BTC miners’ revenue has plunged significantly, a trend underscored by the recent halving event and escalating operational costs. Even as Bitcoin trades around $84,000, mining profits are at a record low, with hashprice metrics reflecting a concerning decline to almost a five-year nadir. This situation reveals the harsh realities faced by miners amidst fluctuating crypto market conditions, where competition and increasing difficulty levels further strain profitability. The Valkyrie Bitcoin Miners ETF, having dropped 50% year-to-date, serves as a stark indicator of the struggles inherent within the industry. As miners navigate these challenges, the need for innovative strategies to adapt to falling revenues has never been more pressing.

The financial landscape for Bitcoin extractors has become increasingly precarious, especially as key performance indicators like mining revenue continue to dwindle. Recent dynamics surrounding Bitcoin extraction, marked by heightened operational expenses and a brutal hashprice decrease, highlight the industry’s ongoing struggles. With market volatility and challenging crypto conditions discouraging profitability, miners find themselves exploring alternative pathways to sustain their businesses. The steep drop in the Valkyrie Bitcoin Miners ETF further emphasizes the urgent need for strategic shifts within this sector. As operational costs soar and competitive pressures mount, the quest for maintaining a viable revenue stream becomes essential for Bitcoin miners.

Understanding BTC Miners Revenue Dynamics

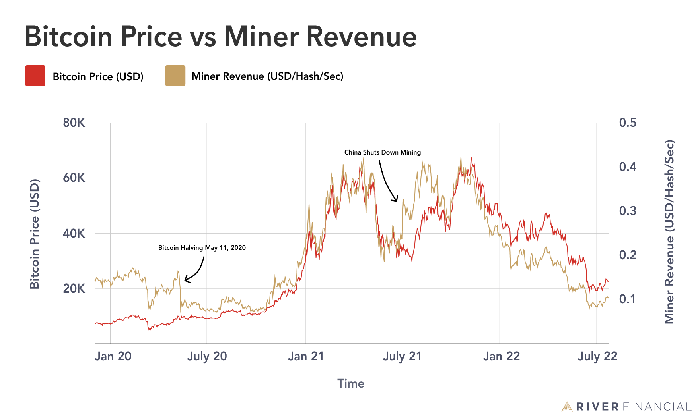

BTC miners revenue is intricately linked to various factors within the cryptocurrency ecosystem. Despite the price of Bitcoin hovering around $84,000, the income generated by miners is faltering due to the simultaneous high operational costs and the halving event that reduced rewards by 50%. With hashprice, a vital metric for measuring miner revenue, falling to levels not seen in five years, miners are feeling the squeeze. This disconnect between Bitcoin’s high market price and miner revenue illustrates a complicated relationship influenced by rising competition and mining difficulties.

The decline in BTC miners’ revenue underscores the pressing challenges the industry faces, despite an ostensibly bullish market for Bitcoin. Many miners find themselves questioning the sustainability of their operations, as the profitability hinges not just on cryptocurrency prices but also on the efficiency of mining technology, energy costs, and overall market conditions. Without immediate solutions, such as better technology or lower energy costs, many mining operations may struggle to remain economically viable.

The Challenges of Bitcoin Mining in Today’s Market

Bitcoin mining challenges have been exacerbated by recent market developments, such as changes in the crypto market conditions and the fallout from the Halving event. The industry is confronted with lower transaction revenue and increased mining difficulty. These challenges are coupled with the reality that compliance with energy regulations may also lead to increased operational costs, further complicating the ability of miners to monetize their activities effectively. As miners face these hurdles, many are reevaluating strategies to remain competitive.

In addition to the direct challenges posed by mining difficulties and operational costs, external factors like geopolitical uncertainty and economic policies can significantly affect profitability. For instance, potential tariffs on energy sources can cripple profit margins for miners in specific regions. The combination of these factors creates a tumultuous environment for Bitcoin miners, leading many to explore alternative revenue streams or even venture into other tech domains, such as AI, to harness their computational capabilities.

Impact of Hashprice Decline on Mining Operations

The decline in hashprice significantly affects the revenue structure for Bitcoin miners. Currently hovering around $44.00 per petahash per second, hashprice is at a near-five-year low, highlighting the struggles miners are experiencing. This crucial metric indicates the income miners can expect, making it a vital point of focus for anyone involved in Bitcoin mining. The lowered hashprice reflects not just operational challenges but also a broader trend of diminishing returns as competition in the market intensifies.

As hashprice continues to decline, miners are left with challenging decisions regarding their operational strategies. While some may attempt to stay operational at breakeven levels, others are rethinking their method of mining. Those who can adapt to the new market conditions may find ways to maintain profitability through innovative approaches or partnerships. However, the relentless drop in hashprice raises concerns about the future viability of many operations if prices and mining returns don’t stabilize.

