The US cheese reserve, a unique asset valued at over $3 billion, has recently become the focal point of an innovative proposal from the Bitcoin Policy Institute (BPI). In a bold suggestion, the BPI advocates for the liquidation of this Strategic Cheese Reserve to finance substantial purchases of Bitcoin, presenting a novel approach to enhance the nation’s crypto holdings. This proposal not only raises eyebrows about the practicality of maintaining a cheese stockpile but also ignites a discussion on the future of valuable assets in the US. Proponents argue that reallocating resources from dairy to digital currency could align with modern financial strategies favored by the crypto community. As pressure mounts to optimize US reserves, the potential conversion of cheese reserves into Bitcoin illustrates a fascinating intersection of agriculture and blockchain economics.

The concept of the US cheese reserve highlights an intriguing juxtaposition of traditional asset management and the evolving landscape of digital currencies. Known as a Strategic Cheese Reserve, this significant stockpile has been viewed through a new lens amid discussions of liquidating cheese stockpiles for funding purposes. Suggestions are resonating within the crypto community regarding alternative strategies to enhance national reserves, particularly through methods like managing Bitcoin reserves or leveraging state-owned assets effectively. As policymakers explore these ideas, the replacement of tangible items with cryptocurrencies such as Bitcoin presents an opportunity for reimagining economic stability in the digital age. This move could redefine how governments perceive asset management, signaling a potential pivot from conventional reserves to innovative financial instruments.

The Value of the US Cheese Reserve: An Unexpected Asset

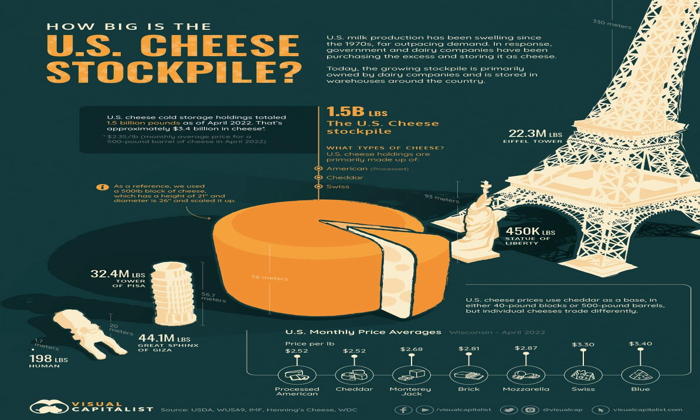

The US cheese reserve is a remarkable asset, currently estimated to be worth over $3 billion. This colossal stockpile, comprising between 1.4 billion and 1.5 billion pounds of cheese, has been maintained to stabilize dairy prices and support local farmers. However, the existence of such a reserve has raised questions about its relevance in today’s digital economy and whether it should remain a government priority. As the nation pivots towards cryptocurrency and digital assets, the strategic importance of this cheese reserve is under scrutiny.

Recently, the Bitcoin Policy Institute proposed a provocative solution: liquidating the cheese stockpile to bolster the US government’s Bitcoin reserves. This radical suggestion highlights a shift in financial strategy towards embracing more modern assets, like Bitcoin, which some experts regard as a more liquid and valuable reserve. The concept of reallocating resources from traditional commodities to digital currencies could reflect a broader trend in which the government reevaluates its asset portfolio, particularly as the role of cryptocurrency continues to expand globally.

Reimagining Strategic Reserves: From Cheese to Bitcoin

The suggestion to transition the US cheese reserve into Bitcoin reflects an innovative mindset within the financial community. The Bitcoin Policy Institute argues that instead of maintaining large quantities of dairy products, a diversified reserve anchored in a global currency like Bitcoin could provide a more effective safety net for the economy. This idea not only underscores the ongoing shift from traditional assets to digital alternatives but also aligns with the emerging trend of utilizing cryptocurrency as a reserve.

Experts such as Mathew Sigel from VanEck have echoed the sentiments of the BPI, emphasizing that Bitcoin could serve as a neutral asset, providing stability and growth potential. By transforming the strategic cheese reserve into Bitcoin, the US would not only optimize its reserves but also take a bold step into the future of digital finance, potentially enhancing its economic resilience in an ever-evolving global landscape.

Proceeds from Liquidating Cheese for Bitcoin Investments

Liquidating the US cheese stockpile could yield significant financial resources to invest in Bitcoin. Given its valuation of approximately $3.4 billion, the sale of this cheese could fund efforts to increase the nation’s Bitcoin reserves without imposing additional costs on taxpayers. The innovative approach proposed by the BPI positions the liquidation as a strategic move that benefits the US government while embracing a forward-thinking fiscal policy.

