The 2024 Bitcoin halving is quickly becoming a focal point for cryptocurrency enthusiasts and investors alike, as it marks a significant event in the Bitcoin market cycle. This halving, which reduces block rewards from 6.25 to 3.125 BTC, underscores the scarcity that drives Bitcoin’s value and potentially sets the stage for future price surges. With Bitcoin price predictions fueled by increased institutional adoption and the recent rise of Bitcoin ETFs, observers are eager to see how this pivotal moment will impact market dynamics. As BTC continues to show resilience amid global economic uncertainty, many anticipate that the halving could trigger an accelerated bullish phase, pushing Bitcoin toward record highs. The interplay of these factors could make 2024 a crucial year for Bitcoin investors, highlighting the implications of Bitcoin scarcity in a rapidly changing financial landscape.

As we delve into the anticipated 2024 Bitcoin halving, it’s essential to consider how this event affects the cryptocurrency’s economic framework. Known as the ‘halving,’ this event reduces the issuance rate of new Bitcoins entering circulation, thereby enhancing the asset’s inherent scarcity, a characteristic that has captivated many investors. Furthermore, the surge of institutional participation and the growing interest in Bitcoin exchange-traded funds (ETFs) are reshaping market expectations and price patterns. Observers and traders are closely monitoring Bitcoin’s response to these developments, particularly as they relate to broader financial trends and sentiments. With discussions around halving cycles and their historical impacts gaining momentum, 2024 promises to be a year of significant transformations in the crypto sphere.

Understanding the 2024 Bitcoin Halving: A Turning Point for BTC

The 2024 Bitcoin halving is anticipated to be a pivotal event for Bitcoin enthusiasts and investors alike. By halving the block rewards from 6.25 BTC to 3.125 BTC, this event dramatically reduces new Bitcoin issuance, thereby directly influencing Bitcoin’s scarcity. Scarcity is one of Bitcoin’s core attributes that enhances its value proposition, especially in light of growing global economic uncertainties. As the market prepares for this crucial event, the dynamics around Bitcoin’s price predictions become increasingly engaging. Will the reduced supply from the halving lead to higher prices, or will external economic factors dictate market trends?

In addition, the accumulation of institutional assets is expected to have a significant impact post-halving. With companies increasingly recognizing the potential of Bitcoin, their larger capital inflows could result in more stable market conditions. Analysts project that the interplay of reduced block rewards and heightened institutional participation could initiate a rapid ascent in Bitcoin’s price, setting the stage for significant investment opportunities. The halving is more than just a technical adjustment; it represents a broader shift in how Bitcoin is perceived in traditional financial markets.

Bitcoin Price Predictions Post-Halving: Are We in for a Surge?

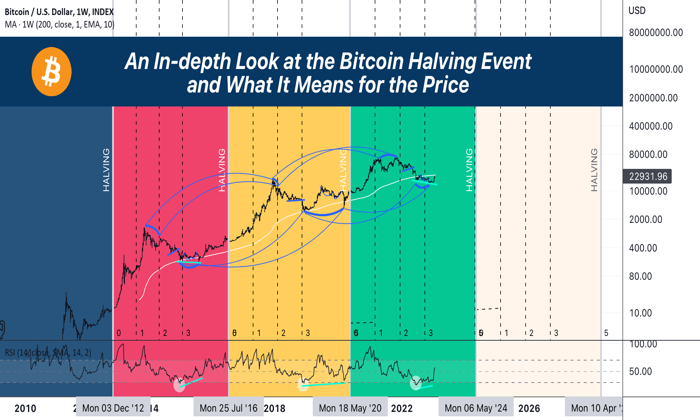

After the 2024 halving, many market analysts are adjusting their Bitcoin price predictions with optimistic forecasts. The historical trend suggests that Bitcoin usually experiences a significant price rally following halving events, with previous cycles indicating peaks occurring within approximately 18 months. This time, factors like institutional adoption and the proliferation of Bitcoin ETFs may further accelerate the ascendant price trajectory. Currently valued at significant levels, some experts believe BTC could break through the formidable $90,000 threshold if momentum continues. Market reactions to halving events also reflect broader economic conditions, hinting that soaring Bitcoin prices might harmonize with favorable monetary policy shifts.

