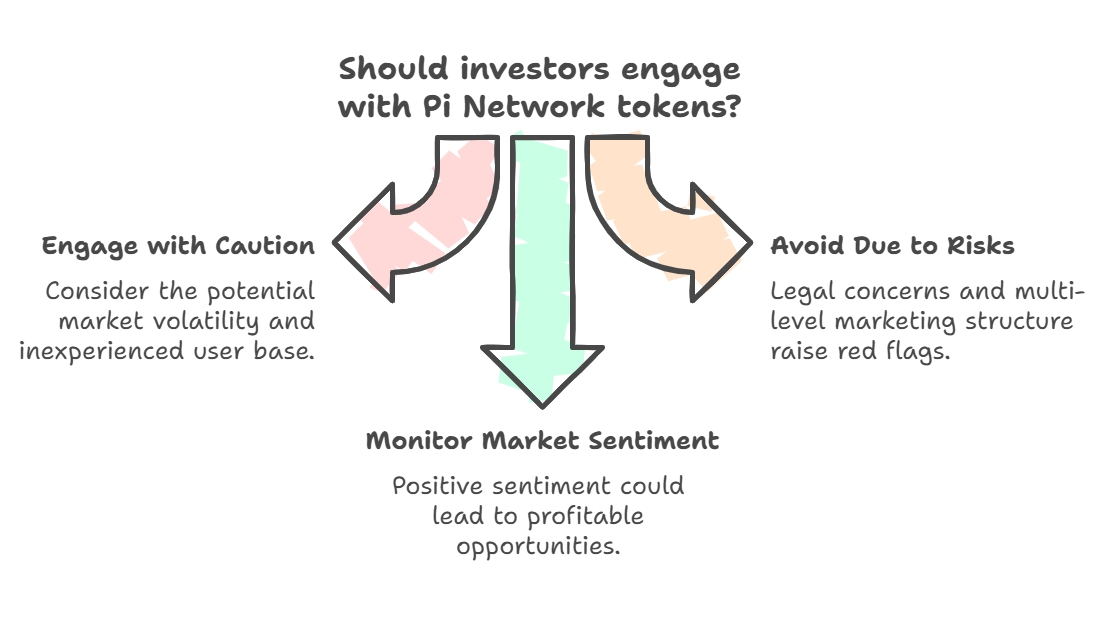

Summary

Pi Network token has experienced a tumultuous journey following the launch of its Open Mainnet. This event not only showcased the potential of the token but also highlighted the volatility and challenges that lie ahead. As Pi Network seeks to establish itself in the competitive cryptocurrency landscape, it must navigate regulatory hurdles and market uncertainties to ensure long-term success. Investors and users alike should remain informed about the developments surrounding the Pi Network token as it strives towards broader adoption and real-world applications.

The Pi Network token has become a focal point of interest in the cryptocurrency space following the recent launch of its Open Mainnet. This event has not only generated buzz among enthusiasts but has also led to significant price fluctuations for Pi, reflecting the volatile nature of cryptocurrency speculation. With its innovative approach to enabling users to mine directly through a mobile app, Pi Network is positioning itself as a unique player in the blockchain integration landscape. However, the rapid rise in value was quickly met with a sharp sell-off, raising questions about the sustainability of such price movements. As the Pi community navigates these ups and downs, understanding the implications of the Open Mainnet launch will be crucial for potential investors and users alike.

The recent debut of Pi Network’s decentralized ecosystem has captured the attention of both seasoned investors and newcomers in the digital currency arena. Known for its user-friendly mining process via smartphones, the Pi Network token is at the heart of discussions surrounding cryptocurrency trends and market behaviors. Following the transition to an open blockchain, many are keen to explore how this shift could influence trading dynamics and overall market confidence. While the surge in value following the launch indicated strong initial interest, the subsequent downturn highlights the unpredictable nature of digital asset investments. As the community continues to adapt to these changes, the focus remains on the potential for real-world applications and regulatory challenges ahead.