Bitcoin market recovery has shown promising signs in recent weeks, sparking renewed interest among traders and investors alike. This resurgence has been accompanied by discussions around crypto market analysis, particularly as Bitcoin’s trading volume fluctuates amid uncertain sentiment. Meltem Demirors, a prominent figure in cryptocurrency, underscores the impact of institutional ETF demand on market dynamics, emphasizing that many traders are cautious despite the growing enthusiasm. In her recent interview with Bloomberg, Demirors addressed critical issues such as the hidden leverage in the ecosystem, highlighting the stark contrast between optimistic market sentiment and the reality of trading levels. As the cryptocurrency rally unfolds, many are eagerly awaiting to see how these factors will play out in influencing Bitcoin’s trajectory in the coming months.

The recent uptick in Bitcoin’s valuation marks a significant moment within the broader realm of digital currencies. As financial analysts delve deeper into trends like crypto market performance and institutional interest in Bitcoin ETFs, a clearer picture emerges of the potential directions the market might take. Experts, including Meltem Demirors, are cautiously optimistic yet alert to underlying issues such as reduced trading activity and potential liquidity shifts. This complex landscape is compounded by ongoing discussions about the future of cryptocurrency investments, offering a rich ground for exploration among traders. Thus, as we navigate this evolving scenario, the interplay of sentiment, trading volume, and institutional strategies remains a crucial focal point for understanding Bitcoin’s enduring appeal.

Understanding Bitcoin Market Recovery

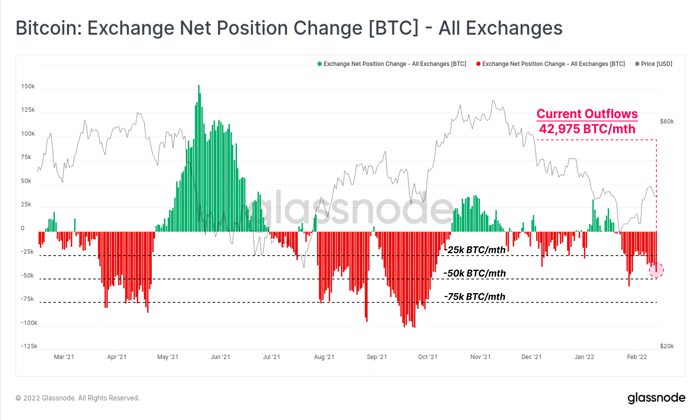

In the past few weeks, the Bitcoin market has shown signs of recovery after a prolonged downturn. Analysts have noted a slight uptick in trading volumes, which many interpret as a positive signal for the crypto market. However, this optimism is met with skepticism, particularly from industry experts who emphasize the need for sustained demand and real investor engagement. Factors such as institutional interest in ETFs and geopolitical developments greatly influence Bitcoin’s trajectory. Despite a resurgence in speculative enthusiasm, true recovery hinges on the influx of genuine investment as opposed to transitory trading spikes.

Meltem Demirors has highlighted critical factors that could dictate Bitcoin’s future, including institutional demand driven by ETF trading strategies. She pointed out that many institutional players are not holding Bitcoin; rather, they are engaging in short trading practices which can artificially inflate trading volumes without motivating long-term growth in demand. As Bitcoin continues to regain its footing, it faces challenges rooted in market fundamentals and investor behavior, underscoring that recovery may not be as straightforward as it seems.

The Role of Institutional ETF Demand in Crypto Markets

Institutional investment through ETFs has emerged as a pivotal component of the cryptocurrency ecosystem. As more institutional players lean towards ETFs, the market is witnessing a paradigm shift in how Bitcoin trading volumes are constructed. According to Demirors, while the presence of these institutional buyers symbolizes a burgeoning interest in the space, their trading strategies often involve rapid trading practices that don’t significantly contribute to growing Bitcoin holdings. This dynamic raises questions about the long-term viability of sustained interest in the cryptocurrency market without a solid foundation of investor conviction.

The trend towards ETFs reflects a maturation of the cryptocurrency space, allowing institutional investors to access Bitcoin while mitigating exposure risks. Rather than engaging directly in purchase transactions, they are more inclined to adopt hedging strategies, such as short selling, to optimize their positions. This trend complicates the narrative around Bitcoin’s market recovery, as ETF activity may mask the underlying trading volumes and demand necessary for real price appreciation in the crypto markets.

Evaluating the Impact of Market Sentiment

Market sentiment plays a crucial role in shaping the trajectory of cryptocurrency prices, particularly in the volatile world of Bitcoin. While external factors, such as political developments and regulatory movements, may drive temporary enthusiasm in trading activities, Meltem Demirors cautions against conflating positive sentiment with genuine market strength. The so-called recovery may often reflect merely a reactive adjustment to news events, failing to generate the foundational buying pressure necessary for sustainable growth.

Moreover, Demirors’ observations about hidden leverage within the crypto ecosystem raise alarms about the fragility of current market trends. Despite signs of positive sentiment, the market remains vulnerable to sudden shifts in trader behavior, as many participants operate on borrowed capital. The eventual unwinding of such leverage could result in significant volatility for Bitcoin and other cryptocurrencies, potentially undermining any perceived recovery. Understanding these intricacies is essential for investors looking for viable entry points into the crypto market.

