Cryptocurrency adoption is rapidly redefining the global financial landscape, as evidenced by an array of recent studies exploring cryptocurrency trends. As digital currencies gain traction, they are not merely a fleeting investment fad but rather pivotal components of tomorrow’s economy. Since Bitcoin first paved the way, various cryptocurrencies have emerged, leading to significant developments in decentralized finance (DeFi adoption) and related financial instruments. This swift ascent in digital assets showcases clear global cryptocurrency patterns, attracting diverse groups of investors eager to capitalize on their potential. Economic factors in crypto, including trust and stability, heavily influence the extent of adoption in different nations, emphasizing the need for a deeper understanding of this evolving market.

The widespread embrace of digital currencies marks a transformative shift in financial practices worldwide, showcasing a paradigm of modern finance. The rise of virtual currencies has sparked interest among various demographics, emphasizing the relevance of this innovative financial technology. Moreover, as decentralized finance solutions proliferate, they highlight an emerging relationship between governmental structures and digital currency engagement. This evolution reflects a broader trend in global finance, where trust and economic realities play significant roles in shaping user adoption of these digital assets. Understanding the nuances of this adoption phenomenon requires an appreciation of the complex interplay between socio-economic indicators and the evolving landscape of digital finance.

Understanding Cryptocurrency Adoption Worldwide

The adoption of cryptocurrencies varies significantly across different countries, influenced by various economic, social, and political factors. A recent study spanning 137 nations reveals that higher cryptocurrency adoption rates correlate with well-educated populations and strong human development indicators. Countries exhibiting a high degree of democracy and regulatory efficiency tend to embrace these digital currencies more readily. This trend indicates a clear link between openness and the willingness to adopt innovative financial technologies like cryptocurrencies.

Conversely, nations marked by lower levels of education, diminished economic freedom, and pervasive corruption generally show minimal interest in embracing cryptocurrencies. This disparity highlights a fundamental observation: prosperous societies with strong governance structures are more likely to explore and integrate digital assets into their economies, while those facing economic challenges lag behind.

The Role of Trust in Cryptocurrency Adoption

Trust is a critical element underpinning the adoption of cryptocurrencies. Research demonstrates that countries with higher levels of interpersonal trust are more inclined to explore cryptocurrency investment and usage. This suggests that the perceived reliability of financial systems and institutions directly impacts individuals’ willingness to engage with cryptocurrencies, thereby shaping overall adoption trends. The foundation of trust not only supports individual investment decisions but also fosters wider acceptance across various sectors of the economy.

Furthermore, the correlation between trust and economic development underscores the importance of fostering a trustworthy environment for financial activities. As the financial landscape evolves, the lack of trust can inhibit growth in cryptocurrency adoption. Hence, while cryptocurrencies may offer new avenues for investment and economic participation, trust remains a requisite component that facilitates their expansion in different markets.

Key Economic Indicators Influencing Cryptocurrency Usage

Several macroeconomic indicators play pivotal roles in determining the level of cryptocurrency adoption in various countries. Studies indicate that nations with higher GDP, better regulatory frameworks, and robust democratic indicators are more likely to adopt cryptocurrencies. These elements contribute to an environment that fosters innovation and technological advancement, encouraging both individual and institutional investments in cryptocurrencies.

On the flip side, countries experiencing economic instability tend to exhibit lower adoption rates. Factors such as high inflation and lack of social connectedness often correlate with diminished interest in cryptocurrencies. Therefore, it is critical to consider these economic aspects when examining the overall trends in cryptocurrency adoption globally, as they provide insights into the motivations behind individuals’ decisions to engage with these digital assets.

Decrypting the Global Cryptocurrency Patterns

Global cryptocurrency patterns illustrate diverse behaviors and attitudes towards digital currencies across various regions. These patterns are shaped by local socioeconomic conditions, cultural contexts, and technological infrastructures. For instance, in some regions, a high prevalence of mobile technology and internet access has led to rapid cryptocurrency adoption, while in others, infrastructural limitations can impede even the most promising digital initiatives.

Additionally, countries with a history of financial crises have shown a keen interest in cryptocurrencies as an alternative to unstable national currencies. Such trends highlight the adaptive nature of cryptocurrencies, which can thrive even in adverse economic climates, reshaping the way individuals perceive value and invest their resources.

Decentralized Finance (DeFi) and Its Relationship with Cryptocurrency

Decentralized Finance (DeFi) is a burgeoning sector within the cryptocurrency space that enables users to engage in financial transactions without traditional intermediaries. The rise of DeFi has been partly driven by the same factors influencing cryptocurrency adoption, such as higher population density and economic instability. As more individuals seek out alternative financial services that circumvent traditional banking, DeFi protocols have gained traction across various demographics.