By converting this traditional commodity into Bitcoin, the US government could increase its holdings of what many experts believe is the next standard of wealth storage. As members of the crypto community rally behind this idea, this transition could signal a broader acceptance of digital currencies in government fiscal structures, bolstering the country’s position in the evolving cryptocurrency landscape.

The Role of the Bitcoin Policy Institute in Crypto Strategy

The Bitcoin Policy Institute has played a pivotal role in shaping the discussion around the future of US financial strategy. By advocating for the liquidation of the US cheese reserve to support Bitcoin accumulation, the BPI is paving the way for more radical and transformative ideas within the cryptocurrency space. Their proposals reflect a dynamic shift in how policymakers are approaching reserve assets, emphasizing the need for innovation and adaptability in the face of changing economic circumstances.

With insights from industry experts and a keen understanding of market trends, the BPI’s suggestions aim to amplify the voices within the crypto community who are pushing for increased Bitcoin adoption at the governmental level. Their willingness to explore unconventional strategies illustrates a commitment to optimizing US financial operations, ensuring that the nation remains competitive and relevant in the age of digital currency.

Building a Digital Fort Knox: Bitcoin Reserves Explained

The concept of a digital Fort Knox is gaining traction as policymakers consider Bitcoin’s potential as a vital reserve asset. Much like the physical Fort Knox holds gold, this proposed Strategic Bitcoin Reserve would function as a safeguard for the nation’s financial future. This initiative highlights the growing complexity of government reserves and the need to adapt to a digital economy where traditional assets may no longer suffice.

With experts like David Sacks emphasizing the contrasting necessity of Bitcoin as a modern store of value, the Strategic Bitcoin Reserve concept reflects a significant paradigm shift. The acknowledgment that Bitcoin could replace outdated reserves like the cheese inventory echoes broader trends within finance, where digital assets are increasingly recognized for their potential impact on fiscal stability and growth.

Community Reactions: Enhancing US Bitcoin Reserves

The proposal to liquidate the cheese reserve has sparked diverse reactions within the crypto community, with many suggesting alternative strategies to bolster US Bitcoin holdings. Community members have been vocal about the potential benefits of tapping into surplus US dollars, gold reserves, and even revenue from privatizing Government-Sponsored Enterprises (GSEs) to fund Bitcoin purchases. These suggestions reflect a growing sentiment within the crypto space that the government must seize opportunities to increase its Bitcoin reserves responsibly.

As discussions progress, the emphasis remains on finding budget-neutral methods for enhancing US Bitcoin reserves. The enthusiasm among crypto proponents demonstrates a keen awareness of market trends and the potential for government intervention in cryptocurrency investments to yield substantial advantages. The community’s involvement is vital in shaping a coherent strategy that aligns with the broader goals of the nation and the burgeoning digital economy.

The Strategic Importance of Bitcoin in Modern Finance

Amidst the ongoing discourse surrounding reserves, Bitcoin’s strategic importance in modern finance cannot be overlooked. As traditional assets face increased volatility and uncertainty, Bitcoin has emerged as a potential hedge against market fluctuations. The idea of treating Bitcoin as a reserve asset invites policymakers to rethink conventional financial strategies in light of new economic realities.

Furthermore, by integrating Bitcoin into the nation’s financial framework, the US can position itself as a leader in the transition toward digital finance. The strategic deployment of Bitcoin, through initiatives proposed by organizations like the Bitcoin Policy Institute, could serve to solidify the nation’s financial footing in an increasingly competitive global economy, ultimately influencing fiscal policy at unprecedented levels.

Investing in Tomorrow: The Future of US Reserves

The future of US reserves may very well hinge on the strategic decisions made today regarding assets like Bitcoin. As discussions about liquidating outdated reserves, such as cheese, gain traction, the opportunity to redefine what constitutes a government reserve emerges. This pivotal moment calls for visionary leaders who can embrace change and recognize the potential inherent in digital assets.

By prioritizing investments in Bitcoin and identifying innovative funding sources, the US government can enhance its financial resilience and pave the way for a transformative economic landscape. As more voices from the crypto community contribute to this discourse, it is vital to maintain focus on the long-term implications of these shifts and the role that a diversified reserve strategy can play in shaping America’s financial future.

Reassessing Dairy Reserves in a Digital Economy

As the world transitions into a digital economy, the rationale behind maintaining large dairy reserves is being called into question. The current cheese reserve, an artifact of past agricultural policies aimed at stabilizing dairy prices, may no longer align with the forward-looking financial strategies that contemporary governments need to adopt. Given the appetites for innovative financial solutions, it’s time for policymakers to reassess the relevance of such reserves.

