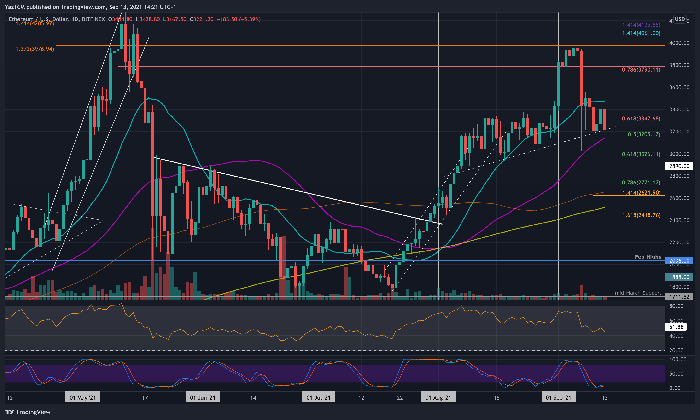

Ethereum price analysis reveals that the second-largest cryptocurrency is currently fighting to reclaim the vital $2,000 mark, having faced substantial selling pressure that brought it down to around $1,900. As Ethereum trading continues, the volatility in the cryptocurrency market has raised concerns among traders, particularly as ETH grapples with over a 57% decrease in value. The primary focus is on Ethereum support levels, with $1,870 emerging as the crucial threshold for bulls to defend against further declines. Conversely, ETH must break through the $2,050 resistance level to signal a potential recovery in momentum and direction. Observing these price points will be essential for investors navigating the intricacies of Ethereum recovery potential in today’s challenging market conditions.

An overview of Ethereum’s ongoing price dynamics highlights the intense market conditions affecting this prominent digital asset. For investors engaged in Ethereum trading, the current scenario underscores the necessity to understand critical ETH support levels and resistance zones. The broader trends within the cryptocurrency landscape reveal that sentiments are heavily influenced by bearish momentum, making it a pivotal time to monitor Ethereum’s price fluctuations. With the risk of further declines looming due to prevailing market fears, many are examining Ethereum’s recovery potential closely. The next few days could prove decisive as traders watch for indications of strength that might signal a reversal in this crypto stalwart’s fortunes.

Current State of Ethereum Trading

Ethereum (ETH) is currently struggling to maintain its position below the $2,000 mark, facing significant headwinds from bearish market forces. After a period of heightened selling pressure, ETH has consolidated around the $1,900 level, indicating a lack of momentum among bullish traders. This struggle places the cryptocurrency in a precarious situation, as it has lost over 57% of its value from its previous highs. The ongoing pressure from broader cryptocurrency market trends complicates any attempts at recovery, prompting many to question whether Ethereum can stabilize in the near future.

As ETH trades closer to critical support around $1,870, traders and analysts are especially cautious. A strong breach below this level could lead to increased selling pressure, signaling a bearish continuation. Conversely, a rebound that holds above support may provide a glimmer of hope for those looking at potential bullish reversals. Regardless, Ethereum remains entrenched in a volatile market, where every price movement is scrutinized for signs of strength or further weakness.

Ethereum Price Analysis and Key Support Levels

A crucial aspect of Ethereum’s price performance lies in its ability to maintain key support levels. Currently, the $1,870 mark serves as Ethereum’s most significant support zone. This level is not just a psychological barrier; it has historically acted as a floor for Ethereum prices. If ETH falls below this support, it risks entering a bearish trend, which could create panic among investors. Technical analysts are keenly monitoring this level, as breaching it would likely lead to increased selling pressure, pushing the price towards ever lower demand areas like $1,750.

Moreover, ETH’s recovery potential hinges on how it interacts with resistance levels. The critical resistance level stands at $2,050, which is essential for any bullish momentum to develop. Ethereum must break above this barrier to reverse its current trend and ignite investor confidence. Only through consistently trading above this resistance can Ethereum hope to reclaim its place among the leading cryptocurrencies and attract new investments, positioning itself favorably within the dynamics of the cryptocurrency landscape.

Impact of Broader Market Trends on Ethereum

The influence of broader cryptocurrency market trends on Ethereum cannot be overstated. As ETH persists in its struggle to gain momentum, it remains subject to the whims of external factors such as macroeconomic conditions and investor sentiment. Currently, fears related to trade wars and financial instability are weighing heavily on the markets, causing a ripple effect on cryptocurrencies. As a result, ETH finds itself navigating through uncertain waters, where fluctuations in market sentiment can lead to sharp price movements.

In times of economic uncertainty, traders often look for safer investments, which can further hamper Ethereum’s price recovery. This scenario emphasizes the importance of broader market trends for Ethereum’s price action. Thus, effectively regulating spending and gauging market sentiment are essential for potential bullish movements. Traders must stay attuned to both macroeconomic events and local developments within the Ethereum ecosystem to adapt their strategies effectively.

