Bitcoin price volatility is a defining feature of the cryptocurrency market, capturing the attention of both seasoned investors and newcomers alike. In recent days, we witnessed dramatic price swings, with Bitcoin plummeting to $76,606 before a swift recovery to $81,700, showcasing the unpredictable nature of this digital asset. Such volatility can be attributed to various factors, including macroeconomic trends and trading strategies employed within the Bitcoin market analysis. Investors engaging in Bitcoin trading strategies must stay informed about potential risks, especially when considering the effects of inflation on Bitcoin. As the cryptocurrency sector grapples with significant liquidations and institutional outflows, understanding price dynamics becomes ever more crucial for anyone investing in Bitcoin.

The erratic nature of Bitcoin’s price movements epitomizes the broader phenomena found within the world of cryptocurrencies. This oscillation in value often influences trading behaviors and investment decisions, prompting traders to refine their strategies in light of new developments. As financial landscapes evolve, especially amid rising inflation and shifts in monetary policy, many are keenly analyzing these impacts on cryptocurrency assets. Furthermore, fluctuations in Bitcoin’s price can signal broader trends that affect altcoins and the entire digital currency sector. Thus, comprehending these dynamics not only aids in informed investing but also fosters a deeper appreciation of the cryptocurrency landscape.

Understanding Bitcoin Price Volatility

Bitcoin price volatility refers to the rapid and significant fluctuations in the value of Bitcoin, often driven by a combination of market sentiment, regulatory news, and macroeconomic factors. In recent days, we have observed Bitcoin experiencing substantial price swings, dropping to as low as $76,606 before rebounding above $80,000. This volatility is not uncommon in the cryptocurrency market, where investor emotions and speculative trading can lead to drastic changes in price within short time frames.

Investing in Bitcoin requires a robust understanding of these price movements, especially given the potential for large liquidations, as seen with leveraged traders facing losses over $955 million recently. As institutional demand appears to wane, and outflows from ETFs increase, traders should be mindful of upcoming economic indicators, such as the Consumer Price Index (CPI), as they may trigger further volatility in Bitcoin’s price.

Frequently Asked Questions

What causes Bitcoin price volatility in the cryptocurrency market?

Bitcoin price volatility in the cryptocurrency market is primarily driven by factors such as market sentiment, economic data releases, and large transactions. Influences like institutional investment trends, regulatory news, and global economic indicators, including inflation metrics, significantly impact Bitcoin trading experiences, creating sharp price swings.

How does inflation impact Bitcoin price volatility?

Inflation can increase Bitcoin price volatility as investors often view Bitcoin as a hedge against inflation. When inflation fears rise, Bitcoin’s appeal can increase, leading to sudden price spikes or drops as market participants react to economic indicators and Federal Reserve policies that affect interest rates, thus heightening market tensions.

What are effective Bitcoin trading strategies to manage price volatility?

To manage Bitcoin price volatility, investors can utilize strategies such as dollar-cost averaging, which involves consistently investing a fixed amount in Bitcoin regardless of its price. Additionally, employing stop-loss orders helps limit potential losses during sudden market downturns, while setting clear profit-taking targets assists in securing gains amidst price fluctuations.

What role does Bitcoin market analysis play during periods of high volatility?

Bitcoin market analysis is crucial in periods of high volatility as it helps traders understand price trends and sentiment shifts. By analyzing key indicators such as the RSI (Relative Strength Index) and moving averages, investors can make informed decisions, better anticipate market movements, and apply effective trading strategies for navigating Bitcoin price fluctuations.

Why is understanding Bitcoin price volatility important for new investors?

Understanding Bitcoin price volatility is essential for new investors as it informs their risk management strategies. Recognizing market dynamics helps investors set realistic expectations, allocate capital wisely, and avoid emotional trading during extreme price movements, which can ultimately lead to more sustainable investment practices and minimize losses.

How do large BTC transactions influence Bitcoin price volatility?

Large BTC transactions can significantly influence Bitcoin price volatility as they may signal potential selling intentions or market manipulation. When substantial amounts are moved from wallets, it raises speculation among investors, potentially causing panic selling or buying, which exacerbates price fluctuations across the entire cryptocurrency market.

What impact do institutional outflows have on Bitcoin price volatility?

