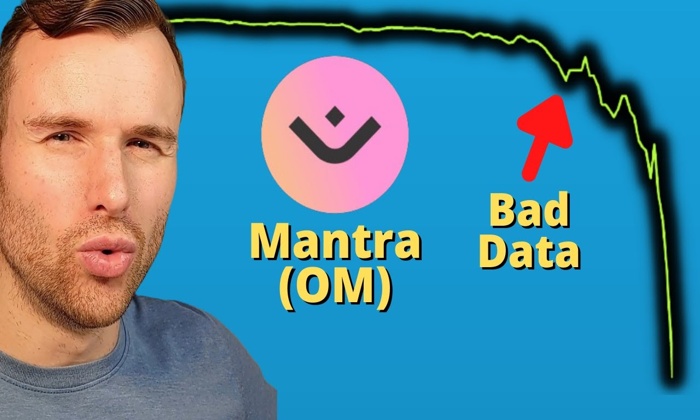

The recent OM token crash has sent tremors through the crypto market, as this dramatic decline simultaneously triggered an extraordinary surge in derivatives trading by 7,000%. As investors scrambled to navigate the chaos, trading volumes skyrocketed to over $6 billion, highlighting a trend where the volatility of the Mantra OM token became a double-edged sword. Platforms like Binance and Bybit accounted for a significant portion of this trading frenzy, capitalizing on the turmoil. Unfortunately, the rise in trading activity also resulted in over $76 million in liquidations, leaving many traders stinging from the abrupt downturn. With OM’s market cap plummeting from $6 billion to just $500 million, the latest events underscore the precarious nature of investments in this ever-evolving landscape of cryptocurrencies, especially amid increasing scrutiny from major exchanges like Binance and OKX.

The tumultuous ordeal surrounding the OM token experience has reverberated across the digital currency landscape, drawing attention to the volatility and risks associated with crypto investments. The dramatic fluctuations observed in the Mantra token’s value have not only impacted market sentiment but also led to an unprecedented uptick in derivatives trading activity, showcasing a phenomenon where investors sought to leverage opportunities amidst chaos. Meanwhile, the scrutiny faced by platforms like Binance and OKX highlights the growing accountability expected from major players in the cryptocurrency arena. This scenario presents a pivotal moment in derivatives trading strategies, particularly for speculators navigating the turbulent waves of liquidations in such uncertain times. With traders grappling with these developments, the focus shifts to understanding the intricate dynamics at play in the current crypto market.

Understanding the OM Token Crash Impact on the Crypto Market

The recent OM token crash has been a pivotal moment in the cryptocurrency sector, with repercussions that extend far beyond its immediate fallout. This incident not only dismantled Market capitalization of MANTRA’s OM from $6 billion to a mere $500 million, but it also triggered an unprecedented 7,000% increase in derivatives trading. This surge signifies the high volatility nature of the crypto market, where traders often take advantage of sharp price changes, leading to massive spikes in trading volume. During this 24-hour period alone, derivatives trading soared over $6 billion across major platforms, such as Binance and Bybit, illustrating the dynamic and speculative nature of crypto trading in response to market chaos.

The dominance of derivatives trading during the OM token crash highlights a critical shift in trader behavior. Traditionally, investors might have been cautious following such a significant drop. However, the allure of potential profits from derivatives instruments often incentivizes swift trading actions. The contrast between the drastic collapse in the token’s value and the exponential rise in trading activity points to a market increasingly driven by speculative movements rather than long-term investment strategies.

In addition to the shockwaves felt by traders, the OM token crisis underscores the risks inherent in the current crypto trading environment, especially in light of an upsurge in liquidations. Within the span of just 24 hours, more than $76 million in liquidations were recorded as traders scrambled to cover positions in response to the OM volatility. Such figures serve as a stark reminder of the dangers associated with high-leverage trading, particularly in the wake of a market crash. The extreme volatility following the OM token crash not only devastated individual investors but also raised further questions about the stability of the broader crypto ecosystem in which these forced liquidations are becoming a norm.