Moreover, the relationship between cryptocurrency adoption and DeFi is symbiotic; as cryptocurrencies become more mainstream, the DeFi ecosystem expands, offering new models for financial engagement. Countries that embrace cryptocurrencies often see flourishing DeFi activities, further enhancing their economic landscapes and promoting innovation in financial services.

Economic Factors Shaping Cryptocurrency Adoption Trends

Economic conditions play a significant role in shaping cryptocurrency adoption trends worldwide. Countries experiencing economic challenges often see increased interest in cryptocurrencies as individuals look for alternative means to preserve value and hedge against inflation. In these scenarios, cryptocurrencies can provide a form of economic empowerment, allowing users to engage in financial activities directly without reliance on potentially unstable local currencies.

In contrast, wealthier nations with strong economic infrastructures tend to endorse cryptocurrencies as legitimate investment assets, resulting in a different form of adoption. Higher financial literacy and access to advanced technology in these regions support innovation and investment in the cryptocurrency sector, signaling a shift from mere speculation to broader acceptance and integration of digital currencies into mainstream finance.

The Impact of Educational Levels on Crypto Adoption

Educational attainment is another crucial determinant of cryptocurrency adoption. Higher education levels often correlate with a better understanding of financial and technological concepts, positioning individuals to recognize the potential benefits of cryptocurrencies. In nations where educational programs include financial literacy and technology training, there tends to be a more robust interest in cryptocurrency investment and usage.

This correlation implies that increasing educational resources can promote greater adoption rates, as informed citizens are more likely to adopt innovative financial solutions such as cryptocurrencies. Consequently, investing in education could be a strategic approach to enhance cryptocurrency engagement in emerging and developing markets.

Cultural Influences on Cryptocurrency Acceptance

Cultural norms and values significantly influence cryptocurrency acceptance in various regions. In cultures that prioritize innovation and technological advancement, there tends to be a higher receptiveness toward cryptocurrencies and blockchain technology. This cultural endorsement facilitates the exploration and adoption of digital currencies among individuals present in these societies.

Conversely, in cultures where traditional financial systems hold more sway, skepticism about cryptocurrencies often prevails. Such cultural resistance can act as a barrier to adoption, highlighting the complexity of integrating cryptocurrencies into the financial fabric of societies rooted in conventional economic practices.

The Future of Cryptocurrency Adoption Dynamics

Looking ahead, the dynamics of cryptocurrency adoption are expected to evolve continuously as more individuals and businesses recognize the potential benefits of digital assets. Factors such as technological advancements, regulatory developments, and changing economic landscapes will play pivotal roles in shaping adoption patterns. Additionally, as institutional investment in cryptocurrencies grows, broader societal acceptance is anticipated.

The future landscape will likely involve increased education and awareness initiatives aimed at demystifying cryptocurrencies for the general public. As understanding deepens, it is probable that adoption rates will rise across various demographics, influenced by an informed populace more willing to engage with innovations in financial technology.

Frequently Asked Questions

What are the key economic factors influencing cryptocurrency adoption?

Economic factors such as GDP, education levels, regulatory quality, and human development significantly influence cryptocurrency adoption. Countries that are more democratic and offer higher economic freedom tend to see higher rates of cryptocurrency adoption due to increased trust and stability.

How does trust affect cryptocurrency adoption globally?

Trust plays a fundamental role in cryptocurrency adoption. Research indicates that nations with higher levels of trust among citizens are more likely to embrace cryptocurrency, as trust enhances economic growth and financial inclusion.

What recent trends influence global cryptocurrency adoption?

Recent trends such as the rise of Bitcoin futures and the launch of Bitcoin spot ETFs indicate a growing interest in cryptocurrencies. These developments attract more investors, particularly in nations with supportive regulatory frameworks and economic stability.

How does decentralized finance (DeFi) adoption differ from cryptocurrency adoption?

While cryptocurrency adoption is often influenced by population size and economic factors like inflation and democracy, DeFi adoption is more associated with a country’s financial development and human development metrics, showcasing different dimensions of the cryptocurrency landscape.

What role does education play in cryptocurrency adoption patterns?

Higher education levels correlate with increased cryptocurrency adoption. Countries with better educational systems tend to have populations that are more informed about financial technologies, leading to a stronger inclination towards adopting cryptocurrencies.

Are there specific countries leading the charge in cryptocurrency adoption?