Ethereum’s Resistance Levels Explained

Understanding Ethereum’s resistance levels is critical for traders seeking to navigate its current trading environment. The most pressing resistance level for Ethereum is set at $2,050. This price point serves as a formidable barrier that Ethereum must successfully break through to signal a potential trend reversal. Each time ETH attempts to penetrate this level without success, it can lead to increased bearish sentiment in the market, compelling traders to reassess their positions.

Analysis of historical price action reveals that the $2,050 resistance has consistently stifled upward momentum, making it a focal point for traders. If bullish traders successfully reclaim this resistance, it could not only indicate a shift in market dynamics but may also attract new buyers, fueling Ethereum’s price recovery. Therefore, traders will need to focus on any developments that suggest a break above this key level, as it could serve as an essential signal for renewed investment in Ethereum.

Ethereum Recovery Potential and Next Moves

Ethereum’s recovery potential is under intense scrutiny as it hovers around critical support levels. The coming days are pivotal in determining whether Ethereum can initiate a bounceback or succumb to further declines. Should ETH manage to solidify above the $2,000 level once again, it could signify the market’s willingness to enter a recovery phase, transforming sentiment from bearish to bullish. Observers are on the lookout for signs that may suggest that this turnaround is possible, including increased buying volume and positive technical indicators.

However, traders must remain vigilant as the market continues to exhibit high volatility. The interplay between ETH’s current position and immediate resistance levels, alongside broader market trends, will play a decisive role in its recovery endeavors. If Ethereum can successfully navigate these turbulent waters and reclaim vital resistance, it could set off a powerful rally, revitalizing interest in the cryptocurrency as an investment.

Strategies for Ethereum Traders Amid Uncertainty

In light of the current market uncertainty surrounding Ethereum, traders are advised to develop strategic approaches to mitigate risks. One effective strategy involves closely monitoring Ethereum’s price movements and key support and resistance levels to determine entry and exit points. Engaging in technical analysis can help traders identify potential patterns that signal forthcoming price action, allowing them to capitalize on short-term fluctuations while minimizing exposure to major downtrends.

Additionally, diversifying one’s investment portfolio is a prudent approach during periods of volatility. By spreading investments across various cryptocurrencies or related assets, traders can reduce overall risk while positioning themselves to benefit from any positive developments in the market. This strategy can cushion the impact of adverse price movements in Ethereum while maintaining the potential for gains from other assets, creating a more balanced trading approach in these unpredictable times.

The Role of On-Chain Data in Ethereum Trading

On-chain data plays a pivotal role in informing Ethereum traders about the asset’s performance and future potential. Metrics such as transaction volume, active addresses, and on-chain flows provide investors with valuable insights into the asset’s health. Currently, analysts utilize this data to gauge Ethereum’s strength, particularly with the critical support level of $1,870. A sustained increase in transaction volume may indicate buying interest, fostering expectations of a recovery and ultimately leading to upward price revisions.

Equally, on-chain data highlights Ethereum’s resilience or frailty based on the number of active addresses engaging with the network. A declining number of active addresses may signal waning interest, while an increase could suggest a potential shift towards a bullish outlook. Thus, savvy traders should harness on-chain analytics to inform their trading decisions, identifying trends and shifts that signal possible price movements, particularly in a market characterized by unpredictable volatility.

Market Sentiment Towards Ethereum: Bullish or Bearish?

Market sentiment defines the tidal shifts in Ethereum’s price trajectory, reflecting the collective mood of traders and investors. Currently, sentiment heavily leans towards a bearish perspective, primarily due to the significant losses ETH has experienced in recent months. The lack of a decisive rebound and continuous selling pressure keep investors apprehensive, heightening the prevailing bearish sentiment. As a result, many traders are adopting a wait-and-see approach, hesitant to enter the market until clearer signals of recovery emerge.

However, amid the prevailing pessimism, there are indicators of potential renewal. Technical analysts who observe patterns and signals may point towards areas where bullish sentiment could begin to build, especially if Ethereum can retake key resistance levels. A shift in sentiment often follows decisive price movements, making it vital for traders to remain alert to potential changes in market perception. Thus, understanding market sentiment is essential for Ethereum traders as they navigate through the current landscape.

Future Outlook for Ethereum Traders

As the cryptocurrency market continues to evolve, the future outlook for Ethereum traders remains cautiously optimistic, hinging on a few critical factors. If Ethereum can bounce back and reclaim its position above the $2,000 mark, it may nurture renewed interest from both retail and institutional investors. Additionally, a broader recovery in the cryptocurrency market could provide the impetus needed for Ethereum to surge past its resistance levels, potentially leading to a new bullish phase for ETH.

