Bitcoin price analysis reveals that the leading cryptocurrency is currently navigating a challenging landscape characterized by price compression and volatility. Despite remaining within a narrow range between $100,000 and $105,000, Bitcoin has demonstrated remarkable on-chain strength, with 99% of addresses reporting profitability as of May 13. This period, described as the “Acceleration Phase” by Fidelity Digital Assets, is often marked by significant market trends and a high degree of volatility, drawing attention from investors and analysts alike. However, the recent activity in Bitcoin derivatives has dampened upward momentum, raising questions about future price predictions. Understanding these dynamics is essential as we delve deeper into the intricacies of Bitcoin’s market behavior and volatility patterns, especially in light of its historical price movements.

In the realm of cryptocurrency investment, analyzing Bitcoin’s pricing behavior is pivotal for stakeholders. As Bitcoin continues to fluctuate within predetermined resistance levels, understanding the underlying factors contributing to these trends becomes essential. This discussion includes examining Bitcoin’s performance within the broader cryptocurrency market, highlighting its low volatility compared to traditional assets like gold. Additionally, insights into Bitcoin’s derivatives activity provide a comprehensive perspective on market sentiment, crucial for informed trading decisions. Ultimately, a thorough cryptocurrency market analysis underscores the importance of strategic investment approaches in navigating the complexities of Bitcoin’s financial landscape.

Understanding Bitcoin Market Trends

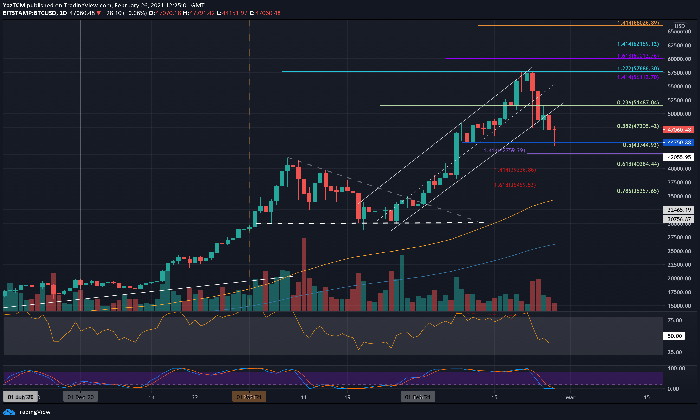

Bitcoin market trends have been a focal point for investors and traders alike, especially during times of price consolidation. Currently, Bitcoin (BTC) is exhibiting a phase of price compression, with values oscillating between $100,000 and $105,000. This stagnation is notable, as it reflects a moment of higher profitability for the majority of Bitcoin addresses, where 99% are in profit. Such conditions often serve as precursors to significant movements, especially in a market characterized by past bullish momentum around key events, such as the surge post-US elections in late 2020.

In addition to profitability, market trends are influenced by factors like overall market sentiment, changes in cryptocurrency demand, and macroeconomic shifts. Monitoring Bitcoin’s performance amidst these factors provides insights into likely future movements. As observed, analysts often use Bitcoin price prediction models in conjunction with market trend analysis to forecast potential breakout points, which are especially pronounced in high-volatility environments.

Bitcoin Price Analysis: Bullish or Bearish?

Bitcoin price analysis is crucial for understanding the cryptocurrency’s trajectory, particularly given its recent behavior in the market. While the leading cryptocurrency remains within a narrow band of $94,000 to $104,000, this compression suggests the presence of strong resistance. Notably, Chris Kuiper, research VP at Fidelity Digital Assets, identifies this period as the ‘Acceleration Phase,’ characterized by elevated wallet profitability. However, despite positive on-chain fundamentals, Bitcoin’s price has yet to decisively break through upper resistance levels.

The interplay of derivatives activity is also a topic of interest in current Bitcoin price analysis. Reports indicate that short positions currently dominate the market, leading to sustained selling pressure. Traders appear skeptical about Bitcoin reaching new all-time highs in the near term, which could impact the price action negatively if this sentiment persists. Analyzing how these factors affect Bitcoin’s price could provide crucial insights for both current holders and potential investors.

Derivatives Activity and Market Dynamics

Derivatives activity within the Bitcoin market is playing a critical role in shaping price dynamics. As highlighted by a recent report from CryptoQuant, the accumulated net taker volume has remained negative since Bitcoin reclaimed the $100,000 mark, signaling a bearish sentiment among traders. This situation has created formidable headwinds against Bitcoin’s upward momentum, as short positions continue to outnumber long positions. This ongoing bearish sentiment reflects traders’ hesitance to assume long positions amidst the prevailing market structure.

Moreover, even in periods of favorable fundamentals, such as strong on-chain signals, the influence of derivatives can distort price discovery. The divergence between on-chain profitability and derivative market sentiment illustrates the complex nature of cryptocurrency trading, where perceived risks and pressures often outweigh positive indicators. As this imbalance persists, it will be essential for traders and analysts alike to explore the potential repercussions of derivatives activity on Bitcoin’s price trajectory.

Low Volatility: A Historical Perspective

Bitcoin’s current volatility level marks a historic moment, as recent analyses reveal that its 30-day volatility has dropped below that of gold for the first time ever. This unprecedented compression of volatility indicates a stabilization period, yet it also raises questions about the potential for future price movements. Cryptocurrency experts like Matthew Sigel from VanEck have cautioned that while subdued volatility usually precedes significant directional changes, it also reflects a nuanced market environment.

