In 2024, public companies doubled their Bitcoin holdings, marking a historic surge in corporate Bitcoin treasury with a total of 592,112 BTC, according to data from Bitcoin Treasuries. This remarkable increase surpasses the total accumulation by institutional investors over the past five years combined, highlighting a pivotal shift in the landscape of institutional investment Bitcoin. As of March 6, these publicly listed corporations accounted for approximately 3% of Bitcoin’s entire supply, worth around $52 billion. The mounting interest and commitment to Bitcoin accumulation, particularly among publicly traded entities, signals a broader acceptance of cryptocurrency within traditional financial systems. This trend not only reflects growing confidence in Bitcoin’s potential but also raises intriguing questions about future corporate strategies in the evolving digital assets market.

In recent years, the corporate sector has increasingly turned its focus towards cryptocurrency, marking a transformative era for companies navigating the digital finance landscape. This shift is especially evident in the significant investments made by publicly traded firms in Bitcoin, a leading cryptocurrency that has become a vital component of many corporate treasuries. The surge in Bitcoin accumulation, particularly in 2024, underscores the growing role of institutional players in the cryptocurrency space, as companies and asset managers alike recognize the importance of diversifying their investment portfolios. With Bitcoin supply statistics showing an unprecedented influx of assets into public companies, the dynamics of cryptocurrency investment continue to evolve, ushering in a new age of financial innovation.

Public Companies Bitcoin Holdings: A Record Surge in 2024

In 2024, publicly listed corporations made headlines as they doubled their Bitcoin holdings to a staggering 592,112 BTC, equating to approximately $52 billion. This leap represents a critical juncture in the narrative of institutional investment in Bitcoin, spotlighting a shift in how corporate entities are integrating cryptocurrency into their treasury strategies. With these corporations now accounting for 3% of Bitcoin’s total supply, the future of Bitcoin accumulation among publicly traded firms is positioned for robust growth as more entities embrace digital assets as a strategic investment.

The surge in Bitcoin holdings signifies more than just numbers; it reflects a broader acceptance of cryptocurrency in corporate America and beyond. Major players are beginning to view Bitcoin not only as a speculative asset but as a vital component of their financial planning and risk management. As public companies increasingly recognize the potential of Bitcoin to hedge against inflation and currency devaluation, the landscape for institutional investment in Bitcoin continues to evolve rapidly.

Comparative Analysis: Bitcoin Accumulation 2024 vs Previous Years

When evaluating Bitcoin accumulation in 2024, it reveals a stark contrast to the previous five years combined, during which publicly traded institutions collectively amassed nearly 296,000 BTC. The unprecedented growth of 2024 showcases an accelerated adoption curve that highlights how market conditions, economic uncertainties, and broader acceptance of cryptocurrencies have spurred corporate investment. Analysts suggest that the confluence of rising inflation and global economic challenges has prompted companies to diversify their assets by including Bitcoin in their portfolios.

This paradigm shift in 2024 is evidenced by the significant strides made in cryptocurrency adoption by corporations. With companies having mined over 592,112 BTC, the increasing inclination to treat Bitcoin as a digital treasury asset has revolutionized financial strategies. Combined with favorable Bitcoin supply statistics—showing a finite supply coupled with rising demand—this year’s momentum is expected to carry into subsequent years, further fostering an environment ripe for growth and investment.

Corporate Treasury Strategies: Investing in Bitcoin

The inclusion of Bitcoin in the corporate treasury has sparked a new trend among publicly listed companies. Firms are now looking beyond traditional assets to secure their financial futures, with Bitcoin regarded as a scalable store of value amidst market fluctuations. By integrating Bitcoin into their financial strategies, these corporations are actively managing risks associated with assets that may depreciate in value, such as fiat currencies. This strategic move underscores a significant evolution in the corporate financial landscape, where Bitcoin’s role as a hedge against volatility is gaining traction.

