Banks custody digital assets has taken a significant leap forward following the recent announcement from the Office of the Comptroller of the Currency (OCC). This regulatory approval allows national banks to engage in vital crypto custody services, eliminating previous restrictions that mandated advance permission for such operations. With this shift, banks can now manage digital assets, including stablecoin operations, while participating in innovative blockchain banking initiatives. As these institutions embrace digital asset management, they are expected to implement robust risk management frameworks to ensure safety and compliance. This pivotal change signals a new era for financial institutions, empowering them to integrate crypto-related services into their offerings seamlessly.

The recent clarification from regulatory authorities has opened the door for financial institutions to manage and hold a variety of virtual currencies. With the emergence of crypto vault services, banks can now participate actively in the burgeoning field of digital currency management. This regulatory evolution reflects a broader acceptance of blockchain technology, paving the way for legacy institutions to explore stablecoin ventures and other digital asset initiatives. As the landscape of digital finance evolves, it becomes imperative for banks to adapt and adopt sound operational practices that align with the innovative nature of this technology. With a governmental nod towards this new frontier, the financial sector is gearing up for an exciting transformation.

OCC Approval for Banks to Custody Digital Assets

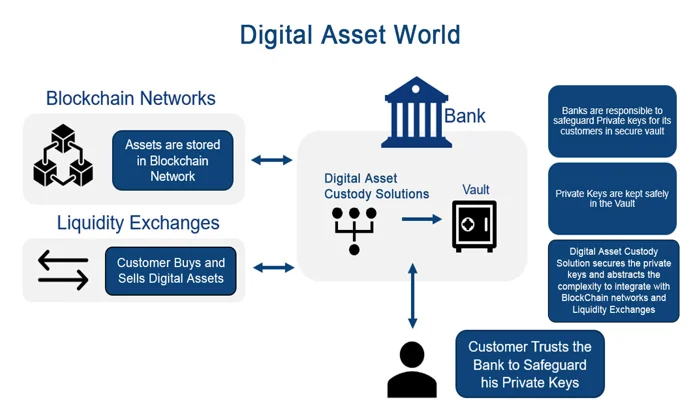

The Office of the Comptroller of the Currency (OCC) has recently granted permission for national banks to possess and manage digital assets, marking a pivotal change in financial regulation. This approval allows banks to offer crypto custody services without the necessity for prior regulatory endorsements, fostering growth in the digital asset management sector. As banks prepare to take on this new custodial role, they will be able to tap into emerging markets, offering services that include storing and safeguarding private keys associated with various cryptocurrencies.

Furthermore, permitting banks to custody digital assets enhances the security and trust surrounding digital transactions. Clients can leverage the reputation and stability of traditional banking institutions while engaging in crypto asset management. This development is especially crucial as more individuals and organizations begin to invest in cryptocurrencies, highlighting the importance of secure storage solutions. The OCC’s easing of restrictions could serve as a significant catalyst for the wider adoption of blockchain banking in the U.S.

Implications of OCC’s New Regulations on Banks and Crypto

With the OCC’s recent ruling, banks are now empowered to engage in stablecoin operations, allowing financial institutions to streamline transactions and improve liquidity. This alignment with the current trends in digital finance indicates that banks will be better positioned to meet customer demands for faster and more efficient payment solutions. The regulatory shift ensures that traditional banking can coalesce with crypto technologies, potentially leading to a standardization of practices across the financial industry.

Additionally, the removal of regulatory roadblocks signifies a robust endorsement of the crypto landscape by the government. Banks will need to adapt their risk management strategies to accommodate the unique challenges of cryptocurrency custody. This transition aligns with the National Bank’s role in fostering innovation while maintaining secure and effective banking systems. As institutions evolve, they can also prioritize sustainable practices within their stablecoin operations, leading to a more stable and growth-oriented environment.

The Role of Risk Management in Crypto Custody Services

The advancement of crypto custody services creates new avenues for financial institutions, but it also introduces inherent risks that need meticulous management. The OCC’s directive emphasizes that banks must employ robust risk management frameworks akin to those used in traditional banking scenarios. These frameworks should encompass comprehensive strategies for cybersecurity, fraud prevention, and regulatory compliance to safeguard against potential breaches that could undermine customer confidence.

Moreover, the necessity for solid risk management practices is underscored by the dynamic nature of blockchain technology and its regulatory landscape. As banks become more active participants in the crypto ecosystem, they must establish clear protocols for monitoring their engagement in various blockchain operations. This ensures that they are not only protecting their assets but are also prepared for ongoing regulatory scrutiny in the rapidly evolving digital economy.