The Role of Valkyrie Bitcoin Miners ETF in the Mining Landscape

The Valkyrie Bitcoin Miners ETF has become a pivotal instrument in illustrating the current state of the Bitcoin mining landscape. With a 50% decline year-to-date, the ETF reflects not just the performance of Bitcoin but also the intricate challenges facing miners, including rising operational costs and the sharp decline in hashprice. The ETF’s performance covers a spectrum of mining operations and highlights how external market conditions can directly influence investor perceptions and the capital flow into the mining sector.

Investors keen on Bitcoin-related ventures are closely watching the Valkyrie Bitcoin Miners ETF as an indicator of market health. The sharp downturn, despite Bitcoin’s comparatively stable price, signals a need for miners to reassess their operational frameworks. For prospective investors, understanding the dynamics driving the ETF is crucial, especially as it serves not just as a measure of financial health, but as a reflection of industry challenges and opportunities.

Operational Costs: The Silent Killer for Miners

Rising operational costs have emerged as a silent killer in the cryptocurrency mining industry. Even when Bitcoin prices surge, as they have recently, miners are confronted with skyrocketing energy prices and rising maintenance costs for machines. These expenses can heavily impact profitability and, in many cases, can offset any potential gains from higher Bitcoin valuations. Addressing operational efficiency is becoming more crucial for miners trying to stay afloat and competitive.

Moreover, the burden of operational costs does not come lightly. Many mining operations must navigate fluctuating energy costs while also maintaining their hardware, which can be both costly and time-consuming. As energy prices soar due to various external factors, miners will need innovative solutions to minimize expenses or face significant revenue losses. Such realities necessitate a strategic approach to mining that goes beyond mere production to encompass comprehensive cost management and system optimization.

Future Outlook: Navigating BTC Mining in Unstable Markets

Looking ahead, the outlook for Bitcoin mining appears fraught with uncertainty as miners grapple with operational challenges amid fluctuating market conditions. With the implications of potential regulatory changes looming, miners must remain vigilant. The cryptocurrency environment is evolving quickly, and conditions are influenced by several external factors, from energy policy changes to technological advances in mining equipment.

Furthermore, geopolitical factors and macroeconomic conditions are likely to influence market dynamics significantly. Miners will need to adopt flexible strategies to adapt to these changes, perhaps by diversifying their portfolios or investing in alternative blockchain technologies and applications. The resilience of the mining sector in the coming years will depend on how well players can navigate these complexities and position themselves for long-term sustainability.

Adapting to Cryptocurrency Market Fluctuations

In the face of periodic fluctuations in crypto market conditions, Bitcoin miners must cultivate adaptability. The rapid changes in Bitcoin’s market value can significantly impact mining profitability. As such, developing the ability to pivot according to market shifts becomes essential for sustaining operations. This adaptability is crucial for survival, especially during bearish market phases that test the limits of operational resilience.

Moreover, successful miners are increasingly seeking innovative solutions to buffer against these market changes—such as incorporating yield optimization techniques or exploring new partnerships in technology sectors. By honing their capacity to respond to fluctuations, miners can not only survive but potentially thrive, finding new revenue opportunities and expanding their operations despite adverse conditions.

Alternative Revenue Streams for Miners

As traditional mining profits wane due to factors such as diminishing hashprice and rising operational costs, many Bitcoin miners are exploring alternative revenue streams to bolster their bottom lines. Opportunities for diversifying income sources include utilizing mining hardware for non-cryptocurrency-related functions, like participating in artificial intelligence processing. This shift may offer miners a lifeline as they search for ways to achieve profitability amid changing market landscapes.

Additionally, creative solutions, such as forming alliances or cooperatives to share resources and reduce costs, are also gaining traction in the mining community. Miners are beginning to realize that collaboration could enhance operational efficiencies and dilute the challenges of profitability. By leveraging their collective capabilities, mining operators can enhance their resilience and establish more sustainable business models moving forward.

The Interplay of Mining Efficiency and Profitability

The interplay between mining efficiency and profitability has never been more apparent in the current marketplace. As operational costs rise and hashprice falters, miners are pushed to enhance their energy efficiency and utilize the latest technologies. Businesses that embrace innovation and adopt more efficient mining practices may find a path to profitability in a landscape where traditional models struggle to sustain themselves.

Investing in cutting-edge mining equipment, optimizing energy usage, and implementing advanced cooling systems represent just a few ways miners can optimize their operations. However, continual investment in efficiency is invaluable. Staying as competitive as possible in such a volatile environment requires a proactive stance, ensuring that profit margins are protected as much as feasible amidst the numerous challenges currently facing the industry.

