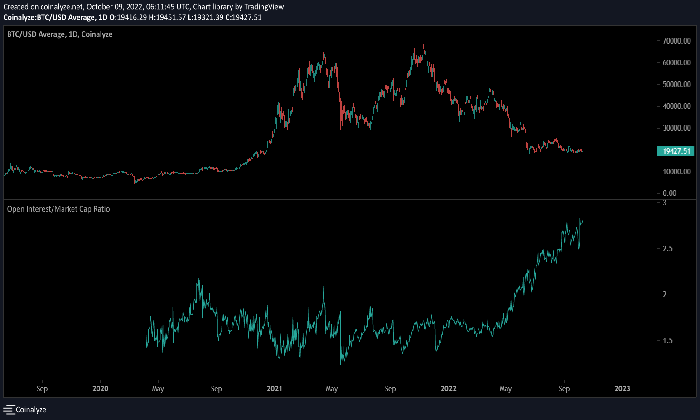

Bitcoin open interest has recently taken a significant hit, dropping to a six-month low, as analyzed by crypto expert CrediBULL Crypto. This decrease in open interest often signals shifts in market sentiment, prompting many to evaluate the potential implications for Bitcoin price prediction and overall crypto market outlook. Interestingly, during the previous instances of similar low open interest, Bitcoin traded within the $50,000 to $60,000 range, suggesting a possible BTC rebound potential ahead. Additionally, the negative funding rate adds another layer of complexity to the current market dynamics, as traders assess their strategies moving forward. With such critical indicators at play, understanding Bitcoin’s open interest becomes essential for anyone looking to navigate the fluctuating waters of cryptocurrency investments.

The term ‘Bitcoin open interest’ refers to the total number of outstanding derivative contracts that have not been settled, and it plays a crucial role in gauging market activity. This metric is vital for traders and investors alike, as it often reflects the overall sentiment surrounding Bitcoin and its potential price movements. Analysts frequently examine changes in open interest alongside other indicators like the funding rate and Relative Strength Index (RSI) to derive insights into Bitcoin’s market trajectory. As we delve deeper into the implications of these metrics, it becomes apparent that understanding open interest is integral to forming a comprehensive Bitcoin analysis, especially when considering recent trends and the potential for future rebounds.

Understanding Bitcoin’s Open Interest and Its Implications

Bitcoin’s open interest has recently dropped to a six-month low, which has raised eyebrows in the crypto community. Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that are yet to be settled. A decrease in this metric often indicates a reduction in investor confidence or market participation. Historically, when Bitcoin’s open interest was this low, the price hovered between $50,000 and $60,000, suggesting a potential turning point in market behavior. This scenario presents an intriguing backdrop for today’s Bitcoin price analysis.

The last time Bitcoin’s open interest experienced a similar dip, it preceded a significant price surge, which saw BTC climb to unprecedented heights. Analysts believe that the current state of low open interest, coupled with the recent negative funding rate, can signal a bullish reversal for Bitcoin. As traders recalibrate their positions and the market adjusts, these signals may provide fertile ground for a potential rebound, setting the stage for an impressive rally in the near future.

Bitcoin Price Prediction: Key Resistance Levels to Watch

As Bitcoin attempts to establish a bullish trend, key resistance levels play a crucial role in determining its potential price trajectory. Recent analysis indicates that Bitcoin must break above the $93,000 mark to confirm a reversal. This resistance level has proven significant in the past, acting as a barrier that must be surpassed for sustained upward momentum. Analysts like CrediBULL Crypto emphasize that the recent price movement towards this level is just the first step, and further strength is required to gain traction beyond it.

In addition to the $93,000 resistance, the $94,000 mark has also emerged as a critical threshold. Analysts suggest that maintaining a position above this level is essential for Bitcoin to solidify its bullish outlook. The Kumo cloud indicator, used by traders to assess market momentum, indicates that BTC is testing this resistance zone. A successful breach could trigger a rally towards higher targets, potentially rekindling the excitement seen during previous bull runs, where Bitcoin surged towards $126,000.