However, traders must contend with uncertainties that could impact Ethereum’s price action moving forward. Continuous monitoring of market trends, supportive technical analysis, and on-chain data will be essential in making informed trading decisions. The underlying sentiment within the market will be equally crucial, so remaining adaptable and responsive to significant shifts will allow traders to better position themselves in anticipation of what may come next in Ethereum’s unfolding story.

Frequently Asked Questions

What is the current situation with Ethereum price analysis?

As of now, Ethereum (ETH) is trading below $2,000, facing significant selling pressure and consolidation around the $1,900 mark. The cryptocurrency market is largely bearish, with ETH having lost over 57% of its value, complicating recovery efforts for bullish traders.

How do ETH support levels affect Ethereum trading?

ETH support levels, particularly the critical $1,870 mark, play a vital role in Ethereum trading. If the price falls below this level, it may lead to further declines. Conversely, maintaining this support could provide an opportunity for a recovery rally.

What are the key resistance levels in Ethereum price analysis?

According to recent analysis, $2,050 serves as the most significant resistance for Ethereum. Breaking through this level is essential for bulls to indicate a potential trend reversal and to restore market confidence.

What role do cryptocurrency market trends play in Ethereum’s recovery potential?

Current cryptocurrency market trends are heavily bearish, which limits Ethereum’s recovery potential. For ETH to gain momentum, the broader market conditions must improve, allowing it to reclaim critical resistance levels and attract buying interest.

What impact does the broader economic environment have on Ethereum price analysis?

The broader economic environment, including fears of trade wars and global financial instability, significantly affects Ethereum price action. These factors contribute to the uncertain sentiment surrounding ETH, making it difficult for traders to establish a confident recovery.

What can investors look for in terms of Ethereum’s short-term direction?

Investors should watch for Ethereum to either reclaim the $2,000 level or maintain the key support at $1,870. These movements will determine ETH’s short-term direction, with a possible breakout leading to a recovery or further downside risks if support is breached.

How does volatility impact Ethereum resistance and support levels?

In a volatile market, Ethereum’s support and resistance levels become crucial indicators of price stability. The fluctuations can test these levels frequently, and a failure to hold support could lead to a rapid decline, while breaking resistance could signal a strong recovery.

What are the implications of Ethereum trading below vital moving averages?

Ethereum’s trading below essential moving averages, such as the 200-moving average and exponential moving average previously around $2,400, highlights the current bearish sentiment. To confirm a potential recovery, ETH must break above these moving averages to regain bullish momentum.

| Key Metrics | Ethereum Price | Critical Support Level | Critical Resistance Level | Market Sentiment | Future Outlook |

|---|---|---|---|---|---|

| Current Trading Level | $1,920 | $1,870 | $2,050 | Bearish | Critical days ahead for a potential recovery or further decline. |

| Percentage Loss | 57%+ Loss Overall | N/A | Needs to Break Above $2,000 | Investor Uncertainty | Bulls must reclaim support levels to avoid decline. |

| Market Status | Below Multi-Year Support | $1,870 as buffer | $2,050 as barrier | Volatile | Possible market recovery if key levels are reclaimed. |

Summary

Ethereum price analysis shows that the cryptocurrency is in a precarious position, currently trading below the critical $2,000 mark amidst ongoing bearish pressure. With significant resistance at $2,050, the ability of ETH to reclaim this level will be vital for a turnaround. Conversely, should it fall below the support of $1,870, further declines could be anticipated. The upcoming days are pivotal as traders watch closely for signs of recovery or continued weakness.

Ethereum price analysis reveals the current struggles of the cryptocurrency as it hovers below the important $2,000 threshold, navigating through a patch of heavy selling pressure and consolidation. In the midst of a bearish cryptocurrency market, Ethereum has seen a staggering drop of over 57% in value, raising concerns for traders looking for potential recovery opportunities. With ETH breaking below significant support levels, the path to regaining lost ground looks increasingly challenging, as this former support could now act as robust resistance. Market participants are keenly observing ETH’s movements around critical price points, particularly focusing on the $1,870 support and the formidable $2,050 resistance levels. As momentum wanes, understanding Ethereum recovery potential is vital for traders trying to capitalize on future market trends.

A deep dive into Ethereum’s current trading scenario showcases the delicate balance it holds just beneath the crucial $2,000 mark. The ongoing bearish sentiment within the cryptocurrency landscape poses significant challenges for traders, particularly those eyeing Ethereum’s journey back to stability. As ETH wrestles with maintaining key support zones while gauging resistance levels, the potential for a rebound appears uncertain amidst volatile market conditions. Analysts emphasize the importance of monitoring Ethereum’s price dynamics, paying close attention to support thresholds like $1,870 and resistance barriers at $2,050. In this unpredictable environment, understanding Ethereum’s market performance and potential bullish signals can guide investors through their trading strategies.