Frequently Asked Questions

What factors are affecting BTC miners’ revenue in the current market?

BTC miners’ revenue is largely impacted by recent halving events, which reduce block rewards, alongside rising operational costs and increased competition in the mining sector. Additionally, the decline in hashprice, currently near a five-year low at $44.00 PH/s, is a major concern, limiting potential earnings despite higher bitcoin prices.

How does the hashprice impact BTC miners’ revenue?

Hashprice is a critical metric for BTC miners’ revenue as it represents the expected income per unit of computing power, typically noted in USD per petahash (PH/s). When hashprice declines, it indicates a tough environment for miners, reducing their total earnings regardless of bitcoin’s market price.

What are the main challenges BTC miners are facing in 2025?

In 2025, BTC miners are facing several challenges, including high operational costs from energy expenses, increased mining difficulty, and decreased transaction fees. The recent halving event has also halved their rewards, while a low hashprice further complicates their revenue generation.

What impact has the Valkyrie Bitcoin Miners ETF had on BTC miners’ revenue perspectives?

The Valkyrie Bitcoin Miners ETF has reflected the tough conditions for BTC miners, as its value has dropped by 50% year-to-date. This significant decline highlights the broader struggles within the mining industry, affecting investor sentiment and the overall outlook for miners’ revenue.

Can BTC miners remain profitable despite declining revenues?

While BTC miners are currently under pressure from declining revenues, some might still break even using efficient mining equipment at the current hashprice levels of around $44.00 PH/s. Miners are also diversifying their operations by reallocating resources to other areas like artificial intelligence to maintain profitability.

How do geopolitical uncertainties affect BTC miners’ revenue?

Geopolitical uncertainties, such as the threat of tariffs, can adversely affect BTC miners’ operational costs and revenue. These uncertainties add to the existing challenges of the crypto market and can lead to further financial strain on mining operations.

What strategies are BTC miners adopting to cope with current revenue challenges?

To cope with revenue challenges, BTC miners are increasingly exploring alternative revenue streams, such as optimizing their computing power for artificial intelligence applications, in addition to looking for operational efficiencies to manage rising costs and stabilize their profit margins.

How does the current state of the crypto market affect BTC miners’ revenue?

The current crypto market, characterized by stagnant bitcoin prices and fluctuating demand, significantly impacts BTC miners’ revenue. Low hashprices and higher operational costs create a financially challenging environment, making it difficult for miners to maintain profitability.

| Key Metric | Current Status | Impact on Miners |

|---|---|---|

| Hashprice (per PH/s) | $44.00 | Near a five-year low, affecting miner profitability. |

| Bitcoin Price | $84,000 | Despite high BTC price, miners face reduced revenue. |

| Valkyrie Bitcoin Miners ETF | -50% YTD | Reflects broader issues in miner revenue. |

| Operational Costs | Rising | Increased competition and energy costs are squeezing margins. |

| Future Outlook | Deteriorating | Geopolitical uncertainties and stagnant prices add pressure. |

Summary

BTC miners revenue is facing severe challenges as operational costs rise and halving events impact profits. Despite Bitcoin trading at $84,000, miner revenue is flatlining, with hashprice hovering near a five-year low at $44.00 PH/s. The mining sector is adapting, but the outlook remains precarious amid increasing competition and geopolitical pressures.

BTC miners revenue is under significant pressure, as recent developments within the crypto market have revealed troubling trends. Despite Bitcoin trading around $84,000, miners are facing a stark decline in earnings due to a combination of operational costs and the recent halving event, which slashed their rewards. A crucial factor, hashprice, now sits near a five-year low, reflecting persistent challenges that Bitcoin miners must navigate to remain profitable. Furthermore, mounting competition and increased mining difficulty compound these financial hurdles, highlighting the complex landscape of bitcoin mining today. With the Valkyrie Bitcoin Miners ETF plummeting 50% year-to-date, the current scenario paints a dire picture for miners striving to stay afloat amid fluctuating market conditions.

The revenue generated by Bitcoin miners is increasingly becoming a topic of concern, especially in light of existing challenges in the crypto mining sector. As miners face rising operational costs and a notable decline in hashprice, many are reevaluating their strategies to ensure sustainability. Often referred to as the earnings of cryptocurrency miners, this revenue stream is being tested by current market fluctuations and economic pressures. The recent performance of the Valkyrie Bitcoin Miners ETF further exemplifies the struggle within the mining community, raising questions about future profitability. With these factors in play, understanding the nuances of miners’ earnings is essential for anyone invested in or engaging with Bitcoin and its ecosystem.