Bitcoin short liquidations are reshaping the narrative in cryptocurrency markets as unexpected price rallies upend prevailing bearish sentiments. Typically, when funding rates dip into negative territory, traders anticipate further declines, prompting many to short-sell. However, a surprising surge in Bitcoin’s price has led to significant short liquidations, catching these traders unprepared and creating a buzz in the market. This phenomenon illustrates a peculiar market dynamic where bearish trends clash with sudden bullish movements, challenging conventional trading strategies. As Bitcoin’s price trajectory defies expectations, understanding the interplay of funding rates and perpetual futures becomes crucial for navigating this volatile landscape.

In the realm of cryptocurrency trading, the liquidation of short positions on Bitcoin presents a compelling story of market unpredictability. Often, negative funding rates signal that traders are bracing for a downturn, aligning with a broader expectation of a falling Bitcoin price. Yet, the recent upturn contradicts this view, with a pronounced rally catching many short-sellers off guard. This interaction between bearish market sentiment and unexpected bullish movement showcases the complexities of the Bitcoin landscape. As traders grapple with these dynamics, comprehending how economic indicators like funding rates correlate with market behavior becomes increasingly essential.

Understanding Bitcoin Short Liquidations

Bitcoin short liquidations occur when traders who have bet against Bitcoin are forced to close their positions due to rising prices. As Bitcoin’s value increases, these short sellers, who profit when the asset price falls, face significant losses, prompting them to liquidate their positions. This action can lead to further price surges, creating a cycle of increasing prices that contradicts the initial bearish expectations often indicated by negative funding rates. This phenomenon highlights the volatility within the cryptocurrency market, where pricing dynamics can shift rapidly and defy common market sentiments.

During periods of negative funding rates, traders often align themselves with a bearish outlook. However, the recent Bitcoin price rally suggests that the market can be unpredictable. Short sellers, who believed they were making a prudent bet against the market conditions, found themselves in dire straits as Bitcoin continued to soar. The link between short liquidations and rapid price changes emphasizes the importance of understanding market sentiment and the inherent risks associated with trading in perpetuity futures.

The Role of Negative Funding Rates in Trading Strategies

Negative funding rates typically indicate that there are more short positions in the market than long positions. Traders might interpret this as a signal that Bitcoin is expected to decline, leading to a bearish trend. However, this inversion between funding rates and actual price movements challenges traditional trading strategies. It prompts traders to reconsider the potential benefits of maintaining long positions, especially during periods of high volatility when market sentiment can rapidly change.

Traders should understand that negative funding rates can also create opportunities for savvy investors. Those willing to take calculated risks can benefit from the potential price appreciation resulting from forced short liquidations. By recognizing the disconnect between funding rates and the market’s actual activity, traders can devise strategies that capitalize on these fluctuations. This duality reflects the complexity of trading Bitcoin, as each decision must account for both technical indicators and broader market dynamics.

Analyzing Bitcoin’s Unexpected Price Rallies

A Bitcoin price rally often surprises market participants, especially when it occurs amidst negative funding rates, which typically suggest that the sentiment is leaning towards a downturn. Understanding the reasons behind these unexpected rallies is essential for traders seeking to position themselves effectively. Factors such as institutional interest, new technology developments, and overall market sentiment can drive Bitcoin’s price upward despite an otherwise bearish outlook in funding rates.

Moreover, these unexpected rallies can be influenced by external events or news related to Bitcoin, such as regulatory changes, adoption by mainstream finance, or significant capital inflows. Traders must stay vigilant and be ready to adjust their strategies accordingly. Analysis of previous price rallies amid negative funding can provide crucial insights into potential future movements and help traders prepare for sudden changes, ensuring they do not fall victim to being excessively bearish when opportunities for profit arise.

Short Sellers: Navigating a Turbulent Market

Short sellers have a challenging task in navigating a market that can swing drastically based on Bitcoin’s volatility. While negative funding rates suggest a strong presence of short positions, the reality is that sudden price increases can lead to frustrations and losses for these traders. The market’s unpredictability requires that short sellers remain agile, ready to adapt their strategies while keeping a watchful eye on Bitcoin’s price movements.

One key aspect for short sellers is the need to analyze broader market trends and sentiments, utilizing tools like technical analysis and monitoring for signs of bullish movement. Despite the bearish funding rates, understanding the broader context can help short sellers make informed decisions—either by closing out positions in fear of liquidation or adjusting their strategies to profit from potential retractions in Bitcoin’s price. This agile approach helps mitigate risk and capitalize on market cycles.