The Role of Bitcoin’s Funding Rate in Market Dynamics

Bitcoin’s funding rate is a key indicator that reflects the cost of holding a long or short position in the futures market. A negative funding rate suggests that short positions are paying long positions, which can often signify bearish sentiment among traders. Recently, Bitcoin’s funding rate turned negative, a condition that historically precedes bullish reversals. This shift in funding dynamics can attract new buyers into the market, potentially leading to a price rebound as pessimistic sentiment shifts.

Understanding the funding rate is crucial for anyone involved in Bitcoin trading or investment. A negative funding rate can act as a contrarian indicator, signaling that the market may be overly pessimistic. Analysts argue that current conditions, marked by a low open interest and a negative funding rate, could create an optimal environment for a BTC resurgence. As traders react to these shifts, the resulting buying pressure could catalyze a significant upward movement in Bitcoin’s price.

Crypto Market Outlook: What Lies Ahead for Bitcoin

The broader crypto market outlook remains optimistic despite recent fluctuations in Bitcoin’s price. Analysts like Titan of Crypto assert that Bitcoin’s recent tests of key resistance levels indicate a readiness for a potential bullish phase. As global liquidity increases and market participants reassess their strategies, Bitcoin’s price trajectory may align with these macroeconomic trends, creating a favorable environment for growth. The sentiment among traders is cautiously optimistic, especially with Bitcoin trading over 6% higher in the last 24 hours.

In addition to the immediate price dynamics, the overall sentiment within the crypto community hints at a possible resurgence in interest and investment. With Bitcoin’s current price around $91,000 and various indicators suggesting a rebound potential, market participants are closely watching for confirmation of a bullish reversal. This outlook is further supported by historical patterns, where similar situations have led to substantial price rallies, making Bitcoin an attractive asset for both short-term traders and long-term investors.

Analyzing Bitcoin’s RSI for Rebound Opportunities

The Relative Strength Index (RSI) is a widely used momentum oscillator that helps traders assess the current strength of an asset’s price movement. Recently, Bitcoin’s RSI dropped to 24, suggesting that it is in an oversold condition. Historically, when the RSI falls below 30, it indicates a potential bottoming of the price, creating a prime opportunity for traders looking to capitalize on a rebound. Analysts like Ali Martinez highlight that this technical indicator signals a likely reversal, reinforcing the bullish narrative for Bitcoin.

Monitoring the RSI is essential for determining entry points for traders. As Bitcoin’s price fluctuates around critical levels, the RSI can provide insight into whether the current price action is sustainable or if it has reached an inflection point. If Bitcoin’s RSI manages to recover above the key threshold, it could serve as confirmation for a bullish sentiment shift, prompting increased buying activity and potentially escalating the price higher in the coming days.

The Impact of Global Liquidity on Bitcoin Prices

Global liquidity plays a significant role in the dynamics of the cryptocurrency market, influencing both short-term price movements and long-term trends. As liquidity increases, traders often find more opportunities and confidence to enter positions, which can lead to upward pressure on prices. Recent reports indicate that global liquidity is on the rise again, and Bitcoin’s lagging performance relative to this metric could signal a unique buying opportunity for market participants. This correlation might indicate that Bitcoin is poised for a breakout as liquidity continues to flow into the market.

Analysts argue that the interplay between global liquidity and Bitcoin prices is crucial for understanding market behavior. As liquidity injections occur on a macro level, they can stimulate demand for Bitcoin, leading to price appreciation. Traders should remain vigilant regarding shifts in liquidity conditions, as they can provide valuable insights into potential price movements. If Bitcoin’s price aligns with increasing global liquidity, it could pave the way for a significant upward trend, marking an exciting phase for cryptocurrency investors.

