The Bybit hack impact has sent ripples through the entire crypto landscape, deeply affecting market dynamics and trading volumes. This substantial breach, which cost the exchange approximately $1.5 billion in Ether, raised valid concerns about security protocols in the ever-evolving crypto ecosystem. Following the incident, Bybit experienced a notable decline in spot trading volumes, presenting challenges for many traders. However, despite these challenges, the exchange’s innovative Retail Price Improvement (RPI) orders have maintained tighter bid-ask spreads, ensuring liquidity for retail investors. As the crypto market analysis unfolds, the aftermath of the hack continues to offer valuable insights into trading behaviors and the resilience of platforms like Bybit.

The repercussions of the Bybit security breach resonate throughout the cryptocurrency sector, highlighting vulnerabilities and the need for bolstered protections. This significant incident illustrates the interplay between trader confidence and market liquidity, particularly following the loss of such a vast sum. In the wake of the hack, trading activities on Bybit underwent a marked dip, yet the introduction of mechanisms like RPI orders played a crucial role in stabilizing conditions. Strategies that enhance bid-ask spreads are essential during such tumultuous times, shedding light on the underlying factors that influence trading behaviors across platforms. Overall, the analysis of Bybit’s recent challenges serves as a compelling case study on risk management within the digital asset trading realm.

The Immediate Effects of the Bybit Hack on Trading Volumes

The recent $1.5 billion hack of Bybit sent shockwaves through the cryptocurrency market, significantly impacting trading volumes across the board. Following the hack, there was a pronounced decline in Bybit’s spot trading volumes, which plummeted from a 11% share of the market to just 4%. This drastic drop can be attributed to a mix of panic selling and market uncertainty following the breach. Notably, Bitcoin’s trading volume fell from over 50% to below 20%, indicating that traders were hesitant to engage with the platform immediately after the incident.

Analysis from BlockScholes highlighted that the sell-off was not isolated to Bybit, but part of a broader trend in the crypto markets driven by macroeconomic factors. Additionally, there was a temporary surge in trading activity for Tether (USDT) pairs, followed by a dip in volumes for multiple altcoins. Although overall trading on Bybit has shown a recovery since the hack, volumes remain lower compared to pre-incident levels, raising concerns about the long-term implications for market liquidity and trader confidence.

Bid-Ask Spreads in the Wake of the Bybit Hack

In the wake of the Bybit hack, one of the most crucial metrics to observe was the bid-ask spreads. Tighter spreads typically indicate better liquidity and lower execution risk for traders. Interestingly, despite the substantial hacking incident, Bybit’s bid-ask spreads remained relatively stable, which played a critical role in the platform’s liquidity management. The difference between the highest bid and lowest ask price remained narrow, allowing retail traders to continue trading with minimal discrepancies between expected and filled order prices.

Bybit’s implementation of Retail Price Improvement (RPI) orders became particularly noteworthy after the hack, as these orders helped maintain competitive bid-ask spreads. By providing tighter spreads through this innovative trading mechanism, Bybit ensured that traders could execute their orders with reduced slippage, thereby enhancing overall market stability. The resilience of these spreads is indicative of Bybit’s commitment to liquidity, even amidst volatility caused by external market pressures.

Impact of the Bybit Hack on Market Confidence

The trust that traders have in exchanges is paramount, especially in the aftermath of a significant security breach. The hack on Bybit raised concerns among traders regarding the safety of their assets, leading to increased scrutiny of the exchange’s security measures. Despite a quick recovery in trading activity, the initial shock resulted in a temporary halt in new user registrations and active trading volumes. This incident highlighted the fragile nature of market confidence in the crypto ecosystem and the potential repercussions of security breaches.

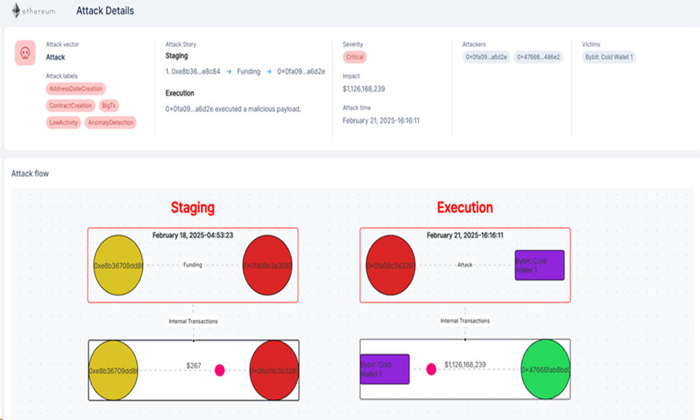

Furthermore, the crypto market has always been sensitive to perceptions of risk. The Ethereum cold wallet hack at Bybit served as a reminder of the vulnerabilities that exist in digital trading platforms. While Bybit’s RPI orders helped stabilize order book depth for retail traders, the incident has sparked discussions on the importance of robust security protocols across the crypto market. To restore full confidence, exchanges will need to demonstrate enhanced security measures and transparent communication with users.