The Role of Binance and OKX in the OM Token Situation

The involvement of major exchanges like Binance and OKX in the OM token crash has drawn significant attention and scrutiny. Following the event, John Patrick Mullin, co-founder of MANTRA, claimed that the crash resulted from ‘reckless forced closures’ by centralized exchanges targeting OM accounts. This allegation sparked responses from both exchanges, with OKX acknowledging ‘unusual volatility’ surrounding the OM token. As the situation unfolded, both platforms took preemptive measures to adjust their risk controls, reflecting a growing recognition of the need for greater oversight in unpredictable market conditions. This reactive approach demonstrates how centralized exchange practices can impact individual tokens and the perceptions of their reliability.

Star Xu, CEO of OKX, highlighted the seriousness of the matter, advising the community to review on-chain data to comprehend the circumstances leading to the crash. He pointed out that unusual deposits into exchanges were detected days prior, with 43.6 million OM being moved to various wallets, exacerbating the volatility. Such movements raise concerns about market manipulations and the apparent risks associated with significant holdings on centralized exchanges, which can trigger brutal market reactions. With Binance also attributing the developments to cross-exchange liquidations, the episode illustrates the intricate interplay between exchange policies, trader behavior, and market dynamics, echoing the growing calls for increased transparency and more robust risk management protocols across trading platforms.

Speculative Trading and Its Consequences in the Crypto Sphere

The dramatic inflation in derivatives trading during the OM token crash speaks volumes about the speculative nature of contemporary cryptocurrency trading. Traders are more likely to engage in derivatives as a response to significant price movements, revealing a trend where volatility becomes a double-edged sword. Speculative trading can yield substantial profits; however, it often includes high risks, especially when paired with the concept of using leverage. The OM token’s 7,000% increase in derivatives trading illustrates a growing trend among traders to capitalize on short-term price fluctuations rather than establishing solid long-term positions. The allure of profit, paired with market chaos, has motivated many to overlook sound investment principles, leading to potential future market instability resulting from reckless trading practices.

Additionally, the consequences of such speculative behavior can precipitate a series of market corrections and liquidations, particularly in futures trading. The over $76 million in liquidations following the OM token crash exemplifies the risks that can arise when traders operate in an environment with heightened volatility. As liquidations pile up, the cascading effects can further destabilize prices, leading to additional panic and hastening the cycle of speculative trading. The interconnectedness of the crypto market means that the fallout from such turbulent events can ripple through numerous assets, exacerbating market anxiety among both retail and institutional investors.

Future of Derivatives Trading in a Turbulent Market

The future of derivatives trading within the cryptocurrency market is a topic that requires careful consideration, especially in the wake of the OM token episode. As trading volumes soar and traders increasingly lean toward speculative strategies, the necessity for robust risk management frameworks is becoming paramount. With incidents like the OM token crash illustrating the impact of extreme volatility on market health, exchanges must adapt by enhancing operational transparency and trader education. Implementing stricter leverage limits and adopting advanced risk-control measures has become not just advisable but necessary for protecting investors and stabilizing the market as a whole, especially in an environment marked by uncertainty.

Moreover, the integration of innovative risk mitigation strategies can help traders navigate through turbulent markets. Exchanges could explore more sophisticated tools like margin calculators and volatility trackers to arm traders with comprehensive market insights before they engage in high-stakes derivatives trading. Such enhancements can bolster trader confidence and protect against the kind of mass liquidations that plagued the OM token scenario. In this evolving landscape, it is crucial for both exchanges and traders to work collaboratively towards fostering a more resilient and informed trading environment that can withstand similar market disruptions in the future.

Analyzing Liquidations and Risk in Cryptocurrency Trading

Liquidations play a critical role in the dynamics of cryptocurrency trading, and understanding them is essential for market participants. Following the catastrophic fall of the OM token, over $76 million worth of liquidations occurred, illustrating the perils associated with high-leverage trading. Liquidations happen when traders are unable to meet margin requirements, resulting in the forced closure of their positions. This not only impacts individual traders but can also exacerbate market volatility by triggering further sell-offs. Analyzing the root causes of liquidations can provide invaluable insights into market behavior, helping traders make more informed decisions.

