Solana price analysis reveals the ongoing struggles of SOL as it battles significant selling pressure within the current cryptocurrency market trends. Since late January, the digital asset has faced a steep downtrend, losing over 60% of its value while striving to stabilize around critical support levels. Analysts note that the $135 resistance level holds immense importance; failing to break above it may lead to further declines. Nevertheless, some investors are hopeful for a Solana recovery, suggesting that improved economic conditions could quickly shift market sentiment. As we delve deeper into Solana’s market dynamics, it’s essential to examine the SOL support and resistance levels that could dictate its future performance.

An exploration of Solana’s price movements highlights the cryptocurrency’s recent challenges, reflecting broader trends within the digital asset space. With SOL grappling under important selling zones, the narrative has shifted to whether it can successfully navigate through these turbulent waters. Many in the trading community are focused on assessing the bearish momentum versus any potential bullish reversals as they analyze Solana’s roadmap ahead. The critical resistance and support levels could serve as pivotal indicators for investors watching closely for signs of recovery or continued downtrends in Solana’s price trajectory.

Understanding Solana Price Analysis and Market Sentiment

In recent months, Solana’s price analysis has been significantly influenced by bearish market sentiments, which have left traders cautious. After a staggering drop of over 60% since late January, the SOL price is currently hovering near critical support levels. Analysts are observing the recent movements closely, as these can serve as indicators of future price action in this turbulent cryptocurrency market. Specifically, the $135 resistance level has been highlighted, indicating a pivotal point where a shift in market trends might occur.

Despite facing overwhelming selling pressure, there is still a glimmer of hope among investors who believe in a potential recovery. Historical price data reveals that if Solana can break through the $135 resistance and hold above it, this could signal a significant trend reversal, opening the door for SOL to regain lost ground. As Solana continues to navigate the challenges presented by the downtrend, monitoring these price points will be crucial for any short- or long-term trading strategies.

Solana Recovery: The Quest for Support Levels

As SOL strives for a recovery amidst a downward trend, maintaining key support levels emerges as a critical focus for traders. Currently, the price sits at $126, marking a significant demand zone that bulls must defend to avoid further declines. The urgency of this situation is underscored by the potential for panic selling if Solana fails to hold its ground. A breakdown below the $120 level could unleash a wave of selling pressure, potentially sending SOL toward the psychological barrier of $100.

Investors remain hopeful that with team developments and improvements in market conditions, Solana can stage a recovery even in the face of challenges. Strong resistance at $135, alongside support at $126 and $120, creates a battleground for bulls and bears alike. The ability to navigate these levels could determine Solana’s trajectory in the coming weeks, with many traders closely watching market trends for signs of renewed upward momentum.

Examining SOL Resistance Levels Amidst Market Volatility

SOL resistance levels have come under scrutiny as Solana trades under the influence of significant market volatility. Following a considerable downtrend, bulls are struggling not only to reclaim previous highs but also to assert dominance at crucial resistance points. Analysts suggest that the identified resistance at $135 is not just a number but a critical battleground that could dictate future price directions for Solana. A failure to breach this level may prolong the current bearish narrative.

Moreover, the consistent observation of market trends is vital in distinguishing whether Solana will break free from its current predicament. Investors are keenly monitoring SOL’s behavior at these resistance points, as historical data indicates that these levels often serve as important markers for future performance. With the potential for explosive moves in the cryptocurrency market, understanding SOL’s resistance will be key to navigating the ongoing volatility.

Solana Downtrend: Challenges and Future Projections

The current downtrend in Solana’s price has raised concerns among traders regarding the implications for future projections. Since hitting its peak, the cryptocurrency has faced relentless selling pressure, contributing to its significant decline. With the overall market sentiment leaning bearish, the ability of SOL to bounce back remains in question. Analysts point towards ongoing changes in the cryptocurrency market trends, which suggest that external factors could play a role in Solana’s recovery.

If broader economic conditions and liquidity situations improve, investors might witness a shift in sentiment. This potential change could act as a catalyst for Solana, allowing it to reverse its downtrend and regain lost value. However, the success of this recovery hinges on the cryptocurrency’s ability to establish a foothold above resistance levels, primarily the crucial $135 mark. In this landscape, understanding the dynamics of Solana’s downtrend becomes essential for traders looking to capitalize on future opportunities.

Navigating SOL Support and Resistance Zones

Traders focusing on Solana must navigate its intricate support and resistance zones carefully. The price action around $126 is particularly notable, as it represents a crucial level for bulls looking to reverse the current bearish trend. If SOL can consolidate above this support, it could pave the way for a move towards the upper resistance at $135, which many view as a decisive battleground for the cryptocurrency. Historical trading volumes within these zones serve as critical indicators of where market participants are likely to act.