Countries characterized by higher democratic values and economic freedoms, such as Switzerland and Singapore, are leading in cryptocurrency adoption. These nations have established robust regulatory frameworks that support innovation in the crypto space.

How does inflation impact cryptocurrency trends in various countries?

High inflation rates can drive cryptocurrency adoption, as individuals seek alternative stores of value amidst economic instability. This trend is particularly noticeable in countries with unstable currencies, prompting residents to turn to cryptocurrencies.

What impact do regulatory frameworks have on cryptocurrency adoption?

Regulatory frameworks significantly impact cryptocurrency adoption. Countries that implement clear, supportive regulations tend to facilitate higher adoption rates, as investors feel more secure operating within a defined legal environment.

Why is understanding global cryptocurrency patterns important for investors?

Understanding global cryptocurrency patterns helps investors identify emerging markets with potential growth. Insights into economic indicators and trust levels can guide investment strategies and highlight regions that may benefit from increased cryptocurrency adoption.

How does social connectedness influence cryptocurrency adoption?

Low levels of social connectedness often correlate with higher cryptocurrency adoption, as individuals in these environments may seek alternative financial solutions. This phenomenon indicates a response to isolation and economic barriers through the adoption of decentralized financial technologies.

| Key Points | Details |

|---|---|

| Global Variation | Cryptocurrency adoption varies significantly across different countries. |

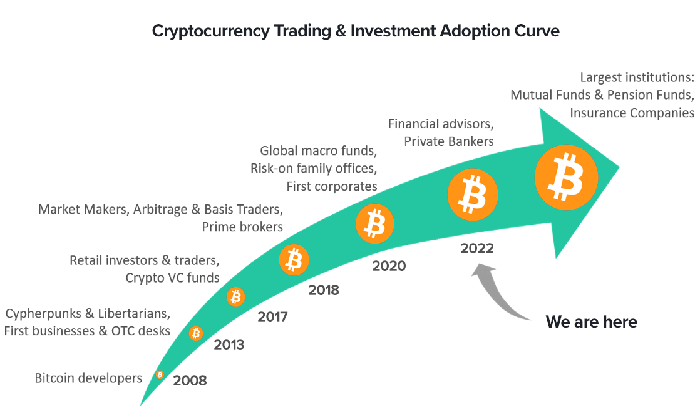

| Growth and Evolution | The evolution from Bitcoin to a variety of financial products has attracted more investors. |

| Factors Influencing Adoption | High education levels, democracy, and GDP are linked to higher adoption rates of cryptocurrencies. |

| Negative Influences | Countries with lower economic freedom and higher corruption show lesser adoption rates. |

| Trust and Its Role | Higher levels of trust in a nation correlate with greater interest in cryptocurrency adoption. |

| Differentiation from DeFi | Factors such as inflation and population density influence cryptocurrency adoption differently from DeFi. |

Summary

Cryptocurrency adoption is gaining momentum across the globe as recent studies highlight its varying patterns in different nations. As cryptocurrencies evolve and become more integrated into the financial market, it’s crucial to understand the economic and social factors influencing their uptake. The findings suggest that countries with higher standards of education and trust tend to adopt cryptocurrencies more readily, signaling a shift towards more democratic and free economies. In conclusion, recognizing these dynamics will be vital for investors and policymakers looking to engage with this innovative asset class.

Cryptocurrency adoption is rapidly reshaping the landscape of modern finance, as recent studies reveal diverse patterns across nations. With the rise of innovative cryptocurrencies and decentralized finance (DeFi) solutions, interest in this digital asset class has surged remarkably. Economic factors in crypto, such as GDP and regulatory quality, significantly influence a country’s willingness to embrace these technologies. This growing trend is not merely a technological shift but also a reflection of broader global cryptocurrency patterns, showcasing the interplay between trust and cryptocurrency acceptance. As awareness and understanding of cryptocurrency trends expand among investors, the potential for mainstream adoption continues to grow.

The uptake of digital currencies is transforming financial ecosystems worldwide, showcasing varying degrees of acceptance in different regions. As alternative financial systems gain momentum, the emphasis on decentralized finance (DeFi) has become increasingly prominent, presenting new opportunities for both individuals and institutions. The interplay of socio-economic indicators with digital currency adoption highlights how essential trust is for fostering confidence in this innovative financial sector. Understanding how global economic factors shape engagement with cryptocurrencies is critical for stakeholders looking to navigate these shifting landscapes. Ultimately, as we delve into the nuances of cryptocurrency integration, it’s clear that its influence extends far beyond mere investment, affecting economies and societies alike.