Long-Term Consequences for Bybit Trading Activities

The long-term impacts of the Bybit hack extend beyond immediate trading volumes and market confidence. Although the exchange has shown resilience with a gradual recovery in trading shares, the overall perception of Bybit could be affected for an extended period. Traders might remain cautious and choose alternative platforms perceived as having more stringent security measures. The incident may also lead to an increase in regulatory scrutiny, influencing how crypto exchanges manage risk and security moving forward.

In addition, Bybit may face challenges in regaining its former market position among other exchanges in terms of trading volumes and user loyalty. The market’s reaction is a critical factor that could shape future platform developments. Institutions and retail traders may opt to reassess their trading strategies and wallet security practices, which can indirectly affect Bybit’s trading dynamics. Effective communication and strategic improvements will be essential for Bybit to navigate and mend relations with its trading community.

Bybit’s Recovery Strategy Post-Hack

In the aftermath of the $1.5 billion hack, Bybit implemented a focused recovery strategy aimed at restoring trader confidence and stabilizing trading activities. The introduction of the RPI orders shortly before the incident proved to be a timely measure that supported liquidity. Bybit’s commitment to enhancing its security infrastructure was also a significant part of its recovery strategy, reassuring users that their investments are secure even post-attack.

Moreover, strategic marketing efforts to educate users on the benefits of RPI orders and improvements in user experience were essential components of Bybit’s post-hack recovery plan. Coupled with transparency about their security measures, these efforts aimed to restore market confidence and encourage traders back to the platform. The company’s adaptive strategies demonstrate a proactive approach to not only recover trading volumes but to enhance overall user experience and security in the volatile crypto market.

The Role of Ethereum Cold Wallets in Security

The Bybit hack emphasized the critical role of cold wallets in managing cryptocurrency exchanges’ security. Cold wallets, designed to be offline and less susceptible to cyber threats, are often considered safer compared to hot wallets. However, this incident underscored that vulnerabilities can still exist even with cold storage, necessitating continuous advancements in security practices within the crypto industry. Moving forward, exchanges must re-evaluate their strategies and potentially adopt multi-signature technologies to further enhance the security of funds held in cold wallets.

Exchanges like Bybit, which deal with significant trading volumes, need to balance accessibility with security. As demonstrated in the aftermath of the hack, even slight lapses can result in catastrophic losses. Therefore, reviewing where and how assets are stored is imperative. Additionally, educational initiatives aimed at informing users about wallet security, particularly regarding the use of cold storage, may prove beneficial for protecting against future hacks.

Market Reactions to Bybit’s Incident

The market reactions following the Bybit hack were multifaceted, involving short-term sell-offs and strategic repositioning among traders. As panic initially set in, many traders opted to liquidate their positions, leading to increased volatility in both Bitcoin and Ethereum prices. However, as the dust began to settle, experienced traders recognized potential opportunities in the lower price levels, prompting some asvid to enter the market. This behavior underscores the inherent opportunism often witnessed in the crypto sector during times of upheaval.

Furthermore, the broader crypto market was affected by a wave of caution, with many traders adopting a ‘wait-and-see’ approach. Bybit’s hack illustrated the interconnected nature of different coins and exchanges. As traders adjusted their navigation strategies, they began to explore venues that offer heightened security assurances and competitive liquidity options. The impact of Bybit’s security breach extends beyond its platform, influencing trading strategies and sentiments across the crypto landscape.

Future Implications for Bybit’s Market Position

Looking ahead, the Bybit hack has critical future implications for its market position within the competitive crypto trading landscape. As the exchange works tirelessly to rectify the damages caused by the incident, it must also consider how to differentiate itself from competitors that may now be perceived as safer options. Building a reputation for security excellence will be paramount for regaining the trust of both retail and institutional investors. Additionally, Bybit may need to enhance its marketing strategies to bolster user loyalty and attract new traders amidst an evolving and wary market.

Another consideration for Bybit’s future is its adaptability to regulatory changes that may arise due to increased scrutiny following high-profile security breaches. The exchange must prioritize compliance and proactively engage with regulatory bodies to bolster its legitimacy and foster a safer trading environment. By positioning itself as a leader in security and user satisfaction, Bybit can carve a path towards regaining market share and establishing a stronger foothold in the crypto trading arena.

The Importance of Educating Retail Traders

Educating retail traders about security measures and trading strategies following the Bybit hack is vital. Knowledge is power, particularly when it comes to navigating risks in the volatile crypto environment. Bybit has an opportunity to lead initiatives aimed at informing users about their security protocols, how to utilize the RPI orders effectively, and strategies for minimizing risks in their trading activities. This education will empower traders to make informed decisions and potentially restore their confidence in the platform.

Additionally, workshops or seminars focusing on best practices for cryptocurrency storage, trading risk management, and understanding market indicators can significantly enhance the overall trading experience for retail users. By fostering a culture of education and informed trading, exchanges such as Bybit can cultivate a loyal user base that feels empowered to engage with the market cautiously yet confidently.

Frequently Asked Questions

What is the impact of the Bybit hack on cryptocurrency trading volumes?