Understanding the interplay between support and resistance levels can significantly influence trading decisions in such a volatile market. Should Solana break below its current support, further declines could ensue, persuading traders to reevaluate their positions. Conversely, a successful retest of the resistance might foster renewed bullish sentiment, prompting market movements in Solana’s favor. As a result, closely monitoring SOL’s price action in relation to these key levels remains essential for any trader navigating the current cryptocurrency landscape.

The Impact of Broader Economic Factors on Solana’s Price

Broader economic factors play a significant role in influencing Solana’s price trajectory and the overall sentiment within the cryptocurrency market. As inflation rates rise and economic uncertainties loom, traders are particularly sensitive to market movements. The expectation of shifts in interest rates and liquidity can lead to heightened volatility, affecting cryptocurrencies like Solana. In such an environment, SOL’s ability to maintain critical support levels will depend significantly on external economic influences.

Analysts suggest that improvements in economic indicators could create a more favorable backdrop for Solana’s recovery. For instance, if the cryptocurrency market experiences renewed investor interest due to easing economic pressure, SOL could break free from its downtrend and reclaim higher resistance levels. As investors continue to scan for signals of a recovery, understanding the implications of broader economic trends becomes essential in forecasting Solana’s price movements.

Upcoming Key Events to Watch for Solana

As Solana continues to grapple with its challenges, upcoming key events are worth monitoring for potential market reactions. Announcements concerning Solana’s technology improvements or partnerships could significantly shift investor sentiment. Additionally, broader industry conferences or regulatory updates can also impact cryptocurrency valuations. Keeping an eye on such developments can help traders anticipate potential price movements, allowing them to strategically position themselves within the market.

Investors should consider the timing of these events in relation to the current market conditions, especially since they can serve as catalysts for movements in Solana’s price. If positive news emerges, it could encourage bulls to reassert control, fostering a potential recovery and overcoming key resistance levels. On the other hand, negative developments could exacerbate existing downtrends, leading to increased selling pressure. Hence, remaining agile and informed will be crucial for capitalizing on opportunities within the fluctuating landscape of Solana.

Technical Indicators to Assess Solana’s Market Position

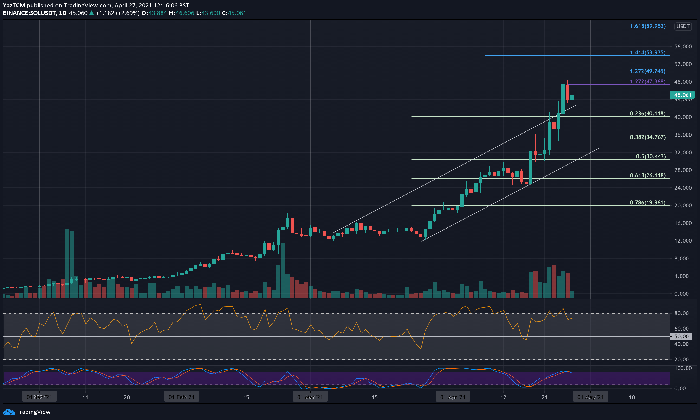

Technical indicators play an essential role in assessing Solana’s market position and potential price movements. As SOL grapples with its current price levels, indicators such as moving averages and the Relative Strength Index (RSI) can provide crucial insights into market dynamics. For example, if the RSI indicates oversold conditions, it might suggest that a bounce could occur soon, drawing in buyers looking to capitalize on potential market rallies.

Moreover, analyzing moving averages can help identify trends in Solana’s price action. If SOL can rise above key moving averages, it could signal a shift in momentum favoring the bulls. Conversely, persistent moves below these averages may reaffirm bearish sentiments within the market. Therefore, incorporating technical analysis into the evaluation of Solana’s price can give traders a clearer picture of its market behavior and anticipated movements.

Investor Sentiment and Its Influence on Solana’s Recovery

Investor sentiment profoundly influences Solana’s potential for recovery in the current market climate. As traders express caution amid soaring prices and economic uncertainty, their psychological impact on price movements cannot be overlooked. The collective behavior of market participants can either amplify existing trends or serve as a counter-force, leading to unexpected price actions. For Solana, reading the sentiment through social media and trading platforms can shed light on the prevailing mood surrounding the cryptocurrency.

Moreover, the sentiment-driven nature of the cryptocurrency market can sometimes lead to deviations from fundamental analyses. In moments of heightened optimism, Solana might defy negative technical indicators, pushing prices higher. However, the opposite can also occur when bearish sentiments take hold, causing snowballing declines. Consequently, evaluating investor sentiment alongside technical and fundamental analyses can provide a more holistic view of Solana’s potential pathways ahead.

