The Ripple SEC lawsuit has captured the attention of the cryptocurrency community as it unfolds into a significant case for the future of digital asset regulation. This legal battle stems from the SEC’s assertion that Ripple sold XRP as an unregistered security, a claim that Ripple vehemently disputes, labeling XRP as a currency beyond the authority of the SEC. As the case progresses, it serves as a critical benchmark for how other cryptocurrencies might be classified under U.S. law, especially in light of evolving SEC regulations. In a surprising turn, a partial ruling from Judge Analisa Torres in July 2023 indicated that while XRP is permissible for public trading, it violates securities laws when sold to institutional investors. This nuanced decision, coupled with recent settlement discussions, signals a transformative moment for Ripple and could redefine cryptocurrency regulation in the United States, potentially easing the ongoing XRP legal troubles and paving the way for favorable Ripple settlement news.

In the ongoing saga involving Ripple and the U.S. Securities and Exchange Commission (SEC), the outcome of this legal dispute is poised to significantly impact the landscape of digital currency governance. The case, which centers around whether Ripple’s flagship token, XRP, constitutes an unregistered security, reflects wider issues of cryptocurrency compliance and financial oversight. As negotiations progress towards a possible resolution, this case could become a cornerstone for establishing clear guidelines on cryptocurrency regulation in America. With industry observers keenly watching, the implications extend not only to Ripple but also to other companies facing similar dilemmas regarding their digital assets. The resolution of Ripple’s conflict with the SEC may ultimately influence future legislative approaches and foster increased clarity in the realm of cryptocurrency law.

Understanding the Ripple SEC Lawsuit: A Legal Overview

The Ripple SEC lawsuit has become a pivotal case in the world of cryptocurrency, primarily because it addresses the classification of digital assets in the U.S. legal system. The Securities and Exchange Commission (SEC) argues that Ripple sold XRP as an unregistered security, which would place it under strict regulatory scrutiny. However, Ripple argues that XRP should be classified as a currency, therefore exempt from SEC regulations. This ongoing legal battle not only impacts Ripple and XRP but also sets a precedent for future cryptocurrency regulation across the nation.

Judge Analisa Torres’ recent ruling, which categorized XRP sales on public exchanges as legal while labeling institutional sales as violations of securities laws, exemplifies the complexities involved in defining digital asset classifications. The overall case highlights the need for clarity in cryptocurrency regulation, as both Ripple and the SEC have filed motions regarding their appeals, suggesting that a resolution might be on the horizon. The outcome of this lawsuit could significantly influence how digital assets, including XRP, are viewed and regulated moving forward.

Ripple’s Expansion Amidst Legal Challenges

Despite the shadow of the SEC lawsuit, Ripple has continued to pursue aggressive growth strategies and expand its market presence. Recent moves, such as the $1.25 billion acquisition of Hidden Road, illustrate Ripple’s commitment to establishing itself as a key player in the financial services sector, beyond merely facilitating blockchain payments. By positioning itself as a global multi-asset prime broker, Ripple is not only enhancing its product offerings but also showcasing its adaptability in an evolving regulatory landscape.

Ripple’s collaborations with various financial institutions further reinforce its strategy to legitimize XRP as a critical asset in global finance. By providing fast and cost-effective international transactions, Ripple enhances the utility and attractiveness of XRP for businesses worldwide. These initiatives reflect a balancing act where Ripple aims to innovate and grow its ecosystem while navigating the complexities of ongoing legal issues related to XRP’s status.

Implications of a Potential Settlement in the Ripple SEC Lawsuit

The potential for a settlement in the Ripple SEC lawsuit carries far-reaching implications for the cryptocurrency landscape in the United States. If Ripple secures a favorable resolution, it could set a landmark precedent that distinguishes between currencies and securities, potentially leading to reforms that modernize the current regulatory framework established by the Howey Test. Legal expert Fred Rispoli’s prediction of a 90% chance of resolution signals a pivotal moment where both Ripple and the SEC may find common ground.