The historic 0.857 ratio of Bitcoin to gold can signal a shift in investor behavior and market dynamics. For many years, Bitcoin has been perceived as a highly volatile asset, yet this recent tranquility could either set the stage for a buildup of pressure that culminates in a substantial price movement or reflect a deeper yield of liquidity in the market. Understanding this volatility compression requires close attention to market indicators and broader economic conditions that may trigger a change in investor sentiment.

Current State of the Bitcoin Market

As of May 17, 2025, Bitcoin remains the undisputed leader in the cryptocurrency market, ranked #1 by market capitalization and boasting a valuation of $2.05 trillion. Recent trading activity shows a 0.55% decline in price within the last 24 hours, reflecting the ongoing fluctuations inherent in the crypto market. Despite this minor downturn, the overall trading volume suggests robust activity, with $44.01 billion exchanging hands, indicating sustained interest among traders and investors.

The current state of the Bitcoin market underscores its resilience despite recent challenges. Price movements are often indicative of broader market sentiments, influenced by global economic factors and developments within the cryptocurrency ecosystem. Keeping a pulse on these metrics will be crucial for anyone involved in Bitcoin trading or investment, as they provide a clearer picture of the market’s health and potential future directions.

Frequently Asked Questions

What is the current state of Bitcoin price analysis in May 2025?

As of May 2025, Bitcoin price analysis reveals a price compression phase between $100,000 and $105,000, with a recent closing price of $104,119. Despite high wallet profitability and volatility shown by 99% of addresses being in profit, Bitcoin has struggled to break resistance levels, largely due to structural issues in the derivatives market.

How do Bitcoin market trends affect future price predictions?

Bitcoin market trends indicate extensive on-chain strength amidst low volatility, suggesting that while current conditions favor bullish scenarios, the derivatives activity might limit price advancements. Analysts suggest that recent price stagnation could precede significant breakout movements in Bitcoin price.

What impact does Bitcoin volatility have on investment strategies?

Bitcoin volatility has historically provided opportunities for traders, but recently, it has reached record lows, even lower than gold. This subdued volatility can lead to suppressed price movements, thus impacting investment strategies by making traditional trading tactics less effective until a breakout occurs.

How does cryptocurrency market analysis influence Bitcoin price movements?

Cryptocurrency market analysis plays a crucial role in understanding Bitcoin price movements. Key factors such as on-chain wallets profitability, derivatives activity, and macroeconomic conditions can influence Bitcoin’s volatility and help determine potential breakout points.

What does Bitcoin derivatives activity indicate about market sentiment?

The recent Bitcoin derivatives activity indicates a bearish market sentiment, as cumulative net taker volume has been negative. This suggests that traders expect limited upward movement, prompting many to establish short positions, which can hinder Bitcoin’s price discovery process.

What is the significance of Bitcoin price prediction in current market conditions?

In current market conditions characterized by high wallet profitability but low price movement, Bitcoin price prediction remains speculative. Analysts emphasize that any predictions should consider potential shifts in derivatives activity and macroeconomic factors that may lead to changes in the Bitcoin market.

| Key Points | Details |

|---|---|

| On-chain Strength | Despite trading between $100,000 – $105,000, Bitcoin shows resilience with high wallet profitability. |

| Acceleration Phase | Bitcoin remains in an acceleration phase with 99% of addresses in profit as of May 13. |

| Resistance Levels | Bitcoin struggles to break past upper resistance levels between $94,000 and $104,000. |

| Derivatives Activity | Negative net taker volume indicates short positions surpass long positions, creating downward pressure. |

| Volatility Trends | Bitcoin’s volatility has been suppressed, hitting record low levels compared to gold. |

| Market Data | As of May 17, Bitcoin’s market cap is $2.05 trillion with a 24-hour trading volume of $44.01 billion. |

Summary

Bitcoin price analysis indicates that while the leading cryptocurrency demonstrates robust on-chain fundamentals with an impressive profit rate among addresses, it is presently hindered by prevailing derivatives market dynamics. Despite a strong bullish backdrop, Bitcoin’s price has remained range-bound, making a decisive breakout through key resistance challenging. Furthermore, the notable decline in volatility as measured against gold implies a potential for significant price movements should trading conditions shift.

Bitcoin price analysis reveals a fascinating landscape marked by ongoing dynamics in the cryptocurrency market. As Bitcoin navigates a complex phase of price compression between $100,000 and $105,000, enthusiasts and investors are keenly observing the trends influencing its future trajectory. High volatility, coupled with robust wallet profitability, suggests that while market sentiment remains cautious, the potential for significant price movements looms. Analysts are increasingly focusing on Bitcoin derivatives activity, which appears to be shaping short-term price fluctuations and creating headwinds against upward momentum. Understanding Bitcoin price prediction will be crucial as traders weigh the implications of recent Bitcoin market trends and the broader context of cryptocurrency market analysis to forecast the path ahead.

In the realm of digital currencies, a comprehensive overview of Bitcoin’s current economic state is critical. This evaluation encompasses various aspects such as fluctuations in value, market volatility, and institutional interest in Bitcoin derivatives. As the leading cryptocurrency, Bitcoin has become a focal point for traders assessing impending directional shifts. Observing its price dynamics provides insights into the broader financial ecosystem surrounding cryptocurrencies. With ongoing speculation and analysis catering to both short-term trades and long-range investments, the conversation about Bitcoin’s future remains ever-relevant.