Institutional outflows can heighten Bitcoin price volatility as they indicate reduced confidence among large investors in the cryptocurrency market. Significant outflows, like those from a Bitcoin spot ETF, suggest a bearish sentiment, which can trigger further selling pressure and amplify price declines, leading to increased overall market instability.

What are the potential effects of macroeconomic data on Bitcoin price volatility?

Macroeconomic data, such as the Consumer Price Index (CPI) and employment statistics, can create significant price volatility for Bitcoin. Anticipated releases often lead to speculative trading, with bullish or bearish expectations influencing buying and selling activity. Unexpected results can trigger drastic market reactions, impacting Bitcoin’s price trajectory.

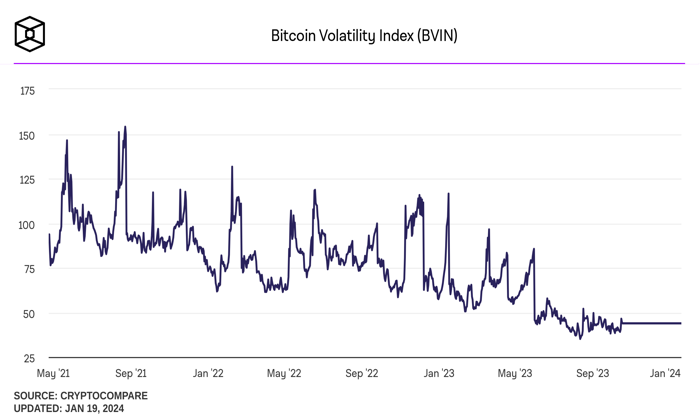

Can Bitcoin’s historical volatility guide future investment decisions?

Yes, Bitcoin’s historical volatility can provide insights for future investment decisions. Analyzing past performance in response to similar market conditions helps investors identify patterns and assess risk. Understanding previous volatility scenarios assists traders in developing strategies that align with their risk tolerance based on Bitcoin’s behavioral trends.

| Key Points | |

|---|---|

| Recent Price Movement | Bitcoin dropped to $76,606 before rebounding to $81,700. |

| Market Liquidations | Over $955.71 million in liquidations, with the largest single loss around $5.26 million. |

| Institutional Demand | Subdued, with significant ETF outflows totaling $278.40 million. |

| Volatility Factors | Upcoming CPI and PPI data may increase market volatility. |

| Technical Indicators | Bitcoin breached the 200-day EMA, reinforcing bearish sentiment. |

| BTC Transfers | Over 11,833 Bitcoin were moved, hinting at potential selling. |

| New Projects and Trends | Emerging decentralized platforms, like the Meme Index, aim to capitalize on market trends. |

Summary

Bitcoin price volatility has been significant recently, characterized by fluctuating market conditions and substantial liquidations. As the landscape evolves, with macroeconomic indicators and institutional demand shaping trader sentiment, investors must remain vigilant. The market’s response to upcoming economic data could influence Bitcoin’s trajectory even further, suggesting that volatility is likely to persist.

Bitcoin price volatility continues to shake the cryptocurrency market as investors navigate through significant fluctuations. Recently, Bitcoin experienced a dramatic drop, hitting a low of $76,606 before recovering to $81,700 within a short span of 24 hours. This intense volatility has led to massive liquidations across the sector, highlighting the risks associated with investing in Bitcoin. With the current landscape marked by institutional outflows and rising inflation fears, analyzing Bitcoin market trends and employing effective Bitcoin trading strategies is crucial for investors. As macroeconomic data unfolds, the effects of inflation on Bitcoin will likely further influence its price movements, making market vigilance essential.

The unpredictable nature of Bitcoin prices has left traders and analysts constantly on alert, especially during tumultuous times in the crypto space. Fluctuating values have spurred discussions about the broader cryptocurrency ecosystem, prompting individuals to develop more sophisticated Bitcoin trading tactics. Market speculations arise not only from breaking news but also from shifts in investor sentiment and external economic indicators. Many are turning to alternative investments and diversifying their portfolios as Bitcoin continues to emerge as both a risky asset and a potential store of value. With ongoing assessments of macroeconomic implications, investors in cryptocurrencies must remain agile in their approach.