Beyond just Ripple, a resolution of this case could have ripple effects—pun intended—across the crypto space by providing guidance to other digital asset firms embroiled in legal disputes. A favorable outcome for Ripple might inspire confidence in institutional investment in cryptocurrencies, leading to more robust growth in the sector as regulatory clarity becomes more apparent. As the SEC evolves under new leadership, the stance on digital asset regulation may shift towards fostering innovation rather than imposing stringent constraints.

The Role of XRP in Global Finance

XRP has positioned itself as a revolutionary asset within the global finance ecosystem by facilitating seamless international transactions. Its ability to offer fast, cost-effective payment solutions appeals to a variety of financial institutions looking to enhance their service offerings. As Ripple expands its partnerships with banks and payment providers, XRP gains further traction as a viable alternative to traditional financial systems, positioning it favorably amidst growing competition in the cryptocurrency market.

Moreover, as the cryptocurrency market continues to evolve, XRP’s use case in cross-border transactions highlights its potential as a driving force for financial inclusion and accessibility. By leveraging blockchain technology, XRP creates opportunities for businesses to transact without the burden of high fees and long settlement times typical in conventional banking systems. The ongoing developments and expanding use cases of XRP reinforce its importance in the broader conversation about the future of money and finance.

Future of Cryptocurrency Regulation Post-Ripple Case

The eventual outcome of the Ripple SEC lawsuit could mark a transformative turning point for cryptocurrency regulation in the United States. If the court rules in Ripple’s favor, it may prompt the SEC and other regulatory bodies to reevaluate their approaches toward digital assets, considering clearer definitions between different types of cryptocurrencies. A successful resolution would likely alleviate some of the legal uncertainties currently faced by other cryptocurrency firms and could encourage innovation and investment in the crypto sector.

Conversely, if the SEC prevails in its case against Ripple, it could reaffirm strict regulatory stances, possibly stifling the growth of numerous digital assets and limiting the scope of innovation within the industry. The ripple effect would extend to how new projects are structured, prompting crypto developers to adapt to a tightened regulatory environment. As this legal saga continues to unfold, all eyes remain on the Ripple case and its potential to redefine the future landscape of cryptocurrency regulation.

Challenges Ahead for Ripple and XRP

While Ripple has made significant strides, it faces challenges beyond the ongoing SEC lawsuit. Critics have raised concerns regarding the centralization of XRP, citing its pre-mined nature and the control exerted by Ripple Labs, which some argue undermines the decentralized ethos of cryptocurrencies. Vocal proponents of more decentralized assets point to these issues, questioning XRP’s validity as a true cryptocurrency and its long-term sustainability in a competitive market.

Moreover, as regulatory scrutiny intensifies, Ripple must navigate these criticisms while continuing to innovate and maintain its market position. The balance between addressing concerns about centralization and driving forward with its growth strategy will be crucial in retaining trust among its user base and the broader cryptocurrency community. Ripple’s management of these challenges will define its future trajectory as a major player in the evolving landscape of digital assets.

Potential Economic Impact of Ripple’s Legal Resolution

The resolution of the Ripple SEC lawsuit could have profound economic implications, influencing investor sentiment and market trends across the broader cryptocurrency landscape. A favorable outcome for Ripple might reignite interest in XRP and boost overall market confidence, leading to increased investment in digital assets. Such a scenario could also encourage other cryptocurrency projects to pursue innovation and market expansion, stimulated by newfound regulatory clarity.

Conversely, an unfavorable ruling for Ripple might result in increased caution among investors, deterring engagement in the cryptocurrency market due to fears of regulatory repercussions. This could lead to volatility in prices as confidence wavers and market dynamics shift. Ultimately, the economic consequences of Ripple’s legal battle underscore the interconnectedness of regulation and market performance in the cryptocurrency ecosystem.