BTC Rebound Potential: What Historical Data Suggests

Historical data plays a vital role in predicting Bitcoin’s potential rebound. Previous instances of low open interest and negative funding rates have often been followed by substantial price increases, suggesting that current market conditions may mirror those past scenarios. Analysts like CrediBULL Crypto cite these historical patterns to bolster their bullish predictions, highlighting that the conditions for a rebound are indeed favorable. As Bitcoin approaches critical support levels, historical context provides further evidence that a price surge could be on the horizon.

Examining Bitcoin’s price history reveals that significant rebounds often occur after periods of consolidation or negative sentiment. The current environment, characterized by a low open interest, negative funding rate, and an oversold RSI, indicates that Bitcoin could be on the cusp of another explosive rally. Traders and investors should keep an eye on price movements and market sentiment, as historical trends suggest that Bitcoin is well-positioned for a potential rebound, aligning with previous bullish cycles.

Market Sentiment: Cautious Optimism in Bitcoin Trading

Market sentiment plays a crucial role in Bitcoin trading, influencing trader behavior and price movements. Currently, there is a sense of cautious optimism among analysts and traders alike. With Bitcoin recently rebounding to around $95,000, many believe that the cryptocurrency has established a bottom and is ready for further gains. However, this sentiment is tempered by the need for Bitcoin to maintain its position above key resistance levels, as outlined by various analysts.

This cautious approach is reflected in the analysis of Bitcoin’s price performance and the broader market outlook. As traders monitor resistance levels and key indicators such as the RSI and funding rate, sentiment is expected to shift dynamically. Maintaining this balance between optimism and caution is essential, as market participants navigate the complexities of Bitcoin trading. The current sentiment suggests that while the potential for a bullish phase is strong, vigilance is necessary to ensure that traders are well-prepared for any market shifts.

Conclusion: Navigating Bitcoin’s Future in a Volatile Market

As Bitcoin navigates its way through a volatile market, understanding the various factors impacting its price is essential for both traders and long-term investors. With recent indicators suggesting a potential rebound, the focus now shifts to monitoring key resistance levels and market sentiment. The interplay between Bitcoin’s open interest, funding rate, and global liquidity will play pivotal roles in shaping its future price movements. Staying informed and adaptable in this ever-evolving landscape will be crucial for successfully navigating Bitcoin’s future.

In conclusion, while the current market conditions present opportunities for traders, they also require careful analysis and strategic planning. The insights provided by crypto analysts highlight the importance of understanding Bitcoin’s historical trends and market dynamics. As Bitcoin prepares to potentially break through critical resistance levels, traders should remain vigilant, leveraging technical analysis and market indicators to capitalize on the forthcoming opportunities in the crypto market.

Frequently Asked Questions

What does a low Bitcoin open interest indicate about market sentiment?

A low Bitcoin open interest, like the recent six-month low reported by CrediBULL Crypto, often indicates decreased market activity and interest from traders. This can signal a potential shift in sentiment, as lower open interest may precede significant price movements, either upward or downward. Analysts have noted that similar conditions in the past, when open interest was low, often corresponded with substantial price rebounds for Bitcoin, suggesting a possible bullish outlook for future price predictions.

How does Bitcoin’s open interest influence price predictions?

Bitcoin’s open interest plays a crucial role in price predictions within the crypto market. When open interest is low, it often reflects a lack of confidence among traders, which can lead to volatility. However, historical patterns indicate that such conditions may create opportunities for bullish price movements. For instance, CrediBULL Crypto highlighted that previous instances of low open interest coincided with Bitcoin trading between $50,000 and $60,000 before significant price surges, making it a critical metric for BTC price predictions.

What is the relationship between Bitcoin’s funding rate and open interest?

Bitcoin’s funding rate and open interest are interrelated metrics that provide insights into market dynamics. A negative funding rate, as noted by CrediBULL Crypto, typically suggests that short positions are being favored, which can lead to reduced open interest. This may indicate bearish sentiment in the market. However, historically, such scenarios have led to price rebounds, as seen the last time Bitcoin’s open interest was at a six-month low. Thus, monitoring both metrics can enhance understanding of the crypto market outlook.