In a landscape where Bitcoin and other digital assets are gaining prominence, reconsidering the cheese stockpile as part of a strategic move to enhance national Bitcoin reserves could be transformative. The ability to pivot resources from a traditional reserve like cheese to a cutting-edge asset like Bitcoin not only demonstrates adaptability but could potentially unleash a wave of economic benefit that propels the US into a new era of financial sustainability.

Frequently Asked Questions

What is the US cheese reserve and its estimated value?

The US cheese reserve, also known as the Strategic Cheese Reserve, is a stockpile of cheese held by the US government, estimated to be worth over $3.4 billion. This reserve includes approximately 1.4 to 1.5 billion pounds of cheese in cold storage, created to stabilize dairy prices and support farmers.

How does the Strategic Cheese Reserve relate to Bitcoin reserves?

The Strategic Cheese Reserve has been proposed by the Bitcoin Policy Institute as a potential source of funds for enhancing US Bitcoin reserves. They suggest liquidating the cheese stockpile to convert the proceeds into Bitcoin, positioning it as a more valuable asset compared to cheese.

What proposals have been made regarding liquidating the US cheese stockpile?

The Bitcoin Policy Institute has proposed liquidating the US cheese stockpile to finance Bitcoin purchases. This suggestion involves selling off the Strategic Cheese Reserve to use the proceeds for increasing the country’s Bitcoin reserves, thereby aligning with modern financial strategies.

Who supports the idea of replacing the US cheese reserve with Bitcoin reserves?

Support for replacing the US cheese reserve with Bitcoin reserves has come from various quarters, including Mathew Sigel from VanEck, who questions the rationale behind maintaining a cheese stockpile and advocates for using Bitcoin or other neutral assets instead.

What are the benefits of converting the US cheese reserve into Bitcoin reserves?

Converting the US cheese reserve into Bitcoin reserves could provide a more stable and appreciated asset for the US government. It may enhance the country’s strategic financial positioning and align with innovative asset management strategies suggested by the crypto community.

What are some methods suggested by the crypto community to enhance US Bitcoin reserves?

Members of the crypto community have suggested several methods to bolster the US Bitcoin reserves, including utilizing surplus US dollars, liquidating gold reserves, leveraging foreign exchange holdings, and generating revenue from the privatization of Government-Sponsored Enterprises (GSEs).

| Key Point | Details |

|---|---|

| US Cheese Reserve Valuation | Estimated worth over $3 billion with a stockpile of 1.4 to 1.5 billion pounds of cheese in cold storage. |

| Bitcoin Policy Institute’s Proposal | Propose to liquidate the cheese reserve to finance Bitcoin purchases for enhancing government Bitcoin reserves. |

| Support for Proposal | Mathew Sigel from VanEck supports the idea, questioning the need for a cheese reserve and advocating for Bitcoin instead. |

| Background of Cheese Reserve | The reserve is part of governmental strategies to stabilize dairy prices and support local farmers. |

| Strategic Bitcoin Reserve Initiative | Announced by President Donald Trump, it focuses on not selling Bitcoin already in the Reserve but using alternative funding methods to increase reserves. |

| Future Funding Suggestions | Matthew Pines proposes utilizing surplus dollars, gold reserves, and revenue from privatizing GSEs to fund Bitcoin purchases. |

Summary

The US cheese reserve holds significant value, estimated at over $3 billion, highlighting its impact on the dairy industry and government financial strategies. The recent proposal from the Bitcoin Policy Institute to liquidate the cheese stockpile and convert the proceeds to Bitcoin presents an unconventional yet intriguing perspective on asset management for the US government. This concept invites further discourse about the relevance of traditional commodity reserves in today’s digital economy.

The US cheese reserve, boasting an astonishing estimated worth of over $3 billion, has recently come into the spotlight due to a bold proposal from the Bitcoin Policy Institute (BPI). This unconventional initiative suggests liquidating the Strategic Cheese Reserve to fund Bitcoin purchases, effectively transforming dairy into digital gold. Advocates argue that reallocating these resources could strategically bolster the government’s Bitcoin reserves, aligning with modern economic practices. The call to action has resonated within the crypto community, prompting discussions around the value of traditional reserves versus digital assets. As innovative financial strategies emerge, the idea of liquidating cheese stockpiles for cryptocurrency investments highlights a fascinating intersection of agriculture and technology in today’s economy.

Discussing the concept of the US cheese reserve evokes thoughts of national food stockpiles and their economic implications. Recently, the proposal to convert this dairy reserve into a digital asset, specifically Bitcoin, has sparked interest across various sectors. With suggestions from experts in the cryptocurrency arena, there is a growing conversation about the future of monetary policy in relation to tangible resources like cheese versus intangible assets like Bitcoin. As the country weighs its strategic reserves, the exploration of turning physical commodities into liquid digital funds could redefine how we approach national securities. This shift from traditional forms of reserve management could signal a transformative moment in economic history.