Bitcoin liquidation has emerged as a critical topic in the ever-evolving crypto market, especially following its recent plunge below the $90K mark. The sudden drop to $86,099 has triggered over $1 billion in liquidations, devastating long positions and resulting in losses exceeding $873 million. This significant Bitcoin price drop has left approximately 230,000 traders facing liquidation in just 24 hours, illustrating the heightened volatility and investor sentiment surrounding the digital currency. As Bitcoin whales offload substantial holdings, the ongoing crypto sell-off raises concerns about further declines and market instability. With open interest down 5% and a notable rise in exchange inflows, the potential for panic selling looms large, prompting increased scrutiny from both market participants and analysts alike.

The recent turmoil in the cryptocurrency landscape highlights the phenomenon of Bitcoin liquidation, a term that encapsulates the forced closure of long positions as prices plummet. Following a significant downturn in value, traders are witnessing an alarming trend that reflects the broader sentiment across the digital asset space. The fallout from the latest Bitcoin price decrease has reverberated throughout the market, impacting not only individual investors but also institutional players and crypto-related stocks. As large holders, often referred to as Bitcoin whales, react to changing market conditions, the potential for further crypto sell-offs remains a pressing concern. This environment of uncertainty is compounded by macroeconomic factors, which continue to influence trading dynamics and investor behavior.

Bitcoin Liquidation Trends Amid Market Volatility

The recent plunge of Bitcoin below $90,000 has sparked a wave of liquidations across the crypto market, amounting to a staggering $1.06 billion in losses. This event underscores the volatile nature of cryptocurrency trading, where rapid price fluctuations can lead to significant financial consequences for traders. In just 24 hours, approximately 230,000 traders found themselves liquidated, highlighting the urgency and panic that can engulf the market during sharp price drops. With long positions bearing the brunt of these losses, amounting to $873 million, it is evident that many investors are over-leveraged in their trading strategies, susceptible to market swings.

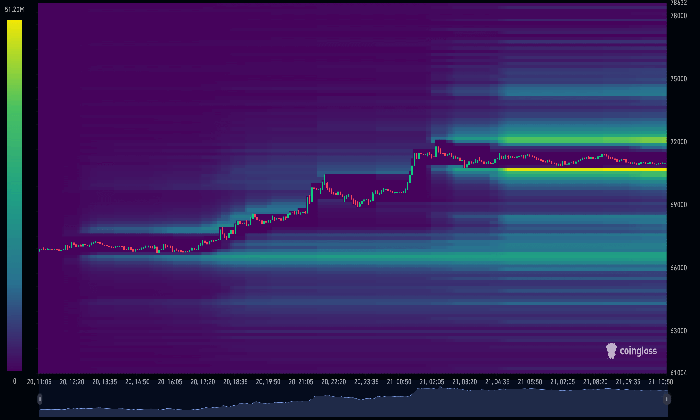

As Bitcoin continues to struggle with maintaining its value, the open interest in futures contracts has declined by 5%. This reduction indicates a broader trend of deleveraging, where traders are reducing their exposure to risk amid increasing volatility. The rise in exchange inflows by 14.2% indicates that many investors are opting to sell their holdings in a bid to secure liquidity, further exacerbating the market’s downward pressure. Such dynamics not only reflect investor sentiment but also raise concerns about the potential for further sell-offs if Bitcoin cannot stabilize above critical support levels.

The role of Bitcoin whales cannot be overlooked in this context, as their trading activities significantly influence market dynamics. Recent data reveals that these large holders have liquidated over $1.2 billion worth of Bitcoin in the last week alone, contributing to the negative sentiment surrounding the cryptocurrency. Such actions can instill fear among smaller investors, leading to broader sell-offs as traders rush to minimize their losses. Furthermore, with 12% of Bitcoin addresses currently holding at a loss—the highest level since October 2024—the potential for increased liquidation events looms large. As the market grapples with these challenges, many investors are left questioning the stability of their positions.

Impact of Macroeconomic Factors on Bitcoin Prices

The recent decline in Bitcoin prices can be attributed to a confluence of unfavorable macroeconomic factors that have rattled investor confidence. The proposed tariffs by Donald Trump on trade with Canada and Mexico have raised concerns about inflation and potential economic stagnation, creating headwinds for riskier assets like Bitcoin. Such geopolitical tensions, particularly between the United States and China regarding semiconductor trade restrictions, have further diminished risk appetite among investors. With traditional financial markets also facing declines—evidenced by the Nasdaq Composite and S&P 500 dropping 2.8% and 2.1%, respectively—the overall economic landscape appears increasingly precarious for cryptocurrencies.