Furthermore, the ongoing trend highlights the importance of Bitcoin as an asset class that companies can leverage for future growth. Corporate players who have recognized the potential of Bitcoin not just as an investment vehicle, but as a mechanism for technological advancement and operational efficiency, are paving the way for further advancements in the cryptocurrency space. This transformative approach to corporate treasury management indicates an exciting era where digital assets are no longer a niche market but a mainstream financial strategy.

Bitcoin Supply Statistics and Institutional Demand

The relationship between Bitcoin supply statistics and institutional demand has become increasingly relevant in the context of corporate investments in digital assets. As of early 2024, Bitcoin’s supply remains capped at 21 million, creating a scenario where institutional investors, including publicly listed firms, perceive ownership of Bitcoin as substantially valuable due to its scarcity. In light of the 592,112 BTC held by public companies, the intrinsic value of this digital asset is becoming more pronounced as institutions jockey for position in the Bitcoin market.

With a reported growth of Bitcoin holdings among institutional investors—rising from 1,622,439 BTC at the start of 2024 to over 2.8 million BTC by year-end—the demand for Bitcoin within the corporate ecosystem suggests an alignment of financial strategies with the principles of scarcity and investment foresight. As more public companies enter the fray, the competitive nature of institutional acquisition is likely to drive Bitcoin’s value higher, influencing both the market and the perception of cryptocurrency as a fundamental asset class.

The Rise of Institutional Investment in Bitcoin

Institutional investment in Bitcoin has witnessed a marked increase, particularly over the past couple of years. This rise can be attributed to various factors including technological advancements in blockchain infrastructure, regulatory clarity, and growing acceptance from traditional financial markets. The statistic that publicly traded corporations have doubled their Bitcoin holdings in 2024 sheds light on this trend, emphasizing the shift towards digital assets as viable investment options. Companies are strategically allocating resources to Bitcoin, often integrating it into their core investment strategies.

As more institutional players enter the Bitcoin market, the implications for both the cryptocurrency and stock markets could be profound. Companies are now viewing Bitcoin not only as a potential profit-making asset but also as a crucial element for long-term financial stability. The increased visibility of Bitcoin in institutional portfolios is fostering a deeper trust in cryptocurrency, which could have ripple effects on global financial markets, thereby encouraging an influx of capital into the crypto space.

Impact of Corporate Bitcoin Treasury on Market Dynamics

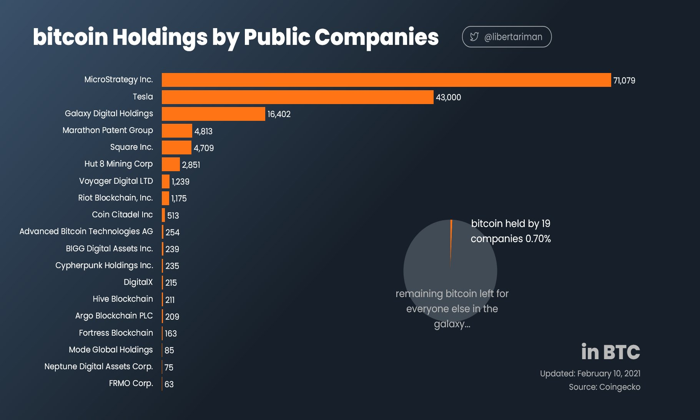

The accumulation of Bitcoin by public companies has a notable impact on overall market dynamics and investor psychology. As companies like MicroStrategy hold substantial amounts of Bitcoin, it validates the asset class and reinforces its legitimacy. This corporate confidence can lead to increased trading volumes, higher price volatility, and a more robust market infrastructure that accommodates institutional investors. The corporate Bitcoin treasury trend suggests that Bitcoin is positioning itself as a cornerstone in many corporate financial strategies, moving beyond speculative investments.

Moreover, as public companies continue to accumulate Bitcoin, their actions influence both market sentiment and broader investor behavior. When notable firms announce significant purchases or changes in their Bitcoin treasury strategies, it often catalyzes additional investment by other firms and retail traders, further fueling the momentum of Bitcoin adoption. As companies proclaim their commitment to holding Bitcoin long-term, the outlook for Bitcoin as a mainstream financial asset becomes increasingly optimistic.