Can low open interest impact Bitcoin’s rebound potential?

Yes, low Bitcoin open interest can significantly impact its rebound potential. CrediBULL Crypto pointed out that low open interest often precedes bullish price movements, especially when combined with other favorable indicators, such as a low Relative Strength Index (RSI). The current low open interest coupled with BTC’s recent price movement suggests that a rebound may be imminent, aligning with historical trends where Bitcoin rebounded sharply after similar conditions.

How does Bitcoin’s open interest reflect overall crypto market trends?

Bitcoin’s open interest is a barometer for overall crypto market trends. A decline in open interest, like the recent drop to a six-month low, often indicates reduced trading activity and can reflect broader market sentiment. Analysts suggest that such trends may lead to significant price movements in Bitcoin, affecting the entire crypto market outlook. When open interest is low, it can be a signal for traders to reassess their positions, potentially leading to a market correction or a bullish reversal.

What should traders consider when Bitcoin’s open interest is at a six-month low?

When Bitcoin’s open interest is at a six-month low, traders should consider several factors: the historical context of similar conditions, potential price rebound signals indicated by other metrics like RSI, and the impact of negative funding rates. Analysts like CrediBULL Crypto suggest that such scenarios may provide unique buying opportunities, but caution is advised until Bitcoin confirms a breakout above key resistance levels.

| Key Point | Details |

|---|---|

| Bitcoin Open Interest | Bitcoin’s open interest has dropped to a six-month low. |

| Price History | Last time open interest was this low, BTC traded between $50,000 and $60,000. |

| Current Funding Rate | Bitcoin’s funding rate has turned negative. |

| Recent Price Movements | BTC rebounded to $95,000 after dropping below $80,000. |

| Analysts’ Perspectives | Analysts suggest BTC has established a bottom, with potential for a price increase. |

| Resistance Level | BTC needs to surpass the resistance level of $93,000 for a significant upward trend. |

| Market Sentiment | Increased global liquidity and positive indicators suggest a buying opportunity. |

Summary

Bitcoin open interest has recently seen a significant decline, hitting a six-month low. This situation is reminiscent of previous market conditions, where a similar open interest level preceded substantial price increases for Bitcoin. Analysts remain optimistic, suggesting that this could signify a bottom for Bitcoin, with expectations of potential upward movement. However, it is crucial for Bitcoin to break key resistance levels to confirm any bullish trends. As the market continues to evolve, investors should remain aware of both the risks and opportunities presented by these metrics.

Bitcoin open interest has recently fallen to a six-month low, sparking interest among traders and analysts alike. This significant decline raises questions about the future of Bitcoin, especially regarding its price trajectory and potential rebound. Crypto expert CrediBULL Crypto highlighted that the last instance of such low open interest coincided with Bitcoin trading between $50,000 and $60,000, just before a remarkable surge to $100,000. Additionally, the recent shift in Bitcoin’s funding rate to negative adds another layer to the current Bitcoin analysis, suggesting a possible turning point in market sentiment. As investors look towards the future, understanding Bitcoin open interest may provide crucial insights for Bitcoin price prediction and the overall crypto market outlook.

The recent trend in Bitcoin’s market dynamics, particularly in terms of trading activity and contract commitments, has drawn attention to its open interest levels. This metric, which reflects the total number of outstanding contracts, is pivotal for assessing the strength of the market. Analysts have pointed out that the current low figures echo historical patterns that preceded significant price increases, hinting at Bitcoin’s rebound potential. Furthermore, with the funding rate now negative, many are reassessing their strategies and looking for indicators that could signal a reversal in Bitcoin’s trajectory. As discussions around Bitcoin’s performance unfold, concepts like market liquidity and investor sentiment continue to play a crucial role in shaping the crypto landscape.