As the crypto market continues to evolve, the ability to measure and anticipate liquidations becomes critical for maintaining stability. Exhibiting trends from previous incidents can inform risk management strategies, allowing traders to adjust their positions accordingly. Awareness of the potential consequences of excessive leveraging, combined with real-time monitoring tools, serves to cushion traders against unforeseeable downturns. Therefore, a comprehensive understanding of liquidations and how they interact with broader market mechanics tantamount becomes paramount in a responsible trading strategy.

Market Sentiment and Open Interest: What the Data Reveals

Open interest is a crucial indicator that reflects overall market sentiment and can gauge the level of trader engagement within the derivatives market. In the aftermath of the OM token crash, futures open interest fell sharply by 62%, dropping to $132 million. This reduction underscores a waning enthusiasm from traders, indicating a broader caution as a result of the recent turmoil. Traders often look to open interest as a sign of potential market trends, with rising open interest commonly associated with increasing confidence and interest in an asset, while falling figures indicate skepticism. In this sense, the dramatic drop in open interest following the OM crisis paints a picture of a community hesitant to invest amidst fear and uncertainty.

Furthermore, tracking open interest alongside price movements can yield significant insights into the underlying strength or weakness of market trends. The significant downturn in the OM token’s value, combined with the drop in open interest, suggests that many traders are opting for a wait-and-see approach, avoiding further risk exposure until a clearer market direction emerges. By maintaining vigilance regarding these indicators, traders can better navigate the landscape, positioning themselves strategically for any eventual recovery. Understanding the interplay between market sentiment, open interest, and trading behavior can empower participants in developing a more robust approach to their investments and risk management.

Lessons Learned from the OM Token Volatility

The OM token crisis has served as a stark reminder of the inherent risks prevalent in the cryptocurrency market, emphasizing the need for heightened awareness and strategic planning by investors. Amid the chaos, traders witnessed the consequences of unchecked speculation, leading to an abrupt market upheaval that affected countless portfolios. While the allure of potential profits from trading can be enticing, this incident underscores the importance of employing responsible trading strategies, including risk management and diversification. Reflecting on the events surrounding the OM token can offer valuable lessons on balancing speculation with sound investment principles.

In moving forward, it’s crucial for traders and investors to integrate these lessons into their practices. The incidents surrounding the OM token emphasize the necessity of thorough research, diversifying holdings, and maintaining an awareness of market conditions. With increased scrutiny and regulation expected in the crypto space, participating market actors should prepare to adapt to a more structured environment. Learning from past experiences will not only enhance individual trading strategies but also contribute to the overall maturity and stability of the cryptocurrency market as its participants navigate future challenges.

Regulatory Implications Following the OM Token Incident

The OM token crash has prompted discussions surrounding potential regulatory implications for the cryptocurrency market. As incidents involving volatility and liquidations become more frequent, regulatory bodies are increasingly tasked with creating frameworks that protect investors while enabling the market to thrive. The response from exchanges like Binance and OKX illustrates a growing focus on risk management and consumer safety, signaling that regulatory scrutiny may intensify in the coming months. Increased transparency and compliance may become prerequisites for operating in the competitive landscape of crypto exchanges, particularly for those involved in high-stakes derivatives trading.

Additionally, the call for greater accountability and clearer guidelines within the trading industry can lead to improved investor protections against sudden market events like the OM token crash. As regulators look to establish boundaries for trading practices, a concerted effort toward education and awareness will also be necessary to empower traders in making informed decisions. The ultimate goal of regulatory measures should be to foster a healthy trading environment that encourages innovation, growth, and stability within the cryptocurrency sector.

Frequently Asked Questions

What caused the OM token crash in the crypto market?

The Mantra OM token crash was attributed to unexpected volatility and a 7,000% surge in derivatives trading. This was exacerbated by forced closures by centralized exchanges, particularly Binance and OKX, which affected many OM account holders.