The Future of Bitcoin and Public Corporations

Looking ahead, the future appears bright for Bitcoin as more public corporations embrace the digital currency. The ongoing trend of institutional investment into Bitcoin suggests a future where cryptocurrencies are woven into the fabric of financial frameworks across various industries. This widespread adoption could potentially lead to a significant increase in Bitcoin’s market value as demand continues to rise. With public companies more enthusiastic about holding Bitcoin, the dynamics of cryptocurrency markets may evolve to accommodate this new wave of investment.

In addition, the strategic use of Bitcoin among public companies raises questions about the future implications of such investments. The prospect of these corporations utilizing Bitcoin not just as a store of value but also as a means to streamline operations through blockchain technology could fundamentally alter how businesses operate. As the cryptocurrency landscape becomes intertwined with corporate strategies, it reinforces Bitcoin’s position as a transformative digital asset capable of reshaping the world’s financial services.

Challenges Faced by Public Companies in Bitcoin Accumulation

Despite the momentum of corporate Bitcoin adoption, public companies face numerous challenges in their accumulation strategies. Regulatory uncertainties pose a significant concern for many corporations contemplating Bitcoin investments. Compliance with varying regulations across countries can complicate treasury strategies and necessitate careful planning to mitigate risks associated with Bitcoin accumulation. Firms must navigate legal frameworks, tax implications, and liquidity management, which could hinder their ability to fully capitalize on the potential benefits of Bitcoin.

Installing robust cybersecurity measures is another critical barrier that companies must address when dealing with Bitcoin holdings. High-profile hacks and scams within the cryptocurrency space have raised concerns regarding the safety of digital assets. As institutions look to safeguard their Bitcoin treasuries, they must invest in secure storage solutions—such as cold wallets—and robust insurance policies to protect against potential losses. Successfully overcoming these challenges will be crucial for public companies as they aim to integrate Bitcoin into their financial portfolios.

Summary of Institutional Investment Trends in Bitcoin

The landscape of institutional investment in Bitcoin has transformed dramatically in recent years, particularly in 2024. As corporations have doubled their Bitcoin holdings compared to previous periods, it signals a continuous trend towards greater adoption and integration into corporate treasury strategies. This expansion reflects a significant cultural shift in identifying Bitcoin as an essential asset for financial planning amidst growing economic volatility.

Understanding the nuances of institutional investment trends in Bitcoin not only provides insights for prospective investors but also indicates that the digital currency is becoming an integral part of mainstream finance. With the increasing capital influx from public companies into Bitcoin, the legitimacy and potential for long-term growth in the cryptocurrency sector seem more promising than ever.

Frequently Asked Questions

How much Bitcoin do publicly listed corporations hold as of 2024?

As of March 2024, publicly listed corporations hold approximately 592,112 BTC, which represents about 3% of the total Bitcoin supply, worth an estimated $52 billion.

What trends are emerging in Bitcoin accumulation for public companies in 2024?

In 2024, public companies have significantly accelerated their Bitcoin accumulation, doubling their holdings compared to the previous five years combined, indicating a growing institutional investment in Bitcoin.

What factors contributed to the increase in corporate Bitcoin treasury holdings?

Public companies have resumed significant Bitcoin accumulation after a brief period of selling in prior years. Key factors include increased institutional confidence in Bitcoin and strategic investments by major firms like Strategy, which holds a substantial portion of Bitcoin.

What is the role of institutional investment in Bitcoin’s price movement and public companies’ Bitcoin holdings?

Institutional investment plays a critical role in stabilizing and potentially boosting Bitcoin’s price, as evidenced by the increased Bitcoin holdings of publicly listed corporations and greater demand from institutional investors in 2024.

How does the Bitcoin supply statistics reflect the growth of Bitcoin held by public companies?