The Future of Blockchain Banking and Digital Asset Management

As banks gain the ability to custody digital assets, the trajectory towards blockchain banking appears more promising. This development is likely to foster greater investment in digital asset management solutions, as banks seek to diversify their offerings and capture a share of the burgeoning cryptocurrency market. The move towards blockchain-integrated banking signifies a commitment to modernization within the financial services sector, where traditional institutions can leverage distributed ledger technology to enhance transaction efficiency and transparency.

Moreover, as banks embrace blockchain banking, they are poised to become validators on public Proof-of-Stake networks. This involvement not only strengthens their investment in the technology but also aligns them with the ethos of decentralization inherent in crypto. Therefore, the implications of this shift extend beyond operational capabilities, suggesting a fundamental transformation in how banks will interact with digital assets moving forward.

Navigating Regulatory Changes in the Crypto Ecosystem

The recent clarity from the OCC regarding crypto-related activities represents a significant regulatory milestone in the U.S financial landscape. By providing banks with the green light to custody digital assets and engage in stablecoin operations, the OCC is paving the way for a more structured integration of cryptocurrency within mainstream finance. This adjustment should not only reassure banks hesitant about entering the digital domain but also offers consumers more secure options for managing their digital assets.

However, despite this progressive stance, stakeholders such as Custodia Bank founder Caitlin Long have highlighted the need for comprehensive changes throughout all regulatory bodies, including the Federal Reserve and the FDIC, to fully realize the potential of digital assets in the banking sector. Only with a supportive regulatory environment that encourages innovation while mitigating risks can banks truly thrive in the evolving landscape of blockchain banking and digital currencies.

Stablecoin Operations: Opportunities and Challenges

Stablecoins have emerged as a pivotal alternative in the cryptocurrency space, and the OCC’s endorsement of banks engaging in stablecoin operations can significantly enhance their acceptance. By allowing banks to provide structured and regulated access to stablecoins, the OCC is facilitating a bridge between traditional banking services and the growing demand for cryptocurrency usage. This move not only promotes stability in the markets but also equips banks to offer innovative solutions to their clients.

Despite the promising opportunities associated with stablecoins, banks must also navigate the challenges they present. Potential risks such as regulatory compliance, market volatility, and consumer protection must be carefully addressed by financial institutions. With effective strategies in place, banks can position themselves as leaders in the stablecoin market while enhancing their credibility and trust among consumers, ultimately leading to a more robust digital economy.

The Importance of OCC’s Regulatory Approach for Banks

The OCC’s recent decision reflects a significant shift in regulatory philosophy, emphasizing the importance of adapting to emerging technologies such as blockchain and cryptocurrency. By allowing banks to custody digital assets, the OCC not only reduces the administrative burdens previously faced by banks but also acknowledges the necessity of evolving financial regulations that appropriately address the realities of digital currencies. This progressive approach helps to fortify the banking sector’s role in the increasingly digital financial ecosystem.

Additionally, this regulatory approach signals a broader commitment to fostering innovation within the financial industry. As banks begin to explore crypto-related operations, they must also enhance their risk management practices and compliance methods. This alignment with both technological advancements and regulatory requirements will be critical for banks aiming to build trust and credibility in their custody services, reinforcing their competitive position in a rapidly changing market.

Potential Impact of the OCC’s Guidance on the Crypto Market

The OCC’s guidance has the potential to catalyze substantial growth within the crypto market by removing barriers to entry for banks. As these institutions take on the responsibility of custody for digital assets, larger investment flows into cryptocurrencies might materialize. This increase could significantly influence the market dynamics, facilitating heightened liquidity and potentially stabilizing prices as institutional players become more active participants.

Furthermore, as banks begin to offer new crypto-focused services, consumer confidence may rise, leading to an influx of retail investors into the cryptocurrency space. The OCC’s green light effectively legitimizes banks’ role in this emerging market, fostering a sense of security and accountability. As such, the crypto market could experience a transformative period, driven by regulatory support and institutional adoption.

Challenges Ahead for Banks Entering the Crypto Space

While the OCC’s announcement is a step forward, banks entering the crypto space still face significant challenges. The necessity for robust cybersecurity measures remains paramount, as digital assets are often targets for cybercriminals. Financial institutions must invest in cutting-edge security technologies and strategies to protect the assets they custody, ensuring that they are equipped to battle evolving threats in an increasingly digital financial landscape.

Moreover, regulatory compliance remains complex and may vary across jurisdictions. Banks not only need to align with federal regulations but also consider state laws and international guidelines. Navigating this complex regulatory environment demands that banks develop comprehensive compliance frameworks tailored to the nuances of crypto transactions. As these institutions transition into the crypto realm, their ability to manage compliance will be critical to their long-term success.

Frequently Asked Questions

What are banks custody digital assets services?