Frequently Asked Questions

What are the key resistance levels for Solana price analysis in the current market?

In the current Solana price analysis, key resistance levels include $135, which is identified as the most critical level according to the UTXO Realized Price Distribution (URPD) indicator. Bears have maintained control, and Solana must reclaim this level to indicate a potential trend reversal.

How does the Solana recovery depend on market conditions?

The Solana recovery is closely tied to broader cryptocurrency market trends and economic conditions. If liquidity improves and market sentiment shifts positively, it could bolster Solana’s attempt to reclaim higher price levels. However, the current downtrend raises concerns for a swift recovery.

What is the significance of SOL support and resistance in the current Solana price analysis?

SOL support and resistance play a crucial role in the Solana price analysis. Currently, $126 serves as a key support level that bulls need to defend. Failing to maintain this support may lead to increased selling pressure, while breaking above $135 could signal an impending price recovery.

What can we expect from Solana amid its current downtrend?

Amid its current downtrend, Solana is facing significant challenges as it attempts to reclaim essential price levels. Analysts predict that until Solana can move above $135 and establish bullish momentum, downside risks will remain. Close monitoring of the price movements around these critical levels is vital.

How does the $135 level impact Solana’s price outlook?

The $135 level is a pivotal resistance point in Solana’s price outlook. According to the URPD indicator, this level represents substantial historical trading activity. If Solana can break and sustain above this resistance, it may indicate a shift towards a bullish trend. Conversely, failing to do so could reinforce the bearish sentiment.

Is Solana expected to recover soon despite ongoing market challenges?

While there are bearish sentiments surrounding Solana due to its downtrend and market volatility, some investors remain hopeful for a recovery. If Solana can break through key resistance levels and economic conditions improve, a strong recovery could be possible in the coming months.

What is the current price of Solana and its implications for near-term recovery?

As of now, Solana is trading around $126, a crucial support level. The immediate implications for a near-term recovery depend on whether bulls can defend this level. A failure to maintain this support could lead to further declines, while a bounce could set the stage for a potential price rally.

What role does the UTXO Realized Price Distribution play in Solana price analysis?

The UTXO Realized Price Distribution plays a significant role in Solana price analysis by identifying key support and resistance levels based on historical trading activity. This metric helps investors understand where significant buying and selling occurred, providing insight into potential price movements and market dynamics.

| Key Points | Details |

|---|---|

| Current Price Situation | Solana has lost over 60% of its value since January and is currently trading around $126. |

| Resistance Levels | The key resistance level is identified at $135, which bulls need to reclaim to signal a potential recovery. |

| Market Sentiment | There is a mix of pessimism with analysts predicting further downtrends, while some investors remain hopeful for a recovery. |

| Potential Support Test | Current support is at $126. If this breaks, it may lead to further declines towards $100. |

| Key Indicators | On-chain data from Glassnode shows $135 as a pivotal level based on the UTXO Realized Price Distribution. |

Summary

In this Solana price analysis, we observe that the cryptocurrency has encountered substantial challenges, losing over 60% of its value since January. Currently, SOL is attempting to stabilize around $126, facing critical resistance at $135 which must be reclaimed for a potential upward trend. The mixed market sentiment illustrates the uncertainty among investors, with some hoping for a swift recovery amidst ongoing bearish pressures. The coming weeks will be crucial in determining whether Solana can rebound or will slip further below its key support levels.

Solana price analysis reveals a tumultuous landscape for the cryptocurrency as it navigates through a significant downtrend observed since late January. With the SOL token plummeting over 60% in value, market sentiment leans towards skepticism, especially as investors face mounting pressure to reclaim critical resistance levels. The SOL support and resistance framework will be crucial in the upcoming weeks, particularly the pivotal $135 level identified by on-chain data from Glassnode. Should Solana manage to break past this resistance, it could indicate a potential recovery phase for the asset. However, if it fails to uphold these levels, it may further validate bearish trends, leaving traders wary of the current cryptocurrency market trends surrounding Solana and its broader implications.

In the current context of Solana’s performance, the focus shifts to its price development and the technical analysis reflecting its struggle within the market. The SOL cryptocurrency has been trapped in a downward spiral, with analysts closely observing its interactions with established support zones and resistance barriers. This has led to increased speculation regarding Solana’s future trajectory as it makes attempts to escape this bearish trend. Investors are particularly interested in how the upcoming resistance points will influence SOL’s rebound efforts amidst current economic conditions. Thus, understanding Solana’s market dynamics is essential for those looking to navigate its future price movements effectively.