Ripple’s Influence on Institutional Investment Trends

Ripple’s ongoing legal saga and its potential resolution could significantly influence trends in institutional investment within the cryptocurrency space. As financial institutions observe how the SEC handles the Ripple case, their willingness to engage with digital assets may be shaped by the outcome. A favorable settlement would signal a more accommodating regulatory environment, encouraging banks and investment firms to invest in cryptocurrencies like XRP, thus accelerating the integration of digital assets into mainstream finance.

Additionally, Ripple’s innovations and its established reputation as a framework for cross-border payments enhance its appeal to institutional investors. The liquidity and efficiency provided by XRP in facilitating international transactions offer strong incentives for institutional interest. Consequently, the resolution of the Ripple SEC lawsuit may not only influence the fate of XRP but also determine the pace at which institutions embrace and integrate cryptocurrencies into their portfolios.

Regulatory Watch: Ripple SEC Lawsuit’s Aftermath

As the Ripple SEC lawsuit approaches a potential resolution, stakeholders in the cryptocurrency space keenly await the regulatory guidance that is likely to follow. The clarification of XRP’s status could lay the groundwork for new regulations governing other cryptocurrencies, giving both existing and future projects a clearer framework within which to operate. This anticipated clarity could mitigate the uncertainties that have previously hindered the growth of the crypto industry.

Moreover, the resolution of the Ripple case may prompt policymakers to take a more proactive approach in establishing comprehensive regulations for digital assets, fostering innovation while ensuring investor protection. As the landscape continues to evolve, Ripple’s case serves as a crucial case study highlighting the delicate balance between regulation and technological advancement in cryptocurrency, impacting not only XRP but the entire digital asset ecosystem.

Frequently Asked Questions

What is the current status of the Ripple SEC lawsuit?

The Ripple SEC lawsuit is in a critical phase as both Ripple and the SEC have indicated they are reaching a settlement. In July 2023, a ruling partially favored Ripple, declaring that XRP sales on public exchanges were not secure transactions. Currently, a joint motion to pause appeals has been filed, suggesting a potential resolution is on the horizon.

How does the Ripple SEC lawsuit affect XRP’s future?

The outcome of the Ripple SEC lawsuit is crucial for XRP’s future and regulatory clarity in the U.S. A favorable settlement could help differentiate securities from currencies within crypto markets, paving the way for broader institutional investment in XRP and similar digital assets.

What are the implications of the Ripple SEC lawsuit for cryptocurrency regulation?

The implications of the Ripple SEC lawsuit could be significant, as a settlement might set precedents for regulating cryptocurrencies. This case has stirred discussions about the outdated 1946 Howey Test, which currently assesses whether an asset qualifies as a security. A favorable resolution for Ripple may encourage more innovative regulatory approaches for cryptocurrencies.

What does Ripple argue regarding its XRP offerings in light of the SEC regulations?

Ripple argues that its offerings of XRP should not be classified as securities, maintaining that XRP functions as a currency. The company believes it falls outside SEC jurisdiction, contrasting with the SEC’s claims of unregistered securities sales, particularly in institutional transactions.

What effects might a Ripple settlement have on other cryptocurrencies facing legal challenges?

A favorable settlement in the Ripple SEC lawsuit could influence other cryptocurrencies facing legal scrutiny. If Ripple successfully negotiates terms that establish precedents in digital asset classification, it may encourage similar outcomes for other crypto firms embroiled in legal battles, potentially easing the regulatory environment.

How has Ripple’s business strategy evolved amid its legal troubles?

Despite its ongoing legal challenges, Ripple has continued to enhance its business strategy by expanding its ecosystem. For instance, Ripple recently acquired Hidden Road for $1.25 billion to establish itself as a global multi-asset prime broker, indicating its commitment to innovation beyond just blockchain payments.

What concerns exist regarding Ripple’s centralization and its impact on XRP?

Concerns about Ripple’s centralization have been longstanding due to its pre-mined supply and control by Ripple Labs. Critics argue that this centralization undermines XRP’s classification as a decentralized cryptocurrency, which could impact investor confidence and regulatory perceptions.

What is the expected timeline for the Ripple SEC lawsuit resolution?