Banks custody digital assets services refer to the secure storage, management, and safeguarding of digital assets, such as cryptocurrencies and tokens, by financial institutions. These services enable banks to hold clients’ digital assets securely, providing enhanced protection and compliance with regulatory requirements.

How has the OCC regulatory approval impacted banks custody digital assets?

The OCC regulatory approval has significantly impacted banks custody digital assets by allowing national banks to engage in crypto activities without seeking prior permission. This enables banks to offer crypto custody services, participate in stablecoin operations, and operate as validators in distributed ledger networks.

What types of digital asset management can banks engage in following the OCC announcement?

Following the OCC announcement, banks can engage in various types of digital asset management, including providing crypto custody services, managing clients’ stablecoin transactions, and participating in blockchain banking initiatives that involve distributed ledger technology.

Are banks now allowed to participate in stablecoin operations under the new OCC guidelines?

Yes, under the new OCC guidelines, banks are permitted to participate in stablecoin operations as part of their custody digital assets services. This change allows banks to offer clients services related to stablecoin transactions and management.

What role does blockchain banking play in banks custody digital assets?

Blockchain banking plays a crucial role in banks custody digital assets by leveraging distributed ledger technology to enhance security, transparency, and efficiency in managing digital assets. By utilizing blockchain, banks can provide more robust custody solutions, ensuring the integrity of their clients’ digital holdings.

What measures should banks implement to ensure effective management of digital assets?

To ensure effective management of digital assets, banks should implement strong risk management controls, robust security protocols, and compliance measures aligned with current regulatory guidelines. These measures are essential to protect clients’ digital assets and maintain trust in the custody services offered.

What implications does the OCC’s withdrawal of previous warnings have for banks and crypto markets?

The OCC’s withdrawal of previous warnings allows banks greater freedom to engage with the crypto market, fostering innovation and potentially boosting the adoption of crypto custody services. It signals a more supportive regulatory environment for banks exploring digital asset management.

How can banks benefit from engaging in crypto custody services now that they have OCC approval?

Banks can benefit from engaging in crypto custody services by expanding their service offerings, attracting new clients interested in digital assets, and positioning themselves as leaders in the evolving financial landscape. This can lead to increased revenue streams and enhanced competitiveness.

| Key Points | ||

|---|---|---|

| OCC Announcement | Banks now allowed to custody digital assets without prior approval | Shift from requiring advance regulatory permissions |

| Crypto Activities Permitted | Crypto-asset custody, stablecoin operations, and participation in distributed ledgers | Role as validators in public Proof-of-Stake networks |

| Regulatory Changes | Banks no longer need to inform supervisors about crypto activities in advance | Withdrawal of previous warnings against crypto engagement |

| Impact on Financial Landscape | Eases burdens on banks for engaging in crypto-related activities | Supports consistency in regulatory treatment regardless of technology |

| Expert Opinions | Industry leaders support the announcement, citing improved conditions for crypto | Call for ongoing regulatory reforms to bolster crypto adoption |

Summary

Banks custody digital assets has taken a significant turn following the OCC’s recent announcement, allowing banks to engage in crypto-related activities without the need for prior regulatory approval. This marks a pivotal shift in the regulatory landscape, enabling banks to offer custody services for digital assets among other services while enhancing their role in the blockchain ecosystem. The move aims to simplify compliance for banks and align regulatory practices with emerging technologies, yet emphasizes the importance of risk management in these novel banking activities. Overall, this development is set to foster greater integration of digital asset management within traditional banking frameworks.

In a groundbreaking move, the Office of the Comptroller of the Currency (OCC) has granted banks the authority to custody digital assets, marking a significant transition in the landscape of banking and finance. This new regulatory approval opens up a myriad of opportunities for banks to offer crypto custody services, allowing them to manage the secure storage of cryptocurrencies and tokens. With this endorsement, financial institutions can participate in stablecoin operations and interact with blockchain banking systems, paving the way for enhanced digital asset management. The OCC’s decision eliminates the previous requirement for banks to seek advance approval for engaging in crypto activities, thereby streamlining their processes. As the digital asset market continues to evolve, this bold step signals the OCC’s commitment to adapting regulatory frameworks to better accommodate the growing interest in cryptocurrency.

The recent announcement that banks can now manage and safeguard digital currencies symbolizes a new era in financial services. This regulatory shift allows banks to embrace various facets of crypto assets and blockchain technology seamlessly. By expanding their roles in crypto-asset governance, institutions can facilitate stablecoin activities and engage more actively in digital investment opportunities. Moreover, broader acceptance of these innovations indicates a vital evolution in how traditional banking will intersect with the rapidly growing digital economy. As regulators adapt to these emerging market trends, the landscape for financial institutions will likely change, leading to more robust participation in the digital asset space.

Leave a Reply