Furthermore, greater liquidity in the market, stronger institutional backing, and a more educated investor base signal that the post-halving landscape could be vastly different from that of earlier cycles. While some investors remain cautious, waiting for clearer signals to guide their decisions, others see the halving as an optimal entry point. The anticipation builds around the idea of Bitcoin eventually retesting its all-time high, with some experts projecting that, given current trends, this could happen sooner rather than later. The historical performance of Bitcoin during these pivotal periods encourages speculation and investment, catering to those with a long-term vision.

Institutional Adoption and the Future of Bitcoin ETFs

Institutional adoption is reshaping the landscape of Bitcoin investment, particularly with respect to Bitcoin exchange-traded funds (ETFs). The recent surge in institutional purchases, especially surrounding the 2024 halving, indicates a mature market where Bitcoin is starting to be seen as a legitimate asset class. With large financial entities now participating, analysts are confident that such involvement can push Bitcoin prices to unprecedented heights. The integration of Bitcoin ETFs provides a structured avenue for traditional investors to gain exposure to Bitcoin without the complexities of direct ownership, thus further binding Bitcoin’s performance to mainstream financial vehicles.

The potential for Bitcoin ETFs to accelerate market cycles cannot be overstated. As institutional investors increasingly recognize Bitcoin as a hedge against inflation and a scarce digital asset, their contributions will likely trim the length of Bitcoin’s typical market cycle. Data indicates that the increased interest from institutions post-halving could catalyze price movements that deviate from historical trends. This growing bond between Bitcoin and institutional finance showcases a promising trajectory for Bitcoin’s future, making it crucial for investors to remain informed about these developments.

Bitcoin Scarcity: The Heart of BTC’s Value Proposition

Scarcity is a fundamental aspect of Bitcoin’s value, amplified by the halving events that systematically reduce the supply of new coins entering circulation. The 2024 Bitcoin halving has underscored the importance of this characteristic, as the reduced issuance creates an environment ripe for increasing demand. As Bitcoin continues to be adopted by larger institutions, the limited availability of new BTC could lead to significant price climbs, especially as more investors come to appreciate Bitcoin’s monetary policy. This is a distinct advantage for BTC as it finds its place within a world increasingly concerned with inflation and monetary instability.

Furthermore, the scarcity factor plays a crucial role in influencing investor sentiment and market dynamics. With the anticipation of supply constraints following the halving, many believe that Bitcoin could set new price records, with projections floating around the $100,000 mark. The combination of decreased issuance alongside growing awareness of Bitcoin among traditional investors casts a spotlight on the asset’s unparalleled potential as a store of value. Scarcity not only elevates Bitcoin’s market cost but also enhances its narrative as a digital asset poised against inflation, solidifying its position in investor portfolios.

The Impact of Global Economic Factors on Bitcoin Trends

Global economic factors significantly impact Bitcoin’s price movements, as the cryptocurrency often reacts to major financial news and policy changes. The interplay between the U.S. Federal Reserve’s monetary policies and Bitcoin’s value cannot be ignored, especially during times of economic uncertainty. For instance, potential rate cuts by the Federal Reserve could stimulate investment in riskier assets, including Bitcoin, driving prices up in response to increased liquidity. The market is keenly observing how global trade tensions and economic policies will evolve as these issues are likely to shape Bitcoin’s trajectory.

Additionally, international conflicts and financial crises historically lead investors to seek alternative assets as a hedge against economic fragility. As Bitcoin gains traction as a viable alternative, its price movements could increasingly correlate with global economic indicators. The 2024 halving occurs within a context of heightened economic scrutiny, prompting investors to adapt their strategies in response to global challenges. Understanding these economic dynamics will be essential for those looking to navigate Bitcoin’s price fluctuations in the coming months.

The Potential for a Shortened Market Cycle Post-Halving

Given the unique dynamics surrounding the 2024 Bitcoin halving, many analysts are discussing the potential for a shortened market cycle. Historically, Bitcoin has entered prolonged periods of bullish and bearish movements, typically spanning several years. However, the infusion of institutional capital, coupled with rapid market adoption of Bitcoin ETFs, may alter this pattern. The growing liquidity and maturity of the market could prompt a swift transition from accumulation phases to accelerated price spikes, drastically reducing the time frames associated with Bitcoin’s market cycles.