Moreover, the strengthening of the U.S. Dollar Index signifies a flight to safety among investors, often at the expense of riskier assets such as Bitcoin. This shift in sentiment reflects a broader tendency for traders to seek stability during uncertain economic times. As Bitcoin approaches critical support levels, such as the $88,000 mark, the potential for additional liquidations looms larger. If Bitcoin fails to hold above this threshold, it could trigger another wave of sell-offs, compounding the current volatility and further impacting investor sentiment.

The interplay between macroeconomic conditions and Bitcoin’s price trajectory cannot be understated. As many investors who entered the market near the all-time highs of $108,000 find themselves underwater, the risk of further sell-offs increases. The current market sentiment is fraught with uncertainty, with excessive leverage and ongoing economic instability contributing to a bearish outlook for Bitcoin. Despite the potential for a recovery around the $90,000 mark, traders remain vigilant, as the macroeconomic environment continues to exert influence over cryptocurrency valuations.

Investor Sentiment and Its Influence on Crypto Market Dynamics

Investor sentiment plays a crucial role in shaping the dynamics of the crypto market, particularly during periods of volatility like the current one. The recent Bitcoin price drop has caused a significant shift in how traders perceive risk, leading to a more cautious approach. Negative funding rates reflect this change, indicating a broader sentiment of fear and uncertainty among investors. As many traders face liquidations, there is a palpable sense of panic that can lead to further declines in Bitcoin prices. Such sentiment can create a self-fulfilling prophecy, where the fear of losses prompts more selling, exacerbating the downward trend in the market.

In addition to the immediate effects of price drops, long-term investor sentiment is also impacted by macroeconomic factors and market behaviors. The intense sell-off seen in recent days, combined with heightened whale activity, suggests that larger players are reacting to market conditions with aggressive trading strategies. This can further influence market sentiment, as smaller investors often follow the lead of Bitcoin whales. As the crypto market continues to navigate this challenging landscape, understanding the underlying sentiment is essential for predicting potential price movements and market recoveries.

Furthermore, the recent outflows from U.S. spot Bitcoin ETFs, amounting to $1.1 billion over five days, signal a shift in investor confidence and sentiment. As institutional investors reevaluate their positions in light of market volatility, the implications for Bitcoin’s future price trajectory could be profound. With many investors feeling the pressure of unrealized losses, the current sentiment could lead to a prolonged period of market instability. If these trends continue, it may take time for confidence to return to the crypto market, emphasizing the need for traders to stay informed and adaptable to rapidly changing conditions.

The Role of Bitcoin Whales in Market Movements

Bitcoin whales, or large holders of the cryptocurrency, play a significant role in the market’s price movements and overall dynamics. Recent data indicates that these investors have offloaded over $1.2 billion worth of Bitcoin in the past week, contributing to the market’s downward trajectory. The actions of whales can create a ripple effect throughout the crypto market, influencing smaller investors’ trading decisions and exacerbating market volatility. When whales decide to sell, it often triggers panic among retail traders, leading to a broader sell-off as fear of further price declines takes hold.

The impact of whale activity is particularly pronounced during periods of heightened volatility, as seen in the recent Bitcoin liquidation events. As the market grapples with losses, the behavior of these large holders can dictate the sentiment and trading strategies of smaller investors. Whales often have the ability to absorb market fluctuations, but their selling pressure can also lead to significant price drops, creating an environment of uncertainty and instability for the entire crypto market.

Moreover, the recent trends in whale activity highlight the strategic moves these large investors make in response to market conditions. With 12% of Bitcoin addresses currently holding at a loss, many smaller investors are left vulnerable to the whims of these whales. The actions of Bitcoin whales not only reflect their own investment strategies but also shape market perceptions and potential future movements. As the crypto market continues to evolve, the influence of whales will remain a critical factor for both traders and analysts, as understanding their behavior can provide valuable insights into market trends.

Market Reactions to Bitcoin Price Declines

The reaction of the crypto market to Bitcoin’s recent price decline has been swift and multifaceted, affecting a wide range of assets beyond Bitcoin itself. Stocks of crypto-related companies, including Coinbase and Robinhood, have experienced significant downturns, with declines of 6.4% and 8%, respectively. These movements highlight the interconnected nature of the crypto ecosystem, where Bitcoin’s performance can directly impact the value of related financial instruments. As investor sentiment shifts towards caution, it is evident that the entire crypto market can experience ripple effects from Bitcoin’s fluctuations, influencing trading strategies and market dynamics across the board.