Navigating Bitcoin Trading Volumes and Price Stability

Bitcoin trading volumes have recently been described as disappointing, an observation echoed by Meltem Demirors in her critique of the current market state. Despite the attention generated from political shifts and institutional engagement, actual trading activity remains subdued, reflective of a broader hesitance among investors. Many traders seem to be waiting for clearer indicators of long-term market stability before committing substantial capital, leading to an uncertain environment for Bitcoin’s price progression.

Analyzing trading volumes may reveal important insights into market health and investor confidence. Currently, Bitcoin dominates the market with a significant share, yet this dominance does not necessarily translate to overall market vitality. As Bitcoin wades through periods of low trading activity and fluctuating investor sentiment, understanding the underlying drivers of these metrics can offer seasoned traders the advantage needed to successfully navigate the unfolding market scenario.

Dissecting the Dangers of ‘Hidden Leverage’

The concept of hidden leverage represents a significant risk in the cryptocurrency markets, as highlighted by Meltem Demirors. Investors may not fully appreciate the extent of leverage embedded in their positions, particularly among institutional holders. This lack of transparency raises concerns about market integrity and could lead to abrupt sell-offs if underlying conditions shift unfavorably.

As market conditions fluctuate, the potential unwinding of leveraged positions could exacerbate volatility in Bitcoin prices. Observations of significant distributions from troubled entities like Mt. Gox and FTX further complicate the landscape, presenting a scenario where existing holders may be forced to liquidate, intensifying downward pressure. Understanding the implications of hidden leverage is critical for both institutional and retail investors, as they consider their exposure and the potential impact on Bitcoin market recovery.

The Influence of Political Developments on Crypto Trends

Political actions and sentiments can have profound impacts on the cryptocurrency landscape. As showcased in the comments from Meltem Demirors, recent statements from public figures, particularly politicians, can spark interest and intrigue among investors. A favorable political stance towards cryptocurrencies can create an environment of optimism and boost public perception, even if it does not immediately translate into increased trading volumes.

Yet, caution is warranted when evaluating these influences. Many market participants may confuse political endorsements with a concrete demand for Bitcoin or other cryptocurrencies. True recovery and sustained growth require solid fundamentals—based on actual investor interest and market activity—rather than sentiments bolstered by political approval. It’s vital for investors to discern the difference between genuine market trends fueled by substantive demand and transient spikes driven by hype.

The Ongoing Impact of MicroStrategy’s Hold on Bitcoin

MicroStrategy’s substantial holdings in Bitcoin have introduced new dynamics in the cryptocurrency market, particularly in relation to trading behaviors among institutional players. As pointed out by Demirors, significant trading strategies often revolve around MicroStrategy’s publicly traded Bitcoin assets, creating a ripple effect throughout market channels. Institutions may engage in strategies like convert arbitrage, which rely on the valuation relationships between MicroStrategy shares and Bitcoin, fueling trading activity but also raising broader questions about market health.

However, the reliance on MicroStrategy’s Bitcoin assets can also pose risks. If large institutions were to unwind their positions or if the market were to perceive weakness in MicroStrategy’s strategy, it could lead to cascading effects across the crypto space. Understanding the implications of institutional reliance on such holdings is essential for any serious market participant looking to navigate potential risks amid the ongoing Bitcoin recovery.

Looking Ahead to 2024: What Drives Crypto Performance?

As we look toward 2024, understanding what could drive Bitcoin and the broader crypto market remains crucial. Emphasis on institutional demand, particularly regarding ETFs, points to a transitional phase where genuine interest could reshape market dynamics. However, without robust trading volumes and clear signs of demand, the journey toward renewed market vitality seems complex.

Future performance will likely depend not only on institutional movements but also on how the market reacts to emerging regulatory discussions and policy changes. Investors must remain watchful of these developments, as they may serve to solidify or dismantle the current fragile state of trading activity. In essence, the crypto landscape appears poised for change, but it requires a comprehensive understanding of underlying factors driving market resilience or decline.

Conclusion: The Reality Behind Bitcoin’s Enthusiasm

In conclusion, while the current enthusiasm surrounding Bitcoin hints at a possible market recovery, a deeper analysis reveals the challenges that lie ahead. Factors such as lackluster trading volumes, hidden leverage concerns, and institutional trading strategies underscore the complexities of the crypto ecosystem. Meltem Demirors’ insights serve as a reminder for investors to remain steadfast and to approach this evolving landscape with caution and critical thinking.

As Bitcoin navigates through these tumultuous waters, the key to understanding its future will lie in deciphering market signals and recognizing the players involved. Only by separating genuine demand from speculative trading can investors make informed decisions and prepare for what lies ahead, ensuring they stay ahead in an unpredictable market.

Frequently Asked Questions

What factors are contributing to the Bitcoin market recovery?