Legal experts predict that a resolution to the Ripple SEC lawsuit could occur soon, with estimates suggesting outcomes may be announced by April 16. Ripple’s legal team is working towards finalizing terms for settlement or withdrawal of their appeals, indicating movement towards closure on this legal matter.

| Key Points |

|---|

| The Ripple SEC lawsuit centers around the SEC’s claim that Ripple sold XRP as an unregistered security. |

| Judge Analisa Torres ruled that while XRP sales on public exchanges do not violate securities laws, institutional sales do. |

| Recent filings indicate a potential resolution, with Ripple and the SEC expressing an agreement to settle. |

| Legal expert Fred Rispoli suggests a 90% chance this case will conclude by April 16. |

| The outcome could impact how digital assets are regulated in the U.S., possibly redefining the distinction between securities and currencies. |

| Ripple continues to grow its ecosystem, notably acquiring Hidden Road for $1.25 billion. |

| Concerns regarding centralization of XRP persist among critics, pointing to its governance structure. |

| Ripple’s case resolution could influence other ongoing legal disputes in the crypto industry. |

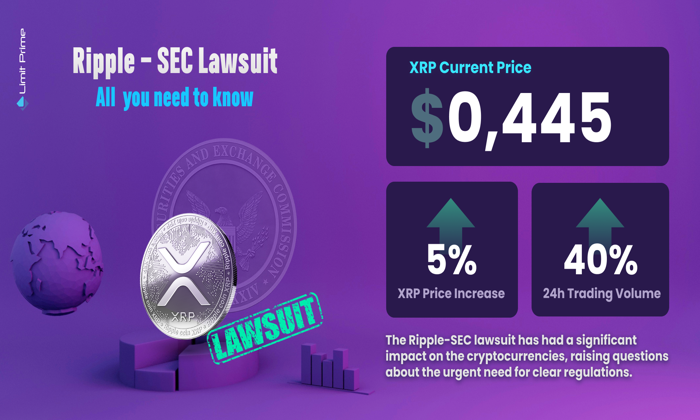

| As of publication, XRP ranks #4 in market cap with a value of $2.15, reflecting a 7.06% increase. |

Summary

The Ripple SEC lawsuit is nearing a resolution that may signal the end of XRP’s legal challenges. This case has been pivotal in defining the regulatory landscape for digital assets in the U.S. and, if settled favorably, could reshape the operational framework distinguishing securities from currencies. As Ripple moves forward, it not only aims to conclude its legal issues but also to expand its marked footprint in the financial ecosystem, making the resolution of the Ripple SEC lawsuit a critical event for both the company and the broader cryptocurrency market.

The Ripple SEC lawsuit has become a pivotal case in the world of cryptocurrency regulation, particularly as it centers around the question of whether XRP should be classified as a security. Initially sparked by the SEC’s claims that Ripple sold XRP without proper registration, this legal battle has drawn the attention of the entire crypto community. Ripple has firmly argued that XRP operates as a currency, thus placing it beyond the scope of SEC regulations. As the case nears a potential resolution, recent developments have raised hopes for a favorable Ripple settlement news, which might reshape the landscape for digital asset regulation in the U.S. The outcome of the Ripple SEC lawsuit could not only affect XRP’s future but also set a significant precedent for other cryptocurrencies grappling with similar legal challenges.

The legal conflict involving Ripple and the SEC highlights the ongoing challenges in the evolving landscape of digital asset oversight in the United States. Central to this dispute are accusations that Ripple, the issuer of the widely traded cryptocurrency XRP, has treated its token as an unregistered financial instrument. Ripple’s defense, asserting that its digital currency should be viewed as a legitimate medium of exchange rather than a security, underscores the complications surrounding cryptocurrency regulation today. As discussions continue about potential resolutions and settlements in this high-profile case, stakeholders across the industry eagerly await clarity on how legal interpretations will influence the broader market. The implications of a favorable judgment for Ripple could fundamentally shift how regulators classify cryptocurrencies, paving the way for increased institutional engagement and participation.