In addition to stocks, Bitcoin miners such as Bitdeer and Marathon Digital have also faced considerable losses, reflecting the broader impact of declining Bitcoin prices on the operational viability of these businesses. With Bitcoin mining profitability closely tied to market prices, significant drops in value can lead to operational challenges for miners, prompting them to adjust their strategies. This interconnectedness underscores the importance of monitoring Bitcoin’s price movements, as they can signal broader trends and potential shifts in the crypto market landscape.

As traders respond to Bitcoin’s volatility, the overall market sentiment tends to follow suit. The recent increase in exchange inflows, coupled with negative funding rates, indicates a growing trend of panic selling among investors. This reaction can perpetuate the cycle of fear and uncertainty, leading to further price declines and liquidations. As the market grapples with these challenges, understanding the broader implications of Bitcoin’s price movements becomes essential for traders looking to navigate the evolving landscape of the crypto market.

Strategies for Navigating Bitcoin Market Volatility

In the face of Bitcoin’s current volatility, developing effective strategies for navigating the market has become crucial for traders and investors alike. One approach is to adopt a cautious stance, minimizing leverage and only entering positions when market conditions appear more stable. Given the recent liquidation events, many traders are reevaluating their risk management strategies to avoid excessive exposure during turbulent periods. By focusing on sound trading practices, such as setting stop-loss orders and diversifying portfolios, investors can better protect themselves against sudden price swings in the crypto market.

Another viable strategy is to stay informed about macroeconomic conditions and market indicators that influence Bitcoin’s price movements. Understanding the broader economic landscape, including factors such as inflation, geopolitical tensions, and investor sentiment, can provide valuable insights into potential market trends. By keeping a pulse on these dynamics, traders can position themselves more strategically, allowing them to capitalize on opportunities while mitigating risks associated with market volatility.

Additionally, it is essential for traders to remain adaptable and responsive to market changes. As Bitcoin continues to fluctuate, being able to adjust trading strategies in real-time can be a significant advantage. This includes monitoring whale activity and understanding how their movements impact market sentiment. By recognizing the influence of large holders on price dynamics, investors can better anticipate potential shifts in the market and make informed decisions. Ultimately, developing a comprehensive approach that combines risk management, market awareness, and adaptability can help traders navigate the challenges of Bitcoin market volatility.

Future Outlook for Bitcoin and the Crypto Market

Looking ahead, the future outlook for Bitcoin and the broader crypto market remains uncertain amidst ongoing volatility and negative investor sentiment. As Bitcoin struggles to maintain its value above critical support levels, traders are closely monitoring key price points to gauge potential recovery opportunities. The recent price drop to $86,099 has raised concerns about further liquidations, particularly if Bitcoin fails to hold above the $88,000 threshold. This precarious situation underscores the need for traders to stay vigilant and responsive to market developments as they unfold.

Moreover, the interplay between macroeconomic factors and investor behavior will play a crucial role in shaping Bitcoin’s future trajectory. As geopolitical tensions and economic uncertainties continue to influence market sentiment, Bitcoin’s performance may remain closely tied to broader economic conditions. Investors should remain aware of these dynamics, as they can significantly impact trading strategies and overall market confidence moving forward.

Despite the challenges currently facing Bitcoin, there remains potential for recovery as traders watch for signs of stabilization in market sentiment. If Bitcoin can reclaim its footing above the $90,000 mark, it may lead to renewed optimism among investors, encouraging a shift in trading strategies. Ultimately, the future of Bitcoin and the crypto market will depend on a complex interplay of factors, including macroeconomic conditions, investor sentiment, and the behavior of large market participants.

Frequently Asked Questions

What causes Bitcoin liquidation in the crypto market?

Bitcoin liquidation in the crypto market occurs when traders are forced to close their leveraged positions due to significant price drops. When Bitcoin prices decline sharply, as seen recently with Bitcoin falling below $90K, it triggers margin calls for leveraged positions, leading to automatic liquidations. This results in widespread losses, often exceeding billions in total liquidated positions.

How does a Bitcoin price drop impact investor sentiment?

A Bitcoin price drop typically negatively impacts investor sentiment, as it can lead to panic selling and increased liquidations. When Bitcoin fell to $86,099, it contributed to a negative shift in sentiment, with many investors experiencing unrealized losses. This heightened anxiety often prompts further sell-offs, exacerbating the situation in the crypto market.