How did derivatives trading activity change during the OM token crash?

During the OM token crash, derivatives trading surged by 7,000%, reaching over $6 billion within 24 hours. This spike indicates that many speculative traders aimed to capitalize on OM’s extreme price fluctuations.

What impact did the OM token crash have on market liquidations?

The OM token crash led to over $76 million in liquidations as traders rushed to close their positions in the face of soaring volatility. This significant liquidation amount reflects traders’ reactions to the rapid price swings.

Did the OM token crash affect open interest in futures?

Yes, following the OM token crash, the futures open interest for the token dropped by 62% to $132 million. This decline suggests that trader enthusiasm may have waned amid increased market caution.

What were Binance and OKX’s responses to the OM token crash?

In response to the OM token crash, both Binance and OKX faced scrutiny for their risk management practices. OKX, in particular, acknowledged unusual volatility and implemented tighter controls, while Binance noted cross-exchange liquidations contributed to the situation.

What should traders consider after the OM token crash?

Traders should exercise caution following the OM token crash and the resulting scrutiny on exchanges. Keeping an eye on open interest in futures and understanding systemic risks in the crypto market can help inform better trading decisions.

How does the OM token crash relate to broader crypto market trends?

The OM token crash underscores the heightened volatility and risks present in the crypto market, especially during periods of intense speculation and derivatives trading surges, mirroring trends seen in previous crypto market crashes.

What historical context should be considered regarding the OM token?

The OM token has experienced historical volatility, and this recent crash is part of a broader narrative in the crypto market, where sudden price movements can trigger significant trading activity and impact market sentiment dramatically.

| Key Points | Details |

|---|---|

| OM Token Crash | MANTRA’s OM token faced a dramatic collapse leading to significant market reactions. |

| Derivatives Trading Surge | Derivatives trading volume surged by 7,000% to over $6 billion in 24 hours. |

| Market Cap Drop | OM’s market cap plummeted from $6 billion to $500 million. |

| Liquidations Recorded | Over $76 million in liquidations occurred during the trading frenzy. |

| Futures Open Interest Decline | Futures open interest decreased by 62% to $132 million, reflecting market caution. |

| Centralized Exchanges Reaction | Binance and OKX responded to the volatility with tightened risk controls. |

| Investor Caution | The situation highlighted the necessity for examining on-chain data to understand trading patterns. |

Summary

The OM token crash has shaken the cryptocurrency landscape, resulting in an unprecedented surge of derivatives trading as traders sought to capitalize on the volatility. This incident highlights the fragility of token economics and the substantial risks involved in speculative trading, especially in turbulent market conditions. Stakeholders are urged to analyze the data and trends surrounding the OM token crash to better navigate future challenges in the crypto space.

The OM token crash has stirred up significant turmoil in the crypto market, coinciding with an unprecedented surge in derivatives trading. Within just 24 hours, the trading volume for the Mantra OM token skyrocketed by 7,000%, highlighting the frenzy among traders eager to capitalize on the token’s volatility. Reports show that over $6 billion in trading activity occurred, primarily on platforms like Binance and Bybit. However, this dramatic rise came hand-in-hand with a staggering drop in OM’s market cap, which plummeted from $6 billion to merely $500 million. This chaotic environment not only led to $76 million in liquidations but also raised concerns about the ongoing scrutiny of exchanges like Binance and OKX due to their role in this tumultuous event.

In the wake of the recent downturn of the Mantra cryptocurrency, known as OM, the financial landscape has been rocked, signaling a broader turbulence within digital asset trading. The crash unleashed a wave of activity in derivatives markets, leading to an extraordinary expansion in trading volumes by a staggering 7,000%. This spike reflects the intense speculative interest generated by OM’s sharp price fluctuations, despite its market valuation suffering a dramatic decline. Additionally, this situation has ignited discussions regarding the accountability of major trading platforms, including Binance and OKX, amidst claims of improper liquidations affecting traders. As the dust settles, analysts are keenly observing the repercussions of these market dynamics on the future of cryptocurrency trading.