The recent Bitcoin market recovery can be attributed to a mix of positive sentiment stemming from political discussions around crypto policies, an uptick in ETF demand, and some minor rallies among altcoins. However, it’s important to approach the recovery cautiously, as trading volumes remain low, raising questions about sustained demand.

How is Bitcoin trading volume impacting the current crypto market recovery?

Bitcoin trading volume plays a critical role in the overall crypto market recovery. Despite a slight uptick in prices, trading volumes are reported to be abysmal, indicating limited buying activity. This low trading volume may hinder the momentum needed for a sustained recovery in the Bitcoin market.

What did Meltem Demirors say about institutional ETF demand and its effects on Bitcoin?

Meltem Demirors highlighted that institutional ETF demand, specifically from firms engaged in basis trading rather than long-term holding, significantly impacts Bitcoin’s market dynamics. While bullish sentiment exists, the reliance on short selling rather than actual purchases raises concerns about the longevity of the current recovery.

What are the implications of Meltem Demirors’ interview on Bitcoin market recovery?

In her recent interview, Meltem Demirors conveyed a cautious outlook on the Bitcoin market recovery, emphasizing that despite political optimism and media hype, real market activity is lacking. She flagged concerns over hidden leverage and pointed out that while Bitcoin dominance is high, underlying trading volume does not support a strong recovery.

Can Bitcoin’s current dominance impact the overall cryptocurrency rally?

Yes, Bitcoin’s current dominance hovering around 70% could influence the overall cryptocurrency rally. A high dominance indicates investor confidence in Bitcoin as a leading asset. However, Demirors warns that without substantial trading volume and demand, the broader crypto market rally may face challenges.

What concerns did Meltem Demirors raise about potential market triggers for Bitcoin in 2024?

Meltem Demirors raised concerns that potential market triggers for Bitcoin in 2024 could be complicated by institutional ETF trading strategies and the effects of large players like MicroStrategy. She emphasized that unwinding trades and distributions from legacy platforms like Mt. Gox and FTX could create selling pressure that might thwart the recovery.

Is the current Bitcoin market rally sustainable according to recent analysis?

Recent analysis indicates that the current Bitcoin market rally may not be sustainable. With low trading volumes, concerns about hidden leverage, and significant market players potentially selling off, the long-term sustainability of the rally remains in doubt. Meltem Demirors emphasized the need for real buying pressure to solidify any upward trends.

What role does political sentiment play in the Bitcoin market recovery?

Political sentiment plays a significant role in the Bitcoin market recovery, especially with discussions around pro-crypto policies under the Trump administration. However, Meltem Demirors cautioned that while this sentiment may boost enthusiasm, it must be matched with real trading activity to effectually drive the market forward.

| Aspect | Details |

|---|---|

| Market Recovery | Bitcoin and the broader crypto market have shown signs of slight recovery over the past two weeks. |

| Expert Opinion | Meltem Demirors from Crucible Capital expresses caution regarding the sustainability of the recovery. |

| Trading Volumes | Trading volumes are notably low, resembling levels seen prior to recent political events. |

| ETF Influence | Institutional ETF buying strategies might trigger demand but are not indicative of long-term investment. |

| Market Dynamics | Concerns from MicroStrategy holdings and potential future sell-offs from Mt. Gox and FTX distributions. |

| Volatility Risks | Potential black swan events could arise from unwinding trades among institutional players. |

| Overall Sentiment | Despite challenges, Bitcoin’s dominance remains strong at around 70%, indicating resilience. |

Summary

The Bitcoin market recovery has stirred mixed sentiments among analysts, with cautious optimism highlighting the need for a deeper examination of trading dynamics, volumes, and potential institutional impacts. While recent gains may suggest a rebound, ongoing concerns surrounding liquidity, hidden leverage, and regulatory influences reveal the complexities underlying the market’s future trajectory. As the landscape evolves, it becomes crucial for investors to remain vigilant about the underlying factors that could shape Bitcoin’s path forward.

In recent weeks, the Bitcoin market recovery has sparked renewed interest among investors and analysts alike. Following a brief downturn, Bitcoin and the broader cryptocurrency sector have shown signs of stabilization, raising hopes for a sustained resurgence. However, industry experts like Meltem Demirors remain cautious, emphasizing that while enthusiasm is palpable, actual trading volumes paint a different picture. In a recent interview, she highlighted the connection between market dynamics and institutional ETF demand, noting the complexity of current trading strategies. As attention shifts to potential triggers for a cryptocurrency rally, it becomes increasingly important to differentiate between the hype and the underlying market fundamentals guiding Bitcoin trading volume.

The resurgence of Bitcoin and its associated cryptocurrencies has initiated a phase of cautious optimism in the market. Factors influencing this recovery include shifting sentiments and institutional trading strategies, particularly concerning Exchange-Traded Funds (ETFs). With experts emphasizing the need for a thorough analysis of current crypto market conditions, understanding the intricate relationship between trading volumes and investor behavior has never been more crucial. As we explore the potential factors that could catalyze a new wave of cryptocurrency interest, attention to market metrics and expert insights becomes paramount. Capturing the nuances behind the current market trends will play a significant role in shaping future cryptocurrency analysis.