According to Bitcoin supply statistics, public companies have increased their Bitcoin holdings dramatically in 2024, showing a clear trend where corporate entities are viewing Bitcoin as a valuable part of their asset portfolio.

Why did public corporations previously sell part of their Bitcoin stash?

Public corporations may have sold parts of their Bitcoin stash to realize profits or to manage cash flow during periods of market volatility, but these actions temporarily interrupted their overall accumulation trend.

What impact has the growth of corporate Bitcoin treasury holdings had on the cryptocurrency market?

The increase in corporate Bitcoin treasury holdings has reinforced Bitcoin’s legitimacy as an institutional asset, contributing to the overall demand and market interest in cryptocurrency.

How do the Bitcoin holdings of public companies compare to institutional holdings overall?

As of the end of 2024, total institutional holdings, which include public companies and other entities, reached 2.8 million BTC, reflecting a general trend of increasing institutional confidence in Bitcoin compared to the previous year.

What are the implications of public companies increasing their Bitcoin accumulation?

The implications include a significant shift in market dynamics as public companies adopt Bitcoin as a core part of their financial strategy, which may lead to greater mainstream adoption and acceptance of cryptocurrencies.

What were the Bitcoin holdings of publicly listed companies at the start of 2024?

At the start of 2024, publicly listed companies held approximately 272,777 BTC, showcasing a substantial rise in their holdings through the year as they actively participated in Bitcoin accumulation.

| Key Points |

|---|

| Public companies held 592,112 BTC by 2024, doubling holdings since the last five years combined. |

| As of March 6, 2024, public corporations controlled 3% of Bitcoin’s total supply, valued at $52 billion. |

| Accumulation flips occurred significantly in 2020 and 2021, largely influenced by the COVID pandemic. |

| During 2023, the pace of Bitcoin accumulation picked up notably after a brief slowdown in prior years. |

| MicroStrategy remains the largest holder among public companies with 499,000 BTC, significantly impacting totals. |

| Overall, institutional Bitcoin holdings rose from 1,622,439 BTC to 2,802,135 BTC during 2024, driven by diverse entities. |

Summary

Public companies’ Bitcoin holdings achieved remarkable growth in 2024, showcasing a considerable shift in the landscape of cryptocurrency investments. This surge reflects a strategic acknowledgment of Bitcoin’s role in modern asset management and highlights how public corporations increasingly regard digital assets as vital components of their financial portfolios.

Public companies Bitcoin holdings have seen a remarkable surge as we moved into 2024, with institutions doubling their Bitcoin accumulation over the past year alone. By March 6, 2024, publicly listed corporations collectively owned 3% of Bitcoin’s total supply, which translated to an impressive $52 billion in value. This pivotal year revealed that the total amount of Bitcoin held by these companies soared to 592,112 BTC, a number that underscores the substantial institutional investment in Bitcoin compared to the previous five years combined. The trend also aligns with broader Bitcoin supply statistics, showcasing corporate interest in establishing robust Bitcoin treasuries as a strategic financial reserve. As major players like Michael Saylor’s Strategy leverage cryptocurrency in their portfolios, the acceleration of public companies’ Bitcoin holdings highlights a significant transformation within the investment landscape.

The dynamic landscape of corporate cryptocurrency investment has transformed how publicly traded entities approach digital assets, particularly Bitcoin. Alternative terms such as ‘corporate Bitcoin treasury’ and ‘institutional investment in Bitcoin’ characterize this brisk market evolution often fueled by a mix of strategic foresight and a response to changing economic conditions. As organizations navigate the intricate web of Bitcoin’s supply statistics, it’s clear that 2024 marked a watershed moment in Bitcoin accumulation—ushering in unprecedented levels of interest from publicly listed firms. This shift reflects not only a growing acceptance of digital currencies but also a recognition of Bitcoin as a legitimate asset class that can enhance corporate financial health. With the increasing presence of Bitcoin in the portfolios of public companies, the implications for both the cryptocurrency market and traditional finance are profound.