What role do Bitcoin whales play during a liquidation event?

Bitcoin whales can significantly influence market dynamics during liquidation events. Their actions, such as offloading large amounts of Bitcoin, can accelerate price declines and trigger additional liquidations. Recent data indicated that Bitcoin whales sold over $1.2 billion worth of Bitcoin, contributing to the downward pressure on prices and influencing overall market sentiment.

What is the effect of a crypto sell-off on Bitcoin liquidity?

A crypto sell-off can severely affect Bitcoin liquidity, resulting in increased volatility and price fluctuations. When large volumes of Bitcoin are sold, as seen during recent market turmoil, it can lead to a rapid decrease in liquidity. Consequently, this may trigger further liquidations as traders struggle to maintain their positions amid falling prices.

How can Bitcoin liquidation influence the broader crypto market?

Bitcoin liquidation can have a cascading effect on the broader crypto market. When Bitcoin suffers significant losses, it often leads to a domino effect, where other cryptocurrencies also decline in value. This was evident when Bitcoin’s drop below $90K coincided with losses in major crypto stocks and ETFs, reflecting a broader sentiment shift across the crypto ecosystem.

What indicators suggest a potential Bitcoin liquidation in the future?

Several indicators can suggest a potential Bitcoin liquidation in the future, including excessive leverage in the market, declining open interest, and negative funding rates. Additionally, if the Bitcoin price approaches critical support levels, such as the observed $88,000 mark, it may trigger further liquidations if breached, leading to a more extensive sell-off in the crypto market.

| Key Point | Details |

|---|---|

| Bitcoin Price Drop | Bitcoin fell to $86,099, leading to significant market liquidations. |

| Total Liquidations | Over $1.06 billion liquidated in the crypto market, with $873 million in long positions. |

| Traders Affected | Approximately 230,000 traders liquidated in the last 24 hours. |

| Market Indicators | Open interest dropped 5% and exchange inflows rose by 14.2%. |

| Investor Sentiment | Funding rates have turned negative, indicating a shift in sentiment. |

| ETF Withdrawals | U.S. Bitcoin ETFs saw $1.1 billion in outflows over five days. |

| Impact on Crypto Stocks | Major declines in crypto-related stocks: Coinbase (-6.4%), Robinhood (-8%). |

| Whale Activity | Bitcoin whales sold over $1.2 billion worth of Bitcoin last week. |

| Macroeconomic Factors | Economic concerns from tariffs and geopolitical tensions are affecting market confidence. |

| Support Level | The critical support level for Bitcoin is $88,000. |

Summary

Bitcoin liquidation has become a significant concern as the cryptocurrency has slipped below the $90K mark, causing over $1 billion in liquidations across the crypto market. This sharp decline highlights the volatility and risk associated with Bitcoin investments, driven by worsening macroeconomic conditions and negative investor sentiment. With many traders facing liquidation and the market reacting to external economic pressures, the future of Bitcoin remains uncertain, especially if it fails to hold critical support levels.

Bitcoin liquidation has recently taken center stage as the leading cryptocurrency plunged below $90,000, resulting in a staggering $1.06 billion wiped from the crypto market. This sharp Bitcoin price drop has significantly impacted long positions, leading to losses amounting to $873 million for traders caught off guard. In the wake of this crypto sell-off, nearly 230,000 traders found themselves liquidated within just 24 hours, highlighting the volatility and risks inherent in cryptocurrency trading. The actions of Bitcoin whales, who have recently offloaded over $1.2 billion, further underscore the shifting tides of investor sentiment in this unpredictable market. As funding rates turn negative and exchange inflows rise, the urgency for traders to reassess their positions becomes increasingly critical.

The recent turmoil in the cryptocurrency landscape has sparked discussions around the concept of Bitcoin liquidation, often linked to the broader dynamics of market volatility. When the price of Bitcoin experiences a sudden downturn, it can lead to significant margin calls and forced selling, commonly referred to as liquidation. This phenomenon is particularly evident during periods of heightened investor anxiety, where a mass exit from positions can exacerbate price declines. Furthermore, the actions of large holders, or ‘whales’, can greatly influence the market, as their selling pressure often triggers a ripple effect among smaller investors. As the crypto market grapples with these challenges, understanding the implications of liquidation becomes vital for anyone navigating this ever-evolving financial frontier.