In this context, the halving is not just a calendar event but a catalyst for transformative market behavior. Analysts suggest that, with the right combination of institutional backing and economic stability, the timeline for Bitcoin to reach significant price milestones could shrink considerably. Observers are keen to see if the patterns of previous halvings hold true or if the current market landscape allows for an evolution in Bitcoin’s ascent, creating a new benchmark for future cycles.

Investor Sentiment: The Driving Force Behind Bitcoin’s Resilience

Investor sentiment plays a crucial role in the resilience of Bitcoin, especially in the wake of significant events like the halving. Market analysts underscore that while Bitcoin has surged post-2024 halving amidst global economic turmoil, the psychological aspects of investing cannot be overlooked. Caution among investors is still palpable, with many waiting for clearer signals before jumping into the fray. This sentiment manifests in the market as price movements fluctuate, reflecting broader economic conditions and resulting in a cautious and deliberate approach to Bitcoin investment.

Moreover, as institutional players continue to adopt Bitcoin, the sentiment around the cryptocurrency becomes more robust, reinforcing its position as a premier digital asset. Given that investor outlook is shaped significantly by news cycles, regulatory developments, and macroeconomic data, understanding these influences can help individuals gauge potential price movements. The need for a clear understanding of market sentiment becomes even more crucial for investors as they navigate potential volatility in the wake of the halving.

The Relationship Between Traditional Financial Markets and Bitcoin

The interconnection between traditional financial markets and Bitcoin has become increasingly evident following the 2024 halving. As Bitcoin transitions into mainstream finance, developments in traditional markets can create ripples in the cryptocurrency landscape. Investors are already noticing correlations between Bitcoin’s performance and shifts in stock markets or economic indicators, sparking new discussions about Bitcoin’s role in financial portfolios. This relationship signals a maturation of Bitcoin as a financial product, often reacting to similar dynamics currently influencing equities and traditional assets.

Furthermore, the stronger linkage with traditional markets poses both risks and opportunities for Bitcoin investors. While rapid gains can be facilitated by buoyant market conditions, adverse movements in traditional finance may weigh down Bitcoin prices as sellers react. Recognizing these connections is vital, as they will continue to shape investment strategies and expectations. As the infrastructure for trading Bitcoin aligns more closely with traditional finance, investors must remain vigilant to how macroeconomic factors will shape their cryptocurrency strategies.

What the Future Holds: Speculating on Bitcoin’s Next Moves

Speculating on Bitcoin’s future movements post-2024 halving brings both excitement and uncertainty. Analysts are divided on how rapidly Bitcoin will recover lost ground and find new heights. With various factors at play, including institutional adoption, economic conditions, and Bitcoin’s inherent scarcity, the landscape appears ripe for both bullish and bearish trends. Investors are now closely monitoring market signals, eager to position themselves advantageously as opportunities arise. In recent weeks, discussions surrounding potential price targets, including crossing new milestones like the $90,000 mark, have intensified.

In essence, as Bitcoin evolves within the broader financial context, the community’s understanding of its potential trajectory is continually deepening. Expectations of nearing all-time highs fueled by institutional investments could lead investors to re-evaluate their strategies. The activities surrounding the halving event serve as a reminder of Bitcoin’s unique structure and its adaptive nature in the face of changing financial landscapes. Whether Bitcoin’s future holds sustained growth, retracement, or a mix of both remains to be seen, but the interest surrounding it is undeniable.

Frequently Asked Questions

What is the significance of the 2024 Bitcoin halving for Bitcoin price predictions?

The 2024 Bitcoin halving significantly impacts Bitcoin price predictions by drastically reducing Bitcoin issuance from 6.25 BTC to 3.125 BTC per block, increasing its scarcity. Historically, halvings have preceded major price surges, positioning Bitcoin for potential growth as demand continues to rise amid institutional adoption and evolving market conditions.

How does institutional adoption influence the effects of the 2024 Bitcoin halving?

Institutional adoption greatly influences the effects of the 2024 Bitcoin halving by driving demand and liquidity. With notable investments from firms and the introduction of Bitcoin ETFs, institutional involvement can lead to quicker price movements and potentially shorten the typical market cycle that follows a halving event.

What are the expectations for Bitcoin’s market cycle following the 2024 halving?