The Bybit hack resulted in a significant decrease in the exchange’s trading volumes, dropping from 11% to 4% of the overall spot trading market. While there was a short-term spike in Tether (USDT) trading due to panic selling, Bitcoin (BTC) and altcoin volumes observed a subsequent decline. Bybit’s trading volumes are still in recovery but have recently stabilized around 6-7%.

How did the Bybit hack affect bid-ask spreads in the crypto market?

Despite the $1.5 billion loss from the hack, bid-ask spreads on Bybit remained relatively tight. This stability indicates that liquidity levels were maintained, which is crucial for minimizing execution risks. Tighter spreads are essential during market volatility, showcasing Bybit’s resilience even after the Ethereum cold wallet attack.

What role did Bybit’s RPI orders play in the aftermath of the hack?

Bybit’s Retail Price Improvement (RPI) orders were pivotal in supporting liquidity for retail traders following the hack. Introduced just days before the incident, these orders allowed for improved execution prices, helping the overall market maintain tight bid-ask spreads and recover quickly in the order book depth for Bitcoin and Ethereum.

Did the Bybit hack have a broader impact on the crypto market beyond Bybit itself?

Yes, the Bybit hack influenced the broader crypto market dynamics. The incident occurred during a period of increased de-risking across crypto assets due to macroeconomic factors. This resulted in an immediate market reaction that affected trading volumes across various cryptocurrencies, culminating in a temporary decline of interest in assets like BTC and ETH.

Is Bybit’s trading platform recovering from the impact of the hack?

Yes, Bybit is recovering from the hack. Although there was an initial sharp decline in trading volumes, the platform has seen a gradual improvement, with its share of spot trading volumes rising to about 6-7%. The introduction of RPI orders also contributed to the recovery by providing better liquidity for retail traders.

What strategies should crypto investors consider after the Bybit hack?

Investors should closely monitor bid-ask spreads and trading volumes, especially on major exchanges like Bybit. Utilizing tools that track market volatility and liquidity can also be beneficial. Additionally, considering the potential impacts of macroeconomic events on the crypto market will be vital for informed trading decisions post-hack.

How does the liquidity of Bybit compare to other platforms after the hack?

While Bybit experienced a decline in trading volumes post-hack, the platform’s liquidity has been sustained through RPI orders. This strategy has led to tighter bid-ask spreads and allowed Bybit to maintain a competitive edge compared to other exchanges that might struggle with liquidity during periods of high volatility.

What long-term effects can the Bybit hack have on the crypto market?

The Bybit hack might lead to increased scrutiny on crypto security practices and could prompt exchanges to enhance their security measures. This incident may also influence investor sentiment and lead to more cautious trading behavior in the short term, potentially affecting overall trading volumes and market trust.

| Key Points | Details |

|---|---|

| Bybit Hack Impact | Bybit lost $1.5 billion in ETH due to a cyber attack. |

| Market Reaction | Significant plunge in trading volumes, BTC share dropped from 50% to below 20%. |

| Retail Price Improvement (RPI) Orders | Introduced just before the attack to provide liquidity for retail traders. |

| Post-Hack Recovery | Spot trading volume share rose to 6-7% weeks after the attack. |

| Bid-Ask Spreads | Despite volume drop, spreads remained tight indicating liquidity. |

Summary

The Bybit hack impact has been profound, not only on the exchange itself but also on the broader cryptocurrency market. With a significant loss of $1.5 billion in ETH, Bybit experienced a drastic drop in trading volumes and a shift in market dynamics, evidenced by the decrease in BTC market share and fluctuating trading patterns across other assets. However, the introduction of Retail Price Improvement (RPI) orders played a crucial role in stabilizing liquidity for retail traders, facilitating a swift recovery in trading activity. Ultimately, while the aftermath of the hack led to initial panic and declines, Bybit’s strategic measures and the resilience of the market have helped in regaining some footing in the turbulent crypto landscape.

The Bybit hack impact continues to resonate across the crypto landscape, particularly after the exchange suffered a staggering loss of $1.5 billion in a recent cyber attack targeting its Ethereum cold wallets. This incident not only diminished Bybit’s trading volumes significantly but also shook the very foundation of market confidence in crypto exchanges. As analysts conduct a thorough crypto market analysis, they reveal how this breach led to a spike in volatility, disrupting bid-ask spreads and eroding the trust of retail investors. Nonetheless, Bybit managed to stabilize its operations through innovative solutions like Retail Price Improvement (RPI) orders, which provide crucial liquidity even during turbulent times. Despite the initial setback, the broader cryptocurrency market has shown signs of recovery, albeit cautiously, as liquidity dynamics shift in response to these security breaches.

The repercussions of the Bybit breach have had far-reaching effects on various aspects of the cryptocurrency ecosystem. Following the substantial loss incurred during the Ethereum cold wallet incident, the trading platform witnessed a drastic shift in its operational metrics and overall market activity. Experts in crypto finance and trading observed critical changes in trading volumes, tighter bid-ask spreads, and shifts in retail trader confidence. Bybit’s unique approach, including the integration of specific order types to support liquidity for retail users, has played a pivotal role in navigating this crisis. As investors digests these developments, the need for robust security measures and strategic trading features has never been more evident.