The Dynamics of Perpetual Futures and Bitcoin Trading

Perpetual futures contracts play a vital role in the trading of Bitcoin, providing traders with the ability to speculate on price movements without an expiration date. These contracts are heavily influenced by funding rates, which are determined by the difference between long and short positions in the market. When the funding rates are negative, it indicates that short sellers are dominant, yet this can create opportunities for unexpected price movements that traders should be prepared for.

Understanding the nuances of perpetual futures allows traders to better navigate the complexities of Bitcoin trading. They enable traders to hedge their positions, capitalize on market inefficiencies, and potentially profit even during downturns. By keeping an eye on the dynamics of funding rates, margin requirements, and market sentiment, traders can enhance their trading strategies and improve their decision-making processes.

Market Sentiment and Its Impact on Bitcoin Prices

The cryptocurrency market is heavily influenced by sentiment, which often leads to volatile swings in asset prices. In the case of Bitcoin, when negative funding rates are prevalent, it tends to signal prevailing bearish sentiment amongst traders. However, understanding that market sentiment can change rapidly is crucial for traders looking to anticipate price movements and potential liquidations.

When a sudden rally occurs amid negative funding, the market can shift rapidly, reversing previously held sentiments. This phenomenon reinforces the notion that market emotions can lead traders to make irrational decisions. By analyzing social sentiment data, news events, and market movements, traders can better gauge potential shifts in Bitcoin prices and adapt their strategies accordingly. Keeping a pulse on market sentiment is essential for effective trading.

The Relationship Between Price Volatility and Liquidation Events

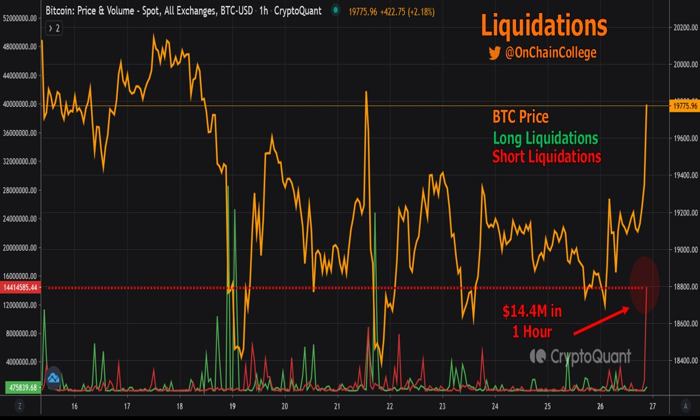

Price volatility is a hallmark characteristic of the Bitcoin market, often leading to significant liquidation events. Short liquidations, which happen when the price rises unexpectedly, can exacerbate volatility as forced selling creates a feedback loop, pushing prices even higher. Understanding this relationship enables traders to develop strategies that either protect against extreme volatility or capitalize on it during periods of heightened activity.

During times of price volatility, traders are often urged to reassess their positions and risk levels. Liquidations can result in sharp price movements that traders must react to quickly. By having risk management strategies and using tools such as stop-loss orders, traders can mitigate potential losses. Moreover, recognizing how volatility drives short liquidations can inform trading decisions, helping traders navigate through turbulent periods effectively.

Strategies for Dealing with Bearish Trends

In a market characterized by bearish trends, traders may encounter negative funding rates and heightened short selling. Outmaneuvering this sentiment requires a solid strategy that incorporates both technical analysis and situational awareness. Understanding market indicators, such as moving averages and Fibonacci retracements, can provide insights into potential price movements and help traders determine optimal entry and exit points.

Moreover, incorporating diversified investment strategies can also mitigate risks associated with participating in a bearish market. Traders should explore different asset classes or consider long-term holdings that are less affected by short-term volatility. By maintaining a well-rounded approach to trading, investors can navigate through challenging market conditions while still positioning themselves for potential gains when market sentiment shifts.

Looking Ahead: Future Trends in Bitcoin and Funding Rates

The future of Bitcoin and its funding rates remains a topic of interest for traders and investors alike. As the crypto market matures, the dynamics between short and long positions will continue to evolve. Analysts predict that as institutional investments grow, funding rates could stabilize, potentially leading to less volatility and clearer market signals for traders.