Following the 2024 Bitcoin halving, expectations suggest an accelerated market cycle, as indicated by analysts who anticipate that a bottom may form in Q3 2024 before reaching new highs by mid-2026. This accelerated cycle is supported by increasing institutional adoption and Bitcoin’s built-in scarcity.

Could Bitcoin ETFs impact Bitcoin prices in the wake of the 2024 halving?

Yes, Bitcoin ETFs could significantly impact Bitcoin prices post-2024 halving, as they facilitate institutional investments and increase demand. With greater access for traditional investors, Bitcoin ETFs are expected to bolster market confidence and may contribute to upward price movements more swiftly than previous cycles.

What role does Bitcoin scarcity play in the aftermath of the 2024 halving?

Bitcoin scarcity plays a crucial role in the aftermath of the 2024 halving by reducing the rate of new Bitcoin creation, making it a scarcer asset. This enhanced scarcity may drive up demand and price, especially as more institutional players enter the market and contribute to Bitcoin’s upward momentum.

Is the 2024 Bitcoin halving likely to lead to a new all-time high for Bitcoin?

The 2024 Bitcoin halving is likely to create conditions conducive to reaching a new all-time high. Analysts suggest that if Bitcoin can surpass critical price levels, such as $90,000, the combination of its reduced issuance and increased institutional demand could propel it toward historical peaks in a shorter timeframe compared to previous halvings.

| Key Points | Details |

|---|---|

| Celebration of 2024 Bitcoin Halving | Bitcoin holders are marking the one-year anniversary of the 2024 halving amidst a global trade war. |

| Impact on Block Rewards | The halving reduced block rewards from 6.25 BTC to 3.125 BTC, significantly cutting new Bitcoin issuance. |

| Bitcoin Price Surge | Despite global trade concerns, BTC has increased by over 33% since April 2024, with notable support from institutional investments. |

| Market Analyst Feedback | Analysts suggest cautious investor sentiment due to economic uncertainties, though expect institutional investments to accelerate market cycles. |

| Future Price Predictions | Potential price peaks are projected around mid-2026, with immediate market movements anticipated due to greater liquidity. |

| Link to Monetary Policy | Bitcoin’s trajectory is influenced by broader monetary policies, including potential U.S. Federal Reserve rate cuts. |

| Institutional Adoption Impact | Bitcoin ETFs and institutional purchases are expected to shorten the market cycle, increasing scarcity may push Bitcoin to retest its all-time high. |

| Historical Context | The current market cycle following the 2024 halving shows potential for rapid growth, with historically shorter times to reach new peaks compared to previous halvings. |

Summary

The 2024 Bitcoin Halving is poised to significantly influence the cryptocurrency market, with Bitcoin holders optimistic about its resilience during a turbulent global economy. This event, characterized by the halving of block rewards, is expected to accelerate market cycles, driven by increased institutional adoption and a shift in broader monetary policies. Analysts predict that with the right market conditions, we could witness Bitcoin reaching new all-time highs in a condensed timeframe, marking a pivotal moment for the digital currency’s future.

The 2024 Bitcoin halving is a pivotal event that has captured the attention of investors and analysts alike, marking a significant reduction in Bitcoin issuance from 6.25 to 3.125 BTC per block. This halving phenomenon plays a crucial role in enhancing Bitcoin’s scarcity, an attribute that many believe will contribute to rising prices in the coming years. With an increasing number of institutional investors engaging in Bitcoin, alongside the rise of Bitcoin exchange-traded funds (ETFs), speculation about Bitcoin price predictions has intensified. As we move through the market cycle, Bitcoin’s resilience in the face of global economic challenges demonstrates its potential as a valuable asset. Investors are closely watching the impact of the halving on overall market dynamics and whether it will drive the next bull run in cryptocurrency markets.

The anticipation surrounding the 2024 Bitcoin halving has ignited discussions about future market trends and the digital currency’s rarity. This event, which reduces the rewards for mining new Bitcoins, is expected to create a more constrained market, influencing Bitcoin’s price trajectory significantly. As institutional adoption continues to grow, and new financial instruments such as Bitcoin ETFs gain traction, the potential for heightened price activity increases. The upcoming halving could signify a turning point within the ongoing Bitcoin market cycle, fueling excitement among traders and investors. With every halving event, the interplay between scarcity and demand becomes more pronounced, shaping the future landscape of cryptocurrency investments.