As the cryptocurrency market gears up for the $2B Crypto Options Expiry, traders and investors alike are keenly observing potential impacts on market dynamics. This significant event includes around 16,500 Bitcoin options contracts and 153,000 Ethereum contracts, collectively valued at an impressive $2 billion. With the put/call ratios indicating a slight preference for bullish positions, the crypto market outlook suggests a cautious optimism amidst low volatility. As options expiry can often sway cryptocurrency trading sentiments, the market participants are left pondering how this expiry could influence future price movements. Understanding the options expiry impact is crucial for those navigating the ever-evolving landscape of Bitcoin options and Ethereum contracts in the lead-up to this critical juncture.

The impending expiration of cryptocurrency derivatives, including Bitcoin and Ethereum options, heralds a notable moment in the digital asset space. With a combined notional value nearing $2 billion, this event is poised to shape market sentiment and price trajectories. As traders prepare for the expiry, the balance between call and put options may offer insights into the prevailing market strategies. The cryptocurrency trading environment remains dynamic, and the outcomes of this options expiry could have lasting effects on the crypto market outlook. In the face of these developments, understanding the nuances of options expiry and its potential ramifications is essential for maximizing trading strategies.

Understanding the $2B Crypto Options Expiry

The $2B crypto options expiry occurring today is a significant event in the cryptocurrency trading calendar, especially for investors in Bitcoin and Ethereum. With approximately 16,500 Bitcoin options contracts and 153,000 Ethereum contracts set to expire, the total notional value of this expiry event is around $2 billion. This figure highlights the importance of options in the crypto market, as they can impact price movements and market sentiment. Investors often speculate on the direction of cryptocurrency prices, and the expiry of such a large volume of options can lead to increased volatility.

Options expiry events are crucial for understanding market dynamics, as they can either trigger significant price movements or reinforce existing trends. In this case, the put/call ratios for both Bitcoin and Ethereum suggest a cautious sentiment among traders. With a put/call ratio of 0.75 for Bitcoin and 0.48 for Ethereum, there is a slight preference for call contracts, indicating that traders are more optimistic about price increases. However, the relatively small size of this expiry compared to others may result in limited impact on spot prices.

Frequently Asked Questions

What is the impact of $2B Crypto Options Expiry on Bitcoin options?

The $2B Crypto Options Expiry, particularly this week’s expiration of approximately 16,500 Bitcoin options contracts valued at $1.6 billion, is expected to have minimal impact on the market. With a put/call ratio of 0.75 indicating more call contracts, the market may see some slight movements, but overall, it has remained largely range-bound.

How do Ethereum contracts contribute to the $2B Crypto Options Expiry?

The $2B Crypto Options Expiry includes about 153,000 Ethereum contracts worth approximately $420 million. This contributes significantly to the total value and shows that Ethereum’s volatility remains higher compared to Bitcoin, influencing traders’ strategies in cryptocurrency trading.

What does the $2B Crypto Options Expiry indicate about the crypto market outlook?

The $2B Crypto Options Expiry suggests a cautiously bearish sentiment in the crypto market, reflecting low volatility and a sideways trading channel. Despite minor gains, the market remains cautious, primarily influenced by the dynamics of Bitcoin and Ethereum options.

Are $2B Crypto Options Expiry events significant for cryptocurrency trading?

While $2B Crypto Options Expiry events can influence short-term price movements, their significance varies. This week’s expiration is among the smallest of the year, indicating limited potential for drastic market shifts, particularly in Bitcoin and Ethereum prices.

What is the relationship between options expiry and market volatility in the crypto market?