Keeping an eye on emerging trends, such as regulatory developments, technological advancements, and changing investor sentiments, will be crucial in navigating the evolving landscape of Bitcoin trading. As the community adapts to these changes, traders must remain proactive and informed, ready to adjust their strategies to maintain a competitive edge in the rapidly shifting environment of cryptocurrency trading.

Frequently Asked Questions

How do Bitcoin short liquidations occur despite negative funding rates?

Bitcoin short liquidations can occur even when negative funding rates are present due to sudden price rallies that catch short sellers off guard. When traders expect a price decline, negative funding rates signal bearish sentiment, yet unexpected upward swings in Bitcoin’s price can lead to significant losses for these short sellers, resulting in liquidations.

What impact do negative funding rates have on Bitcoin short sellers?

Negative funding rates generally indicate a bearish trend, suggesting that the market expects Bitcoin prices to fall. This environment often incentivizes short sellers to enter positions. However, if a Bitcoin price rally occurs unexpectedly, these short positions can be liquidated, leading to sudden market volatility.

Why are short liquidations common during Bitcoin price rallies?

Short liquidations are common during Bitcoin price rallies because, in a bullish scenario, short sellers face mounting pressure as their positions lose value. When prices surge, the need for short sellers to cover their positions can lead to further buying pressure, exacerbating the price increase.

Can Bitcoin’s negative funding rates predict short liquidations?

While negative funding rates can indicate bearish sentiment, they do not reliably predict short liquidations. Market dynamics are complex; bullish rallies can occur unexpectedly, leading to liquidations among those who anticipate continued decline based on the funding rates.

What role do perpetual futures play in Bitcoin short liquidations?

Perpetual futures allow traders to maintain short positions against Bitcoin indefinitely, which can lead to short liquidations if the market unexpectedly rallies. If many traders are short and Bitcoin’s price rises, these perpetual futures can trigger liquidations as margin requirements increase.

How should traders respond to Bitcoin’s short liquidations trends?

Traders should monitor market sentiment and funding rates closely, as trends in Bitcoin short liquidations can indicate broader market movements. A sudden liquidation event may suggest a shift in bullish sentiment, prompting traders to reassess their positions.

What does a Bitcoin price rally indicate for short sellers?

A Bitcoin price rally typically puts short sellers at risk as it contradicts their expectations for price declines. This often leads to increased short liquidations as traders scramble to cover their positions in the face of rising prices.

| Key Point | Explanation |

|---|---|

| Negative Funding Rates | Indicate a bearish trend where traders expect declining prices, leading many to short Bitcoin. |

| Unexpected Price Rally | Bitcoin experienced a significant price increase, catching many short sellers off guard despite negative funding rates. |

| Short Liquidations | Large short liquidations occurred, suggesting a bullish reaction against the bearish sentiment, as short sellers are forced to cover their positions. |

| Market Sentiment | The disconnect between negative funding rates and rising prices points to timing mismatches and heightened volatility in the market. |

Summary

Bitcoin short liquidations highlight a surprising market phenomenon where negative funding rates do not align with price movements. Despite expectations of price drops driven by bearish sentiments, Bitcoin’s recent rally led to significant short liquidations, which confounded many traders. This situation underscores the unpredictable nature of cryptocurrency markets, emphasizing the importance of understanding both funding rates and market signals for better trading strategies.

Bitcoin short liquidations have emerged as a compelling topic amidst the current crypto market dynamics. Recently, despite experiencing negative funding rates in perpetual futures, there has been a remarkable surge in Bitcoin’s price, leading to a wave of liquidations that have caught many short sellers off guard. Typically, negative funding rates signal a bearish trend, suggesting that traders anticipate a decline in value. Yet, in a surprising twist, Bitcoin’s recent rally contradicts this sentiment and has resulted in significant challenges for those betting against it. Understanding the interplay between these liquidations and shifting market conditions provides critical insights into the complexities of trading Bitcoin.

The recent phenomenon surrounding Bitcoin’s short liquidations highlights the paradoxes of market behavior in cryptocurrency trading. While traders often react to negative funding rates, which usually point towards an impending decline in price, the unexpected rise of Bitcoin has blindsided many who expected the market to follow a bearish course. This scenario illustrates the unpredictable nature of the crypto landscape, particularly in relation to perpetual futures contracts and their influence on market decisions. Furthermore, the interplay between liquidations and price momentum offers a fascinating glimpse into the strategies employed by traders, particularly those who engage in short selling. As we explore this topic further, it becomes clear that the current volatility not only challenges existing narratives but also reveals the intricate mechanisms that drive investor sentiment and market movements.