Options expiry, like the current $2B Crypto Options Expiry, often leads to increased volatility as traders adjust positions. However, the low volatility observed recently suggests that this expiry may not lead to significant market movements, keeping the crypto market outlook stable.

| Key Point | Details |

|---|---|

| Bitcoin Options Expiry | Approximately 16,500 Bitcoin options contracts expiring today, total value around $1.6 billion. |

| Put/Call Ratio | Current ratio at 0.75, indicating more call contracts than puts. |

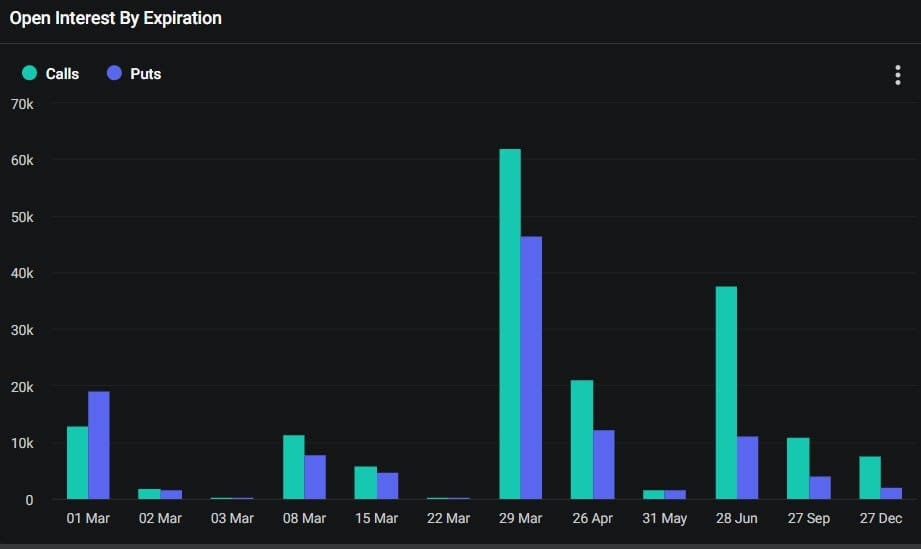

| Open Interest | Highest open interest at $120,000 strike ($1.8 billion), followed by $110,000 ($1.2 billion). |

| Market Sentiment | Sentiment is cautiously bearish with low volatility, affecting trader frustration. |

| Ethereum Contracts | 153,000 Ethereum contracts expiring today, total value of $420 million. |

| Total Notional Value | Total combined crypto options expiry value today is approximately $2 billion. |

| Market Trends | Bitcoin reached $98,750 but faced resistance. Ethereum showed volatility, trading around $2,744. |

Summary

$2B Crypto Options Expiry is set to occur today, reflecting a significant moment in the cryptocurrency market. The expiry includes around 16,500 Bitcoin options contracts and 153,000 Ethereum contracts, totaling a notional value of approximately $2 billion. Despite this sizeable expiry, the impact on spot markets is expected to be minimal due to low volatility and a largely sideways trading channel observed in recent weeks. Traders are experiencing frustration with market stagnation, and while certain altcoins are showing gains, the overall market remains cautious.

The $2B Crypto Options Expiry event on February 21st is set to create ripples in the cryptocurrency trading landscape, with a total notional value of approximately $2 billion in options contracts maturing today. This includes about 16,500 Bitcoin options and 153,000 Ethereum contracts, indicating pivotal moments for both Bitcoin options and Ethereum contracts. As traders prepare for potential price movements, the impact of options expiry on the crypto market outlook cannot be underestimated. Market sentiment has been cautiously bearish, with many anticipating that this expiry could influence volatility in cryptocurrency prices. With the current low volatility levels, this expiry event could be a critical factor in determining future market trends and investor strategies in the coming weeks.

The impending expiration of $2 billion worth of cryptocurrency derivatives marks a significant event for traders and investors alike. Known colloquially as options expiry, this occurrence involves the maturation of numerous Bitcoin and Ethereum contracts, which can lead to notable shifts in market dynamics. As participants assess the implications of these expirations, the overall cryptocurrency market outlook remains cautious, with many eyeing the potential impact on price volatility. The relationship between options expiry and market movements is a crucial aspect of cryptocurrency trading, often serving as a catalyst for future price trends. Understanding the mechanisms behind these expirations is essential for navigating the complexities of the crypto landscape.